by Calculated Risk on 6/21/2009 11:10:00 PM

Sunday, June 21, 2009

FedCASH: "No Credit Needed"

Click on photo for larger image in new window.

Click on photo for larger image in new window.

Photo Credit: Rander (thanks!)

Up to $2500 today!

No Credit Needed!

We Say Yes!

This photo is in Bedford, TX.

Interesting - "FedCash" appears to be a registered trade mark of the Fed.

LA, NY, San Francisco, Boston, Seattle, Detroit: Real Prices and the Unemployment Rate

by Calculated Risk on 6/21/2009 07:32:00 PM

Yesterday I posted a comparison of national real house prices and the unemployment rate. Today I'm posting the comparison for various cities.

Previous posts in this series:

National Real House prices and the unemployment rate.

Washington, D.C. real prices and unemployment.

Miami, Chicago, Dallas: Real House Prices and Unemployment Rate

Notes: House prices are from Case-Shiller (back to 1987) and Freddie Mac's Purchase index (back to 1975). The Case-Shiller index was set equal to the Freddie Mac index in the first quarter Case-Shiller is available for each city, and then both indexes adjusted by CPI less shelter for each region.

The red unemployment rate is for each state and goes back to 1976. The orange unemployment line is for the metropolitan statistical areas (MSA) (most go back to 1990)

Note the scale of unemployment rate doesn't start at zero (to better compare to house prices) and scales are different for each city. Click on image for larger graph in new window.

Click on image for larger graph in new window.

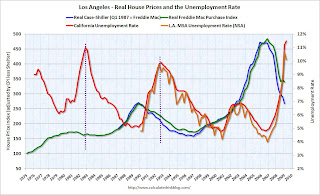

The first graph is for Los Angeles and shows the well known late '80s housing bubble.

There was a much smaller price bubble in the late '70s.

This is a good example of house prices still falling in real terms after a housing bubble, until sometime after the unemployment rate peaks. The second graph is for San Francisco.

The second graph is for San Francisco.

San Francisco had a similar bubble as LA. The purple lines show the peaks in the unemployment rate after a house price bubble.

And the third graph is for New York. New York had a bubble in the late '80s too.

New York had a bubble in the late '80s too.

And just like in LA and SF, real house prices continued to fall even after the unemployment rate peaked.

New York didn't have a bubble in the late '70s. The fourth graph is for Boston.

The fourth graph is for Boston.

Boston had a serious housing bubble in the mid-to-late '80s - in some ways this was the worst of the late '80s housing bubbles.

Once again (sorry no line), real prices continued to drift downwards for a few years after the post-bubble unemployment rate had peaked in the '90s. The fifth graph is for Seattle.

The fifth graph is for Seattle.

Seattle has a changing economy - back in the '70s it was driven by the fortunes of Boeing, but by the '90s, it was more Microsoft and other tech companies and that shift probably kept house prices from falling in the early '90s.

For the late '70s bubble, we see house prices fell until the unemployment rate peaked (see dashed purple line). And finally Detroit (note the price index is on a different scale).

And finally Detroit (note the price index is on a different scale).

Detroit had a mini-bubble in the late '70s, and once again real prices fell, until the post bubble unemployment rate peaked.

Although there are many other factors influencing house prices, I expect real house prices to decline until the unemployment rate peaks - and maybe even decline slightly (in real terms) for a few more years.

Miami, Chicago, Dallas: Real House Prices and Unemployment Rate

by Calculated Risk on 6/21/2009 03:42:00 PM

Yesterday I posted a comparison of national real house prices and the unemployment rate. Today I'm posting the comparison for various cities.

Previous posts:

National Real House prices and the unemployment rate.

Washington, D.C. real prices and unemployment.

Notes: House prices are from Case-Shiller (back to 1987 for Miami and Chicago, and 2000 for Dallas) and Freddie Mac's Purchase index (back to 1975). The Case-Shiller index was set equal to the Freddie Mac index in Q1 1987 (Q 2000 for Dallas), and then both indexes adjusted by CPI less shelter for South Urban cities (Chicago used Midwest urban cities).

The red unemployment rate is for the states and only goes back to 1976. The orange unemployment line is for the metropolitan statistical areas (MSA)

Note the scale of unemployment rate doesn't start at zero (to better compare to house prices). Click on image for larger graph in new window.

