by Calculated Risk on 9/20/2017 09:16:00 AM

Wednesday, September 20, 2017

AIA: Architecture Billings Index "growth streak" continues in August

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index continues growth streak

With all geographic regions and building project sectors showing positive conditions, there continues to be a heightened level of demand for design services signaled in the latest Architecture Billings Index (ABI). As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the August ABI score was 53.7, up from a score of 51.9 in the previous month. This score reflects an increase in design services provided by U.S. architecture firms (any score above 50 indicates an increase in billings). The new projects inquiry index was 62.5, up from a reading of 59.5 the previous month, while the new design contracts index eased somewhat from 56.4 to 54.2.

“The August results continue a string of very positive readings from the design professions, pointing to future healthy growth across the major construction sectors, as well as across the major regions of the country,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Given the focus and discussions around the infrastructure needs of the nation, we expect strong growth in design activity for the coming months and years.”

...

• Regional averages: South (55.7), Northeast (54.3), Midwest (52.5), West (51.3)

• Sector index breakdown: commercial / industrial (57.6), multi-family residential (53.8), mixed practice (52.5), institutional (50.1)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 53.7 in August, up from 51.9 in July. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 10 of the last 12 months, suggesting a further increase in CRE investment in 2017 and into 2018.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 9/20/2017 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 9.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 15, 2017. Last week’s results included an adjustment for the Labor Day holiday.

... The Refinance Index decreased 9 percent from the previous week. The seasonally adjusted Purchase Index decreased 11 percent from one week earlier. The unadjusted Purchase Index increased 10 percent compared with the previous week and was 2 percent higher than the same week one year ago ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) increased to 4.04 percent from 4.03 percent, with points remaining unchanged at 0.40 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 2% year-over-year.

Tuesday, September 19, 2017

Wednesday: FOMC Announcement, Existing Home Sales

by Calculated Risk on 9/19/2017 07:56:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day, The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

• At 10:00 AM, Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 5.48 million SAAR, up from 5.44 million in July. Housing economist Tom Lawler expects the NAR to report sales of 5.39 million SAAR for August.

• At 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to announce the beginning of the process to reduce the Fed's balance sheet at this meeting.

• At 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

Chemical Activity Barometer "Holds Steady" in September

by Calculated Risk on 9/19/2017 01:38:00 PM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Holds Steady; Storms Likely to Cause Future Revisions

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), remained virtually unchanged in September despite the effects of unprecedented Hurricanes Harvey and Irma. Though future revisions are likely, the barometer slipped just 0.04 percent in September, following a 0.03 percent decline in August. Compared to a year earlier, the CAB is up 2.8 percent year-over-year, a marked pullback from recent year-over-year gains. All data is measured on a three-month moving average (3MMA) basis.

On a year-over-year basis, the unadjusted CAB is up 2.3 percent, also an easing from the previous six months.

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

CAB increased solidly in early 2017 suggesting an increase in Industrial Production, however, the year-over-year increase in the CAB has slowed recently.

Comments on August Housing Starts

by Calculated Risk on 9/19/2017 10:53:00 AM

Earlier: Housing Starts decreased to 1.180 Million Annual Rate in August

The housing starts report released this morning showed starts were down 0.8% in August compared to July (July was revised up), and starts were up 1.4% year-over-year compared to August 2016. This was a decent report and was above the consensus forecast. Also permits were solid for August.

This first graph shows the month to month comparison between 2016 (blue) and 2017 (red).

Starts were up 1.4% in August 2017 compared to August 2016, and starts are up only 2.7% year-to-date.

Note that single family starts are up 8.9% year-to-date, and the weakness (as expected) has been in multi-family starts.

My guess is starts will increase around 3% to 7% in 2017.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

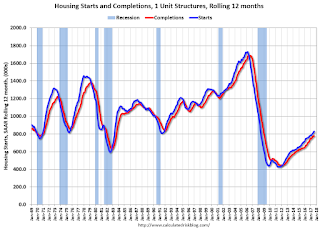

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years - but has turned down recently. Completions (red line) have lagged behind - but completions have almost caught up to starts (more deliveries).

Completions lag starts by about 12 months.

As I've been noting for a couple of years, the growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect a few years of increasing single family starts and completions.

Housing Starts decreased to 1.180 Million Annual Rate in August

by Calculated Risk on 9/19/2017 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in August were at a seasonally adjusted annual rate of 1,180,000. This is 0.8 percent below the revised July estimate of 1,190,000, but is 1.4 percent above the August 2016 rate of 1,164,000. Single-family housing starts in August were at a rate of 851,000; this is 1.6 percent above the revised July figure of 838,000. The August rate for units in buildings with five units or more was 323,000.

Building Permits:

Privately-owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 1,300,000. This is 5.7 percent above the revised July rate of 1,230,000 and is 8.3 percent above the August 2016 rate of 1,200,000. Single-family authorizations in August were at a rate of 800,000; this is 1.5 percent below the revised July figure of 812,000. Authorizations of units in buildings with five units or more were at a rate of 464,000 in August.

emphasis added

Click on graph for larger image.

