by Calculated Risk on 5/28/2014 07:00:00 AM

Wednesday, May 28, 2014

MBA: "Mortgage Applications Decrease Slightly in Latest MBA Weekly Survey"

From the MBA: Mortgage Applications Decrease Slightly in Latest MBA Weekly Survey

Mortgage applications decreased 1.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 23, 2014. ...

The Refinance Index decreased 1 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.31 percent, the lowest level since June 2013, from 4.33 percent, with points decreasing to 0.15 from 0.20 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 73% from the levels in May 2013 (one year ago).

As expected, with the mortgage rate increases, refinance activity is very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 15% from a year ago.

Tuesday, May 27, 2014

ATA Trucking Index increased in April

by Calculated Risk on 5/27/2014 07:43:00 PM

Here is a minor indicator that I follow, from ATA: ATA Truck Tonnage Index Increased 1.5% in April

The American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index increased 1.5% in April, after rising 0.6% the previous month. In April, the index equaled 129.1 (2000=100) versus 127.2 in March. The all-time high was in November 2013 (131.0).

Compared with April 2013, the SA index increased 4.8%, which is the largest year-over-year gain of 2014.

...

“April was the third straight gain in tonnage totaling 4%,” said ATA Chief Economist Bob Costello. Tonnage is off 1.4% from the all-time high in November.

“I’m pleased that tonnage has been making solid progress after falling a total of 5.2% in December and January,” he said. “And April’s nice gain was better than the contraction in industrial production and the lackluster retail sales during the same month.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index has rebounded following the sharp decline during the winter and is now up 4.8% year-over-year.

Weekly Update: Housing Tracker Existing Home Inventory up 8.3% year-over-year on May 26th

by Calculated Risk on 5/27/2014 04:14:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for April). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays. Inventory in 2013 finished up 2.7% YoY compared to 2012.

Inventory in 2014 (Red) is now 8.3% above the same week in 2013.

Inventory is still very low - still below the level in 2012 (yellow) when prices started increasing - but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

Comment on House Prices: Real Prices, Price-to-Rent Ratio

by Calculated Risk on 5/27/2014 01:40:00 PM

I've been expecting a slowdown in year-over-year prices as "For Sale" inventory slowly increases, and the slowdown might be starting, but this was a still very strong month-to-month increase. The Case-Shiller Composite 20 index was up 1.2% in March 2014 seasonally adjusted (SA). Not much of a slowdown!

In March 2013, the Composite 20 index was up an even stronger 1.7% month-to-month SA, so the year-over-year change was slightly lower in March than in February. This is the fourth consecutive month with lower month-to-month changes than the same month last year. So the year-over-year change has declined from 13.7% in November 2013 to a still very strong 12.4% in March 2014.

It is likely the Case-Shiller Composite 20 index is overstating national price increases due to the inclusion of distressed sales, and the heavy weighting of coastal cities. Other indexes show less price appreciation than Case-Shiller (Black Knight, FNC), and Zillow indicated prices declined slightly in April. So I expect a further decline in the year-over-year change in the Case-Shiller April index (this index is a 3 month average and tends to lag some other indexes).

Also, I've heard talk of a new "bubble" for house prices. And it does appear, by the measures below, that house prices are somewhat above the historical norm. However since there is little evidence of speculative buying, I wouldn't call this a bubble - although these double digit price increases are clearly unsustainable.

Note: My definition of a "bubble", from a post I wrote in April 2005, Housing: Speculation is the Key:

A bubble requires both overvaluation based on fundamentals and speculation. It is natural to focus on an asset’s fundamental value, but the real key for detecting a bubble is speculation ... Speculation tends to chase appreciating assets, and then speculation begets more speculation, until finally, for some reason that will become obvious to all in hindsight, the "bubble" bursts.There was a clear bubble in 2005 with prices much more out of line with fundamentals than now, and rampant speculation with excessive leverage. Currently I'm not concerned.

