by Calculated Risk on 12/20/2011 06:34:00 PM

Tuesday, December 20, 2011

Housing Analysis: Bull and Bear

I'll be posting soon on the housing market (see Ten Economic Questions for 2012). In the meantime, here are two different views on housing ...

First from Daniel Alpert at EconoMonitor: Today’s U.S. New Home Starts and Permits Numbers: “Who Knows What Evil Lurks? The Shadow Knows”

Visible existing home inventory is not down for the right reasons (which would include a tightening in the inventory of unoccupied vacant units). It is down because of the enormous backlog in the aggregate “shadow inventory” of homes that are either in foreclosure, or are heading in that direction. The shadow inventory has grown because of a systemic and/or conscious slowing of the foreclosure and liquidation process in a market challenged by loan documentation problems and the general reticence of lenders to push collateral into the for-sale market at prices that result in sizable losses.

To help readers fully comprehend the dimensions of the shadow issue, I offer the following chart taken from the testimony of Laurie Goodman of Amherst Securities given to a congressional committee in September.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. Here is the chart for Laurie Goodman's testimony via Daniel Alpert. This shows some substantial shadow inventory (Goodman only included loans 12+ months delinquent or in foreclosure). However this isn't really "shadow" inventory because homes list for sale - that are 12+ months delinquent or in foreclosure - are not subtracted from the total. I don't think the situation is as grim as this chart suggests.

Alpert also presents a table from Goodman showing an estimate of supply and demand over the next several years (see Alpert's post). I think this is overly pessimistic. Most distressed homes are occupied, and when the occupants leave, most of them become renters. That doesn't increase the overall housing supply (many of the distressed home are bought by investor/landlords and rented - frequently to people who lost their homes in foreclosure).

On the flip side, John Talbott writes at the HuffPo: Homes - Buy Now! Talbott uses several metrics - home prices relative to construction costs, price-to-rent ratio, price-to-income ratio, real prices - and argues now is a good time to buy. (Note: Talbott wrote a book in 2003 titled: The Coming Crash in the Housing Market)

Unfortunately Talbott doesn't provide a graph for price-to-rent, so here is one:

This graph uses both Case-Shiller and CoreLogic house price indexes and compares the indexes to Owners' Equivalent Rent (OER) from the BLS.

This graph uses both Case-Shiller and CoreLogic house price indexes and compares the indexes to Owners' Equivalent Rent (OER) from the BLS.The price to rent ratio was set to 1.0 in January 1998. The price-to-rent ratio has fallen significantly, but appears to still be elevated on a national basis. A price-to-income chart (nationally) would also show slightly elevated prices (not shown since income data is released with a lag).

Talbott then shows prices adjusted by the price of gold. Oops. Gold is not a good measure to deflate prices.

This graph shows the quarterly Case-Shiller National Index SA (through Q3 2011), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes in real terms (adjusted for inflation using CPI less Shelter).

This graph shows the quarterly Case-Shiller National Index SA (through Q3 2011), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes in real terms (adjusted for inflation using CPI less Shelter). As I've pointed out before, there is an upward slope to real house prices in many land constrained areas with increasing population - so just like for the price-to-rent ratio, this measure is close to normal, but still slightly elevated.

I'll post some more thoughts over the next couple of weeks, but I think it is location dependent now - although I expect to see some more price declines on the national repeat sales indexes. Some areas have a significant backlog of distressed homes, and there is no rush to buy in those areas. In other areas, prices have probably already bottomed (or are close enough that there will be some attractive prices).

Earlier:

• Housing Starts increase in November

• Multi-family Starts and Completions, Record Low Total Completions in 2011

• A comment on Existing Home Sales revisions

A comment on Existing Home Sales revisions

by Calculated Risk on 12/20/2011 02:55:00 PM

Tomorrow the National Association of Realtors (NAR) is scheduled to release the November Existing Home Sales report and downward revisions for sales and inventory for the years 2007 through 2011.

Economist Tom Lawler estimates the NAR will report a 1.8% increase in sales from October. He expects a downward revision of about 13%, so he expects the NAR to report sales of around 4.4 million at a seasonally adjusted annual rate (SAAR) in November. Consensus expectations are for 5.08 million sales (SAAR), but that is pre-revision.