Click on image for larger graph in new window.

In Miami, real house prices increased in the last '70s, but those increases were dwarfed by the current bubble.

Miami doesn't have a good example of a previous bubble to compare falling house prices and the unemployment rate.

Maybe if we had data back to the great Florida housing bubble of the 1920s! The second graph is for Chicago.

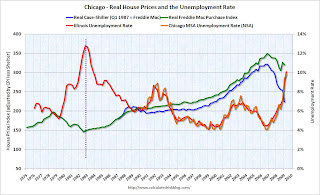

The second graph is for Chicago.

Chicago has an example of a previous housing bubble in the late '70s. And house prices fell basically until the unemployment rate peaked (see dashed purple line).

And the third graph is for Dallas.

Dallas had a housing price bubble in the early '80s because of high oil prices during that period. House prices and the unemployment rate appear unrelated, and we would probably have to look at net migration to understand why prices fell.

House prices and the unemployment rate appear unrelated, and we would probably have to look at net migration to understand why prices fell.

The pattern I expect is for house prices to fall (after a bubble) until the unemployment rate peaks - and possibly for some time after the unemployment rate peaks.

Some serious bubble cities to come ...

House Prices and the Unemployment Rate, Washington D.C.

by Calculated Risk on 6/21/2009 12:28:00 PM

Yesterday I posted a comparison of house prices and the unemployment rate on a national (U.S.) basis.

I'm working on a series of graphs for individual cities. Each graph takes some work and a few assumptions (I will outline the assumptions for each city).

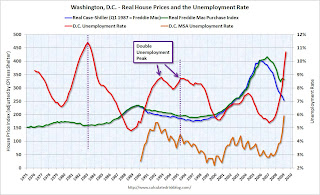

Notes: House prices are from Case-Shiller (back to 1987) and Freddie Mac's Purchase index (back to 1975). The Case-Shiller index was set equal to the Freddie Mac index in Q1 1987, and then both indexes adjusted by CPI less shelter for North Urban cities.

The red unemployment rate is for Wash, D.C. (as statewide) and only goes back to 1976. Update: the orange is for D.C. MSA  Click on image for larger graph in new window.

Click on image for larger graph in new window.

Washington D.C. participated in the late '80s housing bubble, and only somewhat in the late '70s bubble. The dashed purple lines line up the peak unemployment rate - following the housing bubbles - with house prices.

Note the scale of unemployment rate doesn't start at zero (to better compare to house prices).

It appears real house prices declined until the unemployment rate peaked, and then remained stagnant for a few years. Following the late 1980s housing bubble (with a double unemployment peak in D.C.), house prices declined for a few years after the unemployment rate peaked for a 2nd time.

Although there are periods when there is no relationship between the unemployment rate and house prices, this graph suggests that house prices will not bottom (in real terms) until the unemployment rate peaks (or later, especially since the current bubble dwarfs those previous housing bubbles).

More to come ...

Record Bonuses on tap for Goldman Staff

by Calculated Risk on 6/21/2009 09:56:00 AM

From The Observer: Goldman to make record bonus payout (ht Jonathan)

Goldman Sachs staff can look forward to the biggest bonus payouts in the firm's 140-year history after a spectacular first half of the year ... Staff in London were briefed last week on the banking and securities company's prospects and told they could look forward to bumper bonuses if, as predicted, it completed its most profitable year ever.Usually I don't post on compensation issues, but record bonuses in a recession is pretty amazing.

...

In April, Goldman said it would set aside half of its £1.2bn first-quarter profit to reward staff, much of it in bonuses. It is believed to have paid 973 bankers $1m or more last year, while this year's payouts are on track to be the highest for most of the bank's 28,000 staff, including about 5,400 in London.

The Onion: US To Trade Gold Reserves For Cash

by Calculated Risk on 6/21/2009 12:14:00 AM

HT John. Enjoy ...

