by Calculated Risk on 11/27/2011 09:52:00 AM

Sunday, November 27, 2011

Report: Black Friday sales up 7%

With all the "Black Friday" reports, it is important to remember that retail sales are only a small portion of consumer spending.

According to the Bureau of Economic Analysis (BEA), of the $10.8 trillion in personal consumption expenditures in Q3 (seasonally adjusted annual rate), about 34% was spent on goods. From Suzi Khimm at the Wonkblog: Why a Black Friday frenzy doesn’t mean jobs are coming back

Consumer spending on goods is starting to rebound, but spending on services — a key driver of job growth — is lagging significantly farther behind.And from MarketWatch: Black Friday posts big retail-sales gains vs. 2010

U.S. retailers posted sizable "Black Friday" gains vs. 2010's day-after-Thanksgiving sales results, according to data released Saturday. Store sales, according to Chicago-based ShopperTrak, rose 7%, as shoppers spent $11.4 billion, up nearly $1 billion from a year ago ...Earlier:

• Summary for Week Ending Nov 25th

• Schedule for Week of Nov 27th

Saturday, November 26, 2011

Report:: Euro-zone considering bilateral agreements for fiscal integration

by Calculated Risk on 11/26/2011 06:37:00 PM

As we all know the markets are moving faster than the policymakers in Europe. So it appears the policymakers are going to try to implement a fiscal union quicker.

But will that help? Will it bring private investors back into the bond market? Probably not, but some people think it might allow the ECB to take more aggressive action.

Oh well, the new key date is Friday December 9th.

From the WSJ: Euro Zone Weighs Plan to Speed Fiscal Integration

Euro-zone countries are weighing a new plan to accelerate the integration of their fiscal policies ... Under the proposed plan, national governments would seal bilateral agreements that wouldn't take as long as a cumbersome change to European Union treaties ... The pact that euro members are considering could be announced before the EU summit on Dec. 9 ... Some German and French officials fear that an EU treaty change could take far too long.Earlier:

...

A new, binding fiscal regime would not be enough to justify the creation of collective euro-zone bonds, German officials say. But it might be enough to justify ECB action to stabilize bond markets

• Summary for Week Ending Nov 25th

• Schedule for Week of Nov 27th

Schedule for Week of Nov 27th

by Calculated Risk on 11/26/2011 01:31:00 PM

Earlier:

• Summary for Week Ending Nov 25th

The key report this week will be the employment situation report for November on Friday. Other key reports include the November ISM manufacturing index on Thursday, auto sales also on Thursday, and two important housing reports to be released early in the week: New Home sales on Monday and Case-Shiller house prices on Tuesday.

10:00 AM ET: New Home Sales for October from the Census Bureau.

10:00 AM ET: New Home Sales for October from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the current sales rate.

The consensus is for a slight decrease in sales to 310 thousand Seasonally Adjusted Annual Rate (SAAR) in October from 313 thousand in September.

10:00 AM: NY Fed Q3 Report on Household Debt and Credit

10:30 AM: Dallas Fed Manufacturing Survey for November. The index showed some expansion in October with a reading of 4.1. This is the last of the regional Fed manufacturing surveys for November, and the results have been mixed - but generally better than in October.

9:00 AM: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September.

9:00 AM: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The consensus is for a 3.0% year-over-year decrease in prices in September, or mostly flat to slightly down from August. The CoreLogic index showed a 1.1% decrease in September (NSA).

10:00 AM: Conference Board's consumer confidence index for November. The consensus is for an increase to 44.2 from 39.8 last month.

10:00 AM: FHFA House Price Index for September 2011. This is based on GSE repeat sales and is not as closely followed as Case-Shiller (or CoreLogic). However the quarterly FHFA expanded series house price index makes use of "additional sales price information from external data sources" and might be followed more closely in the future.

11:30 AM: Federal Reserve Vice Chair Janet Yellen speaks at the Federal Reserve Bank of San Francisco, San Francisco, Calif. "The Global Economic Recovery".

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been especially weak since early August, although this doesn't include cash buyers.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 130,000 payroll jobs added in November, up from the 110,000 reported in October.

