by Calculated Risk on 6/09/2009 08:39:00 AM

Tuesday, June 09, 2009

TARP Panel Chair Suggests Running Stress Tests Again

From CNBC: Repeat Bank Stress Tests 'Right Now': TARP Panel Chair

The Congressionally-appointed panel overseeing the Troubled Asset Relief Program (TARP) recommends running again the stress tests on US banks, as economic conditions have worsened, its chair, Harvard University professor Elizabeth Warren, told CNBC Tuesday.

"We actually make recommendations to do it all over again right now," Warren told "Squawk Box."

"We've already blown past the worst-case scenario on unemployment," she added.

...

Other reasons for concern are that the model used in the Treasury's stress tests stretches on less than two years, while many commercial mortgages are coming up in 2011, 2012 and 2013, Warren said.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the unemployment rate compared to the stress test economic scenarios on a quarterly basis as provided by the regulators to the banks (no link).

This is a quarterly forecast: in Q1 the unemployment rate was higher than the "more adverse" scenario. The Unemployment Rate in Q2 (only two months) is already higher than the "more adverse" scenario, and will probably rise further in June.

Note also that the unemployment rate has already exceeded the peak of the "baseline scenario".

The second graph compares the Case-Shiller Composite 10 NSA index with the Stress Test scenarios from the Treasury (stress test data is estimated from quarterly forecasts).

The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:Case-Shiller Composite 10 Index, March: 151.41

Stress Test Baseline Scenario, March: 154.82

Stress Test More Adverse Scenario, March: 149.96

It has only been three months, but prices are tracking close to the 'More Adverse' scenario so far.

For GDP, the baseline case was for GDP to decline at a 5.0% annual real rate in Q1, and the more adverse scenario was for a decline of 6.9%. The BEA preliminary report showed a decline of 5.7% in Q1 (about half way between the two scenarios).

So far GDP and house prices are tracking a little better than the more adverse scenario, and unemployment worse.

Meanwhile CNBC says American Express and Morgan Stanley are on the list to repay TARP funds. CNBC also lists Goldman Sachs Group, JPMorgan Chase, State Street, U.S. Bancorp and BB&T.

The WSJ lists American Express Co., Bank of New York Mellon Corp., Capital One Financial Corp., Goldman Sachs Group Inc. and J.P. Morgan Chase & Co.

Monday, June 08, 2009

TARP Repayment Announcement on Tuesday

by Calculated Risk on 6/08/2009 10:22:00 PM

From Bloomberg: U.S. Treasury Said to Plan Approving 10 Banks to Repay TARP

The Treasury is preparing to announce tomorrow it will let 10 banks buy back government shares, people familiar with the matter said, signaling confidence some of the largest U.S. lenders won’t again need a taxpayer rescue.Here is your handy table ...according to the Bloomberg article 10 of these stress tested banks will be approved to repay the TARP money (MetLife didn't take TARP money). I've noted the banks mentioned in various articles ... let the guessing games begin!

JPMorgan Chase & Co. is among those cleared to repay Troubled Asset Relief Program funds ... Goldman Sachs Group Inc., American Express Co. and State Street Corp. are also among those that have sold shares and debt unguaranteed by the government ...

| Name | TARP Amount | Comment |

|---|---|---|

| Bank of America | $52.5 billion | No way! |

| Citigroup | $50 billion | No way! |

| JPMorgan Chase | $25 billion | Mentioned |

| Wells Fargo | $25 billion | Unlikely |

| GMAC | $12.5 billion | No way! |

| Goldman Sachs | $10 billion | Mentioned |

| Morgan Stanley | $10 billion | Mentioned |

| PNC Financial Services | $7.6 billion | - |

| U.S. Bancorp | $6.6 billion | Mentioned |

| SunTrust | $4.9 billion | - |

| Capital One Financial Corp. | $3.6 billion | - |

| Regions Financial Corp. | $3.5 billion | - |

| Fifth Third Bancorp | $3.4 billion | - |

| American Express | $3.4 billion | Mentioned |

| BB&T | $3.1 billion | Mentioned |

| Bank of New York Mellon | $3 billion | Mentioned |

| KeyCorp | $2.5 billion | - |

| State Street | $2 billion | Mentioned |

| MetLife | None | - |

More New Vacant Condos

by Calculated Risk on 6/08/2009 08:48:00 PM

In some cities there are a substantial number of uncounted new condos for sale or just sitting vacant. These units are not included in the Census Bureau new home sales inventory report.

