by Calculated Risk on 11/28/2011 07:50:00 PM

Monday, November 28, 2011

Visible Existing Home Inventory declines 17% year-over-year in November

Another update: I've been using inventory numbers from HousingTracker / DeptofNumbers to track changes in inventory. Tom Lawler mentioned this back in June (Tom also discussed how the NAR estimates existing home inventory - they don't aggregate data from local boards!)

In a few months, the NAR is expect to release revisions for their existing home sales and inventory numbers for the last few years. The sales and inventory revisions will be down (the NAR has pre-announced this).

Using the deptofnumbers.com for monthly inventory (54 metro areas), it appears inventory will be back to 2005 levels this month. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the NAR estimate of existing home inventory through October (left axis) and the HousingTracker data for the 54 metro areas through November. The HousingTracker data shows a steeper decline in inventory over the last few years (as mentioned above, the NAR will probably revise down their inventory estimates in a few months).

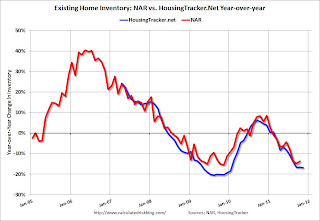

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the November listings - for the 54 metro areas - declined 16.9% from the same month last year.

This is just "visible inventory" (inventory listed for sales). There is a large percentage of distressed inventory, and various categories of "shadow inventory" too, but visible inventory has clearly declined in many areas.

Earlier on New Homes:

• New Home Sales in October: 307,000 SAAR

• New Home Prices: Average Lowest since 2003

• All current New Home Graphs

Dallas Fed Manufacturing Survey shows contraction in November

by Calculated Risk on 11/28/2011 04:09:00 PM

This is the last of the regional Fed surveys for November. The regional surveys provide a hint about the ISM manufacturing index - and the regional surveys were mixed and still fairly weak in November.

From the Dallas Fed: Texas Manufacturing Activity Declines

Texas factory activity decreased in November, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, dipped from 4.1 to –5.1, registering its first negative reading in two years.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Other measures of current manufacturing conditions also indicated contraction in November. The new orders index suggested deterioration of demand, falling to –5.1 after a year in positive territory. ... The capacity utilization index tumbled to –10.2 after several months of weak readings centered around zero.

Perceptions of broader economic conditions improved slightly in November. The general business activity index posted its second positive reading in a row, and it edged up from 2.3 to 3.2. The company outlook index remained positive but moved down from 7.2 to 4.7. More than 90 percent of manufacturers said their outlooks were unchanged or improved from last month.

Labor market indicators reflected continued labor demand growth, albeit at a slower pace. The employment index came in at 9, down from 15.1 in October.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through November), and five Fed surveys are averaged (blue, through November) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through October (right axis).

The ISM index for November will be released Thursday, Dec 1st and the regional surveys suggest another fairly weak reading in November. The consensus is for a slight increase to 51.7 from 50.8 in Octobeber.

New Home Prices: Average Lowest since 2003

by Calculated Risk on 11/28/2011 01:37:00 PM

As part of the new home sales report, the Census Bureau reported that the average price for new homes fell to the lowest level since September 2003.

From the Census Bureau: "The median sales price of new houses sold in October 2011 was $212,300; the average sales price was $242,300."

The following graph shows the median and average new home prices. The average new home price is at the lowest level since August 2003.

Click on graph for larger image.

Click on graph for larger image.

This makes sense - to compete with all the distressed sales, the builders have had to build smaller and less expensive homes.

The second graph shows the percent of new home sales by price. At the peak of the housing bubble, almost 40% of new homes were sold for more than $300K - and over 20% were sold for over $400K. In October, only 20% were sold for more than $300K - and only 8% for over $400K.

Almost half of all home sales in October were under $200K - and about 80% of home sales were under $300K. This is the lowest percentage under $300K since November 2002.

