by Calculated Risk on 1/24/2017 10:12:00 AM

Tuesday, January 24, 2017

NAR: "Existing-Home Sales Slide in December; 2016 Sales Best Since 2006"

From the NAR: Existing-Home Sales Slide in December; 2016 Sales Best Since 2006

Existing-home sales closed out 2016 as the best year in a decade, even as sales declined in December as the result of ongoing affordability tensions and historically low supply levels, according to the National Association of Realtors®.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, finished 2016 at 5.45 million sales and surpassed 2015 (5.25 million) as the highest since 2006 (6.48 million).

In December, existing sales decreased 2.8 percent to a seasonally adjusted annual rate of 5.49 million in December from an upwardly revised 5.65 million in November. With last month's slide, sales are only 0.7 percent higher than a year ago....

Total housing inventory at the end of December dropped 10.8 percent to 1.65 million existing homes available for sale, which is the lowest level since NAR began tracking the supply of all housing types in 1999. Inventory is 6.3 percent lower than a year ago (1.76 million), has fallen year-over-year for 19 straight months and is at a 3.6-month supply at the current sales pace (3.9 months in December 2015).

Click on graph for larger image.

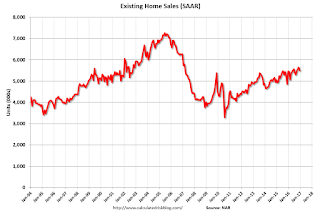

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in December (5.49 million SAAR) were 2.8% lower than last month, and were 0.7% above the December 2015 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.65 million in December from 1.85 million in November. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 1.65 million in December from 1.85 million in November. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 6.3% year-over-year in December compared to December 2015.

Inventory decreased 6.3% year-over-year in December compared to December 2015. Months of supply was at 3.6 months in December.

This was slightly below consensus expectations. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

Monday, January 23, 2017

Tuesday: Existing Home Sales

by Calculated Risk on 1/23/2017 06:54:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Erase Last Week's Losses

Mortgage rates fell somewhat significantly today, fully offsetting last week's rise. Specifically, today's average rates are back in line with those seen on Friday ... 4.125% is back in play, now sharing relatively equal territory with 4.25% as the two most prevalently-quoted conventional 30yr fixed rates on top tier scenarios.Tuesday:

emphasis added

• At 10:00 AM ET, Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 5.54 million SAAR, down from 5.61 million in November. Housing economist Tom Lawler expects the NAR to report sales of 5.55 million SAAR in December.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for January.

• Also at 10:00 AM, Regional and State Employment and Unemployment (Monthly) for December 2016

Trump Economic Goals for Jobs and GDP

by Calculated Risk on 1/23/2017 03:13:00 PM

Just noting these goals for future reference. Based on demographics, I think 2.5 million jobs per year is too high. On GDP, now that the prime working age group is increasing again (by about 0.5% per year), I'd expect some pickup in GDP growth. To average 3.5% over the next four years, we'd have to see an increase in productivity too.

• Jobs: Ten Million jobs over the next four years. "Create a dynamic booming economy that will create 25 million new jobs over the next decade." Source.

• GDP: 3.5% real annual GDP growth. "Boost growth to 3.5 percent per year on average, with the potential to reach a 4 percent growth rate." Source.

Update: Jan 1, 2018: These goals have been removed from the Trump website.

NMHC: Apartment Market Tightness Index remained negative in January Survey

by Calculated Risk on 1/23/2017 11:51:00 AM

From the National Multifamily Housing Council (NMHC): Apartment Markets Soften in the January NMHC Quarterly Survey

— Apartment markets continued to retreat in the January National Multifamily Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions. All four indexes of Market Tightness (25), Sales Volume (25), Equity Financing (33) and Debt Financing (14) remained below the breakeven level of 50 for the second quarter in a row.

