by Calculated Risk on 6/19/2009 08:58:00 AM

Friday, June 19, 2009

FDIC's Bair: 'Too Big to Fail' must end

From CNBC: 'Too Big to Fail' Doctrine Must End: FDIC's Bair

“Clearly, there has been moral hazard and lack of market discipline fed by the 'too big to fail' doctrine, and this in turn has been fed by the lack of resolution mechanism that really works for very large financial organizations and this has been a central focus of ours,” [Sheila Bair, chairman of the Federal Deposit Insurance Corp] said in an interview on CNBC."Still analyzing the whitepaper"?

...

“[Obama’s regulation is] a good opening to the process,” said Bair. “I commend the President for getting personally involved in this and taking leadership and putting his own considerable influence behind the efforts…We’re still analyzing the whitepaper and want to work with the administration and Congress constructively on this.”

...

“[The FDIC] is guaranteeing over $6 trillion right now,” she said. “The FDIC has tremendous exposure to the system so we would like a real say on systemic risk issues. [Reform overhaul] is an institutional issue, not a turf issue or a personality issue.”

Thursday, June 18, 2009

Coldwell Banker CEO: "Move-up buyers absent"

by Calculated Risk on 6/18/2009 09:30:00 PM

From Reuters: Housing Sales Lackluster This Spring: Coldwell (ht Annie)

Jim Gillespie, president and chief executive of Coldwell Banker Real Estate, in an interview with Reuters, said sales were only modest during the spring, with demand overwhelmingly dominated by first-time home buyers and investors.With lenders as sellers in a large percentage of sales, it is no surprise there are few move-up buyers. This will impact the mid-to-high end for some time.

"The more important 'move-up' buyers were absent and that is not encouraging," said Gillespie ..."They are key to a U.S. housing market recovery,"

The article also mentions a proposal for a new $15,000 tax credit.

DataQuick: California Bay Area Home Sales Increase

by Calculated Risk on 6/18/2009 07:49:00 PM

From DataQuick: Uptick in Bay Area home sales and median price

The median price paid for a Bay Area home jumped in May as more expensive homes started to sell again. The overall number of homes sold increased for the ninth month in a row, a real estate information service reported.

The median price [increase] ... was due to a small but noticeable increase in sales of homes financed with home loans for more than $417,000, commonly called “jumbo” mortgages. They accounted for 25.5 percent of the Bay Area’s home sales last month, the highest since 25.8 percent last October. Two years ago it was more than 60 percent. The presence of those high-end sales in the statistics pulled the May median up.

Sales of $800,000-plus existing single-family houses rose to 13.2 percent of all house resales last month, up from 9.8 percent in April and the highest since they were 14.8 percent of sales last October. Sales of sub-$400,000 existing houses dropped to 57.5 percent of May sales, down from 62.2 percent in April and the lowest since 56.5 percent in November.

[CR: Be careful with the median price, it is distorted by the change in mix.]

... A total of 7,447 new and resale houses and condos sold in the nine-county Bay Area last month. That was up 4.3 percent from 7,139 in April and up 19.8 percent from 6,216 in May 2008.

The May 2008 sales were the lowest in DataQuick’s statistics, which go back to 1988. May sales have averaged 9,881 and peaked in May 2004 at 13,567 sales.

...

Last month 42.1 percent of all homes resold in the Bay Area had been foreclosed on in the prior 12 months, down from 46.4 percent in April and the lowest since the figure was 41.6 percent last September. A year ago the percentage was 27.7 percent, while the peak was 52.0 percent this February. By county, foreclosure resales ranged last month from 7.7 percent of all resales in San Francisco to 65.1 percent in Solano.

... Foreclosure activity is off its recent peak but remains high by historical standards ...

Corus Bank Faces Deadline Today

by Calculated Risk on 6/18/2009 05:49:00 PM

No news yet on the June 18th deadline, but if you want to see some dumping ...

Corus faces a June 18 deadline from the Office of the Comptroller of the Currency to boost its capital levels or risk being put into conservatorship or receivership.Robert J. Glickman, the former CEO of Corus Bankshares Inc., ran the bank for 35 years before stepping down in April. Now he is selling like crazy.

