by Calculated Risk on 9/19/2017 10:53:00 AM

Tuesday, September 19, 2017

Comments on August Housing Starts

Earlier: Housing Starts decreased to 1.180 Million Annual Rate in August

The housing starts report released this morning showed starts were down 0.8% in August compared to July (July was revised up), and starts were up 1.4% year-over-year compared to August 2016. This was a decent report and was above the consensus forecast. Also permits were solid for August.

This first graph shows the month to month comparison between 2016 (blue) and 2017 (red).

Starts were up 1.4% in August 2017 compared to August 2016, and starts are up only 2.7% year-to-date.

Note that single family starts are up 8.9% year-to-date, and the weakness (as expected) has been in multi-family starts.

My guess is starts will increase around 3% to 7% in 2017.

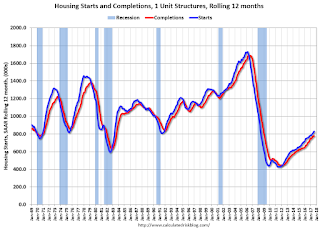

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years - but has turned down recently. Completions (red line) have lagged behind - but completions have almost caught up to starts (more deliveries).

Completions lag starts by about 12 months.

As I've been noting for a couple of years, the growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect a few years of increasing single family starts and completions.

Housing Starts decreased to 1.180 Million Annual Rate in August

by Calculated Risk on 9/19/2017 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in August were at a seasonally adjusted annual rate of 1,180,000. This is 0.8 percent below the revised July estimate of 1,190,000, but is 1.4 percent above the August 2016 rate of 1,164,000. Single-family housing starts in August were at a rate of 851,000; this is 1.6 percent above the revised July figure of 838,000. The August rate for units in buildings with five units or more was 323,000.

Building Permits:

Privately-owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 1,300,000. This is 5.7 percent above the revised July rate of 1,230,000 and is 8.3 percent above the August 2016 rate of 1,200,000. Single-family authorizations in August were at a rate of 800,000; this is 1.5 percent below the revised July figure of 812,000. Authorizations of units in buildings with five units or more were at a rate of 464,000 in August.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in August compared to July. Multi-family starts are down 23% year-over-year.

Multi-family is volatile month-to-month, but has been mostly moving sideways over the last few years.

Single-family starts (blue) increased in August, and are up 17.1% year-over-year.

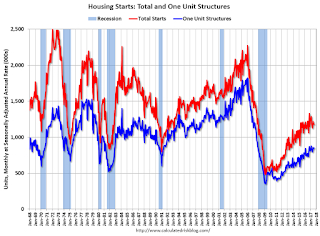

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in August were above expectations, And starts for June and July were revised up. Also permits were strong in August. I'll have more later ...

Monday, September 18, 2017

Tuesday: Housing Starts

by Calculated Risk on 9/18/2017 06:30:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Continue Pushing Recent Highs

Mortgage rates resumed their recent uptrend today, after taking a quick break to end the week last Friday. The result is another push up to the highest levels in just over 3 weeks. The average scenario is being quoted rates that are about an eighth of a point higher compared to the lows seen in early September. The most prevalent top-tier conventional 30yr fixed rates still range from 3.875% to 4.0%, but the latter is increasingly in the spotlight.Tuesday:

• At 8:30 AM ET, Housing Starts for August. The consensus is for 1.173 million SAAR, up from the July rate of 1.155 million.

Lawler: Early Read on Existing Home Sales in August

by Calculated Risk on 9/18/2017 02:32:00 PM

From housing economist Tom Lawler: Early Read on Existing Home Sales in August

Based on publicly-available state and local realtor reports from across the country released through today, I project that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.39 million in August, down 0.9% from July’s estimated pace and up 0.9% from last August’s seasonally adjusted pace. Local realtor data suggest that the inventory of existing homes for sale was down from July to August but that the YOY decline was slightly less than that seen in July, and I project that the NAR’s estimate of the inventory of existing homes for sale at the end of August will be 1.86 million, down 3.1% from July’s preliminary estimate and down 7.5% from last August. Finally, local realtor data suggest that the NAR’s estimate of the median existing SF home sales price last month will by up by about 6.0% from a year earlier.

Hurricane Harvey hit Houston in the latter part of August, and home sales in Houston were down by about 25% from last August’s pace. The impact on September sales will be greater. Hurricane Irma was a September event, and did not appear to impact August closings in Florida at all. The impact on September closings, however, could be considerable.

CR Note: The NAR is scheduled to release August existing home sales on Wednesday. The consensus is for 5.48 million SAAR, so take the under.