Saturday, June 20, 2009

NY Times: Treasury and Bill Gross

by Calculated Risk on 6/20/2009 08:59:00 PM

From the NY Times: Treasury’s Got Bill Gross on Speed Dial

[Bill Gross'] mood brightens when he talks about how much money Pimco could reap by participating in the Geithner [PPIP] plan. No wonder: the terms are deliciously favorable for participants selected as fund managers. Money managers like Pimco would be expected to raise at least $500 million from their clients. The Treasury would match that with taxpayer dollars. Then Pimco and the Treasury would create a jointly owned fund of at least $1 billion that would buy distressed mortgage bonds.These low interest rate, non-recourse loans allow money managers to overpay for bank assets; essentially gambling with the taxpayers money. No wonder this makes Bill Gross salivate. The banks are winners. The money managers are winners (if a few of the gambles pay off). And the taxpayers are the losers.

Government largess doesn’t stop there. The fund will be eligible for low-interest financing from both the Treasury and the Fed that analysts at Credit Suisse First Boston estimate could be as high as four times the total equity in the fund. So if Pimco ponied up $500 million, the fund that it manages could borrow $4 billion.

Pimco would then negotiate with banks to buy their wobbly mortgage-backed securities. Mr. Gross says that some of these securities pay an interest rate as high as 14 percent and that even if default rates were 70 percent, Pimco and the government would still make a 5 percent return after covering their negligible borrowing costs. That means the government-Pimco partnership could make at least $250 million in a year on a $5 billion investment fund. Of that amount, Pimco would get $125 million — a 25 percent return on its original investment.

But here’s the part that makes Mr. Gross salivate. If things go badly, the government is responsible for repaying all that debt.

Also, the article mentions Bill Gross and yoga:

Mr. Gross, 65, has long been celebrated for his eccentricities. He learned some of his lucrative investing strategies by gambling in Las Vegas. Many of his most inspired ideas arrived while he was standing on his head doing yoga.I've attended the same yoga class as Mr. Gross a few times - hence Tanta's joke in this post: BONG HiTS 4 BILL GROSS!

Near the end of 2007, I was waiting for a yoga class, and some random guy walked up to Gross and asked him if it was time to buy distressed bonds (think Bear Stearns). Gross said "probably"! I almost said something, but then I realized maybe Gross didn't like that guy ... or didn't like being asked about bonds at a yoga class.

House Prices and the Unemployment Rate

by Calculated Risk on 6/20/2009 05:00:00 PM

We've discussed supply and demand, price-to-income and price-to-rent ratios, and real house prices, in trying to forecast how long house prices will continue to decline.

This is a comparison of real house prices and the unemployment rate.

Note: House prices are national from Case-Shiller (back to 1987) and Freddie Mac's Purchase index (back to 1970). The Case-Shiller index was set equal to the Freddie Mac index in Q1 1987, and then both indexes adjusted by CPI less shelter. Click on image for larger graph in new window.

Click on image for larger graph in new window.

The two previous national housing bubbles (late 1970s and late 1980s) are shown on the graph. The dashed purple lines line up the peak unemployment rate - following the housing bubbles - with house prices.

It appears real house prices declined until the unemployment rate peaked, and then remained stagnant for a few years. Following the late 1980s housing bubble, the Case-Shiller index suggests prices declined for a few years after the unemployment rate peaked.

Although there are periods when there is no relationship between the unemployment rate and house prices, this graph suggests that house prices will not bottom (in real terms) until the unemployment rate peaks (or later, especially since the current bubble dwarfs those previous housing bubbles). And it is unlikely that the unemployment rate will peak for some time ...

I'll post some similar graphs for a few Metropolitan Statistical Areas (MSA) later, comparing local house prices with the local unemployment rate.

Popular Google Product Suffers Major Disruption

by Calculated Risk on 6/20/2009 02:55:00 PM

UPDATED: Service disruption resolved on Monday June 22nd.

For visitors of many Google hosted blogs, the redirect feature from a blogspot address to a custom URL failed for six days (from late Tuesday June 16th until Monday afternoon June 22nd).

Original post:

The popular Google (GOOG) blogging product, blogger.com, has suffered a major service disruption. The disruption was first reported on Tuesday, June 16th, and is ongoing now resolved (June 22nd update).

This is impacting many blogs hosted on blogger.com, including popular blogs like Americablog.com, eschatonblog.com, and the economics blog calculatedriskblog.com.

Blogger.com offers a feature to redirect users from a blogspot URL to a custom domain name. As an example, atrios.blogspot.com is supposed to be automatically redirected to eschatonblog.com. However, starting last Tuesday, the Google product started inserting an interstitial page before redirecting.