It is important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $277,000 today adjusted for inflation (just over 38%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

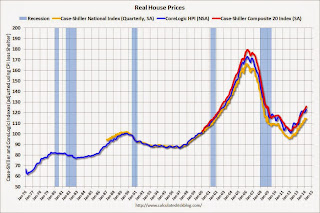

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2014), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through March) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2014), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through March) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to mid-2004 levels (and also back up to Q2 2008), and the Case-Shiller Composite 20 Index (SA) is back to Nov 2004 levels, and the CoreLogic index (NSA) is back to November 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to Q4 2001 levels, the Composite 20 index is back to August 2002, and the CoreLogic index back to June 2002.

In real terms, house prices are back to early '00s levels.

Price-to-Rent

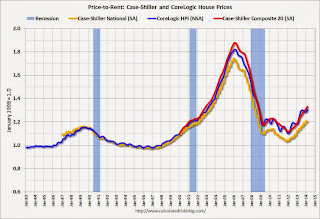

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q1 2002 levels, the Composite 20 index is back to December 2002 levels, and the CoreLogic index is back to February 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to early 2000 levels.

Richmond and Dallas Fed: Manufacturing Actiivty Increases "Mildly"

by Calculated Risk on 5/27/2014 10:30:00 AM

Manufacturing activity in the Richmond region increased "mildly" at the same rate in May as in April, and activity increased in the Dallas region at a "slower pace" in May.

From the Richmond Fed: Manufacturing Sector Activity Increased Mildly; Hiring Continued to Strengthen

Overall, manufacturing conditions improved. The composite index for manufacturing held steady at a reading of 7 during the past two months. The index for shipments gained four points, ending at 10, while the index for new orders softened seven points, finishing at a reading of 3. Manufacturing employment picked up this month; the May indicator advanced six points to a reading of 10.And from the Dallas Fed: Texas Manufacturing Grows but at a Slower Pace

emphasis added

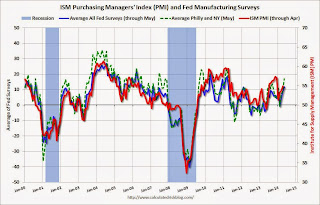

Texas factory activity increased again in May, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell from 24.7 to 11, indicating output grew but not strongly as in April.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The new orders index fell sharply to 3.8, hitting its lowest level this year. ... The general business activity index remained elevated but moved down from 11.7 to 8. ... Labor market indicators reflected a tapering of growth in employment levels and workweek length. The May employment index dropped to 2.9, its lowest reading in nearly a year.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through May), and five Fed surveys are averaged (blue, through May) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

All of the regional surveys showed expansion in May, and it seems likely the ISM index will increase again in May. The ISM index for May will be released Monday, June 2nd.

Case-Shiller: Comp 20 House Prices increased 12.4% year-over-year in March

by Calculated Risk on 5/27/2014 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for March ("March" is a 3 month average of January, February and March prices).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities) and the Q1 National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Rise in March According to the S&P/Case-Shiller Home Price Indices

Data through March 2014, released today by S&P Dow Jones Indices for its S&P/Case-Shiller1 Home Price Indices ... show the 10-City and 20-City Composite Indices gained 0.8% and 0.9% month-over-month. In the first quarter of 2014, the National Index gained 0.2%. Nineteen of the 20 cities showed positive returns in March – New York was the only city to decline. Dallas and Denver reached new index peaks.

In March, the National and Composite Indices saw their annual rates of gain slow significantly. ... The S&P/Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 10.3% gain in the first quarter of 2014 over the first quarter of 2013. The 10- and 20-City Composites posted year-over-year increases of 12.6% and 12.4% in March 2014.

“The year-over-year changes suggest that prices are rising more slowly,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “Annual price increases for the two Composites have slowed in the last four months and 13 cities saw annual price changes moderate in March. The National Index also showed decelerating gains in the last quarter. Among those markets seeing substantial slowdowns in price gains were some of the leading boom-bust markets including Las Vegas, Los Angeles, Phoenix, San Francisco and Tampa.

