by Calculated Risk on 6/17/2009 07:47:00 AM

Wednesday, June 17, 2009

MBA: Mortgage Applications Decrease

The MBA reports:

The Market Composite Index, a measure of mortgage loan application volume, was 514.4, a decrease of 15.8 percent on a seasonally adjusted basis from 611.0 one week earlier.The Purchase Index is now at the level of the late '90s.

...

The Refinance Index decreased 23.3 percent to 1998.1 from 2605.7 the previous week and the seasonally adjusted Purchase Index decreased 3.5 percent to 261.2 from 270.7 one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.50 percent from 5.57 percent ...

With the 10 year yield moving down (3.67% yesterday from 3.99% a week ago), 30-year fixed mortgage rates decreased slightly this week. But mortgage rates are still significantly higher than three weeks ago (4.81%), and that increase in mortgage rates has led to significantly fewer refinance applications.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

Although we can't compare directly to earlier periods because of the changes in the index, this shows no pick up in overall sales activity.

Tuesday, June 16, 2009

Obama Administration Releases Details of Proposed Financial Regulatory Overhaul

by Calculated Risk on 6/16/2009 09:52:00 PM

The WaPo has the document: Near-Final Draft of Document on Regulatory Overhaul (pdf)

From the WaPo: Financial Regulatory Overhaul Is Detailed

The plan is an attempt to overhaul an outdated system of financial regulations, according to senior administration officials.From MarketWatch: Fed may become systemic regulator, hike capital requirements

It would vastly increase the powers of the Federal Reserve ... It also would create a new agency to protect consumers of mortgages, credit cards and other financial products.

President Obama is expected to formally unveil the proposal [Wednesday]. The administration also plans to release an 85-page white paper detailing the plans and justifying each element as a direct response to the causes of the financial crisis.

...

The proposed Consumer Financial Protection Agency would have broad authority to regulate the relationship between financial companies and consumers of mortgage loans, credit cards, checking accounts and other financial products. It would define standards, police compliance and penalize delinquent firms. Other agencies, particularly the Federal Reserve, would surrender some powers.

The proposal will also call for the elimination of the Office of Thrift Supervision and the Federal Thrift Charter, subsuming the agency into a new "National Bank Supervisor," agency based on the Office of Comptroller of the Currency that will supervise all federally chartered depository institutions.

The Accidental Slumlord

by Calculated Risk on 6/16/2009 09:25:00 PM

I've been joking about "accidental landlords" for a couple of years, and how these properties are just more shadow housing inventory.

Daniel McGinn takes it a step further, and describes his own misadventures in Newsweek How I became an Accidental Slumlord (ht Tim waiting for 2012)

... As America copes with a painful hangover from a decade-long real-estate orgy, I'm dealing with a headache of my own. Four years ago, at the height of the boom, I visited Pocatello to write a story for NEWSWEEK about how out-of-state investors had begun buying cheap rental properties there, drawn by ultralow sales prices and a solid rental market. ... A year later, while writing a book about the housing boom, I decided to dive in myself. In late 2006, after seeing only e-mailed photos, an appraisal and an inspection report, I paid $62,750 for a two-unit rental property in Pocatello, which is 2,450 miles from my Massachusetts home. I didn't expect to get rich; my main motivation was to have a good story for the book. By that measure, the deal was a success; when House Lust came out in 2008, the chapter in which I described my early misadventures as a property magnate (an early tenant went to jail; my first property manager made off with $1,300) helped fuel reviews and interviews. But now, long after the buzz over the book has died down, I'm stuck with a house in Idaho—and friends who call me a long-distance slumlord.This is more nightmare than investment. But it could have been worse. I'll never understand why people invest in properties sight unseen.

...

Thanks to an energetic local property manager, my two apartments have never been vacant. Many months the combined rent of $690 covers the $503 mortgage payment and other expenses. Still, I'm frequently hit with repair bills (a broken stove, a leaking underground water line) that send me into the red. And even after the tax write-offs, my costs have exceeded the rental income by more than $2,500 since I purchased it.

...