SC 13D/A SEC Filing June 9th:

On June 3, 2009 ... Robert Glickman disposed of 111,074 shares of Common Stock which he owned directly. On June 4, 2009, Robert Glickman disposed of 800,248 shares of Common Stock beneficially owned by him. On June 5, 2009, Robert Glickman disposed of 485,178 shares of Common Stock beneficially owned by him. On June 8, 2009, Robert Glickman disposed of 16,653 shares of Common Stock beneficially owned by him. ... The shares disposed of by Robert Glickman on June 3, 2009, June 4, 2009, June 5, 2009 and June 8, 2009 represent approximately 2.6% of the total issued and outstanding shares of the CompanySC 13D/A SEC Filing June 12th:

On June 9, 2009, Robert Glickman disposed of 14,126 shares of Common Stock beneficially owned by him. .... On June 10, 2009, Robert Glickman disposed of 391,879 shares of Common Stock beneficially owned by him. ... On June 11, 2009, Robert Glickman disposed of 752,714 shares of Common Stock beneficially owned by him. ... On June 12, 2009, Robert Glickman disposed of 970,123 shares of Common Stock beneficially owned by him.SC 13D/A SEC Filing June 17th:

The shares disposed of by Robert Glickman on June 9, 2009, June 10, 2009, June 11, 2009 and June 12, 2009 represent approximately 4.0% of the total issued and outstanding shares of the Company

On June 15, 2009, Robert Glickman disposed of 390,498 shares of Common Stock beneficially owned by him. ... On June 16, 2009, Robert Glickman disposed of 334,691 shares of Common Stock beneficially owned by him. ...

The shares disposed of by Robert Glickman on June 15, 2009 and June 16, 2009 represent approximately 1.4% of the total issued and outstanding shares of the Company

Blogger Redirect Error

by Calculated Risk on 6/18/2009 05:00:00 PM

Sorry to bother everyone with this issue.

Starting Tuesday, Google / Blogger erroneously started inserting a redirect warning for visitors of my old blogspot address, instead of redirecting the old blogspot URL to the new URL. This is a sytem wide problem, impacting many blogs using the redirect feature from blogspot.

Blogger engineers are working on the problem.

For Firefox users, you will see a redirect warning. Safari and Internet Explorer users are told the site no longer exists.

In my case this means Google-Blogger is not correctly redirecting:

http://calculatedrisk.blogspot.com/

to my new URL:

http://www.calculatedriskblog.com/

This is a problem for anyone who bookmarked the old URL, or is coming in on a link from another site (with the old URL).

To avoid this problem, you can change your bookmark to http://www.calculatedriskblog.com/

I apologize for the inconvenience - thanks for visiting - hopefully this will be fixed soon.

DOT: U.S. Vehicles Miles increase YoY in April

by Calculated Risk on 6/18/2009 03:41:00 PM

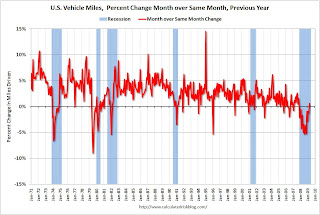

This is the first same month year-over-year increase in miles driven (April 2009 compared to the April 2008) since November 2007.

Of course gasoline prices have increased sharply since April. The EIA reports that gasoline prices have increased from about $2.10 per gallon in April, to $2.70 per gallon in June - and that will probably impact miles driven.

The Dept of Transportation reports on U.S. Traffic Volume Trends:

Travel on all roads and streets changed by +0.6% (1.4 billion vehicle miles) for April 2009 as compared with April 2008. Travel for the month is estimated to be 249.5 billion vehicle miles.

Cumulative Travel for 2009 changed by -1.1% (-10.0 billion vehicle miles).

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the annual change in the rolling 12 month average of U.S. vehicles miles driven. Note: the rolling 12 month average is used to remove noise and seasonality.

By this measure, vehicle miles driven are off 3.1% Year-over-year (YoY); the decline in miles driven was worse than during the early '70s and 1979-1980 oil crisis.

Note that rolling miles driven has a built in lag, and miles driven was larger in April 2009 than April 2008.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT. As the DOT noted, miles driven in April 2009 were 0.6% greater than in April 2008.

This is the first same month year-over-year increase since November 2007.

Year-over-year miles driven started to decline in December 2007, and really fell off a cliff in March 2008. This makes for an easier comparison for April 2009.

