by Calculated Risk on 9/16/2017 08:09:00 AM

Saturday, September 16, 2017

Schedule for Week of Sept 17, 2017

The key economic reports this week are August housing starts and existing home sales.

For manufacturing, the Philly Fed manufacturing survey will be released this week.

The FOMC meets this week and is expected to announce the reduction of the Fed's balance sheet.

10:00 AM: The September NAHB homebuilder survey. The consensus is for a reading of 65, down from 68 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for August. The consensus is for 1.173 million SAAR, up from the July rate of 1.155 million.

8:30 AM: Housing Starts for August. The consensus is for 1.173 million SAAR, up from the July rate of 1.155 million.This graph shows total and single unit starts since 1968.

The graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 5.48 million SAAR, up from 5.44 million in July.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 5.48 million SAAR, up from 5.44 million in July.The graph shows existing home sales from 1994 through the report last month.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to announce the beginning of the process to reduce the Fed's balance sheet at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 303 thousand initial claims, up from 284 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for September. The consensus is for a reading of 18.0, down from 18.9.

9:00 AM ET: FHFA House Price Index for June 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

12:00 PM: Q2 Flow of Funds Accounts of the United States from the Federal Reserve.

No major economic releases scheduled.

Friday, September 15, 2017

Lawler: ACS-Based Household Growth Slowed Last Year: Homeownership Rate Estimate Up, But Barely

by Calculated Risk on 9/15/2017 02:28:00 PM

From housing economist Tom Lawler: ACS-Based Household Growth Slowed Last Year: Homeownership Rate Estimate Up, But Barely

The Census Bureau released the results of its 2016 American Community Survey, which provides a wide range of estimated statistics about people and housing. On the housing front, the ACS-based estimate of the number of occupied housing units (or households) for 2016 (yearly average) was 118,860,065, up just 651,815 from the estimate from the 2015 ACS. The ACS-based homeownership rate for 2016 was 63.1%, up just a tad from the 63.0% in 2015.

The growth rate of nonfamily households outpaced the growth in family households last year, with the fastest growth coming in nonfamily households with two or more people. This growth in part reflected a sharp jump in roomers and boarders.

| ACS-Based Household Estimates | ||||

|---|---|---|---|---|

| 2016 | 2015 | Change | % Change | |

| Total | 118,860,065 | 118,208,250 | 651,815 | 0.55% |

| Family | 77,785,962 | 77,530,756 | 255,206 | 0.33% |

| Nonfamily | 41,074,103 | 40,677,494 | 396,609 | 0.98% |

| 1-person | 33,254,192 | 32,962,990 | 291,202 | 0.88% |

| 2+-person | 7,819,911 | 7,714,504 | 105,407 | 1.37% |

In terms of the composition of people in “family” households, last year there were relatively big gains in (1) the number of “adult” (18+ years old) children living with their parent(s); (2) the number of “other relatives;” and (3) the number of “nonrelatives” excluding the householder’s unmarried partner.

| Number of People in Family Households by Relationship to Householder, ACS | ||||

|---|---|---|---|---|

| 2016 | 2015 | Change | % Change | |

| Total | 261,765,779 | 260,613,760 | 1,152,019 | 0.44% |

| Householder: | 77,785,962 | 77,530,756 | 255,206 | 0.33% |

| Spouse | 56,952,253 | 56,681,711 | 270,542 | 0.48% |

| Child: | 95,553,251 | 95,198,175 | 355,076 | 0.37% |

| Under 18 | 64,448,638 | 64,499,542 | -50,904 | -0.08% |

| 18+ | 31,104,613 | 30,698,633 | 405,980 | 1.32% |

| Other Relatives | 23,949,690 | 23,665,436 | 284,254 | 1.20% |

| Nonrelatives: | 7,524,623 | 7,537,682 | -13,059 | -0.17% |

| Unmarried Partner | 3,092,357 | 3,205,347 | -112,990 | -3.53% |

| Other Nonrelatives | 4,432,266 | 4,332,335 | 99,931 | 2.31% |

Before going further, I do need to qualify the table above. The 2015 ACS results did not incorporate the late 2016 downward revisions in population estimates, but the 2016 ACS results do reflect these revisions. As a result, the 2015 ACS results overstate the total resident US population by about 522 thousand. The 2015 ACS estimates for the number of households, however, would not have been impacted by the downward population revisions (if they had been known at the time), because ACS household estimates are (effectively) controlled to independent housing unit estimates. If the 2015 ACS results were adjusted to reflect the updated lower population estimates for that year, the result would be that both the average household size and the average family size (as estimated by the ACS) would be lowered for 2015. As a result, both the average household size and the average family size adjusted to reflect population revisions for 2015 increased last year.

For “young” adults (18-34 years old), the % of young adults living with parents increased to 34.25% in 2016 from 34.11% in 2015, while the % of young adults living with other relatives rose to 13.30% in 2016 from 13.20% in 2015.The % of young adults who were either (1) a householder, (2) the spouse of a household, or (3) the unmarried partner of a householder declined to 32.95% in 2016 from 33.46% in 2015.