9:45 AM: Chicago Purchasing Managers Index for November. The consensus is for a slight increase to 58.5 from 58.4 in October.

10:00 AM: Pending Home Sales Index for October. The consensus is for a 1.2% increase in the index.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a slight decrease to 390,000 from 393,000 last week. The 4-week average has recently declined to below 400,000.

10:00 AM: Construction Spending for October. The consensus is for a 0.3% increase in construction spending.

10:00 AM ET: ISM Manufacturing Index for November. The consensus is for a slight increase to 51.7 from 50.8 in October.

All day: Light vehicle sales for November. Light vehicle sales are expected to increase to 13.4 million (Seasonally Adjusted Annual Rate), from 13.2 million in October.

8:30 AM: Employment Report for November.

The consensus is for an increase of 112,000 non-farm payroll jobs in November, up from the 80,000 jobs added in October.

The consensus is for an increase of 112,000 non-farm payroll jobs in November, up from the 80,000 jobs added in October. This graph shows the net payroll jobs per month (excluding temporary Census jobs) since the beginning of the recession. The consensus forecast for November is in blue.

The consensus is for the unemployment rate to remain at 9.0% in November.

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through October.

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through October. Through the first ten months of 2011, the economy has added 1.256 million total non-farm jobs or just 125 thousand per month. This is a better pace of payroll job creation than last year, but the economy still has 6.47 million fewer payroll jobs than at the beginning of the 2007 recession. The economy has added 1.529 million private sector jobs this year, or about 153 thousand per month.

Summary for Week Ending Nov 25th

by Calculated Risk on 11/26/2011 08:23:00 AM

It was a short holiday week, but the key story remained the same: the European situation continues to deteriorate as European policymakers fiddle. Europe continues to overshadow the U.S. economic situation and the European financial crisis continues to pose the greatest downside risk to the U.S. economy. I'll have more on Europe later ...

In the U.S., the economic data continues to indicate sluggish growth. Q3 GDP was revised down to 2.0% annualized from the advance report of 2.5%, however most of the downward revision was due to a large decline in the "change in real private inventories" - not final demand.

Personal spending slowed in October, although personal income picked up a little. The four week average of initial weekly unemployment claims is below 400,000, and at the lowest level since early April. This suggests some improvement in the labor market in November.

For manufacturing, the Richmond Fed survey showed activity was unchanged in November (after contracting in five out of the last six months), and the Kansas City survey showed sluggish expansion.

Two other items of interest: The Federal Reserve released the annual stress test scenario for the largest banks (with significant declines for the stock market and house prices), and the FOMC minutes showed the FOMC might consider providing the "likely future path of the target federal funds rate".

Here is a summary in graphs:

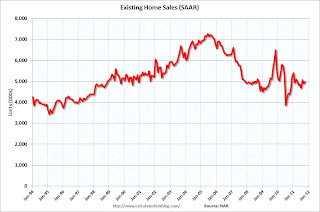

• Existing Home Sales in October: 4.97 million SAAR, 8.0 months of supply

The NAR reported: October Existing-Home Sales Rise, Unsold Inventory Continues to Decline

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October 2011 (4.97 million SAAR) were 1.4% higher than last month, and were 13.5% above the October 2010 rate.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 13.8% year-over-year in October from October 2010. This is the ninth consecutive month with a YoY decrease in inventory.

Inventory decreased 13.8% year-over-year in October from October 2010. This is the ninth consecutive month with a YoY decrease in inventory.

Months of supply decreased to 8.0 months in October, down from 8.3 months in September. This is still higher than normal. These sales numbers were just above the consensus.

• Personal Income increased 0.4% in October, Spending increased 0.1%

The BEA released the Personal Income and Outlays report for October:

The BEA released the Personal Income and Outlays report for October: Personal income increased $48.1 billion, or 0.4 percent ... in October, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $8.2 billion, or 0.1 percent.This graph shows real Personal Consumption Expenditures (PCE) through October (2005 dollars).

