by Calculated Risk on 6/09/2009 10:36:00 PM

Tuesday, June 09, 2009

CRE Mortgage Servicers Seek up to 5 Year Extensions

From Reuters: US commercial loan servicers seek longer extensions

U.S. commercial real estate mortgage servicers are seeking to extend maturing loans for up to five years in a bid to prevent borrowers from defaulting and giving up office, retail and apartment buildings at distressed levels, an industry executive said on Tuesday.Also on CMBS from Fitch: U.S. Super Senior CMBS Expected To Hold Onto 'AAA' Ratings

...

Modifying loans has consumed the $700 billion market for commercial mortgage securities this year.

...

The urgency has also risen since the fourth quarter of 2008 as special servicers have taken on hundreds of new loans due to default or a reduction in cash flow that may presage a default.

While rating actions across the capital structure of many recent vintage U.S. CMBS transactions will be substantial, mezzanine and super-senior 'AAA'-rated classes are expected to stay 'AAA' for the foreseeable future, according to Fitch Ratings as it continues its review of 2006-2008 fixed-rate conduit and fusion transactions.Unlike S&P, Fitch believes the "AAA" rated classes will not be downgraded - but a large percentage of the other classes will be cut. Note that S&P assumed current or market rents, and then decreased rents a further 6 to 30% depending upon property type. Fitch is only assuming an "Immediate and sustained income declines of 15%". We know from recent reports that incomes for hotels are already off more than 15%.

While rating actions on the most senior tranches are not anticipated, Fitch expects to downgrade approximately 75%-85% of subordinate 'AAA' (A-J) classes from these recent vintages as a result of its revised loss forecasts. Downgrades across all classes are expected to average two rating categories.

Fitch assumes the following factors in forecasting losses:

--Peak-to-trough value declines of 35%;

--Immediate and sustained income declines of 15%;

Supreme Court Lifts Stay on Chrysler Deal

by Calculated Risk on 6/09/2009 07:36:00 PM

From SCOTUS Blog: Court clears Chrysler sale

Ending four days of intense, round-the-clock and high-stakes legal maneuvering in the Supreme Court, the Justices on Tuesday evening removed a legal obstacle to sale of the troubled auto industry giant, Chrysler.More at link ...

Insisting that it was denying a postponement “in this case alone,” the two-page order said the challengers had not met their burden of showing that a delay was justified. The order allows a closing of the deal as of next Monday, because it lifts a temporary stay that Justice Ruth Bader Ginsburg had issued on Monday, apparently to give the Court time to ponder the issue.

The Court said nothing about the biggest issue lurking in the case: the legality of using federal “bailout” money to pay for the rescue of an auto manufacturer. In fact, the order stressed that “a denial of a stay is not a ddecision on the merits of the underlying legal issues.”

Chrysler Updates

by Calculated Risk on 6/09/2009 05:15:00 PM

From the AP: Judge OKs Chrysler plan to terminate franchises. The AP is reporting that U.S. Judge Arthur Gonzalez said Chrysler can terminate 789 dealers effective immediately.

From the SCOTUS Blog: Chrysler and the meaning of June 15

[I]t seemed clear that Ginsburg — and perhaps the full Court — were awaiting the new round of briefing on what a widely disputed June 15 “deadline” means.And from Steve Jakubowski at the Bankruptcy Litigation Blog: What's Bothering Ruthie? Chrysler Bankruptcy Sale Opinion Analysis - Part II

It is not clear how central this dispute is to the Justices’ ultimate view of the legal and financial situation, but there was no doubt of the vigor with which all sides were debating that question.

The Indiana funds, in a somewhat triumphant though brief filing, contended Tuesday that they had undermined the claims that Fiat would back out and the deal would collapse if it is not closed by next Monday. Its evidence was a brief wire story on Bloomberg News quoting a Fiat executive as saying it “would never walk away” from the pact.