As readers know, there are numerous and conflicting estimates of the number of and the growth of US households based on various surveys, and this “household conundrum,” while identified and for a brief bit “prioritized” by Census earlier this decade, has not gone away. However, the “latest” data from the CPS/ASEC, the CPS/HVS, and now the ACS all suggest that household growth as decelerated, for reasons that are not crystal clear but which cannot be explained by “cyclical” forces.

I’ll have more on the ACS data later this month.

Q3 GDP Forecasts: Moving Down

by Calculated Risk on 9/15/2017 12:25:00 PM

From Merrill Lynch:

The data [today] sliced 0.8pp from 3Q GDP tracking, down to 1.7%.From the Altanta Fed: GDPNow

emphasis added

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2017 is 2.2 percent on September 15, down from 3.0 percent on September 8. The forecasts of real consumer spending growth and real private fixed investment growth fell from 2.7 percent and 2.6 percent, respectively, to 2.0 percent and 1.4 percent, respectively, after this morning's retail sales release from the U.S. Census Bureau and this morning's report on industrial production and capacity utilization from the Federal Reserve Board of Governors.From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 1.3% for 2017:Q3 and 1.8% for 2017:Q4.CR Note: Looks like weak real GDP growth in Q3, some due to the impact of the hurricanes.

BLS: Unemployment Rates Unchanged in 41 states in August, Tennessee at New Series Low

by Calculated Risk on 9/15/2017 10:28:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were higher in August in 8 states, lower in 1 state, and stable in 41 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Twenty-one states had jobless rate decreases from a year earlier, 1 state had an increase, and 28 states and the District had little or no change. The national unemployment rate, 4.4 percent, was little changed from July but was 0.5 percentage point lower than in August 2016.

...

North Dakota and Colorado had the lowest unemployment rates in August, 2.3 percent and 2.4 percent, respectively. The rate in Tennessee (3.3 percent) set a new series low. (All state series begin in 1976.) Alaska had the highest jobless rate, 7.2 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

Eleven states have reached new all time lows since the end of the 2007 recession. These eleven states are: Arkansas, California, Colorado, Idaho, Maine, Mississippi, North Dakota, Oregon, Tennessee, Washington, and Wisconsin.

The states are ranked by the highest current unemployment rate. Alaska, at 7.2%, had the highest state unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently one state has an unemployment rate at or above 7% (light blue); Only two states and D.C. are at or above 6% (dark blue). The states are Alaska (7.2%) and New Mexico (6.3%). D.C. is at 6.4%.

Industrial Production Decreased 0.9% in August

by Calculated Risk on 9/15/2017 09:23:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production declined 0.9 percent in August following six consecutive monthly gains. Hurricane Harvey, which hit the Gulf Coast of Texas in late August, is estimated to have reduced the rate of change in total output by roughly 3/4 percentage point. The index for manufacturing decreased 0.3 percent; storm-related effects appear to have reduced the rate of change in factory output in August about 3/4 percentage point. The manufacturing industries with the largest estimated storm-related effects were petroleum refining, organic chemicals, and plastics materials and resins.

The output of mining fell 0.8 percent in August, as Hurricane Harvey temporarily curtailed drilling, servicing, and extraction activity for oil and natural gas. The output of utilities dropped 5.5 percent, as unseasonably mild temperatures, particularly on the East Coast, reduced the demand for air conditioning.

At 104.7 percent of its 2012 average, total industrial production in August was 1.5 percent above its year-earlier level. Capacity utilization for the industrial sector decreased 0.8 percentage point in August to 76.1 percent, a rate that is 3.8 percentage points below its long-run (1972–2016) average.

emphasis added

Click on graph for larger image.

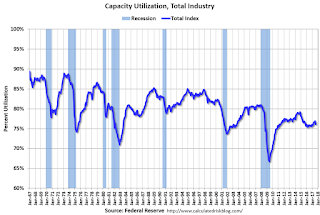

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 9.4 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 76.1% is 3.8% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in August to 104.7. This is 20.2% above the recession low, and close to the pre-recession peak.

The decrease was below expectations, largely due to Hurricane Harvey.

Retail Sales decreased 0.2% in August

by Calculated Risk on 9/15/2017 09:08:00 AM

On a monthly basis, retail sales decreased 0.2 percent from July to August (seasonally adjusted), and sales were up 3.2 percent from August 2016.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for August 2017, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $474.8 billion, a decrease of 0.2 percent from the previous month, and 3.2 percent above August 2016. ... The June 2017 to July 2017 percent change was revised from up 0.6 percent to up 0.3 percent.

Click on graph for larger image.

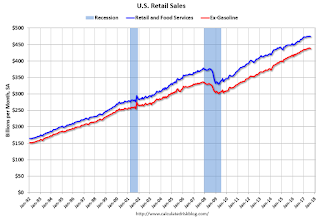

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 0.4% in August.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 3.1% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 3.1% on a YoY basis.The increase in August was below expectations, and sales in June and July were revised down.

Note: Hurricane Harvey impacted sales in August.

