by Calculated Risk on 8/26/2006 04:38:00 PM

Saturday, August 26, 2006

Enough Gloom; A Touch of Grace

This is a short break from the economics posts.

I found this fan tribute to ... well ... long term readers can guess who.

Enjoy and have a great day!

Friday, August 25, 2006

Lower Growth Forecasts

by Calculated Risk on 8/25/2006 04:36:00 PM

A couple of related stories ...

Just a few months ago most analysts were still very positive on the U.S. economy through '07. Now economists are starting to revise down their growth estimates. As an example, from Globe and Mail: Higher odds of a hard landing

The end of the U.S. housing boom will trim consumer spending, slow economic growth and set the stage for a recession in corporate profits, according to a forecast from economists at National Bank Financial.And from the AP: Housing and fuel strain shoppers

"In light of the swift buildup of the inventory of unsold homes, it is only a matter of time before prices decline at the national level," Clément Gignac and Stéfane Marion wrote in a note.

"In our opinion, a deterioration of household net worth, at a time when the sum of the household energy bill and financial obligations has risen to a record share of disposable income, will force consumers to rebuild their savings rate."

The economists cut their U.S. 2007 economic growth target to 1.9 per cent from a 2.4 per cent projection in July-August, and lowered their expectations for personal consumption growth to 1.4 per cent from 2.3 per cent. They also raised the odds of a U.S. hard landing to 40 per cent from 25 per cent.

"This development will set the stage for a recession in U.S. profits," Mr. Gignac and Mr. Marion said.

Retailers and economists say many Americans are waiting to buy big-ticket items and cutting back on frills. Homeowners are shelving plans to remodel kitchens. Families are dining out less and tightening their budgets.The article mentions the sluggish sales at Lowe's, Wal-Mart and at several casual dininrestaurantsts. The AP article concludes with this frightening story:

"People are taking funds from one area and committing them to another, gasoline and utilities in particular," said Gregory Miller, chief economist at Sun Trust Bank Inc. He predicts growth in consumer spending will fall from a rate of 2.5 percent to around 1.5 percent during the second half of this year, bringing down overall economic growth at the same rate.

At the same time, homeowners are seeing a key source of their wealth lose value as housing prices fall in some parts of the country.

Psychologically, this creates the opposite of the "wealth effect" that kept upbeat consumers spending as stock prices rose in the late 1990s and real estate boomed after the recession in 2001, said Robert Weagley, chair of the personal financial planning department at the University of Missouri.

... After two strong years of sales, business has slowed dramatically this summer [says] David Richardson, the 50-year-old co-owner of Rothschild's Antiques and Home Furnishings in St. Louis.Many people will be surprised at how quickly market psychology can change. I'm reminded of something Stephen Robinett once wrote:

"Look around," Richardson said, gesturing to an empty store. "I'm scared. I don't know what's the right thing to do. Do you stand by the tried and true, or do you move on?"

"Speculative bubbles go on longer and end quicker than most people expect."

Thursday, August 24, 2006

Feldstein: Slow Growth, Not Recession

by Calculated Risk on 8/24/2006 10:05:00 PM

Bloomberg reports: Harvard's Feldstein Says U.S. Should Dodge Recession

The U.S. economy should dodge recession, said Harvard Professor Martin Feldstein, who heads the organization that dates business cycles.That is the positive outlook: slow growth, but no recession. Still, Feldstein is clearly concerned about the loss of simulus from the "Home ATM".

"If I had to make a likely guess, I would say slow growth, but not recession," Feldstein said ...

...

Feldstein, who chairs the National Bureau of Economic Research, said a recession could occur if households made a "decision to start saving again" rather than keep spending as the housing market fades. ...

"Household savings is now negative and that was driven by the fact that house wealth was up and that mortgage refinancing was very, very appealing," Feldstein said. "People took that money and they went and spent a lot of it. So if that goes into reverse, that could tip the economy."

Still, he noted a "lot of positives that could keep the economy moving along," among them a moderation in the trade deficit.

As chairman of Cambridge, Massachusetts-based NBER, Feldstein is a member of its Business Cycle Dating Committee.

For the pessimistic view, see Krugman: Housing Gets Ugly (pay). For excerpts see Economist's View.

Housing: Difference a Year Makes

by Calculated Risk on 8/24/2006 07:19:00 PM

From MarketWatch: The difference a year makes

| The difference a year makes Recent data quantify housing cooldown (year-over-year changes). | |

| Builders’ sentiment | |

| New-home sales | |

| Purchase-mortgage applications | |

| Building permits | |

| Housing starts | |

| Existing-home sales | |

| Existing-home inventories | |

| New-home inventories | |

For builder sentiment, they are using the August numbers. For July, builder sentiment was off 44%. So the situation has probably gotten worse. Also, existing home sales lags most of the other indicators.

Update: New Home Sales and Recessions

by Calculated Risk on 8/24/2006 02:25:00 PM

Click on graph for larger image.

Click on graph for larger image.

Here are the updated graphs for New Home Sales vs. recessions, including the July data and revisions.

For an explanation of the 2nd graph, please see this discussion (figure 3): Investment and Recessions

Although sales for July are down over 20% compared to July 2005, the YoY change is down 16% based on the smoothed three month centered average. This indicator is just above the minus 20% threshold.