It is possible that the downward revision will be even larger, but reported sales will probably be in the low to mid 4 million range.

However the key number in the report is inventory. Using data from HousingTracker.net, it appears that visible inventory (listed for sale) will be back to late 2005 levels. Nick Timiraos at the WSJ writes today: Already Low, Housing Inventory Drops More

The number of homes listed for sale in the U.S. fell for the sixth straight month in November to the lowest level since the housing bust began in 2006.Although there are many distressed sales still to come, this decline in visible inventory is a significant story.

The 2.01 million homes listed for sale was down by 4.8% from October and by 21.3% from one year ago, according to data compiled by Realtor.com.

Of course the headlines tomorrow will probably be about the significant downward revision to sales. Diana Olick at CNBC writes: Beware of the Big Bad Home Sales Revisions

Expectations are that home sales could be revised down anywhere from 10 percent to 20 percent. The Realtors’ chief economist said the revision would be, “meaningful.”Yes, there will be screaming headlines tomorrow, and probably accusations against the NAR, but that means reporters are missing the key story - the decline in visible inventory.

...

The Realtors’ revisions will change perception; they may even change consumer sentiment. Headlines will scream Wednesday morning, and reporters like me will jump in with the “breaking news” that far fewer existing homes sold over the past four years than previously thought.

...

The crash will look bigger. Will that change anything in the economy today? Will it affect the housing market going forward? ... My guess is no, but the revisions — and the hue and cry surrounding them — will hurt consumer confidence, which was beginning to come around ever so slightly.

Earlier:

• Housing Starts increase in November

• Multi-family Starts and Completions, Record Low Total Completions in 2011

State Unemployment Rates "generally lower" in November

by Calculated Risk on 12/20/2011 01:00:00 PM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally lower in November. Forty-three states and the District of Columbia recorded unemployment rate decreases, three states posted rate increases, and four states had no rate change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada continued to record the highest unemployment rate among the states, 13.0 percent in November. California posted the next highest rate, 11.3 percent. North Dakota again registered the lowest jobless rate, 3.4 percent, followed by Nebraska, 4.1 percent, and South Dakota, 4.3 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). Every state has some blue - indicating no state is currently at the maximum during the recession.

The states are ranked by the highest current unemployment rate. Seven states and the District of Columbia still have double digit unemployment rates.

Earlier:

• Housing Starts increase in November

• Multi-family Starts and Completions, Record Low Total Completions in 2011

Multi-family Starts and Completions, Record Low Total Completions in 2011

by Calculated Risk on 12/20/2011 10:37:00 AM

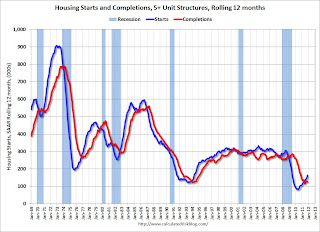

Since it usually takes over a year on average to complete multi-family projects - and multi-family starts were at a record low last year - builders are on track to complete a record low, or near record low, number of multi-family units this year.

The following graph shows the lag between multi-family starts and completions using a 12 month rolling total.

The blue line is for multifamily starts and the red line is for multifamily completions. Since multifamily starts collapsed in 2009, completions collapsed in 2010.

Click on graph for larger image.

Click on graph for larger image.

The rolling 12 month total for starts (blue line) has been increasing all year. It now appears multi-family starts will be around 170 thousand units in 2011, up from 104 thousand units in 2010. That is a 60%+ increase in multi-family starts - but from a very low level.

Completions (red line) appear to have bottomed. This is probably because builders have rushed some projects to completion because of the strong demand for rental units.

It is important to emphasize that even with a strong increase in multi-family construction, it is 1) from a very low level, and 2) multi-family is a small part of residential investment (RI). But this is a very bright spot for construction.

The previous record low for multi-family completions was 127.1 thousand in 1993. It will be close this year, however total completions will be at a record low - and the U.S. will add the fewest net housing units to the housing stock since the Census Bureau started tracking completions in the '60s.

Below is a table of net housing units added to the housing stock since 1990. Note: Demolitions / scrappage estimated.