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.1 percent in October, compared with an increase of 0.5 percent in September. ... PCE price index -- The price index for PCE decreased 0.1 percent in October, in contrast to an increase of 0.2 percent in September.

PCE increased 0.1% in October, and real PCE increased 0.1%.

Note: The PCE price index, excluding food and energy, increased 0.1 percent.

In October, income increased faster than spending - reversing a recent trend - and the saving rate increased slightly. However the saving rate has declined sharply over the last few months. Personal income was slightly better than expected, and spending a little lower than expectations.

• Weekly Initial Unemployment Claims at 393,000

The DOL reports:

The DOL reports:In the week ending November 19, the advance figure for seasonally adjusted initial claims was 393,000, an increase of 2,000 from the previous week's revised figure of 391,000. The 4-week moving average was 394,250, a decrease of 3,250 from the previous week's revised average of 397,500.

This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 394,250.

This is the lowest level for the 4 week average since early April - although this is still elevated.

• FDIC-insured institutions’ 1-4 Family Real Estate Owned (REO) decreased in Q3

The FDIC released the Quarterly Banking Profile for Q3. The report showed that 1-4 family Real Estate Owned (REO) by FDIC insured institutions declined to $11.9 billion in Q3, from $12.1 billion in Q2 - and from a record $14.76 billion in Q3 2010.

As economist Tom Lawler has pointed out before, the FDIC does not collect data on the number of properties held by FDIC-insured institutions, instead they aggregate the carrying value of 1-4 family residential REO on FDIC-insured institutions’ balance sheets.

Using an average of $150,000 per unit would suggest the number of 1-4 family REOs declined from 80,597 in Q2 to 79,335 in Q3.

Here is a graph of the 1-4 family REO carrying value for FDIC insured institutions since Q1 2003.

Here is a graph of the 1-4 family REO carrying value for FDIC insured institutions since Q1 2003. The left scale is the dollars reported in the FDIC Quarterly Banking Profile, and the right scale is an estimate of REOs using an average of $150,000 per unit. Using this estimate for the average per REO gives 79.3 thousand REO at the end of Q3.

Note: FDIC insured institutions have other REO and this is just the 1-4 family residential REO (other REO includes Construction & Development, Multi-family, Commercial, Farm Land).

Of course this is just a small portion of the total 1-4 family REO.

• ATA Trucking Index increased 0.5% in October

From ATA: ATA Truck Tonnage Index Rose 0.5% in October

From ATA: ATA Truck Tonnage Index Rose 0.5% in OctoberThe American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 0.5% in October after rising a revised 1.5% in September 2011.”Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. This index has started increasing again after stalling earlier this year - however this is still fairly sluggish growth.

• Moody's: Commercial Real Estate Prices declined 1.4% in September

From Dow Jones: Moody's: Commercial Real-Estate Prices Fell In September

From Dow Jones: Moody's: Commercial Real-Estate Prices Fell In SeptemberU.S. commercial real-estate prices fell 1.4% in September, ending a four-month growth streak."Here is a graph of the Moodys/REAL Commercial Property Price Index (CPPI). CRE prices only go back to December 2000.

According to Moody's, CRE prices are up 1.3% from a year ago, and down about 42% from the peak in 2007. This index is very volatile because there are relatively few transactions - but it does appear to be mostly moving sideways.

• Final November Consumer Sentiment at 64.1

The final November Reuters / University of Michigan consumer sentiment index declined to 64.1 from the preliminary reading of 64.2, up from the October reading of 60.9, and up from 55.7 in August.

The final November Reuters / University of Michigan consumer sentiment index declined to 64.1 from the preliminary reading of 64.2, up from the October reading of 60.9, and up from 55.7 in August.Consumer sentiment is usually impacted by employment (and the unemployment rate) and gasoline prices. But right now the European financial crisis is probably also impacting sentiment.

Although sentiment is up from October, this is still very weak, and slightly below the consensus forecast of 64.6.

• Other Economic Stories ...