My reaction to seeing my property and my tenants for the first time is common among out-of-state landlords who've visited their property. "When somebody is paying $300 a month in rent, in general they aren't the Rothschilds," says a 47-year-old Los Angeles schoolteacher who visited his own Pocatello duplex for the first time in December. "You're getting somebody who that's all they can afford." Although he'd seen photos of his property before he purchased it, this investor—who declined to be named because he's embarrassed to have made such a "boneheaded" investment—was surprised by its poor condition, citing holes in the walls, an awkward layout and general dinginess.

Cramer Gets Confused on Housing

by Calculated Risk on 6/16/2009 07:04:00 PM

NOTE: I'm not just picking on Cramer. I'm trying to emphasize two key points: 1) there will be two bottoms for housing, and 2) the median price is useless with a changing mix.

I've cautioned that people would make the following analysis errors ...

From CNBC: Cramer: Housing Has Officially Bottomed

Residential real estate has finally found a floor, Cramer told viewers on Tuesday.First, for almost every housing bust there have been two distinct bottoms: the first for activity (like housing starts) and the second for prices. Maybe this time is different, but I think Cramer is confusing activity for price.

...

How can Cramer be so sure? New housing data reported today showed a dramatic change for the better, especially in some of the hardest-hit areas in the US. That news, along with much lower prices and the working off of inventory, validate his prediction, made last August, that housing would stabilize this month, ending its multiyear declines.

...

What does a bottom look like? It’s the combination of ramping sales, and sales in certain areas are up ten times those of last year, and an end to falling prices. That’s exactly what we’ve seen for the past three months, Cramer said.

For more on the two bottoms, see: More on Housing Bottoms

On price, Cramer is probably looking at the median sales price from the National Association of Realtors. This shows that the median price has flattened over the last four months. But the median price has been heavily distorted by foreclosure sales in low end areas. A much better measure of price is the Case-Shiller index, and that shows prices fell at a 25% annual rate in Q1 nationally on a seasonally adjusted basis.

It was predictable that some people would confuse activity with price (remember there will probably be two bottoms). And it was predictable that some people would get confused when the median price started to flatten out (as the mix slowly changed) even though prices are still falling.

Jim the Realtor: Tour of Shadow Inventory

by Calculated Risk on 6/16/2009 04:54:00 PM

Jim takes us on a tour of a few REOs not yet on the market in the north San Diego County Coastal region. Jim says he couldn't find many foreclosed properties that aren't listed.

Some of these homeowners really dipped into the home ATM. Amazing. The home on 3 acres in Rancho Santa Fe isn't much, but that is a very nice area (and that is why the price is so high).

Stock Market Update

by Calculated Risk on 6/16/2009 04:00:00 PM

By popular demand ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

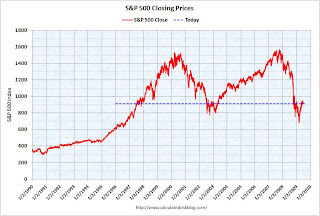

The first graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

The S&P 500 is up almost 35% from the bottom (235 points), and still off almost 42% from the peak (653 points below the max). The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Tiered House Prices

by Calculated Risk on 6/16/2009 03:18:00 PM

In the previous post, I disagreed a little with the JPMorgan analysts - I noted:

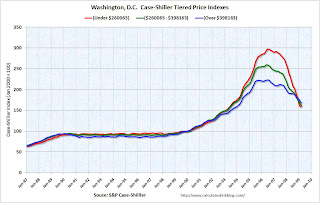

Prices increased more in percentage terms in the low priced areas of California (like the Inland Empire and Sacramento) than in the high priced coastal areas. So prices will probably fall further in percentage terms from the peak in the low priced areas.Case-Shiller has some tiered house price indices for a number of cities, and most of the bubble cities show this pattern (more appreciation in the low priced areas).

| Click on graph for larger image in new window. Here are a few select cities. The first is Washington, D.C. Note the price range of the tiers changes by city. |

The second graph is for Miami. |  |

| The third graph is for San Francisco. Most other bubble areas show a similar pattern of larger percentage price increases for the lower tier. |

JPMorgan Analysts Predict 60% House Price Decline for High End

by Calculated Risk on 6/16/2009 01:30:00 PM

From Bloomberg: ‘Millionaire Homes’ May Lose Value Until 2012 (ht James)