Here is a short video from Jim the Realtor of a few more units in Encinitas (north county San Diego). Hey ... where are the gas meters?

Supreme Court temporarily blocks Chrysler deal

by Calculated Risk on 6/08/2009 06:14:00 PM

From the SCOTUS Blog: Ginsburg temporarily blocks Chrysler deal

Supreme Court Justice Ruth Bader Ginsburg put a temporary hold Monday on the deal to sell Chrysler to save it from collapse. Her order, however, simply gives her or the full Court more time to ponder whether to postpone the sale further, or allow it to go forward. The order can be found here.There is more ...

...

The deal remains in legal limbo until Ginsburg, as the Circuit Justice, or the full Court takes some definitive action. There is now no timetable for further action at the Supreme Court, although the terms of the deal allow Chrysler’s new business spouse — Fiat, the Italian automaker — to back out as of next Monday if the deal has not closed. Moreover, the papers filed in the Supreme Court have suggested that Chrysler is losing money at the rate of $100 million a day, pending the sale. That gives the Justices some incentive not to let much time pass before acting.

Fed: Big Bank Capital Plans are Sufficient

by Calculated Risk on 6/08/2009 05:46:00 PM

The 10 banking organizations required by the Supervisory Capital Assessment Program to bolster their capital buffers have all submitted capital plans that, if implemented, would provide sufficient capital to meet the required buffer under the assessment's more-adverse scenario. As supervisors, we will be working with the institutions to ensure their plans are implemented quickly and effectively.

Supervisors also continue to work with all regulated financial institutions to review the quality of their corporate-governance, risk-management and capital-planning processes.

Krugman: Recession May End this Summer

by Calculated Risk on 6/08/2009 03:58:00 PM

Paul Krugman is delivering a three part lecture at the London School of Economics starting today.

Bloomberg has some quotes: Nobel Laureate Krugman Says Recession May End ‘This Summer’

“I would not be surprised if the official end of the U.S. recession ends up being, in retrospect, dated sometime this summer,” he said in a lecture today at the London School of Economics. “Things seem to be getting worse more slowly. There’s some reason to think that we’re stabilizing.”The next two lectures will be Tuesday ("The eschatology of lost decades") and Wednesday ("The night they reread Minsky") at 6:30 PM London Time.

...

Even with a recovery, “almost surely unemployment will keep rising for a long time and there’s a lot of reason to think that the world economy is going to stay depressed for an extended period,” Krugman said.

The live webcasts are here.

Fed Letter: "Jobless Recovery Redux?"

by Calculated Risk on 6/08/2009 02:42:00 PM

Economic letter from the San Francisco Fed: Jobless Recovery Redux?

Although the pace of layoffs appears to be subsiding and the overall economy is showing hints of stabilization, most forecasters expect unemployment to continue to increase in coming months and to recede only gradually as recovery takes hold. In this Economic Letter, we evaluate this projection using data on three labor market indicators: worker flows into and out of unemployment; involuntary part-time employment; and temporary layoffs. We pay particular attention to how these indicators compare with data from previous episodes of recession and recovery. Our analysis generally supports projections that labor market weakness will persist, but our findings offer a basis for even greater pessimism about the outlook for the labor market. Specifically, we suggest that the relatively low level of temporary layoffs and high level of involuntary part-time workers make a jobless recovery similar to the one experienced in 1992 a plausible scenario.

emphasis aded

| Click on graph for larger image in new window. |

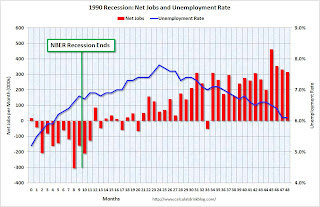

What does all this mean for the course of the labor market? We combine data on involuntary part-time workers with the standard unemployment rate to arrive at an alternative measure of labor underutilization. We plot this measure in Figure 3, which shows that the labor market has considerably more slack than the official unemployment rate indicates. The figure extends this labor underutilization measure using the Blue Chip consensus forecast for the unemployment rate as a benchmark and then adding a share of involuntary part-time workers based on the proportion of workers in that category to the unemployed during the current recession. This projection indicates that the level of labor market slack would be higher by the end of 2009 than experienced at any other time in the post-World War II period, implying a longer and slower recovery path for the unemployment rate. This suggests that, more than in previous recessions, when the economy rebounds, employers will tap into their existing workforces rather than hire new workers. This could substantially slow the recovery of the outflow rate and put upward pressure on future unemployment rates.This weekend I plotted some graphs of jobs and the unemployment rate for four recessions and recoveries (1981, 1990, 2001, and the current recession). See: Jobs and the Unemployment Rate. Here is the graph for the 1990 recession and the jobless recovery that followed:

The unemployment rate continued to rise for 15 months after the recession ended.