“Weaker conditions are evident across all sectors as the apartment industry adjusts to changing conditions,” said Mark Obrinsky, NMHC’s Senior Vice President of Research and Chief Economist. “Rising supply—particularly during a seasonally weak quarter—is causing rent growth to moderate in many markets. At the same time, the sharp rise in interest rates in recent months was a triple whammy for the industry. First, higher rates directly worsen debt financing conditions. Second, the associated rise in cap rates also put a crimp in sales of apartment properties. Third, higher cap rates following the long run-up in apartment prices caused greater caution among equity investors.”

“The underlying demand for apartment residences remains strong, however. While new apartments continue to come online at a good clip, absorptions of those apartments remain strong. As long as the job market continues its steady expansion, any local supply overshoots should be manageable,” said Obrinsky.

The Market Tightness Index dropped three points to 25 – the fifth consecutive quarter of declining conditions and the lowest in more than seven years. Over half (58 percent) reported looser conditions from three months ago, compared to only eight percent who reported tighter conditions.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter. This indicates market conditions were looser over the last quarter.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010.

This is the fifth consecutive quarterly survey indicating looser conditions - it appears supply has caught up with demand - and I expect rent growth to slow.

Black Knight: Mortgage Delinquencies Declined in December

by Calculated Risk on 1/23/2017 10:11:00 AM

From Black Knight: Black Knight Financial Services’ First Look at December 2016 Mortgage Data

• The inventory of loans in active foreclosure nationwide declined by more than 200,000 in 2016According to Black Knight's First Look report for December, the percent of loans delinquent decreased 0.9% in December compared to November, and declined 7.5% year-over-year.

• Delinquencies were down 0.91 percent from November 2016 and 7.5 percent from December 2015

• December’s 59,700 foreclosure starts represented a 24 percent decline from the same time last year

• Pre-payment activity continues to slow, down 5.5 percent from November

The percent of loans in the foreclosure process declined 3.3% in December and were down 30.5% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.42% in December, down from 4.46% in November.

The percent of loans in the foreclosure process declined in December to 0.95%.

The number of delinquent properties, but not in foreclosure, is down 286,000 properties year-over-year, and the number of properties in the foreclosure process is down 206,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for December by February 6th.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Dec 2016 | Nov 2016 | Dec 2015 | Dec 2014 | |

| Delinquent | 4.42% | 4.46% | 4.78% | 5.62% |

| In Foreclosure | 0.95% | 0.98% | 1.37% | 1.75% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,248,000 | 2,263,000 | 2,408,000 | 2,833,000 |

| Number of properties in foreclosure pre-sale inventory: | 483,000 | 498,000 | 689,000 | 881,000 |

| Total Properties | 2,731,000 | 2,761,000 | 3,097,000 | 3,715,000 |

Sunday, January 22, 2017

Sunday Night Futures

by Calculated Risk on 1/22/2017 09:01:00 PM

Menzie Chinn at Econbrowser recommends a new site: EconoFact

EconoFact is a non-partisan publication, online starting today, designed to bring key facts and incisive analysis to the national debate on economic and social policies. It is written by leading academic economists from across the country who belong to the EconoFact Network, and published by the Edward R. Murrow Center for a Digital World at The Fletcher School at Tufts University. The co-editors are Michael Klein and Edward Schumacher-Matos.Weekend:

Inaugural memos tackle Trump’s promise to bring back manufacturing jobs, the prospects for the big, beautiful wall, charter schools, the destination based border tax, whether the trade deficit is a drag on growth, and whether China is now manipulating its currency.

• Schedule for Week of Jan 22, 2017

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are down 5, and DOW futures are down 34 (fair value).

Oil prices were down over the last week with WTI futures at $53.28 per barrel and Brent at $55.53 per barrel. A year ago, WTI was at $28, and Brent was at $28 - so oil prices are up sharply year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.30 per gallon - a year ago prices were at $1.85 per gallon - so gasoline prices are up 45 cents a gallon year-over-year.

Hotels: Concerns about Fewer Foreign Visitors in 2017

by Calculated Risk on 1/22/2017 11:09:00 AM

From HotelNewsNow.com: US hoteliers keep eye on dip in bookings from Europe

U.S. hoteliers have reported seeing a decline in bookings from European travelers heading into 2017 and are looking to explain what has caused the drop.From HotelNewsNow.com: STR: US hotel results for week ending 14 January

Possible factors include economic uncertainty in the continent, coupled with a new U.S. president who is unpopular in several European countries. But it’s hard to say what combination of things, if any, is keeping Europeans away.