For Firefox uses this appears as a redirect warning notifying users that they were leaving Blogger. For Internet Explorer and Safari users (and iPhone users), they are notified that the page could not be displayed or that the blogs no longer exist.

Users are still able to access the blogs via the custom domain name, however any bookmarks, or links from other sites, using the blogspot address are affected.

This has led to a significant decline in traffic for many Blogspot.com hosted blogs, with some sites reporting a 50 percent decline in traffic.

Blogger engineers acknowledged the problem on Wednesday morning, June 17th: Custom domain redirects incorrectly displaying warning page

“Custom domain users are reporting that traffic to their blog's Blogspot URL is inserting a redirect warning notifying users that they are leaving Blogger. Previously, no warning was issued and visits to the Blogspot URL were automatically re-routed to the user's Custom Domain.As of Saturday the service disruption is still unresolved.

Blogger engineers are aware of the issue and are working on a fix. We apologize for the issue, and will update this post when it is fixed.”

The author of Calculated Risk posted a poignant email from a long term reader in the Blogger help forum on Friday:

"Just wondering if everything is OK. Hope you are well. If you have decided to give it up, I wish you the best. You have been doing a Herculean job for the last few years, keeping an outstanding blog going. I don't have words to tell you how much I have appreciated you"At least this reader could be informed of the service disruption and directed to the new URL.

Book Review: The Greenspan Problem

by Calculated Risk on 6/20/2009 11:00:00 AM

CR Note: This is a guest post by Mathew Padilla of the Mortgage Insider blog. All opinions expressed are Matt's.

A book review by Mathew Padilla for Calculated Risk.

Count the following among the most accurate titles ever written: Nasdaq’s Peak was Greenspan’s. The title introduced a 2001 essay by James Grant, author of newsletter Grant’s Interest Rate Observer, in which the author addresses former Fed Chief Alan Greenspan’s approach to the ‘90s stock bubble: “He seeded it, accommodated it, celebrated it and defended it from those who believed they saw it turn into a bubble.”

The essay is an opening salvo against Greenspan to be followed by three other works that eviscerate the Maestro, the Federal Reserve and U.S. monetary policy in Grant’s late 2008 book Mr. Market Miscalculates: The Bubble Years and Beyond, which is a compilation of his essays celebrating the 25th anniversary of his newsletter. (I confess I submitted the review to Calculated Risk this month because I just finished reading the book.)

In the Nasdaq’s Peak essay Grant deconstructs Greenspan’s March 6, 2000 speech before the Boston College Conference on the New Economy. Greenspan praised the “revolution in information technology” including how managers formulated decisions with “real-time” information and that reduced uncertainty, allowing them to better control inventories. Grant delivers one of his many wry lines:

Thanks to clarity afforded by instantaneous communications, Cisco Systems had to write off only $2.25 billion in excess inventories during its third fiscal quarter, in addition to just $1.17 billion in restructuring and other special charges. … Lucent, Corning, Nortel and JDS Uniphase have been devastated by one of the greatest misallocations of investment capital outside the chronicles of the Soviet Gosplan. Who can conceive of the size of this waste had there been no e-mail?It’s the misallocation of capital that gets at the heart of Grant’s criticism of both Greenspan and the Fed. Grant saw Greenspan as the Chairman of Perpetual Intervention, juicing the money supply 1. When a big hedge fund had a serious hiccup 2 When computers might go bonkers over two-digit dates. 3. After Nasdaq tanked. But the former chief saw no need to raise rates to stem speculative excesses. (Recall the 2001 essay is before the most pernicious bubble of all.) Greenspan practiced a lopsided monetary policy.

Compounding his folly, Greenspan was slow to react to the Nasdaq crash and start lowering rates when boom turned to bust in the second half of 2000, Grant writes, adding: “(B)ecause information technology was an absolute and unqualified good thing, it followed that it could not be held responsible for a bad thing – for instance, the bottom falling out of capital investment and, therefore, out of the GDP growth rate.”