... “Tighter lending standards and the lack of cheap financing for these borrowers continue to be key issues,” the New York- based [JPMorgan Chase & Co. analysts] wrote [in a June 12 report], referring to “jumbo” mortgages. That’s after so-called interest-only and option adjustable-rate loans were a “major driver” of soaring values, they said.Most of the low end sales are "one and done" (the seller is a bank), and this will lead to a dearth of move up buyers. This lack of move up buyers, and tight financing will impact demand for the mid-to-high end. Although the percentage of foreclosures will be less in the high end areas than the low priced areas, the foreclosures are still coming (see Alt-A Foreclosures in Sonoma and Foreclosure Resales: Slow in High Priced Areas )

...

“Currently, we have national home prices bottoming in 2011,” they said. “However, prices for more expensive homes may not bottom out until 2012, and ultimately result in peak-to- trough declines in excess of 60 percent (compared to 40 percent nationally).”

“California is probably worse than other states, but higher-priced homes in general are going to be a problem,” Sim said in a telephone interview today.

However I disagree with the JPMorgan analysts on the relative price declines. Prices increased more in percentage terms in the low priced areas of California (like the Inland Empire and Sacramento) than in the high priced coastal areas. So prices will probably fall further in percentage terms from the peak in the low priced areas.

Also, I think the price declines will occur over a longer period in the high priced areas (like the JPMorgan analysts), so the nominal price declines will be less (assuming a little inflation). But those are minor details - I agree there are further substantial price declines ahead.

$13.9 Trillion Total Maximum Government Support Announced

by Calculated Risk on 6/16/2009 12:14:00 PM

The FDIC released the Summer 2009 Supervisory Insights today. The report includes the following table showing all the government support announced in 2008 and soon thereafter. The maximum capacity is $13.9 trillion.

I thought people would like to see the details (not all will be used).

Government Support for Financial Assets and Liabilities Announced in 2008 and Soon Thereafter ($ in billions) | |||

|---|---|---|---|

| Important note: Amounts are gross loans, asset and liability guarantees and asset purchases, do not represent net cost to taxpayers, do not reflect contributions of private capital expected to accompany some programs, and are announced maximum program limits so that actual support may fall well short of these levels | |||

| Year-end 2007 | Year-end 2008 | Subsequent or Announced Capacity If Different | |

| Treasury Programs | |||

| TARP investments1 | $0 | $300 | $700 |

| Funding GSE conservatorships2 | $0 | $200 | $400 |

| Guarantee money funds3 | $0 | $3,200 | |

| Federal Reserve Programs | |||

| Term Auction Facility (TAF)4 | $40 | $450 | $900 |

| Primary Credit5 | $6 | $94 | |

| Commercial Paper Funding Facility (CPFF)6 | $0 | $334 | $1,800 |

| Primary Dealer Credit Facility (PDCF)5 | $0 | $37 | |

| Single Tranche Repurchase Agreements7 | $0 | $80 | |

| Agency direct obligation purchase program8 | $0 | $15 | $200 |

| Agency MBS program8 | $0 | $0 | $1,250 |

| Asset-backed Commercial Paper Money Market Mutual Fund Liquidity Facility (AMLF)9 | $0 | $24 | |

| Maiden Lane LLC (Bear Stearns)9 | $0 | $27 | |

| AIG (direct credit)10 | $0 | $39 | $60 |

| Maiden Lane II (AIG)5 | $0 | $20 | |

| Maiden Lane III (AIG)5 | $0 | $27 | |

| Reciprocal currency swaps11 | $14 | $554 | |

| Term securities lending facility (TSLF) and TSLF options program(TOP)12 | $0 | $173 | $250 |