Those $134 Billion in Fake Bearer Bonds

by Calculated Risk on 6/18/2009 03:00:00 PM

Some mid-day amusement ...

This was funny ... I never posted on this, because it was pretty clear there wasn't any real story. Maybe the post should be titled: "How some blogs were snookered!"

But a false bottom in a suitcase?

From Dow Jones: US Says Seized 'Treasury Bonds' Are Not The Real Thing

A cache of what appeared to be around $135 billion of U.S. bonds seized at the Italian-Swiss border is, in fact, worthless, a Treasury Department spokesman said.

Two alleged Japanese citizens were stopped by Italian authorities June 4 trying to cross into Switzerland with the supposed bonds, hidden in the false bottom of a suitcase, the authorities said.

Hotel RevPAR off 18.6 Percent

by Calculated Risk on 6/18/2009 01:20:00 PM

Note: some readers might notice the occupancy rate has risen to 61% - but that is just seasonal. The hotel occupancy rate is usually the highest during the peak vacation months of June, July and August.

From HotelNewsNow.com: STR posts US results for 7-13 June 2009

In year-over-year measurements, the industry’s occupancy fell 10.1 percent to end the week at 61.0 percent. Average daily rate dropped 9.4 percent to finish the week at US$96.61. Revenue per available room for the week decreased 18.6 percent to finish at US$58.96.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 11.6% from the same period in 2008.

The average daily rate is down 9.4%, so RevPAR is off 18.6% from the same week last year.

Owners' Equivalent Rent Correction

by Calculated Risk on 6/18/2009 01:01:00 PM

In a post yesterday, I misread the BLS methodology on calculating Owners' Equivalent Rent.

For a discussion from the BLS of rent measures see: How the CPI measures price change of Owners’ equivalent rent of primary residence (OER) and Rent of primary residence (Rent)

The survey question referenced in the above post is for weighting, not price changes.

The price relative for OER is calculated by sampling non rent-controlled renters every six months. These average rents are divided by the sample six months earlier - and converted to a monthly change (by taking to the 1/6th power).

From the BLS document above: "The first step is standardizing the collected (market) rents, putting them on a monthly basis, and adjusting them for a number of circumstances that should not affect the CPI."

To be clear - the BLS is using market rents, not the opinion of homeowners to calculated OER.

I apologize for any confusion.

More on State Income Taxes

by Calculated Risk on 6/18/2009 12:20:00 PM

The Nelson A. Rockefeller Institute of Government report on state income taxes is now available on their website: April Is the Cruelest Month

Yesterday I posted a couple of graphs based on the report.

Reader Ann suggested the following graph ... This shows the change in personal income taxes multiplied by the percent personal income tax of total state taxes in 2008.

This shows the change in personal income taxes multiplied by the percent personal income tax of total state taxes in 2008.

This adjusted the decline in personal income taxes by the relative importance of the tax.

As an example, personal income taxes make up 68.5% of the revenue in Oregon and 55.9% in New York. A decline in personal income tax revenue is more important for those states than Arizona (25.3% of the revenue).

Philly Fed: Manufacturing Sector Declines Slow "Dramatically"

by Calculated Risk on 6/18/2009 10:00:00 AM

Still contracting, but the pace of contraction has slowed "dramatically".

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

Declines in the region's manufacturing sector were much less in evidence in June, according to results for this month's Business Outlook Survey. Indexes for general activity, new orders, and shipments showed notable improvement, suggesting recent declines have lessened dramatically. Indicative of ongoing weakness, however, firms reported sustained declines in employment and work hours this month.

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, increased from -22.6 in May to -2.2 this month, its highest reading since September 2008 when the index was positive for one month...

Broad indicators of future activity showed significant improvement this month. The future general activity index remained positive for the sixth consecutive month and increased markedly from 47.5 in May to 60.1, its highest reading since September 2003 (see Chart). The index has now increased 71 points since its trough in December.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

"The index has been negative for 18 of the past 19 months, a span that corresponds to the current recession."

Weekly Unemployment Claims

by Calculated Risk on 6/18/2009 08:29:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending June 13, the advance figure for seasonally adjusted initial claims was 608,000, an increase of 3,000 from the previous week's revised figure of 605,000. The 4-week moving average was 615,750, a decrease of 7,000 from the previous week's revised average of 622,750.

...