That was Grant annoyed. Grant disgusted comes across in a September 13, 2002 essay, Monetary Regime Change, in which Grant’s prose oozes with repugnance as he picks apart Greenspan’s speech that year at the “monetary jamboree” of the Kansas City Federal Reserve Bank in Jackson Hole, Wyo. “Alan Greenspan washed his hands of responsibility for the bubble he said he could not have pricked even if he had noticed it floating above his desk on a string.” Again we are talking about the tech bubble – a warning that Greenspan was a deeply flawed policymaker. Grant goes on:

Following is a speculation on the outlines of a post-Greenspan monetary system. It is supported by some of the historical works that the chairman can read in the well-deserved retirement he should have taken starting in about 1996. We say “post-Greenspan” because, we believe, the Jackson Hole Speech will raise the odds against his reappointment (his current term expires in 2004), speed the day of his departure and reduce his policy-making influence for a long as he remains in office.Grant was right about Greenspan not being reappointed, but wrong about his waning influence. In his final years, Greenspan fueled a pernicious explosion in credit, and he provided intellectual cover to politicians either ideologically opposed to regulation or too preoccupied with other matters to get to it. The essayist also was prescient but a little early with this in 2002: “Only one of the troubles with bubbles is that, after they pop, ultra-low interest rates and extraordinary rates of credit expansion lose their stimulative potency. The rate of creation of new yen by the Bank of Japan stands at 26.1% year-over-year, but this outpouring has yielded no appreciable reflationary results.” Grant was exactly right, but after a property bubble, not a stock-market bubble.

Greenspan is the lighting rod, but monetary policy is the storm. Grant writes since the late 19th century to their creators, each monetary system suited the ages. “But none lasted much longer than a generation. The system in place since 1971 is the worldwide paper-dollar system.” Grant takes this idea and runs with it in Mission Creeps, a November 7, 2003 essay that takes stock of the Federal Reserve on the eve of its 90th anniversary. “The Federal Reserve would be unrecognizable to the men who conceived it.” The law creating the Fed defined its purposes as follows, “to provide for the establishment of the Federal Reserve banks, to furnish and elastic currency, to afford means of rediscounting commercial paper and to establish a more effective supervision of banking in the United States, and for other purposes.”

The founders, including Sen. Carter Glass (D.Va.), feared bank runs and their potential to disrupt commerce. They envisioned a central bank that could keep the banking system liquid. But they lived in the era of the gold standard, and never, ever dreamed of an expanding money supply designed to boost employment. Balancing full employment and appropriate inflation came later – the Fed and Congress found uses for the original act’s “and for other purposes.” Grant’s strongest ammunition is fired at the very idea of a central bank’s power to steer an economy, and all the myriad actors in it, by comparing economics to the hard science of physics in 2003:

Both use quantitative methods to build predictive models, but physics deals with matter; economics confronts human beings. And because matter doesn’t talk back or change its mind in the middle of a controlled experiment or buy high with the hope of selling even higher, economists can never match the predictive success of the scientists who wear lab coats. … Gov. Ben S. Bernanke is one of those true believers, as he reiterated last month in a lecture at the London School of Economic. “If all goes as planned,” said Bernanke, getting off on the wrong foot, “the changes in financial asset prices and returns induced by the actions of monetary policymakers lead to changes in economic behavior that the policy was trying to achieve.” If all went according to plan, the LSE would be teaching case studies in the triumphs of the Soviet economy.In yet another essay, There ought to be Deflation, in January 14, 2005, Grant builds on the idea of a monetary policy as a source of economic distortion. He quotes Friedrich von Hayek, who, while accepting the Nobel price for economics more than 20 years ago, said:

The continuous injection of additional amounts of money at points of the economic system where it creates a temporary demand which must cease when the increase of money stops or slows down, together with the expectation of a continuing rise in prices, draws labor and other resources into employment which can last only so long as the increase of the quantity of money continues at the same rate – or perhaps even only so long as it continues to accelerate at a given rate.And that is exactly what happened when Greenspan cut rates in the 2000s. Workers flooded into subprime lenders, construction companies, Home Depots, and on and on.

Grant bemoans, in more than one essay, the death of the gold standard. In his view a fixed currency would constrain both the Fed and the federal government. It might even have prevented a war of choice in Iraq, since what cannot be funded cannot be done. But fixed currencies have their disadvantages, writes another Nobel laureate, Paul Krugman, in another book tackling our current woes, his updated The Return of Depression Economics and the Crisis of 2008. A currency that is allowed to fall benefits an economy in recession since its exports become cheaper, Krugman argues. He’s also a proponent of a flexible currency giving a central bank freedom to expand money and combat unemployment.

