by Calculated Risk on 6/21/2009 12:28:00 PM

Sunday, June 21, 2009

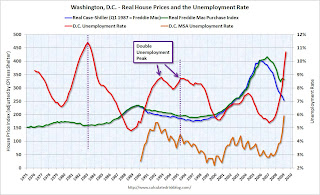

House Prices and the Unemployment Rate, Washington D.C.

Yesterday I posted a comparison of house prices and the unemployment rate on a national (U.S.) basis.

I'm working on a series of graphs for individual cities. Each graph takes some work and a few assumptions (I will outline the assumptions for each city).

Notes: House prices are from Case-Shiller (back to 1987) and Freddie Mac's Purchase index (back to 1975). The Case-Shiller index was set equal to the Freddie Mac index in Q1 1987, and then both indexes adjusted by CPI less shelter for North Urban cities.

The red unemployment rate is for Wash, D.C. (as statewide) and only goes back to 1976. Update: the orange is for D.C. MSA  Click on image for larger graph in new window.

Click on image for larger graph in new window.

Washington D.C. participated in the late '80s housing bubble, and only somewhat in the late '70s bubble. The dashed purple lines line up the peak unemployment rate - following the housing bubbles - with house prices.

Note the scale of unemployment rate doesn't start at zero (to better compare to house prices).

It appears real house prices declined until the unemployment rate peaked, and then remained stagnant for a few years. Following the late 1980s housing bubble (with a double unemployment peak in D.C.), house prices declined for a few years after the unemployment rate peaked for a 2nd time.

Although there are periods when there is no relationship between the unemployment rate and house prices, this graph suggests that house prices will not bottom (in real terms) until the unemployment rate peaks (or later, especially since the current bubble dwarfs those previous housing bubbles).

More to come ...