The unemployment rate continued to rise for 15 months after the recession ended.The researchers argue that the labor recovery following the current recession may be similar or worse than the jobless recovery following the 1991 recession:

[S]hould labor market conditions ... proceed along the path taken in the 1992 recovery, the unemployment rate could peak close to 11% in mid-2010 and remain above 9% through the end of 2011.

Hotel Recession Reaches 19 months

by Calculated Risk on 6/08/2009 01:00:00 PM

From HotelNewsNow: U.S. hotel industry enters 19th month of recession

economic research firm e-forecasting.com, in conjunction with STR, announced that following a decline of 1.1 percent in April, HIP declined 1.3 percent in May. HIP, the Hotel Industry Pulse index, is composite indicator that gauges business activity in the U.S. hotel industry in real-time. The latest decrease brought the index to a reading of 83.1. The index was set to equal 100 in 2000.

...

The U.S. hotel industry is still in its recession, having officially entered the 19th month of decline, said Evangelos Simos, chief economist of e-forecasting.com.

| Click on graph for larger image in new window. |

And from the Chicago Tribune: Chicago hotels racked by glut of rooms (ht dum luk)

Hotel occupancy and average daily room rates have posted double-digit percentage drops over the first four months of this year compared with the same time last year. ... Despite demand being down, the city's supply of hotel rooms is on the way up.The decline in revenue per available room (RevPAR) in Chicago is only slightly worse than the national average decline of 18.9% compared to last year, see: Hotel Occupancy Rate Falls to 51.6%.

The opening of four new hotels, plus rooms that will join the inventory at Trump International Hotel & Tower, will add 989 rooms to the downtown Chicago market this year.

...

In April alone, the average room rate in downtown Chicago hotels was about $162 a night, 23 percent less than the roughly $210 per night guests paid during April 2008, according to data from Smith Travel Research Inc.

As a result, total revenue for the 35,000-plus rooms in downtown Chicago has plunged 25 percent year to date.

Chicago's Magnificent Mile Vacancy Rate Highest Since 1992

by Calculated Risk on 6/08/2009 12:28:00 PM

From Crain's Chicago Business: Mag Mile facing a glitz gap

The vacancy rate in the Mag Mile corridor rose to 7.2% in the year ended April 30 from 6.3% the year before, according to an annual survey by real estate brokerage CB Richard Ellis Inc. provided exclusively to Crain's.

Empty storefronts large and small dot the avenue, a big departure from seven years ago, when the rate dropped to as low as 1%. Based on historical demand and announcements by stores of possible closures next year, the vacancy rate could approach its 1992 level of 9%.

...

"In this recession, high-end merchants have been negatively impacted, and that's reflected in the vacancy numbers on the street," [Bruce Kaplan, a senior vice-president in Chicago at CB Richard Ellis] says.

Large Banks: TARP Repayment, Capital Raising, Management Review

by Calculated Risk on 6/08/2009 09:15:00 AM

The Obama administration will announce this week that several large banks will be approved to repay TARP funds. Some of the rumored banks are J.P. Morgan Chase ($25 billion), Goldman Sachs ($10 billion), Morgan Stanley ($10 billion), American Express ($3.4 billion), Bank of New York Mellon ($3 billion), State Street ($2 billion), US Bancorp ($6.6 billion) and BB&T Corp. ($3.1 billion).

Also today is also the deadline for regulators to approve capital-raising plans and for banks to complete a management review. From the WSJ: Bank Chiefs Await Report Cards

Monday is the deadline for federal bank regulators to approve capital-raising plans at nine of the country's largest banks, a culmination of the stress-test process. But the moment could be overshadowed by a less publicized deadline: banks' equally in-depth review of their management.

Several top banks, including Bank of America Corp. and Citigroup Inc., have had to assess top executives and directors "to assure that the leadership of the firm has sufficient expertise and ability to manage the risks presented by the current economic environment" ...