By early afternoon, the three main defenders of the rescue plan joined the new battle, with Fiat saying that the benefit funds’ new thrust was “unwarranted.” The deal, by its own express terms, “will terminate automatically” if not closed “on or before June 15.” (emphasis in the original).

I'm guessing, though, that what bothers her most -- and frankly what's really been bothering me most (hence Part II) -- is the sale's treatment of tort claimants, both present and future, and Judge Gonzalez's cursory justification for such treatment.And other auto news from CNBC: US House Passes 'Cash for Clunkers' Plan

[T]he House approved a plan Tuesday to provide vouchers of up to $4,500 for consumers who turn in their gas-guzzling cars and trucks for more fuel-efficient vehicles.

Aggregate Hours and Market

by Calculated Risk on 6/09/2009 04:02:00 PM

| Click on graph for larger image in new window. The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. |

Here are aggregate hours index for the last six recessions, with the index normalized to 100 for the last month of the recession. (ht Bob_in_MA)

Here are aggregate hours index for the last six recessions, with the index normalized to 100 for the last month of the recession. (ht Bob_in_MA)Notes: Recessions are labeled based on the starting year. The 1980 line (green) ended early because of the 1981 recession. The 2007 recession is not included since we don't when it will end!

This shows the weak labor market following the 1990 recession - the red line hovers around 100 for about a year following the official end of the recession.

This also shows the aggregate hours index was flat for a few months following the 2001 recession (blue line) and then declined until mid-2003.

Weak Hiring and the Jobless Recovery

by Calculated Risk on 6/09/2009 01:51:00 PM

First a report from Bloomberg: U.S. Third-Quarter Hiring Plans at Record Low, Manpower Says

U.S. employers’ hiring plans for the third quarter held at a record low, signaling fired workers will have to wait many more months to find a job, a survey showed.That fits with the Fed Economic Paper I posted yesterday: Jobless Recovery Redux? that argued a jobless recovery is likely.

...

Companies are “treading slowly and watching with guarded optimism, hoping a few quarters of stability will be the precursor to the recovery,” Jonas Prising, president of the Americas for Milwaukee-based Manpower, said in a statement.

Our analysis generally supports projections that labor market weakness will persist, but our findings offer a basis for even greater pessimism about the outlook for the labor market.And Frankels (on the NBER recession Business Cycle Dating Committee) notes: The labor market has NOT yet signaled a turning point (ht Mark Thoma, Paul Krugman)

...

This projection indicates that the level of labor market slack would be higher by the end of 2009 than experienced at any other time in the post-World War II period, implying a longer and slower recovery path for the unemployment rate. This suggests that, more than in previous recessions, when the economy rebounds, employers will tap into their existing workforces rather than hire new workers. This could substantially slow the recovery of the outflow rate and put upward pressure on future unemployment rates.

emphasis added

The members of the NBER Business Cycle Dating Committee (of which I am one) will be responsible for calling the trough when the time is right.Note that Frankels is making similar arguments as the San Francisco Fed paper - except he is discussing the end of the recession as opposed to a jobless recovery.

...

Speaking entirely for myself, I like to look at the rate of change of total hours worked in the economy. Total hours worked is equal to the total number of workers employed multiplied by the average length of the workweek for the average worker. The length of the workweek tends to respond at turning points faster than does the number of jobs. When demand is slowing, firms tend to cut back on overtime, and then switch to part-time workers or in some cases cut workers back to partial workweeks, before they lay them off. Conversely, when demand is rising, firms tend to end furloughs, and if necessary ask workers to work overtime, before they hire new workers. (The hours worked measure improved in April 1991 and November 2001 which on other grounds were eventually declared to mark the ends of their respective recessions.) The phenomenon is called “labor hoarding” and it is attributable to the costs of finding, hiring and training new workers and the costs in terms of severance pay and morale when firing workers.

And the following graph shows the aggregate hours index from the BLS over several recessions.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Frankel notes that the "hours worked measure improved in April 1991 and November 2001" and that was a factor in declaring the end of those recessions. In 1991 the index flattened out - and in 2001, after improving slightly at the end of the year, the index actually declined further in 2002 and 2003 (the employment recession lasted until July 2003 by this measure).