The advance number for seasonally adjusted insured unemployment during the week ending June 6 was 6,687,000, a decrease of 148,000 from the preceding week's revised level of 6,835,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows weekly claims and continued claims since 1971.

Continued claims decreased to 6.69 million. This is 5.0% of covered employment.

Note: continued claims peaked at 5.4% of covered employment in 1982 and 7.0% in 1975.

The four-week average of weekly unemployment claims decreased this week by 7,000, and is now 43,000 below the peak of 9 weeks ago. There is a reasonable chance that claims have peaked for this cycle, and the decline in continued claims is a positive.

However the level of initial claims (over 608 thousand) is still very high, indicating significant weakness in the job market.

Krugman points out (See: Unemployment claims and employment change)

[T]he level of new claims is basically an indicator of the rate of change of employment. And we are nowhere near the point at which employment looks ready to expand, or for that matter to stop falling at a terrifying rate.

What the figure [see Krugman's graph] suggests is that to stabilize employment, we’d have to see new claims drop below 400,000 or so.

Report: State Personal Income Tax Cliff Diving

by Calculated Risk on 6/18/2009 12:09:00 AM

From the WSJ: State Income-Tax Revenues Sink

State income-tax revenue fell 26% in the first four months of 2009 compared to the same period last year, according to a survey of states by the nonprofit Nelson A. Rockefeller Institute of Government.Here is a Draft of State Revenue Report

The report ... is one of the most up-to-date measures of how deep the recession is digging into Americans' wallets and, consequently, state coffers.

...

The time span notably includes the April 15 deadline for filing taxes, a critical time for states to collect revenues.

And a couple of graphs:

Click on graph for larger image in new window

Click on graph for larger image in new windowThe first graph, from the Nelson A. Rockefeller Institute of Government report, compares the first four months of 2009 to the first four months of 2008, and also compares April 2009 to April 2008 for eight regions. Note that the YoY change for April is worse in all regions than the first four month comparison.

The second graph is the four month comparison of each state (four states had no data).

The second graph is the four month comparison of each state (four states had no data).California isn't the worst, but the state relies heavily on income taxes.

Arizona is just getting crushed - and the pain is widespread.

Wednesday, June 17, 2009

Report: Risk Concentration, Lax Oversight, Brought Down Downey

by Calculated Risk on 6/17/2009 08:21:00 PM

Note: Downey Savings & Loan was seized by regulators on Nov 21, 2008, at an estimated cost to the Deposit Insurance Fund (DIF) of $1.4 billion.

From E. Scott Reckard at the LA Times Money & Co blog: Report: Lax oversight allowed Downey Savings' loan binge

Federal regulators responded inadequately from 2005 on as billions of dollars in high-risk mortgages piled up at weakly managed Downey Savings and Loan, the U.S. Treasury Department inspector general said in a report on last year’s failure of the Newport Beach thrift.Here is a Downey ad from the loose lending period (not in report):

The Office of Thrift Supervision ... began warning Downey management in 2002 about its heavy issuance of pay-option adjustable-rate mortgages but failed to rein in the practice, the report said.

...

Yet despite the warnings, "OTS examiners did not require Downey to limit concentrations in higher-risk loan products," said the 71-page inspector general report, posted Tuesday on the Treasury Department’s website.

Not sure of the exact date of this advertisement, but thanks for the memories! (hat tip Elroy).

From the report:

The primary causes of Downey’s failure were the thrift’s high concentrations in single-family residential loans which included concentrations in option adjustable rate mortgage (ARM) loans, reduced documentation loans, subprime loans, and loans with layered risk; inadequate risk-monitoring systems; the thrift’s unresponsiveness to OTS recommendations; and high turnover in the thrift’s management. These conditions were exacerbated by the drop in real estate values in Downey’s markets.And oversight from the OTS was insufficient:

OTS examiners did not require Downey to limit concentrations in higher-risk loan products. We believe that in light of the OTS’s repeated expressions of concern and management’s unresponsiveness to those concerns, OTS should have been more forceful, at least by 2005, to limit such concentrations. In interviews, OTS examiners commented that this would have been difficult since there was no history of losses in Downey’s option ARM, low documentation, and layered-risk loans from 2002 to 2006. However, both ND Bulletin 02-17 and the successor ND Bulletin 06-14 provide that examiners can direct thrifts to discontinue activities that lead to a specific high-risk concentration when proper oversight and controls are not in place. We believe that if there is one lesson to be learned from Downey’s failure it is that a lack of losses in the short term should not negate the need to address risk exposure such as high concentrations.