| Term Asset-Backed Securities Loan Facility (TALF)13 | $0 | $0 | $1,000 |

| Money Market Investor Funding Facility (MMIFF)14 | $0 | $0 | $600 |

| Treasury Purchase Program (TPP)15 | $0 | $0 | $300 |

| FDIC Programs | |||

| Insured non-interest bearing transactions accounts16 | $0 | $684 | |

| Temporary Liquidity Guarantee Program (TLGP)17 | $0 | $224 | $940 |

| Joint Programs | |||

| Citi asset guarantee18 | $0 | $306 | |

| Bank of America asset guarantee19 | $0 | $0 | $118 |

| Public-Private Investment Program (PPIP)20 | $0 | $0 | $500 |

| Estimated Reductions to Correct for Double Counting | |||

| TARP allocation to Citi and Bank of America asset guarantee21 | – $13 | ||

| TARP allocation to TALF21 | – $80 | ||

| TARP allocation to PPIP21 | – $75 | ||

| Total Gross Support Extended During 2008 | $6,788 | ||

| Maximum capacity of support programs announced through first quarter 200922 | $13,903 | ||

Table notes:

1 $300 is as of 1-23-2009 as reported in SIGTARP report of February 6 2009; EESA authorized $700.

2 Year-end reflects Treasury announcement of September 7, 2009, capacity reflects Treasury announcement of February 18, 2009; funding authorized under Housing and Economic Recovery Act.

3 Informal estimate of amount guaranteed at year-end 2008, provided by Treasury staff.

4 Year-end balances from Federal Reserve Statistical Release H.R. 1, “Factors Affecting Reserve Balances” (henceforth, H.R. 1); capacity from “Domestic Open Market Operations During 2008” (Report to the Federal Open Market Committee, January 2009), page 24.

5 Year-end balances from H.R. 1.

6 Year-end balances from H.R. 1; capacity from “Report Pursuant to Section 129 of the Emergency Economic Stabilization Act of 2008: Commercial Paper Funding Facility,” accessed May 26, 2009, from http://www.newyorkfed.org/aboutthefed/annual/annual08/CPFFfinstmt2009.pdf.

7 Year-end balances from H.R. 1; see also “Domestic Open Market Operations During 2008” (henceforth “DOMO report”) report to the Federal Open Market Committee, January 2009, page 11, summary of activity in program announced March 7 by the Federal Reserve.

8 Year-end balances from H.R. 1, capacity from Federal Reserve announcements of November 25, 2008 and March 18, 2009.

9 H.R. 1.

10 Year-end balances from H.R. 1; capacity from periodic report pursuant to EESA, “Update on Outstanding Lending Facilities Authorized by the Board Under Section 13(3) of the Federal Reserve Act,” February 25, 2009, page 8, henceforth referred to as “Update;” Federal Reserve AIG support is separate from Treasury support that is included in the TARP line item.

11 Year-end balances reported in DOMO report, page 25.

12 Year-end balances from H.R. 1; capacity from Federal Reserve announcement of March 11, 2008, Federal Reserve Bank of New York press release of August 8, 2008, and discussion at page 22 of DOMO report.

13 From “Update,” page 2.

14 From “Report Pursuant to Section 129 of the Emergency Economic Stabilization Act of 2008: Money Market Investor Funding Facility,” accessed May 26, 2009, from http://www.federalreserve.gov/monetarypolicy/files/129mmiff.pdf; Federal Reserve to fund 90 percent of financing or $540 billion.

15 Program and capacity announced by the Federal Reserve, March 18, 2009.

16 FDIC Quarterly Banking Profile, Fourth Quarter 2008, (henceforth, “QBP”) Table III-C.

17 Year-end outstanding from QBP, Table IV-C; total estimated cap for all entities opting in the program from QBP, Table II-C.

18 Announcement by FDIC, Treasury, and Federal Reserve November 23, 2008.

19 Announcement by FDIC, Treasury, and Federal Reserve of January 16, 2009.

20 To purchase legacy assets, as described in Treasury, FDIC, and Federal Reserve announcement of March 23, 2009. $500 refers to maximum capacity of Legacy Loans Program; funding for the Legacy Securities Program is believed to be subsumed under the TALF.

21 SIGTARP quarterly report of April, 2009, page 38.

22 Year-end 2008 amounts plus the amount by which announced capacity exceeds the year-end 2008 amount, minus the amount of known double counting.