This means there will be a record low number of housing units added to the housing stock this year (good news with all the excess inventory), and that the overhang of excess inventory probably declined significantly this year.

| Housing Units added to Stock (000s) | ||||||

|---|---|---|---|---|---|---|

| 1 to 4 Units | 5+ Units | Manufactured Homes | Sub-Total | Demolitions / Scrappage | Total added to Stock | |

| 1990 | 1010.8 | 297.3 | 188.3 | 1496.4 | 200 | 1296.4 |

| 1991 | 874.4 | 216.6 | 170.9 | 1261.9 | 200 | 1061.9 |

| 1992 | 999.7 | 158 | 210.5 | 1368.2 | 200 | 1168.2 |

| 1993 | 1065.7 | 127.1 | 254.3 | 1447.1 | 200 | 1247.1 |

| 1994 | 1192.1 | 154.9 | 303.9 | 1650.9 | 200 | 1450.9 |

| 1995 | 1100.2 | 212.4 | 339.9 | 1652.5 | 200 | 1452.5 |

| 1996 | 1161.6 | 251.3 | 363.3 | 1776.2 | 200 | 1576.2 |

| 1997 | 1153.4 | 247.1 | 353.7 | 1754.2 | 200 | 1554.2 |

| 1998 | 1200.3 | 273.9 | 373.1 | 1847.3 | 200 | 1647.3 |

| 1999 | 1305.6 | 299.3 | 348.1 | 1953 | 200 | 1753 |

| 2000 | 1269.1 | 304.7 | 250.4 | 1824.2 | 200 | 1624.2 |

| 2001 | 1289.8 | 281 | 193.1 | 1763.9 | 200 | 1563.9 |

| 2002 | 1360.1 | 288.2 | 168.5 | 1816.8 | 200 | 1616.8 |

| 2003 | 1417.8 | 260.8 | 130.8 | 1809.4 | 200 | 1609.4 |

| 2004 | 1555 | 286.9 | 130.7 | 1972.6 | 200 | 1772.6 |

| 2005 | 1673.4 | 258 | 146.8 | 2078.2 | 200 | 1878.2 |

| 2006 | 1695.3 | 284.2 | 117.3 | 2096.8 | 200 | 1896.8 |

| 2007 | 1249.8 | 253 | 95.7 | 1598.5 | 200 | 1398.5 |

| 2008 | 842.5 | 277.2 | 81.9 | 1201.6 | 200 | 1001.6 |

| 2009 | 534.6 | 259.8 | 49.8 | 844.2 | 150 | 694.2 |

| 2010 | 505.2 | 146.5 | 50 | 701.7 | 150 | 551.7 |

| 2011 (est) | 430 | 126 | 46 | 602 | 150 | 452 |

Earlier:

• Housing Starts increase in November

Housing Starts increase in November

by Calculated Risk on 12/20/2011 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in November were at a seasonally adjusted annual rate of 685,000. This is 9.3 percent (±13 1%)* above the revised October estimate of 627,000 and is 24.3 percent (±20.1%) above the November 2010 rate of 551,000.

Single-family housing starts in November were at a rate of 447,000; this is 2.3 percent (±8.0%)* above the revised October figure of 437,000. The November rate for units in buildings with five units or more was 230,000.

Building Permits:

Privately-owned housing units authorized by building permits in November were at a seasonally adjusted annual rate of 681,000. This is 5.7 percent (±1.6%) above the revised October rate of 644,000 and is 20.7 percent (±1.8%) above the November 2010 estimate of 564,000.

Single-family authorizations in November were at a rate of 435,000; this is 1.6 percent (±1.6%) above the revised October figure of 428,000. Authorizations of units in buildings with five units or more were at a rate of 224,000 in November.

Click on graph for larger image.

Click on graph for larger image.Total housing starts were at 685 thousand (SAAR) in November, up 9.3% from the revised October rate of 627 thousand (SAAR). Most of the increase this year has been for multi-family starts, but single family starts are increasing a little recently too.

Single-family starts increased 2.3% to 447 thousand in November.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that housing starts have been mostly moving sideways for about two years and a half years - with slight ups and downs due to the home buyer tax credit.