Curiously, Krugman has a chapter in his book dubbed Greenspan’s Bubbles, but he does not address the Greenspan conundrum: what to do about the risk a Fed chairman will over stimulate asset prices while doing nothing to stop credit abuses. Until that problem is addressed I side with Grant and Hayek – expansionary monetary policy is dangerous.

In all of Mr. Market Miscalculates, I have but one quibble with Grant’s views. He cites the “socialization of risk” as encouraging reckless corporate behavior. The problem began with FDIC insurance and culminated in Greenspan’s interventions, including the orderly dissolution of hedge fund Long Term Capital Management. Grant’s case is that banks are more willing to lend to corporate cowboys if they think government will bail them out, or the market overall.

An alternative view is that FDIC insurance has been a key element among government initiatives that maintained safety and soundness in banking for some 50 years. It wasn’t until President Reagan initiated the anti-regulation era that insured institutions went bonkers – S&Ls binged on junk bonds and commercial real estate. Even now, with all that has happened, consumers are not lining up at insured banks in an all out panic – before FDIC insurance some good banks failed on mere rumors of trouble.

And moral hazard did not fuel the excesses of the era just ended. As an example, noninsured, nonbank New Century Financial secured more than $15 billion in credit lines from bigger banks in housing’s heyday. No one thought the subprime generator was too big to fail. And as soon as it wobbled, New Century found its credit cut off, and it fell into the abyss. This is the real issue with the modern era -- capital flows quickly, at times too quickly, into and out of any venture anywhere in the world.

On the whole, there is much genius in Grant’s observations. And his book covers more than what I touched on here. He gives a modern take on value investing, illuminates Wall Street’s mortgage fantasies, and more. As for a solution to the Greenspan problem, it is not Grant’s style to offer one. He never explicitly says the country should return to the gold standard or hack some appendages off the Federal Reserve. Grant is subtler, and more general. He simply warns us: change is coming.

Mathew Padilla is co-author of Chain of Blame: How Wall Street Caused the Mortgage and Credit Crisis, a USA Today Business Book of the Year, and hosts the Mortgage Insider blog.

California Foreclosure Prevention Act: Many Lenders Exempt

by Calculated Risk on 6/20/2009 08:57:00 AM

From the Sacramento Bee: 7 lenders get immunity from state foreclosure prevention act

Bank of America Home Loans, CitiMortgage and Carrington Mortgage Services are among the first seven lenders and loan servicers granted immunity from the state's foreclosure prevention act launched this week in California.From the California Department of Corporations: Mortgage Loan Servicers who have been granted an exemption

The new law makes lenders prove to the state that they have a comprehensive loan-modification program that helps borrowers stay in their homes. Those that can't prove it to the state's satisfaction must wait an extra 90 days before foreclosing on borrowers.

...

State agencies reported Friday that 38 institutions received temporary 30-day immunity while the state reviews their applications. Among them were some of the Sacramento region's leading lenders, including Wells Fargo, GMAC and JPMorgan Chase.

Exemptions under the Department of Corporations

Exemptions under the Department of Financial Institutions

Exemptions under the Department of Real Estate

This was never a big deal. Most lenders will be exempt.

GE Vice Chairman: No Green Shoots

by Calculated Risk on 6/20/2009 01:00:00 AM

From Bloomberg: GE Vice Chair Rice Sees No ‘Green Shoots’ in Orders (ht Comrade de Chaos)

... “I am not particularly of the green shoots group yet,” [General Electric Co. Vice Chairman John] Rice said ... “I have not seen it in our order patterns yet. At the macro level, there may be statistics suggesting the economy is starting to turn. I am not seeing it yet.”Maybe the cliff diving is over, but no green shoots ....

...

“We see a world where good companies and good consumers can’t get all the credit we would like,” Rice said. “Companies with lots of cash on their balance sheet are worried about whether they will get what they need for working capital” and are cutting spending.

“Until that changes I don’t think you will see a significant rebound,” Rice said. “We are preparing for 12 or 18 months of tough sledding.”

