by Calculated Risk on 11/24/2012 05:27:00 PM

Saturday, November 24, 2012

Unofficial Problem Bank list unchanged at 857 Institutions

CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew steadily and peaked at 1,002 institutions on June 10, 2011. The list has been declining recently.

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 23, 2012. (repeat from last week, table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As expected, a very quiet week for the Unofficial Problem Bank List as it went without change. You have to go back to January 6th of this year for the last time it went a week unchanged. The list stands at 857 institutions with assets of $329.2 billion. A year ago, the list held 980 institutions with assets of $400.5 billion.CR Note: The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

Next week, the FDIC will likely release its actions through October 2012 and the Official Problem Bank List as of September 30, 2012. The difference between the two lists will likely drop from 187 at last issuance to the low 170s.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

When the list was increasing, the official and "unofficial" counts were about the same. Now with the number of problem banks declining, the unofficial list is lagging the official list. This probably means regulators are changing the CAMELS rating on some banks before terminating the formal enforcement actions.

Earlier:

• Summary for Week Ending Nov 23rd

• Schedule for Week of Nov 25th

Schedule for Week of Nov 25th

by Calculated Risk on 11/24/2012 01:01:00 PM

Earlier:

• Summary for Week Ending Nov 23rd

Negotiations concerning the "fiscal slope" in the US will be back in the headlines this week. And, in Europe, the discussion on funding for Greece will resume on Monday.

There are two key housing reports this week: Case-Shiller house prices on Tuesday, and New Home Sales on Wednesday.

Revised Q3 GDP will be released on Thursday, and the October Personal Income and Outlays report will be released on Friday.

For manufacturing, three regional manufacturing reports will be released (Richmond, Dallas and Kansas City Fed surveys), plus the Chicago PMI will be released Friday.

The NY Fed will release their Q3 Report on Household Debt and Credit on Tuesday, and the FDIC is expected to release the Q3 Quarterly Banking Profile this week.

8:30 AM ET: Chicago Fed National Activity Index for October. This is a composite index of other data.

10:30 AM: Dallas Fed Manufacturing Survey for November. The consensus is for 4.7 for the general business activity index, up from 1.8 in September.

Expected: LPS "First Look" Mortgage Delinquency Survey for October.

8:30 AM: Durable Goods Orders for October from the Census Bureau. The consensus is for a 0.8% decrease in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September.

9:00 AM: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through August 2012 (the Composite 20 was started in January 2000).

The consensus is for a 2.9% year-over-year increase in the Composite 20 index (NSA) for September. The Zillow forecast is for the Composite 20 to increase 3.0% year-over-year, and for prices to increase 0.4% month-to-month seasonally adjusted.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for November. The consensus is for a decrease to -8 for this survey from -7 in October (below zero is contraction).

10:00 AM: FHFA House Price Index for September 2012. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic). The consensus is for a 0.5% increase in house prices.

10:00 AM: Conference Board's consumer confidence index for November. The consensus is for an increase to 72.8 from 72.2 last month.

3:00 PM: New York Fed to Release Q3 Report on Household Debt and Credit

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

10:00 AM ET: New Home Sales for October from the Census Bureau.

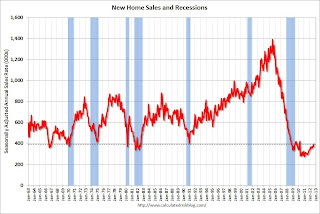

10:00 AM ET: New Home Sales for October from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the September sales rate.

The consensus is for a decrease in sales to 387 thousand Seasonally Adjusted Annual Rate (SAAR) in October from 389 thousand in September.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts. This might show some slight improvement. Some analysts will be looking for concerns about Europe or the "fiscal cliff".

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 390 thousand from 410 thousand.

8:30 AM: Q3 GDP (second release). This is the second release from the BEA. The consensus is that real GDP increased 2.8% annualized in Q3, revised up from 2.0% in the advance release.

10:00 AM ET: Pending Home Sales Index for October. The consensus is for a 1.0% increase in the index.

11:00 AM: Kansas City Fed regional Manufacturing Survey for November. The consensus is for an a reading of -1, up from -4 in October (below zero is contraction).

8:30 AM ET: Personal Income and Outlays for October. The consensus is for a 0.3% increase in personal income in October, and for 0.1% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for November. The consensus is for an increase to 50.3, up from 49.9 in October.

Summary for Week Ending Nov 23rd

by Calculated Risk on 11/24/2012 08:03:00 AM

Last week was a short holiday week and I hope everyone is enjoying their Thanksgiving weekend!

Overall the economic data was positive last week, especially the housing data. Housing starts were at the highest level in four years, but are still very low - and both comments are important. Housing (residential investment) is now a tail wind for the economy, and housing can increase significantly from here.

Also the existing home sales market continues to show improvement. The keys for the existing home report are inventory and the number of conventional sales. Inventory is down significantly, and conventional sales are increasing. There will be more housing data next week (New home sales and the Case-Shiller house price indexes).

Initial weekly unemployment claims were still elevated because of Hurricane Sandy, but I expect claims will decline back to the pre-storm level pretty quickly.

Early in the week I spoke with Joe Weisenthal at Business Insider, and he wrote a way too nice article: The Genius Who Invented Economics Blogging Reveals How He Got Everything Right And What's Coming Next.

As I noted, I just track economic data and make a few forecasts - and I didn't invent economic blogging (although I've been at it for eight years). Professor Krugman added a few nice comments: All Hail Calculated Risk.

