by Calculated Risk on 6/05/2014 12:00:00 PM

Thursday, June 05, 2014

Fed's Q1 Flow of Funds: Household Net Worth at Record High

The Federal Reserve released the Q1 2014 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q1 compared to Q4, and is at a new record high. Net worth peaked at $68.9 trillion in Q2 2007, and then net worth fell to $55.6 trillion in Q1 2009 (a loss of $13.3 trillion). Household net worth was at $81.8 trillion in Q1 2014 (up $26.2 trillion from the trough in Q1 2009).

The Fed estimated that the value of household real estate increased to $20.2 trillion in Q1 2014. The value of household real estate is still $2.5 trillion below the peak in early 2006.

Click on graph for larger image.

Click on graph for larger image.

The first graph shows Households and Nonprofit net worth as a percent of GDP. Although household net worth is at a record high, as a percent of GDP it is still slightly below the peak in 2006 (housing bubble), but above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was increasing gradually since the mid-70s, and then we saw the stock market and housing bubbles. The ratio has been trending up and increased again in Q1 with both stock and real estate prices increasing.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q1 2014, household percent equity (of household real estate) was at 53.6% - up from Q4, and the highest since Q1 2007. This was because of both an increase in house prices in Q1 (the Fed uses CoreLogic) and a reduction in mortgage debt.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 50.7% equity - and millions have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt decreased by $37 billion in Q1.

Mortgage debt has now declined by $1.28 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up in Q1 (as house prices increased), and somewhat above the average of the last 30 years (excluding bubble). However household mortgage debt, as a percent of GDP, is still historically high, suggesting still a little more deleveraging ahead for certain households.

CoreLogic: Year Over Year, the Negative Equity Share Has Declined by 3.5 Million Properties

by Calculated Risk on 6/05/2014 09:22:00 AM

From CoreLogic: CoreLogic Reports 312,000 Residential Properties Regained Equity in Q1 2014

CoreLogic ... today released new analysis showing more than 300,000 homes returned to positive equity in the first quarter of 2014, bringing the total number of mortgaged residential properties with equity to more than 43 million. The CoreLogic analysis indicates that approximately 6.3 million homes, or 12.7 percent of all residential properties with a mortgage, were still in negative equity as of Q1 2014 compared to 6.6 million homes, or 13.4 percent for Q4 2013. As a year-over-year comparison, the negative equity share was 20.2 percent, or 9.8 million homes, in Q1 2013.

... Of the 43 million residential properties with equity, approximately 10 million have less than 20-percent equity. Borrowers with less than 20-percent equity, referred to as “under-equitied,” may have a more difficult time refinancing their existing home or obtaining new financing to sell and buy another home due to underwriting constraints. Under-equitied mortgages accounted for 20.6 percent of all residential properties with a mortgage nationwide in Q1 2014, with more than 1.5 million residential properties at less than 5-percent equity, referred to as near-negative equity. Properties that are near-negative equity are considered at risk if home prices fall. ...

Despite the massive improvement in prices and reduction in negative equity over the last few years, many borrowers still lack sufficient equity to move and purchase a home,” said Sam Khater, deputy chief economist for CoreLogic. “One in five borrowers have less than 10 percent equity in their property, which is not enough to cover the down payment and additional costs associated with a conventional mortgage.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest percentage of mortgaged properties in negative equity at 29.4 percent, followed by Florida (26.9 percent), Mississippi (20.1 percent), Arizona (20.1 percent) and Illinois (19.7 percent). These top five states combined account for 31.1 percent of negative equity in the United States. "

Note: The share of negative equity is still very high in Nevada and Florida, but down significantly from a year ago (Q1 2013) when the negative equity share in Nevada was at 45.4 percent, and at 38.1 percent in Florida.

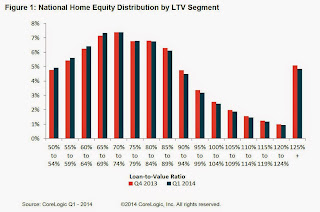

The second graph shows the distribution of home equity in Q1 compared to Q4 2013. Close to 5% of residential properties have 25% or more negative equity, down slightly from Q4.

The second graph shows the distribution of home equity in Q1 compared to Q4 2013. Close to 5% of residential properties have 25% or more negative equity, down slightly from Q4.In Q1 2013, there were 9.8 million properties with negative equity - now there are 6.3 million. A significant change.

Weekly Initial Unemployment Claims increase to 312,000

by Calculated Risk on 6/05/2014 08:30:00 AM

The DOL reports:

In the week ending May 31, the advance figure for seasonally adjusted initial claims was 312,000, an increase of 8,000 from the previous week's revised level. The previous week's level was revised up by 4,000 from 300,000 to 304,000. The 4-week moving average was 310,250, a decrease of 2,250 from the previous week's revised average. This is the lowest level for this average since June 2, 2007 when it was 307,500. The previous week's average was revised up by 1,000 from 311,500 to 312,500.The previous week was revised up from 300,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 310,250.