Hotel Occupancy Rate increases following Hurricanes Harvey and Irma

by Calculated Risk on 9/18/2017 01:06:00 PM

From HotelNewsNow.com: STR: Hurricane Irma’s initial impact on hotel markets

STR data shows Florida hotel markets that were evacuated before the arrival of Hurricane Irma experienced significant performance decreases, but the destinations evacuees flocked to saw significant growth.From HotelNewsNow.com: STR: US hotel results for week ending 9 September

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 3-9 September 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 4-10 September 2016, the industry recorded the following:

• Occupancy: +2.1% to 64.0%

• Average daily rate (ADR): +1.6% to US$120.78

• Revenue per available room (RevPAR): +3.7% to US$77.31

Among the Top 25 Markets, Houston, Texas, reported the largest year-over-year increases in each of the three key performance metrics. Amid the aftermath of Hurricane Harvey, occupancy rose 66.1% to 86.6%, ADR was up 23.9% to US$114.27 and RevPAR surged 105.9% to US$98.91. STR analysts note that hotels in the market filled up with displaced residents, FEMA workers and other demand related to recovery efforts.

...

Ahead of Hurricane Irma landfall, Miami/Hialeah, Florida, saw the week’s largest drop in occupancy (-20.2% to 50.9%) and the largest decrease in RevPAR (-25.5% to US$65.55).

emphasis added

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate to date is ahead of last year, and just behind the record year in 2015. The hurricanes might push the annual occupancy rate to a new record.

Seasonally, the occupancy rate will increase into the Fall business travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

NAHB: Builder Confidence idecreased to 64 in September

by Calculated Risk on 9/18/2017 10:07:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 64 in September, down from 67 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Drops Three Points As Hurricanes Add Uncertainty

Builder confidence in the market for newly-built single-family homes fell three points to a level of 64 in September from a downwardly revised August reading of 67 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI).

“The recent hurricanes have intensified our members’ concerns about the availability of labor and the cost of building materials,” said NAHB Chairman Granger MacDonald, a home builder and developer from Kerrville, Texas. “Once the rebuilding process is underway, I expect builder confidence will return to the high levels we saw this spring.”

“Despite this month’s drop, builder confidence is still on very firm ground,” said NAHB Chief Economist Robert Dietz. “With ongoing job creation, economic growth and rising consumer confidence, we should see the housing market continue to recover at a gradual, steady pace throughout the rest of the year.”

...

All three HMI components posted losses in September but remain at healthy levels. The component gauging current sales conditions fell four points to 70 and the index charting sales expectations in the next six months dropped four points to 74. Meanwhile, the component measuring buyer traffic slipped a single point to 47.

Looking at the three-month moving averages for regional HMI scores, the West increased three points to 77 and the Northeast rose one point to 49. The South dropped a single point to 66 and the Midwest fell three points to 63.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast, but still a solid reading.

Black Knight: Preliminary Assessment Shows Over 3.1 Million Mortgaged Properties in Hurricane Irma Disaster Areas

by Calculated Risk on 9/18/2017 09:19:00 AM

From Black Knight: Black Knight: Hurricane Preliminary Assessment Shows Over 3.1 Million Mortgaged Properties in Hurricane Irma Disaster Areas

• Florida FEMA-designated disaster areas related to Hurricane Irma include over 3.1 million mortgaged propertiesCR Note: Delinquencies will rise in both Texas and Florida in the next few months. Unfortunately it looks like Puerto Rico will take a direct hit from Hurricane Maria this week.

• Irma-related disaster areas contain nearly three times as many mortgaged properties as those connected to Hurricane Harvey, and nearly seven times as many as those connected to Hurricane Katrina in 2005

• The $517 billion in unpaid principal balances in Irma-related disaster areas is nearly three times the amount as in those related to Harvey and more than 11 times of those connected to Katrina

• Irma-related disaster areas now include more than 90 percent of all mortgaged properties in Florida

Today, the Data & Analytics division of Black Knight Financial Services, Inc. released a preliminary assessment of the potential mortgage-related impact from Hurricane Irma. As Black Knight Data & Analytics Executive Vice President Ben Graboske explained, both the number of mortgages and the unpaid principal balances of those mortgages in FEMA-designated Irma disaster areas are significantly larger than in the areas impacted recently by Hurricane Harvey.

“While the total extent of the damage from Hurricane Irma is still being determined, it is clear that the size and scope of the disaster is immense,” said Graboske. “Indeed, in terms of the number of mortgaged properties and their associated unpaid principal balances, Irma significantly outpaces even the number of borrowers impacted by Hurricane Harvey. With FEMA expanding the number of Irma-related designated disaster areas late Wednesday, Sept. 13, to a total of 37 Florida counties, more than 90 percent of all mortgaged properties in the state now fall into such areas. More than 3.1 million properties are now included in FEMA-designated Irma disaster areas, representing approximately $517 billion in unpaid principal balances. In comparison, Harvey-related disaster areas held 1.18 million properties – more than twice as many as with Hurricane Katrina in 2005 – with a combined unpaid principal balance of $179 billion. Irma-related disaster areas now contain nearly seven times as many mortgaged properties as those connected to Katrina, with more than 11 times the principal balances.

