by Calculated Risk on 5/20/2009 08:15:00 PM

Wednesday, May 20, 2009

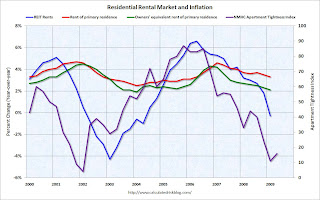

Residential Rental Market and Inflation

Goldman Sachs tracks the rents at a large number of apartment REITs - and rents are now falling (excerpted from research report with permission):

REITs tend to adjust more rapidly to changing market conditions than the typical landlord, so changes in their behavior are useful signals of turns in the market ... Public REITs typically report the rent increases they have achieved on a year-over-year, comparable-unit basis with each quarterly filing. ... [the tracked] REITS managed 300,000 units that were comparable to the year-before period in the first quarter of 2009 ... In the first quarter of 2009, the major REITs collectively reported an outright decline in rents for the first time since 2004.Goldman notes that declining rents for REITS typically lead declines in the CPI measures of rent: Owners' equivalent rent of primary residence (OER) and Rent of primary residence.

The following graph shows the year-over-year (YoY) in the REIT rents (from Goldman), Owners' equivalent rent of primary residence and Rent of primary residence (both from the BLS). The Apartment Tightness Index from the National Multi Housing Council is on the right Y-axis.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows that the Apartment Tightness Index leads REIT rents, and that the BLS measures of rent follow.

This suggests further declines in the YoY REIT rents, and future disinflation for the BLS measures of rent.

This is important for house prices too. With falling rents, house prices need to fall further to bring the house price-to-rent ratio back to historical levels.