This will be an important series to follow in trying to predict when the NBER calls the end of the recession.

As the recession ends, we should see hours worked increase (or at least stop falling), and the number of part time for economic reasons workers decline. New hiring will probably remain sluggish for some time.

Commercial Mortgage Defaults Seen Rising to 17 Year High

by Calculated Risk on 6/09/2009 12:15:00 PM

From Bloomberg: U.S. Commercial Mortgage Defaults May Rise to 17-Year High (ht Brian)

The default rate on commercial mortgages held by U.S. banks may rise to the highest in 17 years in the fourth quarter as debt for refinancing remains scarce and the recession drags down rents.Earlier this morning, TARP panel chair Elizabeth Warren recommended running the stress tests again on US banks, but using a higher unemployment rate and for more years (including 2011 through 2013). This would include these higher commercial real estate defaults that everyone now sees coming.

The rate is likely to reach 4.1 percent by year-end, Real Estate Econometrics LLC ... said in a report today. ...

Commercial defaults already are at a 15-year high after climbing to 2.3 percent in the first quarter ... from 1.6 percent at the end of 2008 ...

The projection for this year would match the 4.1 percent rate seen in 1993 and be the highest since defaults reached 4.6 percent in 1992 during the savings and loan crisis ...

The company projects the default rate on commercial mortgages will reach 5.2 percent by the end of 2010 and peak at 5.3 percent in 2011 before starting to decline.

Treasury: Ten Large Banks can Repay $68 Billion in TARP Funds

by Calculated Risk on 6/09/2009 09:52:00 AM

From MarketWatch: Ten large banks can return $68 billion in TARP

Repay TARP: NTRS, BBT, MS, STT, JPM, USB, AXP, COF, GS, BNY

It is a little confusing because Northern Trust (NTRS) wasn't one of the 19 stress test banks.

| Name | TARP Amount | Repay |

|---|---|---|

| Bank of America | $52.5 billion | No way! |

| Citigroup | $50 billion | No way! |

| JPMorgan Chase | $25 billion | XXX |

| Wells Fargo | $25 billion | - |

| GMAC | $12.5 billion | No way! |

| Goldman Sachs | $10 billion | XXX |

| Morgan Stanley | $10 billion | XXX |

| PNC Financial Services | $7.6 billion | - |

| U.S. Bancorp | $6.6 billion | XXX |

| SunTrust | $4.9 billion | - |

| Capital One Financial Corp. | $3.6 billion | XXX |

| Regions Financial Corp. | $3.5 billion | - |

| Fifth Third Bancorp | $3.4 billion | - |

| American Express | $3.4 billion | XXX |

| BB&T | $3.1 billion | XXX |

| Bank of New York Mellon | $3 billion | XXX |

| KeyCorp | $2.5 billion | - |

| State Street | $2 billion | XXX |

| MetLife | None | - |

TARP Panel Chair Suggests Running Stress Tests Again

by Calculated Risk on 6/09/2009 08:39:00 AM

From CNBC: Repeat Bank Stress Tests 'Right Now': TARP Panel Chair

The Congressionally-appointed panel overseeing the Troubled Asset Relief Program (TARP) recommends running again the stress tests on US banks, as economic conditions have worsened, its chair, Harvard University professor Elizabeth Warren, told CNBC Tuesday.

"We actually make recommendations to do it all over again right now," Warren told "Squawk Box."

"We've already blown past the worst-case scenario on unemployment," she added.

...

Other reasons for concern are that the model used in the Treasury's stress tests stretches on less than two years, while many commercial mortgages are coming up in 2011, 2012 and 2013, Warren said.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the unemployment rate compared to the stress test economic scenarios on a quarterly basis as provided by the regulators to the banks (no link).

This is a quarterly forecast: in Q1 the unemployment rate was higher than the "more adverse" scenario. The Unemployment Rate in Q2 (only two months) is already higher than the "more adverse" scenario, and will probably rise further in June.