Excuse my blushing - thanks to all for reading!

Here is a summary of last week in graphs:

• Housing Starts increased to 894 thousand SAAR in October

Click on graph for larger image.

Click on graph for larger image.

Total housing starts were at 894 thousand (SAAR) in October, up 3.6% from the revised September rate of 863 thousand (SAAR). Note that September was revised down from 872 thousand.

Single-family starts decreased slightly to 594 thousand in October.

Total starts are up about 87% from the bottom start rate, and single family starts are up about 70% from the low.

This was above expectations of 840 thousand starts in October. This was mostly because of the volatile multi-family sector that increased sharply in October, however single family starts have increased recently too. Starts are still very low, but on pace to be up about 25% from 2011.

• Existing Home Sales in October: 4.79 million SAAR, 5.4 months of supply

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in October 2012 (4.79 million SAAR) were 2.1% higher than last month, and were 10.9% above the October 2011 rate.

The second graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 21.9% year-over-year in October from October 2011. This is the 20th consecutive month with a YoY decrease in inventory.

Inventory decreased 21.9% year-over-year in October from October 2011. This is the 20th consecutive month with a YoY decrease in inventory.Months of supply declined to 5.4 months in October.

This was slightly above expectations of sales of 4.74 million. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing.

• Weekly Initial Unemployment Claims decline to 410,000

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 396,250.

This sharp increase in the 4 week average is due to Hurricane Sandy as claims increased significantly in the impacted areas. Note the spike in 2005 related to hurricane Katrina - we are seeing a similar impact, although on a smaller scale.

Weekly claims were about at the consensus forecast.

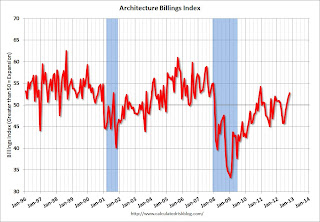

• AIA: Architecture Billings Index increases in October, Highest in Two Years

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

This graph shows the Architecture Billings Index since 1996. The index was at 52.8 in October, up from 51.6 in September. Anything above 50 indicates expansion in demand for architects' services.

This graph shows the Architecture Billings Index since 1996. The index was at 52.8 in October, up from 51.6 in September. Anything above 50 indicates expansion in demand for architects' services.This increase is mostly being driven by demand for design of multi-family residential buildings - and this suggests there are more apartments coming (there are already quite a few apartments under construction). New project inquiries are also increasing. Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests some increase in CRE investment next year (it will be some time before investment in offices and malls increases significantly).

• Final November Consumer Sentiment at 82.7

The final Reuters / University of Michigan consumer sentiment index for November declined to 82.7 from the preliminary reading of 84.9, and was up from the October reading of 82.6.

The final Reuters / University of Michigan consumer sentiment index for November declined to 82.7 from the preliminary reading of 84.9, and was up from the October reading of 82.6.This was below the consensus forecast of 84.0. Overall, consumer sentiment has been improving; the recent decline in sentiment might be related to the stock market decline (the consumer sentiment index is impacted by employment, gasoline prices, the stock market and more).

Friday, November 23, 2012

Las Vegas: Visitor Traffic on pace for Record High, Convention Attendance Lags

by Calculated Risk on 11/23/2012 08:34:00 PM

During the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic has recovered and here is an update.

Through September visitor traffic is running just ahead of the 2007 pace (the previous peak) and it is possible Las Vegas will see 40 million visitors this year. However convention attendance is barely ahead of last year, and about 20% below the peak level in 2006. Here is the data from the Las Vegas Convention and Visitors Authority.

Click on graph for larger image.

Click on graph for larger image.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale). 2012 is estimated based on traffic through September.

The gamblers are back, but not the conventions ...

ATA Trucking Index declines sharply in October, Impacted by Hurricane Sandy

by Calculated Risk on 11/23/2012 04:09:00 PM

This is a minor indicator that I follow. Clearly truck tonnage was impacted by Hurricane Sandy in October, and we will probably see a bounce back in November and December.

From ATA: ATA Truck Tonnage Index Fell 3.8% in October

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 3.8% in October after falling 0.4% in September. (The 0.4% decrease in September was revised from a 0.1% gain ATA reported on October 23, 2012.) October’s drop was the third consecutive totaling 4.7%. As a result, the SA index equaled 113.7 (2000=100) in October, the lowest level since May 2011. Compared with October 2011, the SA index was off 2.1%, the first year-over-year decrease since November 2009. Year-to-date, compared with the same period last year, tonnage was up 2.9%.Note from ATA:

...

“Clearly Hurricane Sandy negatively impacted October’s tonnage reading,” ATA Chief Economist Bob Costello said. “However, it is impossible for us to determine the exact impact.”

Costello noted that a large drop in fuel shipments into the affected area likely put downward pressure on October’s tonnage level since fuel is heavy freight, in addition to reductions in other freight.

“I’d expect some positive impact on truck tonnage as the rebuilding starts in the areas impacted by Sandy, although that boost may only be modest in November and December,” he said. “Excluding the Hurricane impacts, I still think truck tonnage is decelerating along with factory output and consumer spending on tangible-goods.”

emphasis added

Trucking serves as a barometer of the U.S. economy, representing 67% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.2 billion tons of freight in 2011. Motor carriers collected $603.9 billion, or 80.9% of total revenue earned by all transport modes.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

Even with the sharp decline in October, the index is at the pre-recession level. However, even before the hurricane, the index was mostly moving sideways this year due to the slowdown in manufacturing.