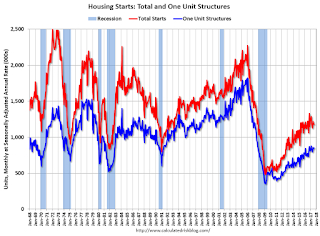

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in August compared to July. Multi-family starts are down 23% year-over-year.

Multi-family is volatile month-to-month, but has been mostly moving sideways over the last few years.

Single-family starts (blue) increased in August, and are up 17.1% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in August were above expectations, And starts for June and July were revised up. Also permits were strong in August. I'll have more later ...

Monday, September 18, 2017

Tuesday: Housing Starts

by Calculated Risk on 9/18/2017 06:30:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Continue Pushing Recent Highs

Mortgage rates resumed their recent uptrend today, after taking a quick break to end the week last Friday. The result is another push up to the highest levels in just over 3 weeks. The average scenario is being quoted rates that are about an eighth of a point higher compared to the lows seen in early September. The most prevalent top-tier conventional 30yr fixed rates still range from 3.875% to 4.0%, but the latter is increasingly in the spotlight.Tuesday:

• At 8:30 AM ET, Housing Starts for August. The consensus is for 1.173 million SAAR, up from the July rate of 1.155 million.

Lawler: Early Read on Existing Home Sales in August

by Calculated Risk on 9/18/2017 02:32:00 PM

From housing economist Tom Lawler: Early Read on Existing Home Sales in August

Based on publicly-available state and local realtor reports from across the country released through today, I project that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.39 million in August, down 0.9% from July’s estimated pace and up 0.9% from last August’s seasonally adjusted pace. Local realtor data suggest that the inventory of existing homes for sale was down from July to August but that the YOY decline was slightly less than that seen in July, and I project that the NAR’s estimate of the inventory of existing homes for sale at the end of August will be 1.86 million, down 3.1% from July’s preliminary estimate and down 7.5% from last August. Finally, local realtor data suggest that the NAR’s estimate of the median existing SF home sales price last month will by up by about 6.0% from a year earlier.

Hurricane Harvey hit Houston in the latter part of August, and home sales in Houston were down by about 25% from last August’s pace. The impact on September sales will be greater. Hurricane Irma was a September event, and did not appear to impact August closings in Florida at all. The impact on September closings, however, could be considerable.

CR Note: The NAR is scheduled to release August existing home sales on Wednesday. The consensus is for 5.48 million SAAR, so take the under.

Hotel Occupancy Rate increases following Hurricanes Harvey and Irma

by Calculated Risk on 9/18/2017 01:06:00 PM

From HotelNewsNow.com: STR: Hurricane Irma’s initial impact on hotel markets

STR data shows Florida hotel markets that were evacuated before the arrival of Hurricane Irma experienced significant performance decreases, but the destinations evacuees flocked to saw significant growth.From HotelNewsNow.com: STR: US hotel results for week ending 9 September

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 3-9 September 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 4-10 September 2016, the industry recorded the following:

• Occupancy: +2.1% to 64.0%

• Average daily rate (ADR): +1.6% to US$120.78

• Revenue per available room (RevPAR): +3.7% to US$77.31

Among the Top 25 Markets, Houston, Texas, reported the largest year-over-year increases in each of the three key performance metrics. Amid the aftermath of Hurricane Harvey, occupancy rose 66.1% to 86.6%, ADR was up 23.9% to US$114.27 and RevPAR surged 105.9% to US$98.91. STR analysts note that hotels in the market filled up with displaced residents, FEMA workers and other demand related to recovery efforts.

...

Ahead of Hurricane Irma landfall, Miami/Hialeah, Florida, saw the week’s largest drop in occupancy (-20.2% to 50.9%) and the largest decrease in RevPAR (-25.5% to US$65.55).

emphasis added

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate to date is ahead of last year, and just behind the record year in 2015. The hurricanes might push the annual occupancy rate to a new record.

Seasonally, the occupancy rate will increase into the Fall business travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

NAHB: Builder Confidence idecreased to 64 in September

by Calculated Risk on 9/18/2017 10:07:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 64 in September, down from 67 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Drops Three Points As Hurricanes Add Uncertainty

Builder confidence in the market for newly-built single-family homes fell three points to a level of 64 in September from a downwardly revised August reading of 67 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI).

“The recent hurricanes have intensified our members’ concerns about the availability of labor and the cost of building materials,” said NAHB Chairman Granger MacDonald, a home builder and developer from Kerrville, Texas. “Once the rebuilding process is underway, I expect builder confidence will return to the high levels we saw this spring.”

“Despite this month’s drop, builder confidence is still on very firm ground,” said NAHB Chief Economist Robert Dietz. “With ongoing job creation, economic growth and rising consumer confidence, we should see the housing market continue to recover at a gradual, steady pace throughout the rest of the year.”

...

All three HMI components posted losses in September but remain at healthy levels. The component gauging current sales conditions fell four points to 70 and the index charting sales expectations in the next six months dropped four points to 74. Meanwhile, the component measuring buyer traffic slipped a single point to 47.

Looking at the three-month moving averages for regional HMI scores, the West increased three points to 77 and the Northeast rose one point to 49. The South dropped a single point to 66 and the Midwest fell three points to 63.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast, but still a solid reading.