by Calculated Risk on 8/27/2014 10:25:00 AM

Wednesday, August 27, 2014

CBO Projection: Budget Deficits in Future Years to be Smaller than Previous Forecast

The Congressional Budget Office (CBO) released new budget projections today An Update to the Budget and Economic Outlook: 2014 to 2024. The projected budget deficits have been reduced for most of the next ten years, although the projected deficit for 2014 has been revised up slightly (by $14 billion).

NOTE: In the previous update, the CBO revised down their projection of the deficit for fiscal 2014 from 3.7% to just under 2.9% of GDP.

From the CBO:

The federal budget deficit for fiscal year 2014 will amount to $506 billion, CBO estimates, roughly $170 billion lower than the shortfall recorded in 2013. At 2.9 percent of gross domestic product (GDP), this year's deficit will be much smaller than those of recent years (which reached almost 10 percent of GDP in 2009) and slightly below the average of federal deficits over the past 40 years.The CBO projects the deficit will decline further in 2015, and will be at or below 3% of GDP through fiscal 2019. Then the deficit will slowly increase.

...

CBO's current economic projections differ in some respects from the ones issued in February 2014. The agency has significantly lowered its projection of growth in real GDP for 2014, reflecting surprising economic weakness in the first half of the year. However, the level of real GDP over most of the coming decade is projected to be only modestly lower than estimated in February. In addition, CBO now anticipates lower interest rates throughout the projection period and a lower unemployment rate for the next six years.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the CBO.

The CBO revised down their deficit projections for fiscal years 2017 through 2024.

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

by Calculated Risk on 8/27/2014 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 22, 2014. ...

The Refinance Index increased 3 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.28 percent from 4.29 percent, with points decreasing to 0.25 from 0.26 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

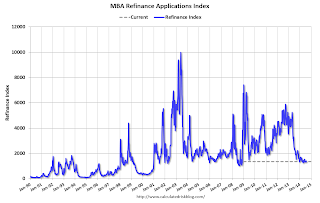

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 73% from the levels in May 2013.

As expected, refinance activity is very low this year.

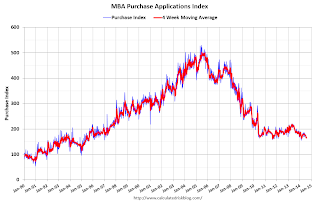

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 11% from a year ago.

Tuesday, August 26, 2014

Zillow: Case-Shiller House Price Index expected to slow further year-over-year in July

by Calculated Risk on 8/26/2014 08:31:00 PM

The Case-Shiller house price indexes for June were released this morning. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: Case-Shiller Slowdown Forecasted to Continue

The Case-Shiller data for June 2014 came out this morning, and based on this information and the July 2014 Zillow Home Value Index (ZHVI, released August 21), we predict that next month’s Case-Shiller data (July 2014) will show that the non-seasonally adjusted (NSA) 20-City Composite Home Price Index increased by 7.0 percent and the NSA 10-City Composite Home Price Index increased by 6.9 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from June to July will be 0.1 percent for the 20-City Composite Index and flat for the 10-City Composite Home Price Index (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for July will not be released until Tuesday, September 30.So the Case-Shiller index will probably show a lower year-over-year gain in July than in June (8.1% year-over-year).

| Zillow July 2014 Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | July 2013 | 176.39 | 172.88 | 162.38 | 158.96 |

| Case-Shiller (last month) | June 2014 | 187.19 | 185.57 | 172.33 | 170.69 |

| Zillow Forecast | YoY | 6.9% | 6.9% | 7.0% | 7.0% |

| MoM | 0.7% | 0.0% | 0.8% | 0.1% | |

| Zillow Forecasts1 | 188.5 | 185.2 | 173.7 | 170.5 | |

| Current Post Bubble Low | 146.45 | 149.91 | 134.07 | 137.13 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 28.7% | 23.5% | 29.6% | 24.3% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 8/26/2014 04:45:00 PM

• Starting this month, S&P is releasing the Case-Shiller National Index on a monthly basis. This probably means most reporting of a "headline number" will be switched from the Case-Shiller Composite 20 to the National Index.