More GM Bankruptcy

by Calculated Risk on 6/20/2009 12:11:00 AM

During the Chrysler bankruptcy, I excerpted and linked to lawyer Steve Jakubowski's Bankruptcy Litigation Blog. Steve has taken it a step further and stepped into the GM fray ...

From Steve: Objecting to the GM 363 Sale's Treatment of Product Liability Claims: Stepping Into The Fray

[A] lot of panicked plaintiffs' lawyers involved in cases against GM are screaming these days as they watch years of toil on behalf of people seriously injured by defective GM products (like crushed roofs, exploding "side saddle" gas tanks, and collapsing seat backs) potentially go for naught as GM makes its grandest attempt ever to crush an entire class of former customers and existing and future products liability claimants in a sale that many plaintiffs lawyers of record only received written notice of in the past couple of days.From the NY Times: New Objections May Delay G.M. Exit From Bankruptcy

Those following this blog know my rising concern (even anger) over how products liability claimants were completely stiffed in Chrysler ...

So, I decided to do something about it, and officially stepped into the fray by filing this Objection to the GM Sale and this Memorandum in Support jointly with counsel for the Center for Auto Safety, Consumer Action, Consumers for Auto Reliability and Safety, National Association of Consumer Advocates, and Public Citizen.

A group of General Motors bondholders and some of the automaker’s labor unions filed objections on Friday to G.M.’s plan to sell its assets to a new company that could emerge from bankruptcy protection.The GM bankruptcy might take a little longer than Chrysler.

Their opposition, with objections filed by consumer groups, a handful of states and cities, and individual retirees, shareholders and bondholders, threatens to put the brakes on what the company and the government had hoped would be a rapid trip through the Chapter 11 process.

Friday, June 19, 2009

Bank Failure #40: First National Bank of Anthony, Anthony, KS

by Calculated Risk on 6/19/2009 07:13:00 PM

Carry on my wayward bank...

Now, dust in the wind

by Soylent Green is People

From the FDIC: Bank of Kansas, South Hutchinson, Kansas, Assumes All of the Deposits of First National Bank of Anthony, Anthony, Kansas

As of March 31, 2009, First National Bank of Anthony had total assets of $156.9 million and total deposits of approximately $142.5 million.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $32.2 million. Bank of Kansas' acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. First National Bank of Anthony is the 40th FDIC-insured institution to fail in the nation this year, and the second in Kansas.

Bank Failures 38 & 39: Southern Community Bank, Fayetteville, Georgia and Cooperative Bank, Wilmington, North Carolina

by Calculated Risk on 6/19/2009 06:11:00 PM

Crushing debt broods over banks

Fresh Winter for one.

by Soylent Green is People

From the FDIC: United Community Bank, Blairsville, Georgia Assumes All of the Deposits of Southern Community Bank, Fayetteville, Georgia

As of May 29, 2009, Southern Community Bank had total assets of $377 million and total deposits of approximately $307 million.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $114 million. United Community Bank's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. Southern Community Bank is the 38th FDIC-insured institution to fail in the nation this year, and the seventh in Georgia.

Blair's agents aren't advisors

More like a Capo

by Soylent Green is People

And from the FDIC: First Bank, Troy, North Carolina, Assumes All of the Deposits of Cooperative Bank, Wilmington, North Carolina

As of May 31, 2009, Cooperative Bank had total assets of $970 million and total deposits of approximately $774 million.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $217 million. First Bank's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. Cooperative Bank is the 39th FDIC-insured institution to fail in the nation this year, and the second in North Carolina.

California Mortgage Loan Data by Product and Type

by Calculated Risk on 6/19/2009 05:24:00 PM

NOTE: These graphs were correct, but the data was incorrect. The State added a zero to the HELOC data - I'll post corrected charts tomorrow. (ht Armin)

best to all

California Survey of Loan Servicers Q1

by Calculated Risk on 6/19/2009 02:58:00 PM

The 2009 First Quarter results from the Department of Corporations Survey of Loan Servicers has been released. Historical data is here.

There is a lot of information in this survey: the unpaid balances by loan type, the number of loans by loan type, and modification data.