U.S. Rejects California Aid Request

by Calculated Risk on 6/16/2009 10:15:00 AM

From the WaPo: Calif. Aid Request Spurned By U.S

The Obama administration has turned back pleas for emergency aid from one of the biggest remaining threats to the economy -- the state of California.Hey, hoocoodanode?

Top state officials have gone hat in hand to the administration, armed with dire warnings of a fast-approaching "fiscal meltdown" caused by a budget shortfall. Concern has grown inside the White House in recent weeks as California's fiscal condition has worsened, leading to high-level administration meetings. But federal officials are worried that a bailout of California would set off a cascade of demands from other states.

...

The administration is worried that California will enact massive cuts to close its deficit, estimated at $24 billion for the fiscal year that begins July 1, aggravating the state's recession and further dragging down the national economy.

After a series of meetings, Treasury Secretary Timothy F. Geithner, top White House economists Lawrence Summers and Christina Romer, and other senior officials have decided that California could hold on a little longer and should get its budget in order rather than rely on a federal bailout.

...

The state entered the downturn burdened with an inflexible budgeting apparatus, constrained by a state ballot initiative approved by voters in 1978 that severely limited property taxes in California. The signature example of "ballot box budgeting" left the Golden State inordinately reliant on the personal income tax, which accounts for half of revenue to Sacramento.

California's budget is also heavily dependent on taxes paid on capital gains and stock options, which have been clobbered during the meltdown of financial markets. State budget analysts made their annual estimate of revenue a month before the crisis spiked in the fall and have been backpedaling ever since.

"Those revenue projections turned out to be wildly optimistic, but nobody was predicting the October collapse of the financial markets," said Michael Cohen, deputy analyst in the Legislative Analyst's Office.

California enjoyed the housing bubble, but is now being hit hard by the housing bust with house prices falling sharply and double digit unemployment. And it doesn't help that the state system of government is completely dysfunctional.

Industrial Production Declines, Capacity Utilization at Record Low

by Calculated Risk on 6/16/2009 09:15:00 AM

The Federal Reserve reported:

Industrial production decreased 1.1 percent in May after having fallen a downward-revised 0.7 percent in April. The average decrease in industrial production during the first three months of the year was 1.6 percent. Manufacturing output moved down 1.0 percent in May with broad-based declines across industries. Outside of manufacturing, the output of mines dropped 2.1 percent, and the output of utilities fell 1.4 percent. At 95.8 percent of its 2002 average, overall industrial output in May was 13.4 percent below its year-earlier level. The rate of capacity utilization for total industry declined further in May to 68.3 percent, a level 12.6 percentage points below its average for 1972-2008. Prior to the current recession, the low over the history of this series, which begins in 1967, was 70.9 percent in December 1982.emphasis added

Click on graph for larger image in new window.

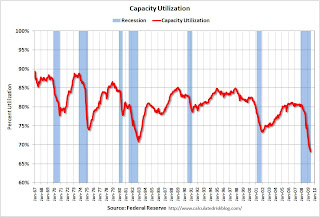

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series is at another record low (the series starts in 1967).

In addition to the weakness in industrial production, there is little reason for investment in new production facilities until capacity utilization recovers.

Housing Starts May

by Calculated Risk on 6/16/2009 08:30:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

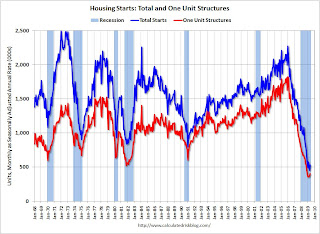

Total housing starts were at 532 thousand (SAAR) in May, rebounding from the all time record low in April of 454 thousand. The previous record low was 488 thousand in January (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 401 thousand (SAAR) in May; above the record low in January and February (357 thousand) and above 400 thousand for the first time since last November.

Permits for single-family units were 408 thousand in May, suggesting single-family starts will remain at about the same level in June.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Building Permits:

Privately-owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 518,000. This is 4.0 percent (±1.7%) above the revised April rate of 498,000, but is 47.0 percent (±2.1%) below the May 2008estimate of 978,000.

Single-family authorizations in May were at a rate of 408,000; this is 7.9 percent (±1.5%) above the revised April figure of 378,000.