Almost half of all home sales in October were under $200K - and about 80% of home sales were under $300K. This is the lowest percentage under $300K since November 2002.

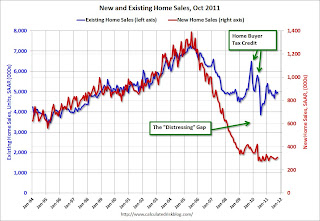

The third graph shows existing home sales (left axis) and new home sales (right axis) through October.

This graph starts in 1994, but the relationship has been fairly steady back to the '60s. Then along came the housing bubble and bust, and the "distressing gap" appeared due mostly to distressed sales.

The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders can't compete with the low prices of all the foreclosed properties.

The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders can't compete with the low prices of all the foreclosed properties.

I expect this gap to close over the next few years once the number of distressed sales starts to decline.

Note: The National Association of Realtors (NAR) is working on a benchmark revision for existing home sales numbers and I expect significant downward revisions to sales estimates for the last few years - perhaps as much as 10% to 15% for 2011. Even with these revisions, most of the "distressing gap" will remain.

Earlier:

• New Home Sales in October: 307,000 SAAR

• All current New Home Graphs

NY Fed Q3 Report on Household Debt and Credit

by Calculated Risk on 11/28/2011 11:56:00 AM

From the NY Fed: Consumer Debt Falls in Third Quarter

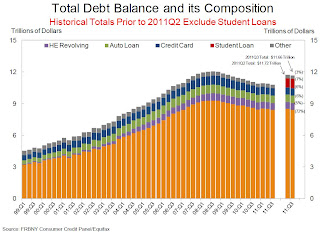

Aggregate consumer debt fell approximately $60 billion to $11.66 trillion in the third quarter of 2011 according to the Federal Reserve Bank of New York’s latest Quarterly Report on Household Debt and Credit.Here is the Q3 report: Quarterly Report on Household Debt and Credit. Here are two graphs:

...

"The decline in outstanding consumer debt reveals that households continue to try and deleverage in the wake of a challenging economic environment and large declines in home values," said Andrew Haughwout, vice president in the Research and Statistics Group at the New York Fed. "However, our findings also provide evidence that consumer credit demand continues to increase, a positive sign for consumer sentiment."

Click on graph for larger image.

Click on graph for larger image.The first graph shows aggregate consumer debt decreased slightly in Q3. From the NY Fed:

Aggregate consumer debt fell slightly in the third quarter. As of September 30, 2011, total consumer indebtedness was $11.66 trillion, a reduction of $60 billion (0.6%) below its (revised) June 30, 2011 level. The 2011Q2 and 2011Q3 totals reflect improvements in our measurement of student loan balances, which we had previously undercounted ... As a result, student loan and total debt balances for 2011Q2 and 2011Q3 are not directly comparable to earlier data ...

Mortgage balances shown on consumer credit reports fell noticeably ($114 billion or 1.3%) during the quarter; home equity lines of credit (HELOC) balances rose by $14 billion (2.3%). Household mortgage and HELOC indebtedness are now 9.6% and 10.5%, respectively, below their peaks. Consumer indebtedness excluding mortgage and HELOC balances rose slightly ($32 billion or about 1.3%) in the quarter. Consumers’ non-real estate indebtedness now stands at $2.62 trillion.

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining (there was a small increase in Q3), but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining (there was a small increase in Q3), but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). From the NY Fed:

Total household delinquency rates rose in 2011Q3. As of September 30, 10.0% of outstanding debt was in some stage of delinquency, compared to 9.8% on June 30. About $1.2 trillion of consumer debt is currently delinquent, with $834 billion seriously delinquent (at least 90 days late or “severely derogatory”).There are a number of credit graphs at the NY Fed site.

About 264,000 individuals had a foreclosure notation added to their credit reports between June 30 and September 30, a 7% decrease from the 2011Q2 level of new foreclosures. New bankruptcies in 2011Q3 were 18.8% below their levels of 2010Q3, at 423,000.