Sunday, June 07, 2009

Report: Administration to Propose More Oversight of Compensation

by Calculated Risk on 6/07/2009 10:12:00 PM

From the NY Times: U.S. to Propose Wider Oversight of Compensation

The Obama administration plans to require banks and corporations that have received two rounds of federal bailouts to submit any major executive pay changes for approval by a new federal official who will monitor pay, according to two government officials.

The proposal is part of a broad set of regulations on executive compensation expected to be announced by the administration as early as this week. Some of the rules are required by legislation enacted in the wake of the worst financial crisis since the Great Depression, and would apply only to taxpayer money.

Others, which are being described as broad principles, would set standards that the government would like the entire financial industry to observe as they compensate their highest-paid executives, though it is not clear how regulators will enforce them.

Hotel Owner "Walking Away"

by Calculated Risk on 6/07/2009 06:23:00 PM

"At some point, you just stop the bleeding and hand the keys back."From the WSJ: Sunstone Hotel Investors to Turn Over W San Diego to Mortgage Holders

John Arabia, an analyst with real estate research company Green Street Advisors

Sunstone Hotel Investors Inc. intends to forfeit the 258-room W San Diego to its lenders after its efforts to reach a compromise on the luxury hotel's $65 million securitized mortgage failed.Much less than $65 million? That means the price has probably fallen 50% or more since 2006.

Sunstone ... bought the W for $96 million in 2006 ... Sunstone estimates the W San Diego is worth much less than the $65 million balance on its mortgage. At the end of last year, the hotel posted an occupancy of 69% and generated revenue per available room of nearly $153.

Jobs and the Unemployment Rate

by Calculated Risk on 6/07/2009 12:13:00 PM

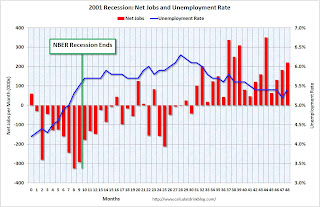

These four graphs show the monthly net job losses (and gains) and the unemployment rate for each of the last four recessions and recoveries.

Note: scales are not the same for all graphs, and the unemployment rate doesn't start at zero to better show the change.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph is for the 1981 recession.

Job losses abated, and the unemployment rate peaked, as the recession ended. This used to be the pattern for a recession as employers hired back employees immediately after the recession ended.

The second graph is for the 1990 recession and shows the jobless recovery.

The second graph is for the 1990 recession and shows the jobless recovery.The unemployment rate continued to rise for 15 months (corrected) after the recession ended.

This is because the working age population continued to grow, so the unemployment rate increased even with no net job losses. Also discouraged workers usually start to return to the workforce as the economy recoveries - increasing the labor force too - and pushing up the unemployment rate if there are insufficient job gains. Note: the BLS only counts people actively seeking employment as part of the labor force.

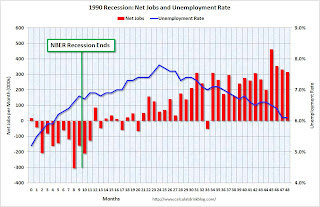

The third graph is for the 2001 recession.

The third graph is for the 2001 recession. This is similar to the 1990 recession in that the unemployment rate continued to rise for 19 months (corrected) following the end of the recession.

However, following the 2001 recession, the labor market remained very weak with several months of substantial job losses. Also the participation rate declined sharply - suggesting a large number of discouraged workers.

And the fourth graph is for the current recession.

And the fourth graph is for the current recession.It is very possible that the NBER will call the end of the recession before the job losses abate (like for the 1990 and 2001 recessions). And it also seems likely that the unemployment rate will continue to rise for the 18 months to 2 years or so since any recovery will probably be very sluggish.

The Psychology of Short Sales by Tanta, April 2008

by Calculated Risk on 6/07/2009 12:24:00 AM

Note: The following is an article that Tanta wrote for our April 2008 newsletter. This has not appeared on the blog before (ht Jillayne for reminding me of this).

As CR mentions in his essay on housing supply in this issue, plenty of markets are seeing very large segments of for-sale inventory coming in the form of short sale listings. Yet completed short sales remain a small segment of actual “distressed sales” or final dispositions of “worked out” loans. It is difficult to get reliable current data on short sales completed; the MBA reported in its first major analysis of workout data back in Q3 2007 that in that quarter, there were around 384,000 foreclosure starts and about 9,000 short sales completed. Certainly we have a lot of anecdotal evidence in the mainstream news media and from real estate agent reports suggesting that while short sales were never especially easy to accomplish, they are getting less so as time goes on.