PM Hotel Group began watching reservations originating from other countries shortly after the presidential election, President Joe Bojanowski said. Company officials had serious concerns about foreign inbound travel in the New York City and San Francisco areas, he said, and the company has seen a decline in reservations in those markets.

The U.S. hotel industry reported mixed results in the three key performance metrics during the week of 8-14 January 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In year-over-year comparisons, the industry’s occupancy decreased 0.9% to 56.6%. However, average daily rate (ADR) rose 2.8% to US$122.29, and revenue per available room (RevPAR) increased 1.9% to US$69.24.

emphasis added

The red line is for 2017, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2017, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2017 is close to 2015, and well ahead of the median rate.

For hotels, this is the slow season of the year, and occupancy will pick up into the Spring.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, January 21, 2017

Schedule for Week of Jan 22nd

by Calculated Risk on 1/21/2017 08:04:00 AM

The key economic report this week is the advance report of Q4 GDP on Friday.

Other key reports are December New and Existing Home sales.

No economic releases scheduled.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 5.54 million SAAR, down from 5.61 million in November.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 5.54 million SAAR, down from 5.61 million in November.Housing economist Tom Lawler expects the NAR to report sales of 5.55 million SAAR in December.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for January.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for December 2016

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: FHFA House Price Index for November 2016. This was originally a GSE only repeat sales, however there is also an expanded index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 247 thousand initial claims, up from 234 thousand the previous week.

8:30 AM: Chicago Fed National Activity Index for December. This is a composite index of other data.

10:00 AM ET: New Home Sales for December from the Census Bureau.

10:00 AM ET: New Home Sales for December from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the October sales rate.

The consensus is for a decrease in sales to 590 thousand Seasonally Adjusted Annual Rate (SAAR) in December from 592 thousand in November.

11:00 AM: the Kansas City Fed manufacturing survey for January.

8:30 AM: Gross Domestic Product, 4th quarter 2016 (advance estimate). The consensus is that real GDP increased 2.2% annualized in Q4, down from 3.5% in Q3.

8:30 AM: Durable Goods Orders for December from the Census Bureau. The consensus is for a 3.0% increase in durable goods orders.

10:00 AM: University of Michigan's Consumer sentiment index (final for January). The consensus is for a reading of 98.2, up from the preliminary reading 98.1.

Friday, January 20, 2017

Lawler: The Household Conundrum, Part I Continued: The CPS/ASEC Data for 18-29 Year Olds

by Calculated Risk on 1/20/2017 05:25:00 PM

Earlier: Lawler: The Household Conundrum, Part I: The CPS/ASEC Data

From housing economist Tom Lawler: The Household Conundrum, Part I Continued: The CPS/ASEC Data for 18-29 Year Olds

Many analysts have noted that estimates for the number of households from the CPS/ASEC appear to have overstated the “actual” number of households, with most of the overstatement being estimates of the number of “young adult” householders. If that were the case, then obviously the CPS/ASEC also understates the “other” living arrangements of young adults (e.g., young adults living with parents, other relatives, or non-relatives. Below is a table comparing the shares of 18-29 year olds by household relationship as estimated by the CPS/ASEC to those from Decennial Census 2010.