• Q3 real GDP growth revised down to 2.0% annualized rate

• FOMC Minutes: Discussion of providing "likely future path of the target federal funds rate"

• Fed outlines new bank supervisory stress test

• From the Kansas City Fed: Growth in Manufacturing Activity Eased Slightly

• From the Richmond Fed: Manufacturing Activity Steadied in November; Expectations Were Upbeat

• State Unemployment Rates "little changed or slightly lower" in October

• DOT: Vehicle Miles Driven declined 1.5% in September

• Chicago Fed: Economic activity up slightly in October

Friday, November 25, 2011

Unofficial Problem Bank list increases to 980 institutions

by Calculated Risk on 11/25/2011 09:04:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 25, 2011. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Happy Thanksgiving to all our readers!CR Note: Thanks to surferdude808! Earlier this week, the WSJ reported that Bank of America was warned by regulators of a possible formal action if the bank doesn't make progress. That would be a huge addition to the Unofficial Problem Bank list!

The FDIC did not deliver a "Black Friday" to any bank today as they let their closing teams enjoy a long weekend off. Still, there were a number of changes to the Unofficial Problem Bank List as the OCC and FDIC released their enforcement actions for the past month this week. As a result, there were seven additions and four removals, which leave the list with 980 institutions with assets of $400.5 billion. A year ago, there were 919 institutions with assets of $410 billion.

During this month, the list fell by a net five institutions with changes including eight additions, four failures, two unassisted mergers, and seven cures. Positively, it is the fifth consecutive monthly decline; however, the list has only declined by a net 21 institutions with failure causing 40 removals over this span.

The removals this week were all cures and include Commercial National Bank of Texarkana, Texarkana, TX ($191 million); The National Bank of Waupun, Waupun, WI ($126 million); Texas National Bank, Mercedes, TX ($92 million); and First National Bank of the Lakes, Navarre, MN ($61 million).

Among the seven additions are First Community Bank, Santa Rosa, CA ($698 million); CoastalStates Bank, Hilton Head Island, SC ($372 million); Commerce Bank, Geneva, MN ($207 million); and Regal Bank & Trust, Owings Mills, MD ($182 million Ticker: RGBM).

The OCC and FDIC replaced a number of existing outstanding actions during the past month. The other change of note is a Prompt Corrective Action Order issued by the OCC against Western National Bank, Phoenix, AZ ($163 million).

Gasoline Prices and Brent WTI Spread

by Calculated Risk on 11/25/2011 03:10:00 PM

According to Bloomberg, Brent Crude is down to $106.40 per barrel, while WTI is up to $96.77. The spread has been narrowing for over a month, especially following the recent announcement of a partial reversal of the Seaway pipeline to transport crude oil from Cushing, Oklahoma, to the Gulf Coast.

If the global economy really slows, oil and gasoline prices will probably fall - and probably offset some of the impact from lower exports. There hasn't been a sharp decline in world oil prices yet.

Click on graph for larger image.

Click on graph for larger image.

This graphs shows the prices for Brent and WTI over the last few years. Usually the prices track pretty closely, but the "glut" of oil at Cushing pushed down WTI prices relative to Brent. Now the gap is closing (the pipeline is scheduled to be reversed in Q2 2012).

On a longer term basis, here is a little good news for Bloomberg: Renewable power trumps fossil fuels for first time

Renewable energy is surpassing fossil fuels for the first time in new power-plant investments, shaking off setbacks from the financial crisis and an impasse at the United Nations global warming talks.And here is a graph of gasoline prices. Gasoline prices have been slowly moving down since peaking in early May as the shown on the graph below. Note: The graph below shows oil prices for WTI; gasoline prices in most of the U.S. are impacted more by Brent prices.

Electricity from the wind, sun, waves and biomass drew $187 billion last year compared with $157 billion for natural gas, oil and coal, according to calculations by Bloomberg New Energy Finance using the latest data. Accelerating installations of solar- and wind-power plants led to lower equipment prices, making clean energy more competitive with coal.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

S&P cuts Belgium's credit rating to AA

by Calculated Risk on 11/25/2011 01:23:00 PM

Just a headline on Belgium ... I guess S&P noticed the Belgian bond yields are moving up sharply.