This shows the huge collapse following the housing bubble, and that housing starts have been mostly moving sideways for about two years and a half years - with slight ups and downs due to the home buyer tax credit.Multi-family starts are increasing in 2011 - although from a very low level. This was well above expectations of 630 thousand starts in November.

Single family starts are still mostly "moving sideways".

Monday, December 19, 2011

Credit Stress Indicators

by Calculated Risk on 12/19/2011 07:40:00 PM

There are several possible channels of contagion from the European financial crisis.

The most obvious is the trade channel. A recession in Europe will negatively impact U.S. exports. Although Europe is a major U.S. trading partner, exports only make up a small portion of U.S. GDP. Also some of the impact from trade would probably be offset by lower oil prices – and of course lower interest rates as investors seek safety (the European crisis is a key reason the U.S. 10 year bond yield is at 1.81%).

A more significant channel would be tightening of U.S. credit conditions in response to the European crisis. That is why I looked so closely at the Fed’s October Senior Loan Officer Opinion Survey on Bank Lending Practices that was released in November. The survey showed “considerable” tightening on lending to European banks, and some tightening to European firms, but the survey showed no tightening in the U.S. (although lending standards are already pretty tight).

There are other possible channels of contagion, such as less European lending to emerging markets and a slowdown in those economies – and then fewer exports from the U.S. to those emerging markets. But the most significant channel will probably be credit stress. Here are a few indicators of credit stress:

• The three month LIBOR has increased:

Data from the British Bankers' Association showed the three-month dollar London Interbank Offered Rate, or Libor, was higher at 0.56695% from 0.56315% Friday. ... The spread between the three-month dollar Libor and overnight index swaps, a barometer of market stress, widened to 48.1 basis points from 47.5 basis points Friday.The three-month LIBOR rate peaked during the crisis at 4.81875% on Oct 10, 2008. This is rising again, but still low.

• The TED spread is at 0.57, and has been rising recently. the TED spread is the difference between the three month T-bill and the LIBOR interest rate. The 5 year graph shows that recent increase in comparison to the U.S. financial crisis in 2008.

Here is a screen shot of the TED spread from Bloomberg.

Here is a screen shot of the TED spread from Bloomberg. Click on graph for larger image.

The peak was 4.63 on Oct 10th. A normal spread is around 0.5.

• The A2P2 spread as at 0.47. This spread has increased recently, but is far below the peak of the financial crisis of 5.86.

This is the spread between high and low quality 30 day nonfinancial commercial paper. Right now high quality 30 day nonfinancial paper is yielding close to zero.

•

The two year swap spread screen shot from Bloomberg. This spread is just under 50.

The two year swap spread screen shot from Bloomberg. This spread is just under 50. This spread peaked at near 165 in early October 2008.

As the ECB noted today, there are signs of severe credit stress in Europe, but there hasn't been much spillover to the U.S. yet.

ECB Warns on Risks

by Calculated Risk on 12/19/2011 03:47:00 PM

From the NY Times: E.C.B. Warns of Dangers Ahead for Euro Zone Economy

The European Central Bank warned Monday of a perilous year ahead as the sovereign debt crisis collides with slower economic growth and a dearth of market financing for banks.From the Financial Times: ECB warns of global contagion risks

...

By some measures, the stresses on the European financial system are approaching or even exceeding levels last seen after the bankruptcy of Lehman Brothers in September 2008.

...

A teleconference among E.U. finance ministers ended Monday with an agreement by euro zone nations to contribute around €150 billion, or $195 billion, through the I.M.F. European leaders had committed to contribute “up to €200 billion” at a summit in Brussels on Dec. 9.

The comments hinted at ECB concern over politicians’ failure to bring the crisis under control, and at the danger of countries’ fiscal austerity plans being derailed by domestic politics.This is very depressing. Europe is probably already in a recession, and the ECB and other European policymakers still think that fiscal deficits are the cause of the problem. What Europe needs is growth and re-balancing - and some fiscal adjustments. The ECB is also concerned that austerity will be "derailed by domestic politics". That should not be a surprise. The results of austerity alone - a deeper recession - will not survive the ballot booth.

excerpt with permission

Q3 2011: Mortgage Equity Withdrawal strongly negative

by Calculated Risk on 12/19/2011 12:59:00 PM

Special Note: Dr. James Kennedy has a new method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". I still haven't evaluated his method yet (here is a companion spread sheet), so the following is using my old "simple" method.