Because so many observers of the scene express endless frustration that short sales have not been embraced by lenders as a “solution” to the foreclosure crisis—and no doubt because many potential real estate investors may be thinking that buying in a short sale is a good way to find a bargain—I thought it would be worthwhile to examine some of the reasons why they just don’t happen as often as one might expect. Part of the problem is overwhelmed servicers dealing with securitization documents that give them limited negotiating room, but that isn’t all of it. There is, I think, a certain psychological issue with two of the important participants in a short sale scenario other than the servicer, namely the current owner and the potential buyer, and this issue is causing short sale proposals that just don’t pass muster with servicers.

We should start by reviewing why it is that a servicer might be inclined to accept a short sale: the idea is that the loss incurred is less than the loss that would be incurred in a foreclosure. To start, then, the servicer must have some model it can use to project likely losses in foreclosure. A good deal of the data going into that model involves not just a projection of the likely sales price of the eventual REO, but also the servicer’s estimates of the costs and expenses of foreclosure, which the short sale is supposed to be minimizing or eliminating. This modeling is dynamic: as a local RE market changes (prices fall, inventory mounts, timelines for foreclosure extend), the model has to keep updating its loss projections.

There is no particular “rule of thumb” for what loss severity in a foreclosure is in any market, but one can start with a fairly simple example of where the losses come from by looking at some aggregated national data prepared by two Freddie Mac economists, Amy Crews Cutts and William A. Merrill, in a recent paper entitled “Interventions in Mortgage Default: Policies and Practices to Prevent Home Loss and Lower Costs” (available for download at www. freddiemac.com). The authors estimate the “breakout” of foreclosure losses on Freddie Mac (conforming dollar, prime or near-prime credit quality mortgages) in the period up to the third quarter of 2007 as follows:

• 20% Principal loss (the difference between the unpaid principal balance or UPB of the loan and the REO sales price, or the amount of the borrower’s “negative equity”)

• 37% Pre-Foreclosure Expenses (24% interest expense, 4% legal fees, 8% property costs such as taxes, insurance, assessments and utilities)

• 43% Post-Foreclosure Expenses (21% sales commission/concessions, 2% legal fees, 20% property costs and maintenance/repair

To take a simple example, then, in a market which is currently experiencing a “loss severity” of 40% (of the unpaid principal balance or UPB of the loan), the breakout would look something like this on average (using a smaller than “average” loan balance just to simplify the math):

| Loan Amount | 100,000 |

| REO Sales Price | 92,000 |

| UPB Loss | 8,000 |

| Pre-FC Expense | 14,800 |

| Post-FC Expense | 17,200 |

| Total Loss | 40,000 |

| Loss Severity | 40% |

A short sale, then, would be of interest to the servicer only if it could result in a loss severity less than 40%. Of course, we do not necessarily expect the buyer in a short sale scenario to be offering $92,000 in this example, because that is not, in the buyer’s mind, a “discount” from the price the property would fetch as REO. The idea is that the servicer can be brought to accept a lower price for the property today than it could (potentially) get for the REO, because the short sale saves on the “foreclosure expenses.” Much frustration is being expressed by certain market participants or buyers who are nonplussed by servicers who apparently don’t want to “save” this money by accepting low-ball offers.

Part of the difficulty here is coming to terms with what the components of a servicer’s expenses are, and also what a difference it makes whether the current owner is delinquent (and cash-strapped) or not. It simply isn’t clear to me that everyone who is listing a property as a short sale these days is, actually, delinquent yet. That certainly makes a difference to a servicer’s willingness to negotiate, but it also makes a big difference in terms of what the cost comparisons are.

We also need to consider questions of timing. We looked in last month’s newsletter at some comparative foreclosure timeline numbers, making the point that they are dependent on the state’s laws as much if not more so that the servicer’s capacity or efficiency, although the latter is certainly significant. A short sale, more or less by definition, needs to be a “quick sale.” Delinquent borrowers do not have time to “expose” the property to “typically motivated” buyers for long enough to get the “optimum” price for the property; that’s why they’re facing foreclosure. Non-delinquent borrowers, presumably, can. However, they don’t want to deal with the extraordinarily extended “exposure” time required in a thorough-going RE bust, which moves from a matter of months to, apparently, a matter of years. Short sales offered by non-delinquent sellers fall into this odd sort of time-continuum: not as “quick” as a distressed borrower, but much “quicker” than a borrower seeking at least his loan amount. This no doubt accounts for a lot of the “failure to communicate” between non-delinquent borrower and servicer that we’re hearing about these days.