This was close to the consensus forecast of 310,000. The 4-week average is at the lowest level since June 2007 and is at normal levels for an expansion.

Wednesday, June 04, 2014

Thursday: ECB, Unemployment Claims, Flow of Funds

by Calculated Risk on 6/04/2014 07:05:00 PM

A few analyst views on the ECB decision tomorrow via the WSJ: The Market Says the ECB Will Act. What to Expect Next. As an example from Credit Agricole economists:

“We do not believe the ECB can afford to do nothing this week after having intentionally raised hopes of further monetary easing. While the maximum impact from an ECB rate cut would come with a negative deposit rate and liquidity-boosting measures, […] there is no guarantee that negative rates alone would boost bank lending. However, credit easing measures are becoming increasingly likely, either indirectly, via LTRO, or directly, via private quantitative easing. Communication will be an important part of the June ‘package’. We expect ECB President Mario Draghi to leave the door open to unconventional action in case inflation fails to pick up by year-end.”Should be interesting!

Wednesday:

• 7:45 AM ET (1:45 PM CET) the ECB meets in Frankfurt. From Nomura:

We expect the ECB to deliver a package of measures on 5 June to ease monetary policy. We expect a 10bp cut to all key interest rates, taking the refi rate down to 0.15%, the deposit rate negative for the first time to -0.10% and the marginal lending facility rate down to 0.65%. We also expect an extension of the forward guidance on liquidity provisions, with the fixed-rate full-allotment procedure extended by a further 12 months to at least the end of June 2016. We also expect the ECB to launch a targeted LTRO programme in June (60% probability), to address credit weakness and risks to the recovery from this channel.• Early: the Trulia Price Rent Monitors for May. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 310 thousand from 300 thousand.

• At 12:00 PM, the Q1 Flow of Funds Accounts of the United States from the Federal Reserve.

Fed's Beige Book: Non-residential construction activity picking up, Residential is Mixed

by Calculated Risk on 6/04/2014 02:07:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of New York and based on information collected on or before May 23, 2014."

All twelve Federal Reserve Districts report that economic activity expanded during the current reporting period. The pace of growth was characterized as moderate in the Boston, New York, Richmond, Chicago, Minneapolis, Dallas, and San Francisco Districts, and modest in the remaining regions. Compared with the previous report, the pace of growth picked up in the Cleveland and St. Louis Districts but slowed slightly in the Kansas City District.And on real estate:

Residential real estate activity has been mixed since the last report, with a lack of inventory at times cited as a constraining factor. Boston, New York, and Kansas City indicated that existing home sales were being held back due to low or dwindling inventories. Sales rose modestly in the Cleveland, Richmond, Atlanta, Chicago, and Dallas Districts, with inventories described as low in Richmond and Chicago and declining in Cleveland. Sales activity, however, softened in the Philadelphia, St. Louis, Minneapolis, and San Francisco Districts, though Philadelphia did note some signs of improvement in May. San Francisco attributed some of the weakness to severe weather. Home prices continued to increase across most of the Districts; Boston reported some pullback in prices of single-family homes, though condo prices in that District, as well as in New York, rose. New York, Chicago, and Dallas reported strengthening demand for apartment rentals, whereas Boston noted some slackening in demand.Some more positive comments on commercial real estate. Residential is mixed.

Homebuilders gave mixed reports on new home sales and construction in recent weeks: Residential construction strengthened, to varying degrees in the New York, Richmond, Atlanta, Chicago, Kansas City, and Dallas Districts. However, Philadelphia, St. Louis, and Minneapolis indicated some weakening in new home sales and construction. Overall residential construction activity was mixed across the San Francisco District, though contacts there expect activity will increase over the next year. Both Boston and New York reported a good deal of recent multi-family development at the high end of the market, while Cleveland, Richmond, Atlanta, Chicago, and Dallas noted strength in multi-family construction more generally.

Non-residential construction activity was steady to stronger in most Districts over the latest reporting period, with strengthening reported in the Boston, St. Louis, and Kansas City Districts. Cleveland described pipeline activity as strong, and San Francisco noted that a number of public and commercial high rise projects have been announced or are underway. In contrast, Minneapolis reported a decline in non-residential construction activity, and Philadelphia characterized it as steady at a low level; Chicago described activity as mixed--with office construction weak but industrial and some segments of retail fairly strong. The commercial real estate market was mostly stronger since the last report. Leasing activity and vacancy rates improved in the Richmond, Atlanta, Chicago, Minneapolis, Kansas City, Dallas, and San Francisco Districts, and were generally steady in the Boston, New York, Philadelphia, and St. Louis Districts. Dallas described market conditions as robust.

emphasis added