Note that the CPS/ASEC is a “household” survey, and not a survey of the entire population. Note also that the CPS/ASEC counts students living in college housing as living at home, while the Decennial Census counts students living in college housing as living in “group quarters” (and as such are not counted in the “household” population. On April 1, 2010 Decennial Census estimates show about 2.5 million people living in college housing, with the vast majority (though not quite all) of those people being between 18 and 29 years old. As such, I have added the number of 18-29 year olds living in college housing to the Decennial Census estimates of the “household” population in order to make Census data comparable in definition to the CPS/ASEC data.

| Share of 18-29 Year Olds in the "Household" Population (CPS definition) by Relationship to Householder, 2010 | |||

|---|---|---|---|

| CPS/ASEC | Census | Difference | |

| Householder | 30.5% | 27.6% | 2.9% |

| Spouse | 10.0% | 9.7% | 0.3% |

| Child | 38.4% | 39.7% | -1.4% |

| Other Relative | 7.9% | 8.2% | -0.2% |

| Non-Relative | 13.2% | 14.8% | -1.6% |

As the table indicates, CPS/ASEC estimates of the share of 18-29 year olds that were householders in 2010 is almost 3 percentage points higher than estimates from the Decennial Census. CPS/ASEC estimates of the share of 18-29 year olds living with parents, in contrast, are 1.4 percentage points below Census estimates, and the share of 18-29 year olds living with “non-relative” (roomer or boarder, housemate or roommate, unmarried partner, or “other”) is 1.6 percentage points below Census estimates.

While these differences may not seem that large, the (1) are statistically significant; and (2) imply that the CPS/ASEC estimate for the number of 18-29 year old householders is about 1.6 million “too high.”

Even more startling, though not as important, are the CPS/ASEC estimates for the number of householders 15-17 years old – about 210,000 – compared to the Decennial Census estimate of 28,297.

On the next table is a comparison of the number of households by age group from Census 2010 (“official” numbers) compared to those of the CPS/ASEC (adjusted to reflect Census 2010 population count “controls).

| Household Estimates by Age Group, 2010 (000's) | |||

|---|---|---|---|

| Decennial Census | CPS/ASEC (Adjusted) | % Difference | |

| 15-17 | 28 | 209 | 638.5% |

| 18-24 | 5,373 | 6,116 | 13.8% |

| 25-29 | 8,490 | 9,397 | 10.7% |

| 30-34 | 9,468 | 9,776 | 3.3% |

| 35-44 | 21,291 | 21,729 | 2.1% |

| 45-54 | 24,907 | 25,113 | 0.8% |

| 55-64 | 21,340 | 20,777 | -2.6% |

| 65-74 | 13,505 | 13,400 | -0.8% |

| 75+ | 12,315 | 12,243 | -0.6% |

| Total | 116,716 | 118,760 | 1.8% |

It is not readily apparent either (1) why the CPS/ASEC estimates for the number of “young” adult households are overstated by as much as they are (or why the overstatement is a function of age); or (2) why this overstatement showed up for the first time (albeit by not nearly as much) in 2000.

Some believe related to the significant increase in the non-response rate in the CPS that began around the same time (1994) that the CPS shifted computer-assisted interview data collection system (CATI), combined with higher non-response rates for younger adults relative to older adults. Others wonder whether the differences are somehow related to the “imperfect” sampling frame of the CPS/ASEC. Personally, I don’t know the answer.

If, in fact, the CPS is not getting the “living arrangements” of young adults “right” – overstating both the share of young adults that are householders and the share of young adults that are homeowners (see LEHC, 1/18/2016), then it would not be surprising that other statistics about young adults from the CPS (employment, income, etc.) may also be “off.”

Then and Now

by Calculated Risk on 1/20/2017 01:42:00 PM

A few indicators comparing eight years ago and today ...

| Jan-09 | Dec-16 | |

|---|---|---|

| Vehicle Sales1 | 9.6 | 18.3 |

| Monthly Employment change2 | -791 | 156 |

| Unemployment Rate3 | 7.8% | 4.7% |

| Housing Starts4 | 490 | 1,126 |

| New Home Sales5 | 336 | 592 |

| Mortgage Delinquency Rate6 | 13.0% | 6.1% |

| Budget Deficit7 | 9.8% | 2.8% |

| S&P 5008 | 805 | 2,269 |

| 1millions, SAAR 2Thousands 3Peaked at 10% in 2009 4Thousands, SAAR 5Thousands, SAAR 6Source: MBA, Quarterly including in-foreclosure 7Annual, fiscal 2008 vs. 2016 8Jan 20, 2009 vs Jan 20, 2017 | ||