Note 2: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity (hence the name "MEW", but there is little MEW right now!), normal principal payments and debt cancellation.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q3 2011, the Net Equity Extraction was minus $75 billion, or a negative 2.6% of Disposable Personal Income (DPI). This is not seasonally adjusted.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding declined sharply in Q3. Mortgage debt has declined by $730 billion over the last fourteen quarters. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance. Note: most homeowners pay down their principal a little each month unless they have an IO or Neg AM loan, so with no new borrowing, equity extraction would always be slightly negative.

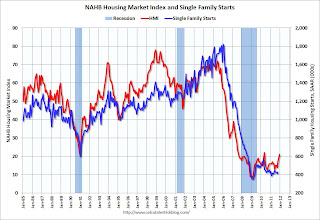

NAHB Builder Confidence index increases in December

by Calculated Risk on 12/19/2011 10:00:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) increased in December to 21 from 19 in November. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Rises for the Third Consecutive Month

Builder confidence in the market for newly built, single-family homes edged up two points from a downwardly revised number to 21 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for December, released today. This marks a third consecutive month in which builder confidence has improved, and brings the index to its highest point since May of 2010.

...

“This is the first time that builder confidence has improved for three consecutive months since mid-2009, which signifies a legitimate though slowly emerging upward trend,” said NAHB Chief Economist David Crowe. “While large inventories of foreclosed properties continue to plague the most distressed markets and consumer worries about job security and the challenges of selling an existing home remain significant factors, builders are reporting more inquiries and more interest among potential buyers than they have seen in previous months.”

...

Each of the HMI’s three component indexes registered a third consecutive month of improvement in December. The component gauging current sales conditions rose two points in the latest month to 22, while the component gauging sales expectations in the next six months edged up one point to 26. The component gauging traffic of prospective buyers gained three points to 18, which is its highest level since May of 2008.

Builder confidence primarily gained strength in the South in December, where a four-point gain to 25 brought that region’s HMI score to its highest level since March of 2008. A one-point gain to 16 was registered in the West, while the Midwest held unchanged at 24 and the Northeast slipped one point to 15.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the December release for the HMI and the October data for starts (November housing starts will be released tomorrow).

Both confidence and housing starts have been moving sideways at a very depressed level for several years - but confidence seems to be moving up a little now. This is still very low, but this is the highest level since May 2010 - and that boost was due to the housing tax credit. Not counting the tax credit, the last time the index was above this level was in 2007.

Weekend:

• Summary for Week ending Dec 16th

• Schedule for Week of Dec 18th

• Ten Economic Questions for 2012

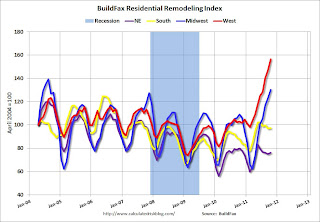

Residential Remodeling Index at new high in October

by Calculated Risk on 12/19/2011 08:30:00 AM

The BuildFax Residential Remodeling Index increased for the twenty-fourth straight month in October to 147.6, a new high for the index. This was up from 141.4 in September, and up 39% year-over-year from 105.8 in October 2010. This is based on the number of properties pulling residential construction permits in a given month.

In October 2011, all four regions - West, Midwest, Northeast and South - had gains. The West is at a new all time high, and is up 52% year-over-year. The Midwest is near an all time high, and is up 20% year-over-year. The South is up 11% year-over-year and the Northeast was up from September but is still down 4% year-over-year.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the NSA index by region. Most of the recent increase is in the West and Midwest. The South is also starting to increase.

Note: Permits are not adjusted by value, so this doesn't mean there is more money being spent, just more permit activity. Also some smaller remodeling projects are done without permits and the index will miss that activity.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.

Even though new home construction is still moving sideways, two other components of residential investment are doing better: multi-family construction and home improvement. Data Source: BuildFax, Courtesy of Index.BuildFax.com