Earlier:

• New Home Sales in October: 307,000 SAAR

New Home Sales in October: 307,000 SAAR

by Calculated Risk on 11/28/2011 10:00:00 AM

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 307 thousand. This was up from a revised 303 thousand in September (revised down from 313 thousand).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in October 2011 were at a seasonally adjusted annual rate of 307,000 ... This is 1.3 percent (±19.7%)* above the revised September rate of 303,000 and is 8.9 percent (±17.2%)* above the October 2010 estimate of 282,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

Months of supply decreased to 6.3 in October.

The all time record was 12.1 months of supply in January 2009.

This is still slightly higher than normal (less than 6 months supply is normal).

This is still slightly higher than normal (less than 6 months supply is normal).The seasonally adjusted estimate of new houses for sale at the end of October was 162,000. This represents a supply of 6.3 months at the current sales rate.On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was at 60,000 units in October. The combined total of completed and under construction is at the lowest level since this series started.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In October 2011 (red column), 25 thousand new homes were sold (NSA). This was just above the record low for October of 23 thousand set in 2010. The high for October was 105 thousand in 2005.

This was slightly below the consensus forecast of 310 thousand, and just above the record low for the month of October set last year (NSA).

This was slightly below the consensus forecast of 310 thousand, and just above the record low for the month of October set last year (NSA). New home sales have averaged only 299 thousand SAAR over the 18 months since the expiration of the tax credit ... mostly moving sideways at a very low level.

OECD: Euro zone in recession

by Calculated Risk on 11/28/2011 08:47:00 AM

The OECD's track record hasn't been great lately, but it does seem likely that the euro zone is already in a recession ...

From Reuters: Euro Zone in Mild Recession, US May Follow: OECD

The global economic recovery is running out of steam, leaving the euro zone stuck in a mild recession ... In the absence of decisive action from euro zone leaders, the European Central Bank (ECB) alone has the power to contain the bloc's crisis, the Paris-based [Organization for Economic Cooperation and Development] said.And here is the report from the OECD: OECD calls for urgent action to boost ailing global economy

...

Its twice-yearly Economic Outlook forecast world growth would slow to 3.4 percent in 2012 from 3.8 percent this year.

Yesterday:

• Summary for Week Ending Nov 25th

• Schedule for Week of Nov 27th

Sunday Night Futures

by Calculated Risk on 11/28/2011 12:07:00 AM

From MarketWatch: Europe agrees on EFSF; IMF may aid Italy: reports

Finance ministers from the euro zone are slated to meet Tuesday and expected to sign off on rules for borrowing against the European Financial Stability Facility (EFSF), as well as guidelines for intervening in the euro-zone bond markets and providing credit lines to governments, according to a Reuters report Sunday.And the denial from Dow Jones:

...

The reports on the EFSF deal came amid reports that the IMF may offer €400 billion to €600 billion in aid to Italy, Dow Jones Newswires reported Sunday, citing an unsourced account in Italy’s La Stampa.

A report that the International Monetary Fund could offer Italy between EUR400 billion and EUR600 billion in financial support is not credible, people familiar with ongoing international discussions on the European debt crisis said Monday.The Asian markets are mostly green tonight. The Nikkei is up about 1.8%, the Hang Seng is up 1.9%.

The report is "not credible," one of the people told Dow Jones Newswires

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 futures are up about 20 and Dow futures are up 160.

Oil: WTI futures are up to $98.29 and Brent is up to $107.64 per barrel.

Yesterday:

• Summary for Week Ending Nov 25th

• Schedule for Week of Nov 27th

Sunday, November 27, 2011

Wolfgang Münchau: "Only days to avoid collapse" of eurozone, Currency Market prepares for breakup

by Calculated Risk on 11/27/2011 08:12:00 PM

From Wolfgang Münchau at the Financial Times: The eurozone really has only days to avoid collapse

First, the European Central Bank must agree a backstop of some kind ... The second measure is a firm timetable for a eurozone bond. ... The third decision is a fiscal union. ...See Brad DeLong's post for more excerpts.