Housing Starts:

Privately-owned housing starts in May were at a seasonally adjusted annual rate of 532,000. This is 17.2 percent (±14.4%) above the revised April estimate of 454,000, but is 45.2 percent (±5.8%) below the May 2008 rate of 971,000.

Single-family housing starts in May were at a rate of 401,000; this is 7.5 percent (±14.2%)* above the revised April figure of 373,000.

Housing Completions:

Privately-owned housing completions in May were at a seasonally adjusted annual rate of 811,000. This is 3.3 percent (±20.6%)* below the revised April estimate of 839,000 and is 28.8 percent (±11.1%) below the May 2008 rate of 1,139,000.

Single-family housing completions in May were at a rate of 491,000; this is 9.4 percent (±13.8%)* below the revised April figure of 542,000.

Note that single-family completions of 491 thousand are still significantly higher than single-family starts (401 thousand). This is important because residential construction employment tends to follow completions, and completions will probably decline further.

It is still too early to call the bottom for single family starts in January, however I do expect single family housing starts to bottom sometime in 2009.

Monday, June 15, 2009

Credit Card Debt: "A line has been crossed"

by Calculated Risk on 6/15/2009 10:59:00 PM

From David Streitfeld at the NY Times: Credit Bailout: Issuers Slashing Card Balances

... Mr. McClelland’s credit card company was calling yet again, wondering when it could expect the next installment on his delinquent account. He proposed paying half of his $5,486 balance and calling the matter even.The story notes that these settlements still damage the borrowers credit. But this appears to be a significant shift.

It’s a deal, the account representative immediately said, not even bothering to check with a supervisor.

As they confront unprecedented numbers of troubled customers, credit card companies are increasingly doing something they have historically scorned: settling delinquent accounts for substantially less than the amount owed.

... many credit card issuers have revised internal guidelines to give front-line employees the power to cut deals with consumers. The workers do not even have to wait for customers to call and ask for a break.

...

An example of how quickly the card companies are shifting their approach is in the behavior of HSBC, a major issuer, toward Mr. McClelland.

He was paying fitfully on his card, which was canceled for delinquency. In April, HSBC offered him full settlement at 20 percent off. He declined. A few weeks later, it agreed to let him pay half.

...a line has been crossed, credit experts say.

“Even in the early stages of delinquency, settlements can be dramatic,” said Carmine Dorio, a longtime industry executive who ran collection departments for Citibank, Bank of America and Washington Mutual.

As an aside: My personal view is that in a financially literate world, almost all borrowers would pay off their credit card balances monthly (there are exceptions).

Federal Reserve Appears to be Big Loser in Extended Stay Bankruptcy

by Calculated Risk on 6/15/2009 09:29:00 PM

A few more details on the Extended Stay Bankruptcy (ht Brian):

And from the NY Times Dealbook (April 2008)

Under questioning from Robert Casey Jr., a Democratic Senator from Pennsylvania, Mr. Bernanke said Wednesday that the assets making up the Fed’s collateral were “entirely investment grade, entirely current and performing.” He said BlackRock, which the Fed has hired to manage the collateral, is “confident, or at least reasonably confident, that we would be able to recover the full amount.”

But, he was asked, what if BlackRock concludes that the collateral is worth far less than $30 billion? Can the Fed go back and ask for more?

Mr. Bernanke’s answer was brief: No, we cannot.

WSJ: Major Banks Try to Block MBIA Split

by Calculated Risk on 6/15/2009 07:48:00 PM

From the WSJ: Banks Challenge N.Y. Insurance Regulator Over MBIA Split

A group of large banks stepped up their fight against MBIA Inc.'s decision to split its businesses, filing a petition claiming the New York State Insurance Department had no right to approve the move.The New York State Insurance Department earlier approved MBIA's restructuring plan to split its municipal-bond insurance business from its mortgage-backed securities insurance business. Many banks and hedge funds bought MBIA insurance on their structured product portfolios, and they are concerned about the financial strength of the MBS insurance business (and whether they will be paid or suffer further losses).

The banks contend the move benefited some policyholders at the expense of others.

The 18 financial institutions, which include Barclays PLC., Bank of America Corp. and J.P. Morgan Chase & Co ...