Note also that the unemployment rate has already exceeded the peak of the "baseline scenario".

The second graph compares the Case-Shiller Composite 10 NSA index with the Stress Test scenarios from the Treasury (stress test data is estimated from quarterly forecasts).

The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:Case-Shiller Composite 10 Index, March: 151.41

Stress Test Baseline Scenario, March: 154.82

Stress Test More Adverse Scenario, March: 149.96

It has only been three months, but prices are tracking close to the 'More Adverse' scenario so far.

For GDP, the baseline case was for GDP to decline at a 5.0% annual real rate in Q1, and the more adverse scenario was for a decline of 6.9%. The BEA preliminary report showed a decline of 5.7% in Q1 (about half way between the two scenarios).

So far GDP and house prices are tracking a little better than the more adverse scenario, and unemployment worse.

Meanwhile CNBC says American Express and Morgan Stanley are on the list to repay TARP funds. CNBC also lists Goldman Sachs Group, JPMorgan Chase, State Street, U.S. Bancorp and BB&T.

The WSJ lists American Express Co., Bank of New York Mellon Corp., Capital One Financial Corp., Goldman Sachs Group Inc. and J.P. Morgan Chase & Co.

Monday, June 08, 2009

TARP Repayment Announcement on Tuesday

by Calculated Risk on 6/08/2009 10:22:00 PM

From Bloomberg: U.S. Treasury Said to Plan Approving 10 Banks to Repay TARP

The Treasury is preparing to announce tomorrow it will let 10 banks buy back government shares, people familiar with the matter said, signaling confidence some of the largest U.S. lenders won’t again need a taxpayer rescue.Here is your handy table ...according to the Bloomberg article 10 of these stress tested banks will be approved to repay the TARP money (MetLife didn't take TARP money). I've noted the banks mentioned in various articles ... let the guessing games begin!

JPMorgan Chase & Co. is among those cleared to repay Troubled Asset Relief Program funds ... Goldman Sachs Group Inc., American Express Co. and State Street Corp. are also among those that have sold shares and debt unguaranteed by the government ...

| Name | TARP Amount | Comment |

|---|---|---|

| Bank of America | $52.5 billion | No way! |

| Citigroup | $50 billion | No way! |

| JPMorgan Chase | $25 billion | Mentioned |

| Wells Fargo | $25 billion | Unlikely |

| GMAC | $12.5 billion | No way! |

| Goldman Sachs | $10 billion | Mentioned |

| Morgan Stanley | $10 billion | Mentioned |

| PNC Financial Services | $7.6 billion | - |

| U.S. Bancorp | $6.6 billion | Mentioned |

| SunTrust | $4.9 billion | - |

| Capital One Financial Corp. | $3.6 billion | - |

| Regions Financial Corp. | $3.5 billion | - |

| Fifth Third Bancorp | $3.4 billion | - |

| American Express | $3.4 billion | Mentioned |

| BB&T | $3.1 billion | Mentioned |

| Bank of New York Mellon | $3 billion | Mentioned |

| KeyCorp | $2.5 billion | - |

| State Street | $2 billion | Mentioned |

| MetLife | None | - |

More New Vacant Condos

by Calculated Risk on 6/08/2009 08:48:00 PM

In some cities there are a substantial number of uncounted new condos for sale or just sitting vacant. These units are not included in the Census Bureau new home sales inventory report.

Here is a short video from Jim the Realtor of a few more units in Encinitas (north county San Diego). Hey ... where are the gas meters?

Supreme Court temporarily blocks Chrysler deal

by Calculated Risk on 6/08/2009 06:14:00 PM

From the SCOTUS Blog: Ginsburg temporarily blocks Chrysler deal

Supreme Court Justice Ruth Bader Ginsburg put a temporary hold Monday on the deal to sell Chrysler to save it from collapse. Her order, however, simply gives her or the full Court more time to ponder whether to postpone the sale further, or allow it to go forward. The order can be found here.There is more ...

