by Calculated Risk on 12/17/2011 08:11:00 AM

Saturday, December 17, 2011

Summary for Week ending Dec 16th

If it wasn’t for Europe, the economic outlook might be improving a little. Unfortunately this was another tough week in Europe, and the European financial crisis is dragging down global economic growth.

The good news this week included a decline in initial weekly unemployment claims (the 4-week average is now at the lowest level since July 2008), and a pickup in the Empire State and Philly Fed manufacturing surveys. Also small business optimism increased in November. However industrial production and retail sales were a little weaker than expected.

Here is a summary of last week in graphs:

• Retail Sales increased 0.2% in November

Click on graph for larger image.

Click on graph for larger image.

On a monthly basis, retail sales were up 0.2% from October to November (seasonally adjusted, after revisions), and sales were up 6.7% from November 2010. Retail sales excluding autos increased 0.2% in November.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 20.0% from the bottom, and now 5.5% above the pre-recession peak (not inflation adjusted)

• Industrial Production decreased 0.2% in November, Capacity Utilization decreased

Industrial production decreased 0.2 percent in November. Capacity utilization for total industry decreased to 77.8 percent.

Industrial production decreased 0.2 percent in November. Capacity utilization for total industry decreased to 77.8 percent. This graph shows Capacity Utilization. This series is up 10.5 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.8% is still 2.6 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 81.3% in December 2007.

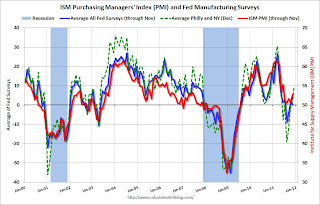

• Empire State and Philly Fed Manufacturing Indexes show improvement in December

From the NY Fed: Empire State Manufacturing Survey "The general business conditions index rose nine points to 9.5" and from the Philly Fed: December 2011 Business Outlook Survey "the survey’s broadest measure of manufacturing conditions, remained positive for the third consecutive month and increased from 3.6 in November to 10.3"

From the NY Fed: Empire State Manufacturing Survey "The general business conditions index rose nine points to 9.5" and from the Philly Fed: December 2011 Business Outlook Survey "the survey’s broadest measure of manufacturing conditions, remained positive for the third consecutive month and increased from 3.6 in November to 10.3" Both surveys indicated expansion in December, and at a faster pace than in November. Both indexes were above the consensus forecasts.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through December. The ISM and total Fed surveys are through November.

The average of the Empire State and Philly Fed surveys increased again in December and suggests the December ISM index will be in the mid 50s.

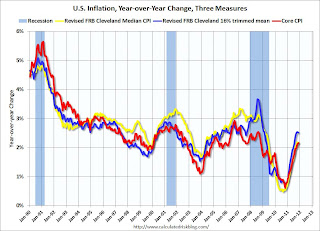

• Key Measures of Inflation mostly lower in November

This graph shows the year-over-year change for these three key measures of inflation (core CPI, median CPI, and trimmed-mean CPI).

This graph shows the year-over-year change for these three key measures of inflation (core CPI, median CPI, and trimmed-mean CPI). On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 2.5%, and core CPI rose 2.2%. These measures of inflation have stopped increasing, and are slightly above the Fed's target.

On a monthly basis, the rate of increase is mostly below the Fed's target. On a monthly basis, the median Consumer Price Index increased 1.1% at an annualized rate, the 16% trimmed-mean Consumer Price Index increased 1.0% annualized, and core CPI increased 2.1% annualized.

• Weekly Initial Unemployment Claims declined to 366,000

The DOL reported "In the week ending December 10, the advance figure for seasonally adjusted initial claims was 366,000, a decrease of 19,000 from the previous week's revised figure of 385,000. The 4-week moving average was 387,750, a decrease of 6,500 from the previous week's revised average of 394,250." The following graph shows the 4-week moving average of weekly claims since January 2000.

The DOL reported "In the week ending December 10, the advance figure for seasonally adjusted initial claims was 366,000, a decrease of 19,000 from the previous week's revised figure of 385,000. The 4-week moving average was 387,750, a decrease of 6,500 from the previous week's revised average of 394,250." The following graph shows the 4-week moving average of weekly claims since January 2000.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 387,750.

This is the lowest level for weekly claims - and the lowest level for the 4-week average - since early 2008.

• BLS: Job Openings "essentially unchanged" in October

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS. Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings declined slightly in October, but the number of job openings (yellow) has generally been trending up, and are up about 13% year-over-year compared to October 2010.

Quits declined in October, but have mostly been trending up - and quits are now up about 10% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

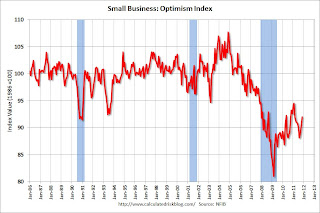

• NFIB: Small Business Optimism Index increases in November

From the National Federation of Independent Business (NFIB): Small-Business Confidence Rises for Third Consecutive Month: Is Hope for the Economy on the Horizon?

From the National Federation of Independent Business (NFIB): Small-Business Confidence Rises for Third Consecutive Month: Is Hope for the Economy on the Horizon? Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

This graph shows the small business optimism index since 1986. The index increased to 92.0 in November from 90.2 in October. This is the third increase in a row after declining for six consecutive months.

• Other Economic Stories ...

• From the WSJ: Realtors to Revise 2007-2011 Sales Data Lower

• Pulse of Commerce Index Increased 0.1 Percent in November

• FOMC Statement: Economy expanding "moderately", Global growth slowing

• Lawler on NAR Revisions for 2007 through 2011

• The Excess Vacant Housing Supply