Green Shoots Artwork

by Calculated Risk on 6/15/2009 06:38:00 PM

LA Area Port Traffic in May

by Calculated Risk on 6/15/2009 05:16:00 PM

Note: this is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Inbound traffic was 19.7% below May 2008.

Outbound traffic was 15.3% below May 2008.

There has been some recovery in exports over the last few months (the year-over-year comparison was off 30% from December through February). But this is the 3nd worst YoY comparison for imports - only February and April were worse. So imports from Asia appear especially weak.

This suggests a little more improvement in the trade balance with Asia in the May trade report. Of course the overall trade deficit will probably be worse because of rising oil prices.

Record Credit Card Default Rate

by Calculated Risk on 6/15/2009 03:52:00 PM

From CNBC: Credit Card Default Rate Hits Record High

U.S. credit card defaults rose to record highs in May, with a steep deterioration of Bank of America's lending portfolio ...For the stress tests, the indicative two year loss rate for the more adverse scenario was 18% to 20% for credit cards (around 9% per year). That test might have been too lenient.

Bank of America—the largest U.S. bank—said its default rate, those loans the company does not expect to be paid back, soared to 12.50 percent in May from 10.47 percent in April.

In addition, American Express ... said its default rate rose to 10.4 percent from 9.90 ...

Capital One said its credit card default rate rose to 9.41 percent from 8.56 percent, while Discover said its charge-off rate increased to 8.91 percent from 8.26 percent.

JPMorgan Chase ... said its default rate rose to 8.36 percent in May from 8.07 percent in April

NAHB: Builder Confidence Decreases Slightly in June

by Calculated Risk on 6/15/2009 01:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) decreased to 15 in June from 16 in May. The record low was 8 set in January.

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

Press release from the NAHB (added): Builder Caution Reflects Fragile Housing Market In June

Indicating that single-family home builders remain cautious and concerned about the fragile state of today’s economy and housing market, the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) declined one point to 15 in June.

...

“As expected, the housing market continues to bump along trying to find a bottom,” said NAHB Chief Economist David Crowe. “Meanwhile, builders are taking their cue from consumers, who remain uncertain about the economy and their own situation. Builders are also finding it difficult to complete a sale because customers cannot sell their existing homes.”

...

Two out of three of the HMI’s component indexes were unchanged in June, including the index gauging current home sales, which held at 14, and the index gauging traffic of prospective buyers, which held at 13. Meanwhile, the index gauging expectations for the next six months declined a single point, to 26.

Regionally, the decline was entirely focused in the South, which is the nation’s largest housing market. There, the HMI declined 3 points to 15, while the rest of the regions posted gains. The Northeast had a one-point gain to 20, the Midwest, a one-point gain to 15, and the West, a two-point gain to 14.

Fitch: U.S. CMBS Delinquencies Past 2%

by Calculated Risk on 6/15/2009 11:56:00 AM

Large loan defaults coupled with declining performance on multifamily and retail properties resulted in a 29 basis point (bp) climb to 2.07% for U.S. CMBS delinquencies in May, according to the latest Fitch Ratings Loan Delinquency Index. This marks the highest percentage of delinquencies since Fitch began its Index in 2001.Some CRE loans were based on overly optimistic proforma income (aka wishful thinking like stated income), and the loans included reserves to pay interest until rents increased (like a negatively amortizing option ARM). When the reserves run dry, and the proforma income is "unrealized", the borrower defaults.

"Defaults on larger loans continue to drive delinquency increases because later vintage transactions have larger loans, many underwritten with now unrealized proforma income, as well as now-depleted debt service reserves and high leverage," said Managing Director and U.S. CMBS group head Susan Merrick.

emphasis added

And by sector:

Declining performance, particularly in oversupplied markets, as well as in secondary and tertiary markets, has pushed the multifamily delinquency rate to 4.55%, the highest of all property types. Multifamily properties have been highly susceptible to default in CMBS during the current economic downturn.

The 60 days or more delinquency rate for retail properties is slightly higher than the index at 2.24%.

...

Loans backed by hotels have thus far withstood economic pressures and continue to slightly outperform the Index with a 1.91% delinquency rate.