• On a method to improve the seasonal factors, see Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

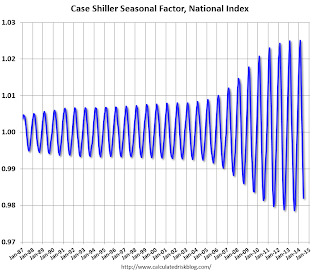

There has always been a clear seasonal pattern for house prices, but the seasonal differences have been more pronounced since the housing bust.

Even in normal times house prices tend to be stronger in the spring and early summer than in the fall and winter. Recently there has been a larger than normal seasonal pattern mostly because conventional sales are following the normal pattern (more sales in the spring and summer), but distressed sales (foreclosures and short sales) happen all year. So distressed sales have had a larger negative impact on prices in the fall and winter.

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010).

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller National index since 1987 (both through Jnue). The seasonal pattern was smaller back in the '90s and early '00s, and increased since the bubble burst.

It appears we've already seen the strongest month this year (NSA) for both Case-Shiller NSA and CoreLogic. This suggests both indexes will turn negative seasonally (NSA) earlier this year than the previous two years - perhaps in the August reports.

It appears the seasonal factor has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels (Kolko's article has more on this).

Zillow: Negative Equity declines further in Q2 2014

by Calculated Risk on 8/26/2014 02:11:00 PM

From Zillow: High Negative Equity Causing Generational Housing Gridlock

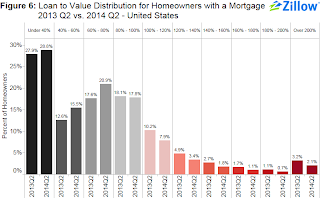

According to the second quarter Zillow Negative Equity Report, the national negative equity rate continued to decline in 2014 Q2, falling to 17 percent, down 14.4 percentage points from its peak (31.4 percent) in the first quarter of 2012. Negative equity has fallen for nine consecutive quarters as home values have risen. However, more than 8.7 million homeowners with a mortgage still remain underwaterThe following graph from Zillow shows negative equity by Loan-to-Value (LTV) in Q2 2014 compared to Q2 2013.

emphasis added

Click on graph for larger image.

Click on graph for larger image.From Zillow:

Figure 6 shows the loan-to-value (LTV) distribution for homeowners with a mortgage in 2014 Q2 versus 2013 Q2. The bulk of underwater homeowners, roughly 7.9 percent, are underwater by up to 20 percent of their loan value and will soon cross over into positive equity territory.Almost half of the borrowers with negative equity have a LTV of 100% to 120% (7.9% in Q2 2014). Most of these borrowers are current on their mortgages - and they have probably either refinanced with HARP or the loans are well seasoned (most of these properties were purchased in the 2004 through 2006 period, so borrowers have been current for eight years or so). In a few years, these borrowers will have positive equity.

The key concern is all those borrowers with LTVs above 140% (about 5.7% of properties with a mortgage according to Zillow). It will take many years to return to positive equity ... and a large percentage of these properties will eventually be distressed sales (short sales or foreclosures).

Note: CoreLogic will release their Q2 negative equity report in the next couple of weeks. For Q1, CoreLogic reported there were 6.3 million properties with negative equity, and that will be down further in Q2 2014.

House Prices: Better Seasonal Adjustment; Real Prices and Price-to-Rent Ratio Decline in June

by Calculated Risk on 8/26/2014 11:22:00 AM

This morning, S&P reported that the Composite 20 index declined 0.2% in June seasonally adjusted. However, it appears the seasonal adjustment has been distorted by the high level of distressed sales in recent years. Trulia's Jed Kolko wrote last month: "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

The housing crisis substantially changed the seasonal pattern of housing activity: relative to conventional home sales, which peak in summer, distressed home sales are more evenly spread throughout the year and sell at a discount. As a result, in years when distressed sales constitute a larger share of overall sales, the seasonal swings in home prices get bigger while the seasonal swings in sales volumes get smaller.

Sharply changing seasonal patterns create problems for seasonal adjustment methods, which typically estimate seasonal adjustment factors by averaging several years’ worth of observed seasonal patterns. A sharp but ultimately temporary change in the seasonal pattern for housing activity affects seasonal adjustment factors more gradually and for more years than it should. Despite the recent normalizing of the housing market, seasonal adjustment factors are still based, in part, on patterns observed at the height of the foreclosure crisis, causing home price indices to be over-adjusted in some months and under-adjusted in others.