Let’s look at a theoretical set of alternative transactions based on the average numbers I laid out above. Please note that what I’m trying to capture here is the “mathematics of psychology,” not precisely the mathematics of “reality.” That will, I hope, be clearer after we look at some numbers:

| Foreclosure With 40% Loss Severity | Short Sale with Delinquent Owner | Short Sale with Non-Delinquent Owner | |||

|---|---|---|---|---|---|

| Deal Fails | Deal Passes | "Typical" Exposure | "Quick Sale" | ||

| Loan Amount | 100,000 | 100,000 | 100,000 | 100,000 | 100,000 |

| "Gross" Sales Price | 92,000 | 80,000 | 84,000 | 80,000 | 80,000 |

| Sales Expense to Buyer | - | 8,400 | 8,400 | - | 21,200 |

| "Net" Sales Price | 92,000 | 71,600 | 75,600 | 80,000 | 58,800 |

| UPB Loss | 8,000 | 28,400 | 24,400 | 20,000 | 41,200 |

| Pre-FC Legal & Property | 5,200 | 5,200 | 5,200 | 2,000 | 2,000 |

| Pre-FC Interest Expense | 9,600 | 9,600 | 9,600 | - | - |

| Post FC Legal & Property | 8,800 | - | - | - | - |

| Post-FC Sales Expense | 8,400 | - | - | - | - |

| Total Loss: | 40,000 | 43,200 | 39,200 | 22,000 | 43,200 |

| "Discount" From REO Price | - | 22% | 18% | 13% | 36% |

| Post-FC Sales Expense to Owner | - | - | - | 8,400 | - |

| Pre-FC Interest Expense to Owner | - | - | - | 9,600 | - |

| Pre-FC Property Expense to Owner | - | - | - | 3,200 | - |

In the foreclosure scenario, all costs to maintain the property, as well as cover interest payments on the outstanding loan balance due to the investor, are carried by the servicer and reimbursed from liquidation proceeds. This includes the “post-FC” costs of sales commissions and typical sales concessions (such as paying all or part of a buyer’s closing costs).

In our first example of a short sale with a delinquent owner, the buyer offers $80,000 for the property. However, we are going to assume a cash-strapped seller who is unable to cover the $8,400 in commissions/ concessions that would, in the foreclosure, have been paid by the servicer, and so we will assume that these costs are “passed on” to the buyer of the home, resulting in a net sales price of $71,600, or a 22% “discount” from the assumed REO price of $92,000. I don’t think it’s unreasonable to believe there might be buyers out there telling themselves that surely a servicer would rather lose 22% than 40%.

As we can see, however, it is really only the “post-FC” expenses that the servicer is “saving” in this deal, because the property seller has not, we assume, been making mortgage payments in a time-frame we will, for example purposes, consider to be equivalent to an “average” pre-FC period. You can, of course, and you would reduce the servicer’s expenses if the short sale were very fast, fast enough to make a meaningful difference in the servicer’s property expenses and interest costs. We’re just trying to keep the math constant to show, exactly, that you do have to sell not just “short” but “quick” to “pass” the servicer’s test here.

The second delinquent-owner column shows that the proposed deal doesn’t “pass” the servicer’s less-loss test until the sales price gets up to $84,000. That is still a “discount” from $92,000, if you choose to think of it that way, but not anywhere near a “lowball” offer.

The last two columns show how “psychological math” changes when we have a non-delinquent seller. In the first column, we assume a “rational” seller who understands that he needs to keep paying his mortgage until the sale takes place, meaning that he carries that “interest cost” and “pre-FC property expense” that the servicer would carry in the foreclosure scenario. Also, he will have to pony up at settlement for commission and typical concessions. If he is not particularly pressed for time here—he isn’t, after all, facing imminent foreclosure—then we’ll call his situation something like a “typical” marketing time for the property, which we are for simplicity’s sake making the equivalent of the foreclosure timeline. That scenario results in what should surely be an attractive deal to the servicer: a loss of only $22,000. With the property seller “paying” most of the costs that would otherwise have been the servicer’s. (I assume for example purposes that the legal costs of pre-foreclosure ($2,000) are equivalent to the legal/administrative costs to the servicer of processing a short sale.)