Also something we discussed this morning, from Bloomberg: Italian, Spanish Yield Curves Start Looking Greek: Euro Credit

Spain and Italy face paying more to borrow for two years than for a decade, echoing shifts that presaged bailouts in Greece and Portugal and suggesting skepticism about their new governments avoiding contagion.The Italian 2 year yield is at 7.66%. And the ten year yield is at 7.26%.

But the Spanish curve is not inverted yet. The Spanish 2 year yield is at 6.09%, and the ten year yield is at 6.7%.

Italian two-year Bond Yields above 7.8%

by Calculated Risk on 11/25/2011 09:13:00 AM

From the WSJ: Italian Yields Jump After Poor Auction

Italian two-year and five-year government-bond yields soared to euro-era highs Friday as investors began giving up on the euro zone's ability to break the political gridlock that is blocking a more decisive response to the currency bloc's debt crisis ... The Italian treasury sold €8 billion ($10.67 billion) of six-month treasury bills and €2 billion of 24-month zero-coupon bonds. The six-month paper carried an average yield of 6.5%, sharply up from the 3.5% rate paid at its October auction.The Italian 2 year yield is up to 7.84%. Ouch. The 5 year yield is at 7.8%.

Note: I've added the table of links to European bond yields below the first post.

Update: From Reuters: Moody's cuts Hungary to "junk," government sees attack

Moody's lowered Hungary's sovereign rating by one notch to Ba1, just below investment grade, with a negative outlook, hours after rival Standard & Poor's held fire on a flagged downgrade after Budapest said it would seek international aid. ... It also came after [Prime Minister Viktor] Orban relaunched aid talks this week with the International Monetary Fund, a dramatic reversal after he cut cooperation with the Fund short last year after sweeping a 2010 election on a vow to regain "economic sovereignty."

Thursday, November 24, 2011

More Europe

by Calculated Risk on 11/24/2011 06:47:00 PM

NOTE: I've added a link below the first post for the table of links to European Bond Yields.

More on Europe ...

From the WSJ: ECB Considers Longer Bank Loans

The European Central Bank ... may extend loans to banks at maturities of two or three years, according to people familiar with the matter. The longest maturity at present is 13 months.This would be for banks - with haircuts on collateral - and not countries.

From the Telegraph: Germany unmoved by French pleas for more ECB action

Ms Merkel instead used a three-way summit with France and Italy in Strasbourg to insist that new treaty powers to intervene and punish sinner states remained the key focus of Europe's rescue efforts. She said: "The countries who don't keep to the stability pact have to be punished – those who contravene it need to be penalised. We need to make sure this doesn't happen again."

Even suggestions that the ECB could extend longer loans to countries over a period of up to three years appeared to be ruled out. Ms Merkel said: "The ECB is independent, the modification of the treaty does not concern the ECB, which is dealing with monetary policy and financial stability. We are worried about a fiscal policy. It's a very different chapter. It has nothing to do with the European bank."

Happy Thanksgiving!

by Calculated Risk on 11/24/2011 03:31:00 PM

A few housekeeping notes for a holiday ...

• For anyone accessing Calculatedriskblog via an iPad, I'm trying out some new software with a customized tablet layout. The layout is from Onswipe. I'll be adding smart phone software soon ...

• Follow on Twitter.

• Receive blog posts via email. Sign up here for free (No subscription information will be sold or otherwise provided to third parties).

• Change to Graphs: If you click on a graph in a post, a larger image will appear (with thumbnails if there are multiple graphs in the post). This is very fast and does not use scripting.

For those looking for all current graphs, just click on "graph galleries" below the first post or in the menu bar.

The graph galleries are grouped by category:

* Employment Graphs

* New Home Sales

* Existing Home Sales

* House Price Graphs

* Mortgage Delinquency Graphs

* Retail Graphs

* GDP Graphs

* Manufacturing Graphs

* Commercial Real Estate

* Transportation Graphs

* Trade Graphs

Enjoy!

• And on European bond yields: Below is a table for several European bond yields (links to Bloomberg).

Check out the Belgian and Portuguese graphs. Ouch.

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Thanks to all for reading. Have a great Thanksgiving!