Thursday, September 14, 2017

Friday: Retail Sales, Industrial Production, NY Fed Mfg Survey

by Calculated Risk on 9/14/2017 09:07:00 PM

From housing economist Tom Lawler:

Hurricane Harvey Hit Houston in the latter part of August, but that was enough to have a significant impact on home sales stats in the metro region. According to the Houston Association of Realtors, single family home sales by realtors this August were down 25.4% from last August (to 5,917 from 7,927), while condo/townhome sales were down 31.4% from a year ago to 443. September sales should be impacted even more.Friday:

• At 8:30 AM ET, Retail sales for August be released. The consensus is for a 0.1% increase in retail sales.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for September. The consensus is for a reading of 19.0, down from 25.2.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for August. The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to increase to 76.8%.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for July. The consensus is for a 0.2% increase in inventories.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for September). The consensus is for a reading of 96.0, down from 96.8 in August.

• Also at 10:00 AM, Regional and State Employment and Unemployment (Monthly) for August 2017

Phoenix Real Estate in August: Sales up slightly, Inventory down 7% YoY

by Calculated Risk on 9/14/2017 04:41:00 PM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in August were up 0.4% year-over-year.

2) Active inventory is now down 7.4% year-over-year.

More inventory (a theme in most of 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster. Prices were up 6.3% in 2015 according to Case-Shiller.

With flat inventory in 2016, prices were up 4.8%.

This is the tenth consecutive month with a YoY decrease in inventory, and prices are rising a little faster this year (2.8% through June or 5.7% annual rate).

| August Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Aug-08 | 5,660 | --- | 1,004 | 17.7% | 53,5691 | --- |

| Aug-09 | 8,008 | 41.5% | 2,849 | 35.6% | 38,085 | -28.9% |

| Aug-10 | 7,358 | -8.1% | 3,129 | 42.5% | 44,307 | 16.3% |

| Aug-11 | 8,712 | 18.4% | 3,953 | 45.4% | 26,983 | -39.1% |

| Aug-12 | 7,574 | -13.1% | 3,382 | 44.7% | 20,934 | -22.4% |

| Aug-13 | 7,055 | -6.9% | 2,409 | 34.1% | 21,444 | 2.4% |

| Aug-14 | 6,431 | -8.8% | 1,621 | 25.2% | 26,138 | 21.9% |

| Aug-15 | 7,023 | 9.2% | 1,588 | 22.6% | 22,554 | -13.7% |

| Aug-16 | 7,975 | 13.6% | 1,616 | 20.3% | 23,318 | 3.4% |

| Aug-17 | 8,010 | 0.4% | 1,541 | 19.2% | 21,590 | -7.4% |

| 1 August 2008 probably includes pending listings | ||||||

Key Measures Show Inflation mostly below 2% in August

by Calculated Risk on 9/14/2017 01:18:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (3.0% annualized rate) in August. The 16% trimmed-mean Consumer Price Index also rose 0.2% (2.3% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for August here. Motor fuel increased 107% in August, annualized.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.4% (4.9% annualized rate) in August. The CPI less food and energy rose 0.2% (3.0% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.8%, and the CPI less food and energy rose 1.7%. Core PCE is for July and increased 1.4% year-over-year.

On a monthly basis, median CPI was at 3.0% annualized, trimmed-mean CPI was at 2.3% annualized, and core CPI was at 3.0% annualized.

Using these measures, inflation was soft year-over-year again in August (although inflation picked up month-to-month). Overall these measures are mostly below the Fed's 2% target (Median CPI is slightly above).

Early Look at 2018 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 9/14/2017 11:01:00 AM

The BLS reported this morning:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 1.9 percent over the last 12 months to an index level of 239.448 (1982-84=100). For the month, the index increased 0.3 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and is not seasonally adjusted (NSA).

• In 2016, the Q3 average of CPI-W was 235.057.

The 2016 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year. (Sometimes we have to look back two years).

For July and August 2017, the average is 239.0325 - or a 1.7% increase over the Q3 average last year. Inflation probably picked up a little in September due to the increase in gasoline prices following Hurricane Harvey, so COLA will probably be close to 2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 1.9% year-over-year in August, and although this is early - we still need the data for September - it appears COLA will be positive this year, and inflation probably picked up in September due to Hurricane Harvey and gasoline prices - so COLA will probably be close to 2% this year.

Contribution and Benefit Base

The law prohibits an increase in the contribution and benefit base if COLA is not greater than zero. However if the there is even a small increase in COLA (seems likely this year), the contribution base will be adjusted using the National Average Wage Index.

From Social Security: Cost-of-Living Adjustment Must Be Greater Than Zero

... ... any amount that is directly dependent for its value on the COLA would not increase. For example, the maximum Supplemental Security Income (SSI) payment amounts would not increase if there were no COLA.The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2016 yet, but wages probably increased again in 2016. If wages increased the same as last year, then the contribution base next year will increase to around $131,500 from the current $127,200.

... if there were no COLA, section 230(a) of the Social Security Act prohibits an increase in the contribution and benefit base (Social Security's maximum taxable earnings), which normally increases with increases in the national average wage index. Similarly, the retirement test exempt amounts would not increase ...

Remember - this is an early look. We still need the data for September, but it appears COLA will be close to 2%, and the contribution base will increase next year.