Kolko proposed a better seasonal adjustment:

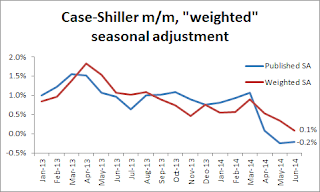

Kolko proposed a better seasonal adjustment:This graph from Kolko shows the weighted seasonal adjustment (see Kolko's article for a description of his method). Kolko calculates that prices increased 0.1% on a weighted seasonal adjustment basis in June.

I've been expecting a slowdown in year-over-year prices as "For Sale" inventory increases, and the slowdown is here! The Case-Shiller Composite 20 index was up 8.1% year-over-year in June; the smallest year-over-year increase since December 2012.

This is still a very strong year-over-year change, but on a seasonally adjusted monthly basis, the Case-Shiller Composite 20 index was down 0.2% in June (the second monthly decline in a row), and on a weighted seasonal adjusted basis (Kolko's method), the Composite 20 index was only up 0.1% in June. This suggests price increases have slowed sharply in recent months.

On a real basis (inflation adjusted), prices actually declined for the third consecutive month. The price-rent ratio also declined in June for the Case-Shiller Composite 20 index.

It is important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $280,000 today adjusted for inflation (40%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

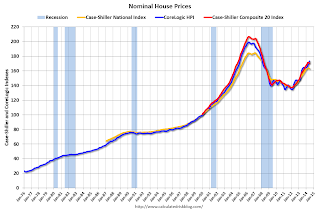

The first graph shows the monthly Case-Shiller National Index SA, and the Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through June) in nominal terms as reported.

The first graph shows the monthly Case-Shiller National Index SA, and the Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through June) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to early 2005 levels (and also back up to July 2008), and the Case-Shiller Composite 20 Index (SA) is back to September 2004 levels, and the CoreLogic index (NSA) is back to January 2005.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to June 2002 levels, the Composite 20 index is back to July 2002, and the CoreLogic index back to February 2003.

In real terms, house prices are back to early '00s levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

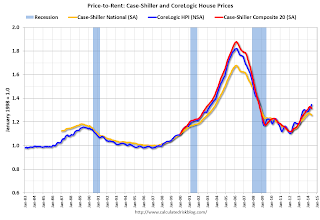

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to January 2003 levels, the Composite 20 index is back to October 2002 levels, and the CoreLogic index is back to June 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to early 2000 levels. And real prices (and the price-to-rent ratio) have declined for three consecutive months using Case-Shiller National and Comp 20 indexes.

Case-Shiller: Comp 20 House Prices increased 8.1% year-over-year in June

by Calculated Risk on 8/26/2014 09:17:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for June ("June" is a 3 month average of April, May and June prices).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities) and the National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Wide Spread Slowdown in Home Price Gains According to the S&P/Case-Shiller Home Price Indices

Data through June 2014, released today by S&P Dow Jones Indices for its S&P/Case-Shiller1 Home Price Indices ... show a sustained slowdown in price increases. The National Index gained 6.2% in the 12 months ending June 2014 while the 10-City and 20-City Composites gained 8.1%; all three indices saw their rates slow considerably from last month. Every city saw its year-over-year return worsen.

The National Index, now being published monthly, gained 0.9% in June. The 10- and 20-City Composites increased 1.0%. New York led the cities with a return of 1.6% and recorded its largest increase since June 2013. Chicago, Detroit and Las Vegas followed at +1.4%. Las Vegas posted its largest monthly gain since last summer. ...

“Home price gains continue to ease as they have since last fall,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “For the first time since February 2008, all cities showed lower annual rates than the previous month."

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 18.2% from the peak, and down 0.1% in June (SA). The Composite 10 is up 23.8% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 17.4% from the peak, and down 0.2% (SA) in June. The Composite 20 is up 24.5% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 8.1% compared to June 2013.

The Composite 20 SA is up 8.1% compared to June 2013.

Prices increased (SA) in 7 of the 20 Case-Shiller cities in June seasonally adjusted. (Prices increased in 20 of the 20 cities NSA) Prices in Las Vegas are off 42.7% from the peak, and prices in Denver and Dallas are at new highs (SA).