This graph from the Inspector General's report (with color added) shows the shift over time to reduced documentation loans. This add risk to already risky products and should have been a huge red flag.

This graph from the Inspector General's report (with color added) shows the shift over time to reduced documentation loans. This add risk to already risky products and should have been a huge red flag."Reduced documentation" is code word for borrower underwritten, as opposed to lender unwritten loans. Not surprisingly, reduced documentation loans perform worse than full documentation loans.

At the same time Downey was shifting to more and more reduced doc loans, they were also increasing the percentage of Option ARMs.

(See the ad above)

This was a toxic combination of risk layering.

BofE's Mervyn King : No Bank should be too big to fail

by Calculated Risk on 6/17/2009 06:01:00 PM

A couple of quotes from The Times: Mervyn King presses his case to limit size of banks

Mervyn King said he wanted a restriction on the size of banks, and that investment banks might have to be split from retail banks. ... he said banks should not be allowed to grow so large that they were deemed too big to fail.That last sentence shows King's frustration - after the crisis is over, it will be business as usual, unless the regulatory reforms have teeth.

...

“It is not sensible to allow large banks to combine high street retail banking with risky investment banking or funding strategies, and then provide an implicit state guarantee against failure,” Mr King said.

The State could limit providing a guarantee for depositors to high street banks that offered straight-forward services. Alternatively, riskier banks should have to hold much more capital. Finally, banks may have to provide their own plan for how they could be wound down in the event of failure. “Making a will should be as much a part of good housekeeping for banks as it is for the rest of us,” Mr King said.

... he was not sure how the Bank [BofE] would use its enhanced authority because its new tools were limited to issuing warnings that were likely to be ignored. “The Bank finds itself in a position rather like that of a church whose congregation attends weddings and burials but ignores the sermons in between,” he said.

Even then it is just a matter of time - and lobbying. The banks are notorious for having no institutional memory.

Nine Banks Repay $66.3 Billion in TARP Funds

by Calculated Risk on 6/17/2009 04:05:00 PM

UPDATE: State Street repaid $2 billion according to Bloomberg, so the total is $68.3 billion.

From DOW JONES: Financial Firms Repay $66.3B In TARP Funds

Ten banks were given $68.3 billion last fall and received approval last week to repay the funds. So far, just State Street Corp. (STT) - which ranked 9th in terms of the amount it received at $2 billion - has yet to announce its repayment.It is a little confusing because Northern Trust (NTRS) wasn't one of the 19 stress test banks.

JPMorgan, U.S. Bancorp (USB), American Express Co. (AXP), Bank of New York Mellon Corp. (BK), BB&T Corp. (BBT) and Northern Trust Corp. (NTRS) also announced plans to buy back the related warrants associated with TARP. Goldman, Morgan Stanley and Capital One Financial Corp. (COF) didn't address the warrants.

| Name | TARP Amount | Repay |

|---|---|---|

| Bank of America | $52.5 billion | No way! |

| Citigroup | $50 billion | No way! |

| JPMorgan Chase | $25 billion | Repaid |

| Wells Fargo | $25 billion | - |

| GMAC | $12.5 billion | No way! |

| Goldman Sachs | $10 billion | Repaid |

| Morgan Stanley | $10 billion | Repaid |

| PNC Financial Services | $7.6 billion | - |

| U.S. Bancorp | $6.6 billion | Repaid |

| SunTrust | $4.9 billion | - |

| Capital One Financial Corp. | $3.6 billion | Repaid |

| Regions Financial Corp. | $3.5 billion | - |

| Fifth Third Bancorp | $3.4 billion | - |

| American Express | $3.4 billion | Repaid |

| BB&T | $3.1 billion | Repaid |

| Bank of New York Mellon | $3 billion | Repaid |

| KeyCorp | $2.5 billion | - |

| State Street | $2 billion | Repaid |

| MetLife | None | - |

DataQuick: SoCal Home Sales Increase

by Calculated Risk on 6/17/2009 02:10:00 PM

From DataQuick: Southland median sale price inches up for first time since ‘07

Southern California home sales rose for the 11th consecutive month in May as sales of $500,000-plus homes started to come back. The median price paid increased slightly from the prior month for the first time since July 2007, the result of a shift in market activity where sales of deeply discounted foreclosures waned and mid- to high-end purchases rose, a real estate information service reported.Yesterday I noted that Cramer was fooled by the rise in median prices (as reported by NAR). DataQuick makes this clear that the increase was because of a slight change in mix. Prices are still falling.

