by Calculated Risk on 5/26/2009 11:00:00 AM

Tuesday, May 26, 2009

House Prices: Real Prices, Price-to-Rent, and Price-to-Income

Note earlier house price posts: Case-Shiller: Prices Fall Sharply in March and Case-Shiller: House Prices Tracking More Adverse Scenario

Here are three key measures of house prices: Price-to-Rent, Price-to-Income and real prices based on the Case-Shiller quarterly national home price index.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through Q1 2009 using the Case-Shiller National Home Price Index: Click on image for larger graph in new window.

Click on image for larger graph in new window.

This graph shows the price to rent ratio (Q1 1997 = 1.0) for the Case-Shiller national Home Price Index. For rents, the national Owners' Equivalent Rent from the BLS is used.

Looking at the price-to-rent ratio based on the Case-Shiller index, the adjustment in the price-to-rent ratio is maybe 85% complete as of Q1 2009 on a national basis. This ratio will probably continue to decline.

It is important to note that it appears rents are now falling (this is not showing up in the OER measure yet) and rents will probably continue to decline. Goldman Sachs notes that declining rents for REITS typically lead declines in Owners' equivalent rent of primary residence (OER) - so OER will probably be falling later this year and in 2010.

And declining rents will impact the price-to-rent ratio.

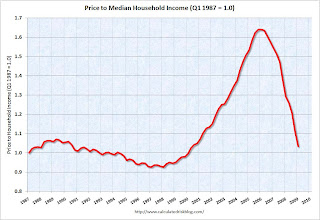

Price-to-Income:

The second graph shows the price-to-income ratio: This graph is based off the Case-Shiller national index, and the Census Bureau's median income Historical Income Tables - Households (and an estimate of 2% increase in household median income for 2008 and flat for 2009).

This graph is based off the Case-Shiller national index, and the Census Bureau's median income Historical Income Tables - Households (and an estimate of 2% increase in household median income for 2008 and flat for 2009).

Using national median income and house prices provides a gross overview of price-to-income (it would be better to do this analysis on a local area). However this does shows that the price-to-income is still too high, and that this ratio needs to fall another 10% or so. A further decline in this ratio could be a combination of falling house prices and/or rising nominal incomes.

In Q2 2008 this index was over 1.25. In Q4, the index was just over 1.1. Now the index is at 1.04. At this pace the index will hit 1.0 in mid-2009. However, during a recession, nominal household median incomes are usually stagnate - so it might take a little longer. And the index might overshoot too.

Real Prices This graph shows the real and nominal house prices based on the Case-Shiller national index. (Q1 2000 = 100 for nominal index)

This graph shows the real and nominal house prices based on the Case-Shiller national index. (Q1 2000 = 100 for nominal index)

Nominal prices are adjusted using CPI less Shelter.

The Case-Shiller real prices are still significantly above prices in the '90s and perhaps real prices will decline another 10% to 20%.

Summary

These measures are useful, but somewhat flawed. These measures give a general idea about house prices, but there are other important factors like inventory levels and credit issues. All of this data is on a national basis and it would be better to use local area price-to-rent, price-to-income and real prices.

One thing is pretty certain - as long as inventory levels are elevated, prices will continue to decline. And right now inventory levels of existing homes (especially distressed properties) are still very high.