by Calculated Risk on 12/17/2011 12:41:00 PM

Saturday, December 17, 2011

Schedule for Week of Dec 18th

Earlier:

• Summary for Week ending Dec 16th

There are three key housing reports that will be released this week: December homebuilder confidence on Monday, November existing home sales (and benchmark revisions) on Wednesday, and November new home sales on Friday.

Other key U.S. economic reports include the third estimate of Q3 GDP on Thursday, and the November Personal Income and Outlays report on Friday.

10 AM ET: The December NAHB homebuilder survey. The consensus is for a reading of 20, unchanged from November. Any number below 50 indicates that more builders view sales conditions as poor than good. This index has been below 25 for four years.

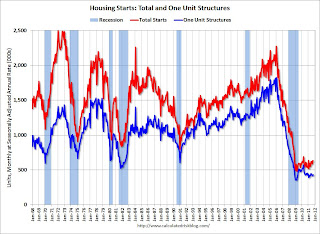

8:30 AM: Housing Starts for November.

8:30 AM: Housing Starts for November. After collapsing following the housing bubble, single family housing starts have been moving sideways for almost three years. However multi-family starts have been increasing all year.

The consensus is for a slight increase in total housing starts to 630,000 (SAAR) from 628,000 (SAAR) in October. This consensus might be a little low based on the uptick in permits and the recent increases in the homebuilder confidence survey.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for November 2011

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been especially weak since early August, although this doesn't include cash buyers.

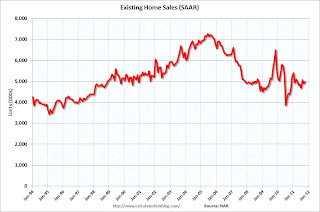

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). Important: This release will include the benchmark revisions for 2007 through 2011.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). Important: This release will include the benchmark revisions for 2007 through 2011.The consensus is for a 2% increase in sales. This would be around 5.08 million based on the reported sales in October, but sales will be much lower after the downward revisions.

Economist Tom Lawler estimates the NAR will report a 1.8% increase in sales from October. He expects a downward revision of about 13%, so he expects the NAR to report sales of around 4.4 million SAAR in November.

Expected: The Moody's/REAL Commercial Property Price Index (commercial real estate price index) for October.

During the day: The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 380,000 from 366,000 last week. Last week was the lowest level for the 4-week average of weekly claims since July 2008.

8:30 AM: Gross Domestic Product, 3rd quarter 2011 (third estimate). This is the third estimate from the BEA. The consensus is that real GDP increased 2.0% annualized in Q3, unchanged from the 2nd estimate.

8:30 AM ET: Chicago Fed National Activity Index (November). This is a composite index of other data.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for December). The consensus is for a slight increase to 68.0 from the preliminary reading of 67.7.

10:00 AM: FHFA House Price Index for October 2011. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

10:00 AM: Conference Board Leading Indicators for October. The consensus is for a 0.3% increase in this index.

8:30 AM: Durable Goods Orders for November from the Census Bureau. The consensus is for a 2.0% increase in durable goods orders. This might be a little stronger than consensus because of an increase in commercial aircraft orders.

8:30 AM: Personal Income and Outlays for November. The graph shows real Personal Consumption Expenditures (PCE) through October (2005 dollars).

8:30 AM: Personal Income and Outlays for November. The graph shows real Personal Consumption Expenditures (PCE) through October (2005 dollars). PCE increased 0.1% in October, and real PCE increased 0.1%. The price index for PCE decreased 0.1 percent in October.

The consensus is for a 0.2% increase in personal income in November, and a 0.3% increase in personal spending, and for the Core PCE price index to increase 0.1%.

10:00 AM ET: New Home Sales for November from the Census Bureau.

10:00 AM ET: New Home Sales for November from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the current sales rate.

The consensus is for a slight increase in sales to 313 thousand Seasonally Adjusted Annual Rate (SAAR) in November from 307 thousand in October. This consensus might be a little low based on the homebuilder confidence survey.