“Despite signs of decelerating prices, all cities were higher than a year ago and all but New York were higher in March than in February. However, only Denver and Dallas have set new post-crisis highs and they experienced relatively lower peak levels than other cities. Four locations are fairly close to their previous highs: Boston (8%), Charlotte (9%), Portland (13%) and San Francisco (15%).

Click on graph for larger image.

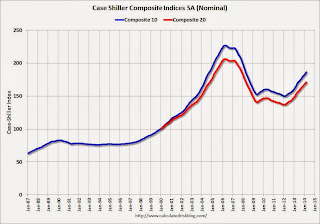

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 17.8% from the peak, and up 1.2% in March (SA). The Composite 10 is up 24.3% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 17.0% from the peak, and up 1.2% (SA) in March. The Composite 20 is up 25.0% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 12.6% compared to March 2013.

The Composite 20 SA is up 12.4% compared to March 2013.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in March seasonally adjusted. (Prices increased in 19 of the 20 cities NSA) Prices in Las Vegas are off 43.8% from the peak, and prices in Denver and Dallas are at new highs (SA).

This was above the consensus forecast for a 11.9% YoY increase. I'll have more on house prices later.

Monday, May 26, 2014

Tuesday: Durable Goods, Case-Shiller House Prices, Richmond and Dallas Fed Mfg Surveys

by Calculated Risk on 5/26/2014 07:19:00 PM

Tuesday:

• At 8:30 AM ET, Durable Goods Orders for April from the Census Bureau. The consensus is for a 0.8% decrease in durable goods orders.

• At 9:00 AM, the FHFA House Price Index for March. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.5% increase.

• Also at 9:00 AM, the S&P/Case-Shiller House Price Index for March. Although this is the March report, it is really a 3 month average of January, February and March. The consensus is for a 11.9% year-over-year increase in the Composite 20 index (NSA) for March. The Zillow forecast is for the Composite 20 to increase 11.9% year-over-year, and for prices to increase 0.8% month-to-month seasonally adjusted.

• At 10:00 AM, Conference Board's consumer confidence index for May. The consensus is for the index to increase to 83.0 from 82.3.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for May. The consensus is for a reading of 9, up from 7 in April.

• Also at 10:00 AM, Dallas Fed Manufacturing Survey for May. This is the last of the regional Fed manufacturing surveys for May.

Weekend:

• Schedule for Week of May 25th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 4 and DOW futures are up 40 (fair value).

Oil prices were up over the last week with WTI futures at $104.27 per barrel and Brent at $110.32 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.63 per gallon (might have peaked, and slightly below the level of a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Employment Graph Fail!

by Calculated Risk on 5/26/2014 01:42:00 PM

Reader MC sent me the following graph and asked "This chart looks highly questionable for a number of reasons. Any thoughts?"

Usually I ignore this nonsense, but I have a little extra time today - and this is an egregious example of "Graph Fail"

Click on graph for larger image.

Here is the apparent source of the graph.

The graph is constructed from the start of the 1982 and 2009 recoveries, and the graph subtracts the change in the Civilian noninstitutional population, 16 years and over, from the change in total non-farm payroll jobs.

This is just another way to ignore the change in demographics and the participation rate (that I've written about for years - and most research shows the decline in the participation rate is primarily due to changing demographics).

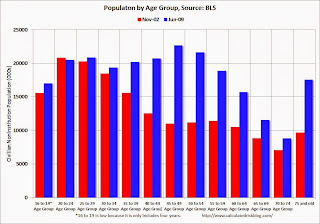

Here is a quick look at demographics: This graph shows the population in each 5 year age group in November 1982 (red) and June 2009 (blue). This is the start of each recovery. Note: Not Seasonally Adjusted, Source: BLS.

Here is a quick look at demographics: This graph shows the population in each 5 year age group in November 1982 (red) and June 2009 (blue). This is the start of each recovery. Note: Not Seasonally Adjusted, Source: BLS.

In November 1982 (red), the two largest groups were in the "20 to 24" and "25 to 29" age groups. These people were just entering the prime working age! Is anyone surprised there was an increase in the overall participation rate during the '80s?