If the European summit could reach a deal on December 9, its next scheduled meeting, the eurozone will survive. If not, it risks a violent collapse.

From the WSJ: Europe's Leaders Pursue New Pact

The proposal ... would make budget discipline legally binding and enforceable by European authorities. ... A majority of euro-zone governments hope that the pact would be an unstated quid pro quo for massive intervention in bond markets by the ECB. Many policy makers, investors and economists believe that only decisive ECB action can stop the unraveling of euro-zone debt markets ...From the WSJ: Inner Workings of Market Readied for Euro Breakup

Companies that provide the plumbing for the $4 trillion-a-day foreign-exchange market are testing systems that could handle trading of previously shelved European currencies. ... Banks, analysts and investors are preparing for what many of them say is an increasing likelihood of a euro-zone breakup, either completely or in parts, leading to the potential return of currencies such as the drachma, German mark or Italian lira.Interesting times.

Earlier:

• Summary for Week Ending Nov 25th

• Schedule for Week of Nov 27th

Report: Payroll tax cut extension is likely

by Calculated Risk on 11/27/2011 05:57:00 PM

The two key downside risks to the U.S. economy are contagion from the European financial crisis and more rapid fiscal tightening. On fiscal tightening, there have been several recent reports suggesting that some sort of deal will be reached an the extension of the payroll tax cut.

From the LA Times: Parties look to payroll tax deal after collapse of deficit talks

The Obama administration has asked Congress to extend payroll tax cuts set to expire at the end of the year, and also to renew unemployment benefits. The tax-cut extension could cost the Treasury an estimated $112 billion, but if it lapses American workers will see an immediate tax increase on Jan. 1 that would cost a typical family $1,000 per year.It seems likely that some sort of deal will be reached to extend both the payroll tax cut and emergency unemployment benefits, but there will be some politics first.

...

Economists warn that a failure to extend the payroll tax cut and unemployment benefits could cut the economy’s weak growth almost in half next year.

Earlier:

• Summary for Week Ending Nov 25th

• Schedule for Week of Nov 27th

Tim Duy: "Europe Scrambles for Solutions"

by Calculated Risk on 11/27/2011 02:14:00 PM

From Tim Duy at Fed Watch: Europe Scrambles for Solutions. Some excerpts:

Monday morning is fast approaching, and European leaders are scrambling to come up with something credible to float ahead of the market opening. Recall that we ended last week with the S&P downgrade of Belgium, and policymakers would like to have something on the table in response. Most significant is that policymakers now realize that changing the Lisbon Treaty to enshrine fiscal discipline is a far too lengthy process to serve as an effective counterweight to emerging the sovereign debt crisis.

...

The risk here is that market participants read the bilateral agreements as they emerge as an invitation to attack those nations not yet signed up to the plan.

...

Note also that although these ideas are bandied about in terms of "greater fiscal integration," I don't think we are seeing much mention of fiscal transfers, just mechanisms to enforce budget discipline. This is certainly a framework for a two-speed Europe.

In other news, someone is floating rumors that the IMF is preparing a massive lending program for Italy. From Bloomberg:The International Monetary Fund is preparing a 600-billion euro ($794 billion) loan for Italy in case the country’s debt crisis worsens, La Stampa said.Details are unclear. Ed Harrison at Credit Writedowns has a translation of a German version of the story that mentions the possibility of ECB funding of the bailout, with an IMF guarantee.

The money would give Italy’s Prime Minister Mario Monti 12 to 18 months to implement his reforms without having to refinance the country’s existing debt, the Italian daily reported, without saying where it got the information. Monti could draw on the money if his planned austerity measures fail to stop speculation on Italian debt, La Stampa said.