emphasis added

A total of 20,775 new and resale houses and condos closed escrow in San Diego, Orange, Los Angeles, Ventura, Riverside and San Bernardino counties last month. That was up 1.3 percent from 20,514 in April and up 22.8 percent from 16,917 a year ago, according to San Diego-based MDA DataQuick.

Sales have increased year-over-year for 11 consecutive months.

May’s sales were the highest for that month since May 2006, when 30,303 homes sold, but were 21.2 percent below the average May sales total since 1988, when DataQuick’s statistics begin.

Foreclosure resales – homes sold in May that had been foreclosed on in the prior 12 months – accounted for 50.2 percent of all Southland resales. That was down from 53.5 percent in April and from a peak of 56.7 percent in February. May’s figure was the lowest since foreclosure resales were 50.9 percent of all resales last October.

The remarkably sharp declines in the Southland’s median sale price over the past year have been exacerbated by a shift toward an above-average number of sales occurring in lower-cost inland markets rife with discounted foreclosures. However, the number of homes lost to foreclosure declined over the winter, leaving fewer for bargain hunters to scoop up this spring. Meantime, sales have begun to rise a bit in many mid- to high-end markets, which could be due at least in part to sellers dropping their asking prices.

Last month 83 percent of the existing Southland houses sold were purchased for less than $500,000, compared with 84.8 percent in April. Conversely, sales $500,000 and above rose from 15.2 percent of sales in April to 17 percent in May. The last time the $500,000-plus market made up more than 17 percent of all sales was last October, when they were 19.9 percent of sales.

...

“We appear to be in the early stages of the market gradually tilting back toward a more normal balance of sales across the home price spectrum. As more sellers get realistic, more buyers get off the fence and more lenders offer reasonable terms for high-end purchase financing, we’ll see a more normal share of sales in the more established, higher-cost areas that have been nearly comatose,” said John Walsh, MDA DataQuick president.

...

Absentee buyers, including investors who will have their property tax bills sent to a different address, bought 19.4 percent of the Southland homes sold last month. That’s up from 16.9 percent a year ago and 18.6 percent in April. The monthly average since 2000: 15 percent.

...

Foreclosure activity remains near record levels ...

The Obama Regulatory Reform Plan

by Calculated Risk on 6/17/2009 12:55:00 PM

From the Treasury: President Obama to Announce Comprehensive Plan for Regulatory Reform

President Obama will lay out a comprehensive regulatory reform plan this afternoon to modernize and protect the integrity of our financial system. ... The President will be joined by Treasury Secretary Tim Geithner, representatives from the regulatory community, consumer groups, the financial industry and members of Congress for an event in the East Room later this afternoon.And a little reading material ...

White Paper: Requiring Strong Supervision And Appropriate Regulation Of All Financial Firms

Strengthening Consumer Protection

Providing The Government With Tools To Effectively Manage Failing Institutions

Improving International Regulatory Standards And Cooperation

A few excerpts:

We propose the creation of a Financial Services Oversight Council to facilitate information sharing and coordination, identify emerging risks, advise the Federal Reserve on the identification of firms whose failure could pose a threat to financial stability due to their combination of size, leverage, and interconnectedness (hereafter referred to as a Tier 1 FHC), and provide a forum for resolving jurisdictional disputes between regulators.CR: No off balance sheet nonsense and they propose to regulate the shadow banking system.

...

Any financial firm whose combination of size, leverage, and interconnectedness could pose a threat to financial stability if it failed (Tier 1 FHC) should be subject to robust consolidated supervision and regulation, regardless of whether the firm owns an insured depository institution.

...

Capital and management requirements for FHC status should not be limited to the subsidiary depository institution. All FHCs should be required to meet the capital and management requirements on a consolidated basis as well.

emphasis added

On derivatives:

All OTC derivatives markets, including CDS markets, should be subject to comprehensive regulation that addresses relevant public policy objectives: (1) preventing activities in those markets from posing risk to the financial system; (2) promoting the efficiency and transparency of those markets; (3) preventing market manipulation, fraud, and other market abuses; and (4) ensuring that OTC derivatives are not marketed inappropriately to unsophisticated parties.