...

The deal remains in legal limbo until Ginsburg, as the Circuit Justice, or the full Court takes some definitive action. There is now no timetable for further action at the Supreme Court, although the terms of the deal allow Chrysler’s new business spouse — Fiat, the Italian automaker — to back out as of next Monday if the deal has not closed. Moreover, the papers filed in the Supreme Court have suggested that Chrysler is losing money at the rate of $100 million a day, pending the sale. That gives the Justices some incentive not to let much time pass before acting.

Fed: Big Bank Capital Plans are Sufficient

by Calculated Risk on 6/08/2009 05:46:00 PM

The 10 banking organizations required by the Supervisory Capital Assessment Program to bolster their capital buffers have all submitted capital plans that, if implemented, would provide sufficient capital to meet the required buffer under the assessment's more-adverse scenario. As supervisors, we will be working with the institutions to ensure their plans are implemented quickly and effectively.

Supervisors also continue to work with all regulated financial institutions to review the quality of their corporate-governance, risk-management and capital-planning processes.

Krugman: Recession May End this Summer

by Calculated Risk on 6/08/2009 03:58:00 PM

Paul Krugman is delivering a three part lecture at the London School of Economics starting today.

Bloomberg has some quotes: Nobel Laureate Krugman Says Recession May End ‘This Summer’

“I would not be surprised if the official end of the U.S. recession ends up being, in retrospect, dated sometime this summer,” he said in a lecture today at the London School of Economics. “Things seem to be getting worse more slowly. There’s some reason to think that we’re stabilizing.”The next two lectures will be Tuesday ("The eschatology of lost decades") and Wednesday ("The night they reread Minsky") at 6:30 PM London Time.

...

Even with a recovery, “almost surely unemployment will keep rising for a long time and there’s a lot of reason to think that the world economy is going to stay depressed for an extended period,” Krugman said.

The live webcasts are here.

Fed Letter: "Jobless Recovery Redux?"

by Calculated Risk on 6/08/2009 02:42:00 PM

Economic letter from the San Francisco Fed: Jobless Recovery Redux?

Although the pace of layoffs appears to be subsiding and the overall economy is showing hints of stabilization, most forecasters expect unemployment to continue to increase in coming months and to recede only gradually as recovery takes hold. In this Economic Letter, we evaluate this projection using data on three labor market indicators: worker flows into and out of unemployment; involuntary part-time employment; and temporary layoffs. We pay particular attention to how these indicators compare with data from previous episodes of recession and recovery. Our analysis generally supports projections that labor market weakness will persist, but our findings offer a basis for even greater pessimism about the outlook for the labor market. Specifically, we suggest that the relatively low level of temporary layoffs and high level of involuntary part-time workers make a jobless recovery similar to the one experienced in 1992 a plausible scenario.

emphasis aded

| Click on graph for larger image in new window. |

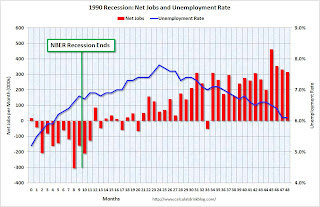

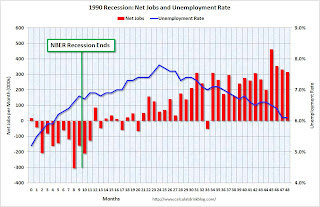

What does all this mean for the course of the labor market? We combine data on involuntary part-time workers with the standard unemployment rate to arrive at an alternative measure of labor underutilization. We plot this measure in Figure 3, which shows that the labor market has considerably more slack than the official unemployment rate indicates. The figure extends this labor underutilization measure using the Blue Chip consensus forecast for the unemployment rate as a benchmark and then adding a share of involuntary part-time workers based on the proportion of workers in that category to the unemployed during the current recession. This projection indicates that the level of labor market slack would be higher by the end of 2009 than experienced at any other time in the post-World War II period, implying a longer and slower recovery path for the unemployment rate. This suggests that, more than in previous recessions, when the economy rebounds, employers will tap into their existing workforces rather than hire new workers. This could substantially slow the recovery of the outflow rate and put upward pressure on future unemployment rates.This weekend I plotted some graphs of jobs and the unemployment rate for four recessions and recoveries (1981, 1990, 2001, and the current recession). See: Jobs and the Unemployment Rate. Here is the graph for the 1990 recession and the jobless recovery that followed:

The unemployment rate continued to rise for 15 months after the recession ended.