This was lower than the consensus forecast for a 8.4% YoY increase and suggests a further slowdown in price increases. I'll have more on house prices later.

Black Knight: Mortgage Loans in Foreclosure Process Lowest since March 2008

by Calculated Risk on 8/26/2014 08:01:00 AM

According to Black Knight's First Look report for July, the percent of loans delinquent decreased in July compared to June, and declined by 12% year-over-year.

Also the percent of loans in the foreclosure process declined further in July and were down 34% over the last year. Foreclosure inventory was at the lowest level since March 2008.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 5.64% in July, down from 5.70% in June. The normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 1.85% in July from 1.88% in June.

The number of delinquent properties, but not in foreclosure, is down 344,000 properties year-over-year, and the number of properties in the foreclosure process is down 471,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for July in early September.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| July 2014 | June 2014 | July 2013 | July 2012 | |

| Delinquent | 5.64% | 5.70% | 6.41% | 7.03% |

| In Foreclosure | 1.85% | 1.88% | 2.82% | 4.08% |

| Number of properties: | ||||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,713,000 | 1,728,000 | 1,846,000 | 1,960,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,136,000 | 1,155,000 | 1,347,000 | 1,650,000 |

| Number of properties in foreclosure pre-sale inventory: | 935,000 | 951,000 | 1,406,000 | 2,042,000 |

| Total Properties | 3,785,000 | 3,834,000 | 4,599,000 | 5,562,000 |

Monday, August 25, 2014

Tuesday: Durable Goods, Case-Shiller & FHFA House Prices, Richmond Fed Mfg Survey

by Calculated Risk on 8/25/2014 09:22:00 PM

From Gavyn Davies at the Financial Times: Draghi steals the show at Jackson Hole

The markets may read this as an empty threat, but they should note the importance of what [ECB President Mario Draghi] said about inflation expectations, which was added to the written text by the President himself on the day of the speech:Tuesday:

"Over the month of August, financial markets have indicated that inflation expectations exhibited significant declines at all horizons. The 5 year/5 year swap rate declined by 15 basis points to just below 2% … But if we go to shorter and medium-term horizons the revisions have been even more significant. The real [interest] rates on the short and medium term have gone up … The Governing Council will acknowledge these developments and within its mandate will use all the available instruments needed to ensure price stability over the medium term."This is much more explicit language about declining inflation expectations than anything the ECB has used in the past.

• At 8:30 AM ET, Durable Goods Orders for July from the Census Bureau. The consensus is for a 5.1% increase in durable goods orders. NOTE: The headline number could be huge because of a large number of aircraft orders in July.

• At 9:00 AM, S&P/Case-Shiller House Price Index for June. Although this is the June report, it is really a 3 month average of April, May and June. The consensus is for a 8.4% year-over-year increase in the Composite 20 index (NSA) for June. The Zillow forecast is for the Composite 20 to increase 8.1% year-over-year, and for prices to be unchanged month-to-month seasonally adjusted.

• Also at 9:00 AM, the FHFA House Price Index for June. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.3% increase.

• At 10:00 AM, the Conference Board's consumer confidence index for August. The consensus is for the index to decrease to 89.7 from 90.9.

• At 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for August.

New Home Prices: 43% of Home over $300K, 8% under $150K

by Calculated Risk on 8/25/2014 04:54:00 PM

Here are two graphs I haven't posted for some time ...

As part of the new home sales report, the Census Bureau reported the number of homes sold by price and the average and median prices.

From the Census Bureau: "The median sales price of new houses sold in July 2014 was $269,800; the average sales price was $339,100. "

The following graph shows the median and average new home prices.

During the bust, the builders had to build smaller and less expensive homes to compete with all the distressed sales. With fewer distressed sales now, it appears the builders have moved to higher price points.

The average price in July 2014 was $339,100, and the median price was $269,800. Both are above the bubble high (this is due to both a change in mix and rising prices). The average is at an all time high.

The second graph shows the percent of new homes sold by price. At the peak of the housing bubble, almost 40% of new homes were sold for more than $300K - and over 20% were sold for over $400K.

And only 8% of homes sold were under $150K in July 2014. This is down from 30% in 2002 - and down from 20% as recently as August 2011. Quite a change.

Earlier on New Home Sales:

• New Home Sales at 412,000 Annual Rate in July

• Comments on New Home Sales