“As Irma forged its path of destruction through the Caribbean, one relatively positive development was that Puerto Rico escaped the direct hit many had predicted. From a mortgage performance perspective, this was particularly good news, as delinquencies there were already quite high leading up to the storm. At more than 10 percent, Puerto Rico’s delinquency rate is nearly three times that of the U.S. average, as is its 5.8 percent serious delinquency rate. In contrast, the disaster areas declared in Florida have starting delinquency rates below the national average, providing more than a glimmer of optimism as we move forward.”

Sunday, September 17, 2017

Sunday Night Futures

by Calculated Risk on 9/17/2017 07:52:00 PM

Weekend:

• Schedule for Week of Sept 17, 2017

Monday:

• At 10:00 AM ET, The September NAHB homebuilder survey. The consensus is for a reading of 65, down from 68 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are up slightly (fair value).

Oil prices were up over the last week with WTI futures at $49.79 per barrel and Brent at $55.53 per barrel. A year ago, WTI was at $43, and Brent was at $46 - so oil prices are up 15% to 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.61 per gallon - up sharply due to Hurricane Harvey, but starting to decline - a year ago prices were at $2.20 per gallon - so gasoline prices are up 41 cents per gallon year-over-year.

FOMC Preview

by Calculated Risk on 9/17/2017 08:11:00 AM

The consensus is that the Fed will not change the Fed Funds Rate at the meeting this coming week. However the Fed is expected to start the process of balance sheet normalization.

Assuming the expected happens - no rate hike and the start of balance sheet normalization - the focus will be on the wording of the statement, the projections, and Fed Chair Janet Yellen's press conference to try to determine if there will be a 3rd rate hike in 2017 at the December meeting.

Here are the June FOMC projections.

The projection for GDP in 2017 will likely be either unchanged or revised down slightly. GDP in Q1 was at 1.2% annualized, and Q2 at 3.0%. Currently projections put Q3 GDP at around 1.3% to 2.2% (the hurricanes probably pushed down Q3 GDP, and some bounce back is likely in Q4).

My guess is, as far as the impact of any fiscal stimulus, the Fed will continue to wait and see what the actual proposals will be.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2017 | 2018 | 2019 |

| June 2017 | 2.1 to 2.2 | 1.8 to 2.2 | 1.8 to 2.0 |

| Mar 2017 | 2.0 to 2.2 | 1.8 to 2.3 | 1.8 to 2.0 |

The unemployment rate was at 4.4% in August. So the unemployment rate for Q4 2017 will probably be unchanged.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2017 | 2018 | 2019 |

| June 2017 | 4.2 to 4.3 | 4.0 to 4.3 | 4.1 to 4.4 |

| Mar 2017 | 4.5 to 4.6 | 4.3 to 4.6 | 4.3 to 4.7 |

As of July, PCE inflation was up 1.4% from July 2016. It appears inflation might be revised down for 2017.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2017 | 2018 | 2019 |

| June 2017 | 1.6 to 1.7 | 1.8 to 2.0 | 2.0 to 2.1 |

| Mar 2017 | 1.8 to 2.0 | 1.9 to 2.0 | 2.0 to 2.1 |

PCE core inflation was up 1.4% in July year-over-year. Core PCE inflation will probably be revised down for 2017.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2017 | 2018 | 2019 |

| June 2017 | 1.6 to 1.7 | 1.8 to 2.0 | 2.0 to 2.1 |

| Mar 2017 | 1.8 to 1.9 | 1.9 to 2.0 | 2.0 to 2.1 |

In general, it appears GDP and inflation might be revised down (GDP slightly), and the unemployment rate will be unchanged. The inflation outlook will be key for a Fed rate hike in December.

Saturday, September 16, 2017

Goldman: FOMC Preview

by Calculated Risk on 9/16/2017 05:32:00 PM

CR Note: The FOMC is scheduled to meet on Tuesday and Wednesday. No change to rates is expected at this meeting, but the FOMC is expected to announce the beginning of the process to reduce the Fed's balance sheet.

A brief excerpt from a research note by Goldman Sachs economists:

We expect the FOMC to officially announce next week that balance sheet runoff will begin in October. As the Fed has already communicated extensively about its plan for a gradual and predictable runoff, we expect markets to focus instead on the outlook for the federal funds rate. The key question is whether the committee’s expectations for the federal funds rate have declined in light of the surprising deceleration in the inflation data since the start of the year.