From Jim Wasserman at the Sacramento Bee: Growing trouble with prime loans (ht Paul)

I was going through the state Department of Corporation's newest quarterly report (Q1-2009) for lenders' loan modification activities and this jumped out at me: The number of workouts initiated for prime loans is rising fast, mirroring rising unemployment in California.

The data come from lenders that report to the state as part of Gov. Arnold Schwarzenegger's Nov. 2007 Subprime agreement. These lenders service about 3.3 million loans in California, about half the state's total.

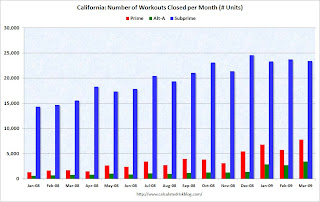

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the number of loan modifications initiated by type (Prime, Alt-A, Subprime). This totals almost 1.5 million loan modifications initiated in California since January 2007 (there are 3.3 million loans including HELOCs) - so there is probably some double counting as modification negotiations are started and stopped.

Modifications for prime loans are surging (and Alt-A is increasing rapidly too). It is possible that subprime peaked during the moratorium period.

The second graph shows loan mods completed by category. The data was only broken out by category starting in Jan 2008.

The second graph shows loan mods completed by category. The data was only broken out by category starting in Jan 2008.I expect a surge in prime loan mods completed based on the mods initiated.

Note that completion can mean: account paid current (about 5%), paid-in-full (6%), modified terms (about 60% of completions), short sale (about 11%), deed-in-lieu of foreclosure (few), reductions in principal (few), and other workouts (about 15%).

As an aside, the California website is titled "Subprime". With the surge in prime modifications, I guess we're all subprime now!

FHFA Director: May Expand Loan Refinance to 125 Percent LTV

by Calculated Risk on 6/19/2009 01:11:00 PM

From Bloomberg: Obama Mortgage Refinancing Program May Expand, Lockhart Says

President Barack Obama’s program to help more homeowners refinance may be expanded to include borrowers who owe more than 105 percent of their homes’ values, Federal Housing Finance Agency Director James Lockhart said.This is part of the Home Affordable program, and only applies to homeowners with loans that Fannie and Freddie holds or guarantees.

The Obama administration is considering allowing Fannie Mae and Freddie Mac to refinance loans with current loan-to-value ratios of 125 percent or higher, Lockhart said at a National Association of Real Estate Editors Association conference in Washington yesterday.

As long as this is no cash out, increasing the LTV limit from 105% to 125% just allows Fannie and Freddie to lower the risk on loans they already own or guarantee.

Record Unemployment Rates in Eight States

by Calculated Risk on 6/19/2009 11:04:00 AM

Note: the BLS started keeping state records in 1976, so obviously this doesn't include the Depression.

From the BLS: Regional and State Employment and Unemployment Summary

Michigan again reported the highest jobless rate, 14.1 percent in May. The states with the next highest rates were Oregon, 12.4 percent; Rhode Island and South Carolina, 12.1 percent each; California, 11.5 percent; Nevada, 11.3 percent; and North Carolina, 11.1 percent. Six additional states and the District of Columbia recorded unemployment rates of at least 10.0 percent. The California, Nevada, North Carolina, Oregon, Rhode Island, and South Carolina rates were the highest on record for those states. Florida, at 10.2 percent, and Georgia, at 9.7 percent, also posted series highs. Nebraska and North Dakota registered the lowest unemployment rates, 4.4 percent each. Overall, 12 states and the District of Columbia had significantly higher jobless rates than the U.S. figure of 9.4 percent, 29 states reported measurably lower rates, and 9 states had rates little different from that of the nation.

Office Buildings: 50 Percent Off in London

by Calculated Risk on 6/19/2009 10:30:00 AM

Here are some more CRE price declines ...

From Bloomberg: Simon Halabi’s Companies Default on $1.9 Billion Debt (ht Brian)

Billionaire investor Simon Halabi’s real estate companies defaulted on 1.15 billion pounds ($1.9 billion) of bonds backed by nine London office buildings as the recession cut the value of the properties by about 50 percent.Another 'half off' sale.

...

The buildings were valued at 929 million pounds as of June 8, down from 1.83 billion pounds in October 2006, Hatfield Philips said. Halabi’s companies borrowed against the buildings in 2006. The debt, which was packaged into bonds, expires in October.