UCLA Forecast: Weakest Recovery of Post War Era

by Calculated Risk on 6/17/2009 11:58:00 AM

Here is a fairly positive outlook. I think they are overly optimistic on house prices (forecasting an increase of 0.9% nationwide in 2010). Note: the Anderson forecast has a pretty good track record, but they missed the current recession (a major miss!)

From Reuters: U.S. poised for weak recovery : UCLA forecast

"The free-fall stage of the recession appears to be over and in fact we anticipate that the economy will record positive, albeit minimal, growth as early as the third quarter," ... We are forecasting the weakest economic recovery of the post-war era with real growth on the order of 2 percent to 3 percent," the report said.More from Jeff Collins at the O.C. Register:

"Simply put, we believe that the economy will be weighed down by newly chastened consumers attempting to increase their saving rate and a wrenching structural adjustment in the financial services, automotive and retail industries,"

The lion’s share of the housing decline is behind us, the UCLA Anderson Forecast reports today.

U.S. home prices have fallen 31% from the peak and are still falling. But home prices should start rising again by late 2009 or early 2010, the forecast said.

In addition:

•New home prices will increase 0.9% nationwide in 2010 and 2.9% in 2011, according to the forecast. The 2011 price still is forecast to be 13% below the peak, however.

[CR: This seems too optimistic. I think prices will fall through 2010 nationally, and for a longer period in some higher priced bubble areas]

•The forecast warns: “Because house price bear markets tend to have ‘long tails,’ do not expect any swift rise in prices over the next several years. Indeed, there are still more ’shoes to drop’ as a new round of Alt-A mortgage resets hits the market in 2010-11 and foreclosures rise on prime mortgages weighed down by high unemployment.”

•The supply of homes listed for sale has gone down faster in Orange County than in the nation as a whole, said Jerry Nickelsburg, co-author of the Anderson Forecast.

•“People are on the sidelines, and they’ll come back into the market when they see the benefit of waiting is no longer there,” Nickelsburg said.

•In Orange County, that’ll start to happen later this year, he said.

•New home construction bottomed out in California in the first quarter of this year, and in the second quarter nationwide, the forecast said.

[CR: This could be correct. I've been expecting new home construction to bottom sometime this year.]

•Developers now are under-building, and the market is primed for growth since homebuilding is failing to keep up with population growth.

•Nickelsburg said that while there is pent-up demand for new homes, potential buyers are on the sidelines — living with their parents, for example — and have yet to jump back into the market.

Owners' Equivalent Rent

by Calculated Risk on 6/17/2009 10:23:00 AM

Owners' equivalent rent (OER) is a major component of CPI (23.8% of CPI, see Cleveland Fed), and even though rents are falling in most areas, OER is still increasing (up 2.1% Year-over-year and up 1.8% annualized in May).

For a discussion from the BLS of rent measures see: How the CPI measures price change of Owners’ equivalent rent of primary residence (OER) and Rent of primary residence (Rent)

The expenditure weight in the CPI market basket for Owners’ equivalent rent of primary residence (OER) is based on the following question that the Consumer Expenditure Survey asks of consumers who own their primary residence:UPDATE: I misread the BLS document.“If someone were to rent your home today, how much do you think it would rent for monthly, unfurnished and without utilities?”

The survey question above is for weighting. The price relative for OER is calculated by sampling non rent-controlled renters every six months. These average rents are divided by the sample six months earlier - and converted to a monthly change (by taking to the 1/6th power).

From the BLS document above: "The first step is standardizing the collected (market) rents, putting them on a monthly basis, and adjusting them for a number of circumstances that should not affect the CPI."

I apologize for any confusion.

END UPDATE.

The following graph shows the year-over-year (YoY) in the REIT rents (from Goldman Sachs), Owners' equivalent rent of primary residence and Rent of primary residence (both from the BLS). The Apartment Tightness Index from the National Multi Housing Council is on the right Y-axis.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows that the Apartment Tightness Index leads REIT rents, and that the BLS measures of rent follow.

This suggests further declines in the YoY REIT rents, and future disinflation for the BLS measures of rent.