The only problem with that scenario, besides the fundamental question of the servicer’s motivation to accept loss when there is no delinquency to signal probable eventual foreclosure, is that this seller is displaying a set of behaviors I suggest might not be very common: wanting to sell quickly (compared to the years you might have to wait out a bust) but not too quickly (willing to pay out of pocket for sales commissions and market-driven concessions in order to get the best possible price in listing time comparable to the average 6-9 months of a foreclosure timeline). All while considering the monthly mortgage interest, taxes, and insurance as simply an inevitable expense that he needs to carry until he is approved by the servicer and relieved of ownership of the property.

My sense is that what we are actually seeing on the ground with non-delinquent short sale offers is probably closer to the second column: the one in which the seller in essence “decides” to “pass on” the sales costs and interest expense to the new buyer, to “get out without a loss.” (Again, I’m talking a certain kind of psychology here, not what you might call realistic math.) In this case, the seller presents the servicer with a “quick” low-ball price which will, he hopes, get him out before he incurs any more expense—expense here including the mortgage payment. The result of that? A loss to the servicer that is basically identical to the loss in the “failed” delinquent owner short sale.

In reality, of course, these costs that a “buyer” is taking are really costs that the servicer/investor is taking: it’s really the investor who ends up covering the transaction costs in most of these scenarios (because of the reduced sales price). Yet I don’t think enough prospective short-sellers have that in mind. Many, many people weren’t very good negotiators—or rational cost analysts—when they first bought these homes or took out these mortgages. It’s rather bizarre to think they’ll suddenly take a different view of things now, isn’t it? Our examples suggest that the deal most attractive to the servicer—the non-delinquent “typical” exposure or adequately-marketed property—is the one least likely to be offered. The “math of reality” works on these deals, but the “math of psychology” doesn’t.

My view is that, realistically, only the short sales with delinquent owners stand much of a chance of getting “passed” by servicers, and those few are being overtaken by events, namely, such a rapidly falling price environment that it’s hard to get that $84,000 bid and make it stick long enough to close the deal. This part is where servicer inability in so many cases to “just pull the trigger and close the deal” is hampering things, that being mostly a result of securitization rules requiring servicers to get investor/trustee approval, plus the endlessly updating numbers on those “models” that the servicers are using to find the “trigger point” where a short sale makes sense.

There are no doubt some bargains to be had for real estate investors looking into short sales, but for nearly anyone except an expert in certain markets, I think I’d suggest not wasting your time. Unless, that is, the listed “short” price has already been “pre-approved” by the owner’s servicer. That does sometimes happen; the seller will in that case have a letter from the servicer indicating the minimum allowable sales price/maximum concessions. It will also help to be working with a real estate agent who knows more than a little about doing short sales. Otherwise I suspect you’ll end up waiting for Godot. I hate to spoil the plot, if you’ve never seen that play, but in the end he never arrives.

Saturday, June 06, 2009

Does Education Pay?

by Calculated Risk on 6/06/2009 06:36:00 PM

Earlier I posted a graph on unemployment by education level (and a table from the BLS on compensation by education level), see: Unemployment Rate and Level of Education

Education clearly matters, but does it pay? I think it does, but it depends on the cost of education and opportunity costs. Eric sent me this cartoon that captures the reaction of many graduates ...

| From cartoonist Eric G. Lewis. Click on cartoon for larger image in new window. |

Foreclosures and the Home ATM

by Calculated Risk on 6/06/2009 04:10:00 PM

From Matt Padilla at the O.C. Register: Do these homeowners deserve help?

Homeowners who treated their houses like cash machines, tapping the equity as home values rose, are among the most likely to end in foreclosure, even more than those who bought at housing’s peak, a new study finds.During the housing bubble, many bought homes they could not afford using "affordability products" like Option ARMs. But there was another group of speculators that lived beyond their means, using their homes like ATM cash machines. I think this an important issues and I'm looking forward to Padilla's article.

Often homeowners have had second, third and even fourth mortgages at time of foreclosure — a trend not adequately addressed by any of the federal or state foreclosure avoidance progams, said Michael LaCour-Little, a finance professor at Cal State Fullerton who authored the study.