In June 2009 (blue), the two largest groups were in the "45 to 49" and "50 to 54" age groups . The older group was moving into a lower participation age group. And look at all those people in the 75+ group in 2009! That is good news - people are living longer - but most of these people are not participating in the labor force (the 75+ participation rate was 8.3% in April 2014).

And there are other long term demographic trends. As an example, in November 1982, 54.7% of the "16 to 19" age group participated in the labor force, and in 2009, only 38.5% participated (this is a long term trend and is mostly because more young people are staying in school - more good news).

So just ignore this graph. It is a Graph Fail!.

Note: The 1981 recession was primarily caused by then Fed Chairman Paul Volcker tightening monetary policy to fight inflation, and the recovery was directly related to the Fed easing policy. The 2007 recession was a direct result of the housing bubble and bust, and resulting financial crisis (all research shows recoveries from financial crisis are very difficult).

Sunday, May 25, 2014

Vehicle Sales Forecasts: Over 16 Million SAAR in May

by Calculated Risk on 5/25/2014 03:13:00 PM

The automakers will report May vehicle sales on Tuesday, June 3rd. Sales in April were close to 16.0 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in May will be above 16 million (SAAR).

Here are a few forecasts:

From WardsAuto: May Sales to Continue Upward Trend

A new WardsAuto forecast calls for U.S. light-vehicle deliveries to best April’s strong showing, with modest increases to incentives and a full post-holiday sales week on the calendar boosting the retail outlook. ... The projected 16.1 million-unit seasonally adjusted annual rate would be slightly higher than [in April].From J.D. Power: J.D. Power and LMC Automotive Report: May New-Vehicle Retail Sales Continue Growth Trend; Strong Memorial Day Weekend Expected

The strong retail performance is expected to lift total light-vehicle sales to 1.5 million units in May 2014 ... [16.1 million SAAR]

From TrueCar: May SAAR to Hit 16.1 Million Vehicles, According to TrueCar; 2014 New Vehicle Sales Expected to be up 5.5 Percent Year-Over-Year

Seasonally Adjusted Annualized Rate ("SAAR") of 16.1 million new vehicle sales is up 6 percent from May 2013 and up 1.1 percent over April 2014.The sales growth rate will probably slow this year and auto sales will contribute less to GDP growth in 2014 than the previous four years. Here is a table showing annual sales and the growth rate since 2000.

| Light Vehicle Sales | ||

|---|---|---|

| Sales (millions) | Annual Change | |

| 2000 | 17.4 | 2.7% |

| 2001 | 17.1 | -1.3% |

| 2002 | 16.8 | -1.8% |

| 2003 | 16.6 | -1.1% |

| 2004 | 16.9 | 1.4% |

| 2005 | 16.9 | 0.5% |

| 2006 | 16.5 | -2.6% |

| 2007 | 16.1 | -2.5% |

| 2008 | 13.2 | -18.0% |

| 2009 | 10.4 | -21.2% |

| 2010 | 11.6 | 11.1% |

| 2011 | 12.7 | 10.2% |

| 2012 | 14.4 | 13.4% |

| 2013 | 15.5 | 7.6% |

| 20141 | 16.1 | 3% |

| 1LMC Automotive Forecast | ||

Unofficial Problem Bank list declines to 499 Institutions

by Calculated Risk on 5/25/2014 09:30:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 23, 2014.

Changes and comments from surferdude808:

Three removals this week lower the Unofficial Problem Bank List to 499 institutions with assets of $154.9 billion. A year ago the list held 767 institutions with assets of $283.7 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 499 (just under half the peak).

Actions were terminated against First Bank, Creve Coeur, MO ($5.8 billion) and Parke Bank, Sewell, NJ ($794 million Ticker: PKBK). Somewhat surprisingly in front of the Memorial Day holiday, the FDIC closed Columbia Savings Bank, Cincinnati, OH ($38 million), which had been operating under a formal enforcement action since 2007. The failure is the eight this year compared to 13 failures at the 20th week last year.

Next week the FDIC is expected to release its enforcement action activity through April and release industry results and an updated Official Problem Bank List as of the first quarter.