The unemployment rate continued to rise for 15 months after the recession ended.The researchers argue that the labor recovery following the current recession may be similar or worse than the jobless recovery following the 1991 recession:

[S]hould labor market conditions ... proceed along the path taken in the 1992 recovery, the unemployment rate could peak close to 11% in mid-2010 and remain above 9% through the end of 2011.

Hotel Recession Reaches 19 months

by Calculated Risk on 6/08/2009 01:00:00 PM

From HotelNewsNow: U.S. hotel industry enters 19th month of recession

economic research firm e-forecasting.com, in conjunction with STR, announced that following a decline of 1.1 percent in April, HIP declined 1.3 percent in May. HIP, the Hotel Industry Pulse index, is composite indicator that gauges business activity in the U.S. hotel industry in real-time. The latest decrease brought the index to a reading of 83.1. The index was set to equal 100 in 2000.

...

The U.S. hotel industry is still in its recession, having officially entered the 19th month of decline, said Evangelos Simos, chief economist of e-forecasting.com.

| Click on graph for larger image in new window. |

And from the Chicago Tribune: Chicago hotels racked by glut of rooms (ht dum luk)

Hotel occupancy and average daily room rates have posted double-digit percentage drops over the first four months of this year compared with the same time last year. ... Despite demand being down, the city's supply of hotel rooms is on the way up.The decline in revenue per available room (RevPAR) in Chicago is only slightly worse than the national average decline of 18.9% compared to last year, see: Hotel Occupancy Rate Falls to 51.6%.

The opening of four new hotels, plus rooms that will join the inventory at Trump International Hotel & Tower, will add 989 rooms to the downtown Chicago market this year.

...

In April alone, the average room rate in downtown Chicago hotels was about $162 a night, 23 percent less than the roughly $210 per night guests paid during April 2008, according to data from Smith Travel Research Inc.

As a result, total revenue for the 35,000-plus rooms in downtown Chicago has plunged 25 percent year to date.

Chicago's Magnificent Mile Vacancy Rate Highest Since 1992

by Calculated Risk on 6/08/2009 12:28:00 PM

From Crain's Chicago Business: Mag Mile facing a glitz gap

The vacancy rate in the Mag Mile corridor rose to 7.2% in the year ended April 30 from 6.3% the year before, according to an annual survey by real estate brokerage CB Richard Ellis Inc. provided exclusively to Crain's.

Empty storefronts large and small dot the avenue, a big departure from seven years ago, when the rate dropped to as low as 1%. Based on historical demand and announcements by stores of possible closures next year, the vacancy rate could approach its 1992 level of 9%.

...

"In this recession, high-end merchants have been negatively impacted, and that's reflected in the vacancy numbers on the street," [Bruce Kaplan, a senior vice-president in Chicago at CB Richard Ellis] says.

Large Banks: TARP Repayment, Capital Raising, Management Review

by Calculated Risk on 6/08/2009 09:15:00 AM

The Obama administration will announce this week that several large banks will be approved to repay TARP funds. Some of the rumored banks are J.P. Morgan Chase ($25 billion), Goldman Sachs ($10 billion), Morgan Stanley ($10 billion), American Express ($3.4 billion), Bank of New York Mellon ($3 billion), State Street ($2 billion), US Bancorp ($6.6 billion) and BB&T Corp. ($3.1 billion).