...

I plan a bigger story on his findings, but wanted to share a few results now.

...

For example, for the early November 2008 data sample, he tracked 2,358 properties. Here’s what he found:

•They were purchased at an average price of $354,000 and average year of 2002 (long before the housing peak of 2005).

•Total debt on the properties averaged $551,000 at time of foreclosure. That’s 56% more than the properties were worth when purchased, meaning at least that much was cashed out!

•An automatic valuation model estimated average value at time of foreclosure was $317,000, which suggests a combined loan-to-value at foreclosure of more than 170% ($551,000/$317,000). And that is a conservative estimate. Properties that banks later sold had an average resale price of $271,000!

Unemployment Rate and Level of Education

by Calculated Risk on 6/06/2009 11:19:00 AM

By request ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the unemployment rate by four level of education.

And here is a graphic from the BLS based on 2008 data: Education pays ...

Note that the unemployment rate has risen sharply for all categories in 2009. For "less than a high school diploma" the rate has increased from 9% in 2009 to almost 16% in May.

Education matters!

Consumer Bankruptcy Filings up Sharply

by Calculated Risk on 6/06/2009 08:26:00 AM

From the American Bankruptcy Institute: Consumer Bankruptcy Filings up 37 Percent in May

U.S. consumer bankruptcy filings rose 37 percent nationwide in May from the same period a year ago, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). The overall May consumer filing total of 124,838 was roughly level from the April total of 125,618. Chapter 13 filings constituted 27 percent of all consumer cases in May, slightly above the April rate.

“As consumers continue to face increasing levels of unemployment and rising foreclosure rates, bankruptcy filings will continue to accelerate as families seek financial relief from the tough economic climate,” said ABI Executive Director Samuel J. Gerdano. “We predict more than 1.4 million new bankruptcies by year end.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter.

Note: Quarterly data from Administrative Office of the U.S. Courts, Q1 data and Q2 estimate (based on April and May) from American Bankruptcy Institute.

The quarterly rate is close to the levels prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

| Click on cartoon for larger image in new window. Another great cartoon from Eric G. Lewis, a freelance cartoonist living in Orange County, CA. |

The American Bankruptcy Institute is predicting over 1.4 million new bankruptcies by year end - I'll definitely take the over!

TARP Repayments may exceed $50 Billion

by Calculated Risk on 6/06/2009 12:14:00 AM

From the WaPo: Bank Repayments May Exceed Estimate

The Obama administration is set to announce next week that a larger-than-expected number of big financial firms can repay their bailout funds ... The size of the repayments may double the initial estimate of $25 billion by the Treasury Department, the sources said. That would mean that many, perhaps nearly all, of the nine firms that regulators found to have sufficient reserves in a recent "stress test" would be allowed to return federal aid.MarketWatch has a list : JP Morgan, Goldman among banks set to repay TARP

J.P. Morgan Chase ($25 billion), Goldman Sachs ($10 billion) and some other large U.S. banks ... include Morgan Stanley ($10 billion), American Express ($3.4 billion), Bank of New York Mellon ($3 billion), State Street ($2 billion), US Bancorp ($6.6 billion) and BB&T Corp. ($3.1 billion)That totals $63.1 billion.

Bailout amounts from Pro Publica : Eye on the Bailout

Friday, June 05, 2009

This American Life on the Rating Agencies

by Calculated Risk on 6/05/2009 09:20:00 PM

This weekend's 'This American Life' is about the rating agencies.

Here is preview (with a 7 min audio): Economy Got You Down? Many Blame Rating Firms. (ht Bob) A few excerpts:

"We hired a specialist firm that used a methodology called maximum entropy to generate this equation," says Frank Raiter, who until 2005 was in charge of rating mortgages at Standard and Poors. "It looked like a lot of Greek letters."

...

Managing director Tom Warrack was in the room when Standard and Poor's gave those mortgage-backed securities AAA ratings. He stands by that decision.

"I wouldn't say anything was missed," he says. "Never before in the history of the country, dating back to the Great Depression, have we had the type of nationwide market value declines, declines in home prices, and the associated default levels."

Warrack says that his agency required riskier loans to have more protections built in to receive the highest grade. He says the agency knew plenty about the mortgages inside those bonds. "We had lots of data," he says. "We had years' worth of data as to how borrowers perform over time."