Also today is also the deadline for regulators to approve capital-raising plans and for banks to complete a management review. From the WSJ: Bank Chiefs Await Report Cards

Monday is the deadline for federal bank regulators to approve capital-raising plans at nine of the country's largest banks, a culmination of the stress-test process. But the moment could be overshadowed by a less publicized deadline: banks' equally in-depth review of their management.

Several top banks, including Bank of America Corp. and Citigroup Inc., have had to assess top executives and directors "to assure that the leadership of the firm has sufficient expertise and ability to manage the risks presented by the current economic environment" ...

Sunday, June 07, 2009

Report: Administration to Propose More Oversight of Compensation

by Calculated Risk on 6/07/2009 10:12:00 PM

From the NY Times: U.S. to Propose Wider Oversight of Compensation

The Obama administration plans to require banks and corporations that have received two rounds of federal bailouts to submit any major executive pay changes for approval by a new federal official who will monitor pay, according to two government officials.

The proposal is part of a broad set of regulations on executive compensation expected to be announced by the administration as early as this week. Some of the rules are required by legislation enacted in the wake of the worst financial crisis since the Great Depression, and would apply only to taxpayer money.

Others, which are being described as broad principles, would set standards that the government would like the entire financial industry to observe as they compensate their highest-paid executives, though it is not clear how regulators will enforce them.

Hotel Owner "Walking Away"

by Calculated Risk on 6/07/2009 06:23:00 PM

"At some point, you just stop the bleeding and hand the keys back."From the WSJ: Sunstone Hotel Investors to Turn Over W San Diego to Mortgage Holders

John Arabia, an analyst with real estate research company Green Street Advisors

Sunstone Hotel Investors Inc. intends to forfeit the 258-room W San Diego to its lenders after its efforts to reach a compromise on the luxury hotel's $65 million securitized mortgage failed.Much less than $65 million? That means the price has probably fallen 50% or more since 2006.

Sunstone ... bought the W for $96 million in 2006 ... Sunstone estimates the W San Diego is worth much less than the $65 million balance on its mortgage. At the end of last year, the hotel posted an occupancy of 69% and generated revenue per available room of nearly $153.

Jobs and the Unemployment Rate

by Calculated Risk on 6/07/2009 12:13:00 PM

These four graphs show the monthly net job losses (and gains) and the unemployment rate for each of the last four recessions and recoveries.

Note: scales are not the same for all graphs, and the unemployment rate doesn't start at zero to better show the change.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph is for the 1981 recession.

Job losses abated, and the unemployment rate peaked, as the recession ended. This used to be the pattern for a recession as employers hired back employees immediately after the recession ended.

The second graph is for the 1990 recession and shows the jobless recovery.

The second graph is for the 1990 recession and shows the jobless recovery.The unemployment rate continued to rise for 15 months (corrected) after the recession ended.

This is because the working age population continued to grow, so the unemployment rate increased even with no net job losses. Also discouraged workers usually start to return to the workforce as the economy recoveries - increasing the labor force too - and pushing up the unemployment rate if there are insufficient job gains. Note: the BLS only counts people actively seeking employment as part of the labor force.

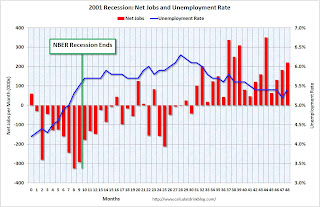

The third graph is for the 2001 recession.

The third graph is for the 2001 recession. This is similar to the 1990 recession in that the unemployment rate continued to rise for 19 months (corrected) following the end of the recession.

However, following the 2001 recession, the labor market remained very weak with several months of substantial job losses. Also the participation rate declined sharply - suggesting a large number of discouraged workers.

And the fourth graph is for the current recession.

And the fourth graph is for the current recession.It is very possible that the NBER will call the end of the recession before the job losses abate (like for the 1990 and 2001 recessions). And it also seems likely that the unemployment rate will continue to rise for the 18 months to 2 years or so since any recovery will probably be very sluggish.