For another look at New Home Sales data, see: New home sales continue to fall.

July New Home Sales: 1.072 Million Annual Rate

by Calculated Risk on 8/24/2006 10:31:00 AM

According to the Census Bureau report, New Home Sales in July were at a seasonally adjusted annual rate of 1.072 million. Sales for June were revised down to 1.120 million, from 1.131 million. Numbers for April and May were also revised down.

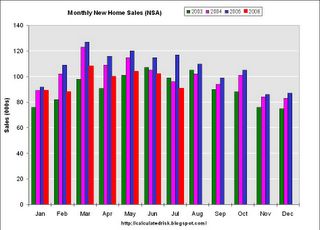

Click on Graph for larger image.

Sales of new one-family houses in July 2006 were at a seasonally adjusted annual rate of 1,072,000 ... This is 4.3 percent below the revised June rate of 1,120,000 and is 21.6 percent below the July 2005 estimate of 1,367,000.

The Not Seasonally Adjusted monthly rate was 91,000 New Homes sold. There were 117,000 New Homes sold in July 2005.

On a year over year NSA basis, July 2006 sales were 22.2% lower than July 2005. Also, July '06 sales were below July 2004 (96,000) and July 2003 (99,000) sales. This is the lowest July since 2002 when 82,000 new homes were sold.

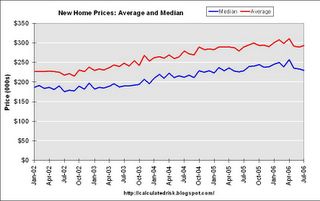

The median and average sales prices were down slightly. Caution should be used when analyzing monthly price changes since prices are heavily revised.

The median sales price of new houses sold in July 2006 was $230,000; the average sales price was $293,500.

The seasonally adjusted estimate of new houses for sale at the end of July was 568,000. This represents a supply of 6.5 months at the current sales rate.

The 568,000 units of inventory is another record for new houses for sale.

On a months of supply basis, inventory is above the level of recent years.

This report is weaker than expected by Wall Street, but is in line with recent reports from home builders. More later today on New Home Sales and Recessions.

Wednesday, August 23, 2006

AutoNation chief warns of recession

by Calculated Risk on 8/23/2006 07:03:00 PM

The Orange Country Register reports: AutoNation chief warns of recession

The chief executive of the nation's largest auto-dealing company said Tuesday the economy is "at a tipping point," threatened with recession as rising interest rates undermine consumer confidence.

"The question is how bad a recession," said Mike Jackson, CEO of AutoNation, which owns 338 auto franchises, including House of Imports in Buena Park, Power Toyota Cerritos, Lexus Cerritos and Power Toyota Irvine.

During the first six months of this year, auto sales fell 0.3 percent nationwide and 6.8 percent in Orange County. Sales of autos and gasoline account for almost one-third of retail spending in Orange County...

TIPPING POINT: "Sales of pickup trucks are down because construction activity is backing off," says, Mike Jackson, CEO of AutoNation. "Pickups are the backbone of construction."

Photo: Jeff Kowalsky, Bloomberg

And from the AP: Slowing Pickup Truck Sales Hurt Profits

Much to the detriment of Detroit's Big Three, people like [carpenter Tom] Wright are delaying truck purchases, cutting into profits and forcing Ford Motor Co., General Motors Corp. and DaimlerChrysler AG's Chrysler Group to idle some assembly lines.This is a secondary effect from the housing bust; slower auto sales, especially slower truck sales as construction workers find less work.

Pickup sales overall are off 15.7 percent in the first seven months of the year from the same time last year.

Sales of Ford's F-series pickups, the highest-selling vehicles in the nation, are down 12.3 percent. The No. 2 seller, the Chevrolet Silverado, is off 20.1 percent as the company changes production to a new model. Dodge's Ram line is down 11.7 percent.

More from the Archetypical Eeyore

by Calculated Risk on 8/23/2006 02:06:00 PM

From Professor Duy: Fed Watch: Finally – Some FedSpeak

Last week Dallas Fed President Richard Fisher stepped up to the podium, but revealed little new in Fed thinking, simply noting the tight spot between accelerating inflation and slower growth. The only new information one could glean from his speech was when he described recession-minded analysts as “Eeyores.” Such a dismissive remark can only suggest that the idea of a rate cut is furthest from his mind. That said, Fisher’s “eighth inning” remark lingers in everyone’s minds – perhaps the best strategy is to bet against Fisher, and side with the “Eeyores.”

'Eeyore is a fictional character from the book series and cartoon Winnie-the-Pooh. ... He is a pessimistic, gloomy, old donkey who is a friend of Winnie the Pooh. Eeyore is hardly ever happy and when he is, he is still sardonic and a bit cynical.'And who is the archetypical Eeyore? More from Tim Duy:

To be sure, policymakers have an eye on the housing slowdown, but I just doubt they feel much urgency. Certainly, not as much urgency as the current archetypical Eeyore, Nouriel Roubini, whose recent writing leaves me thinking about liquidating all my assets and rebalancing into a “diversified” portfolio of dry goods, gold, guns, and ammunition (which in Oregon would not be considered out of the ordinary).Very funny! Duy's commentaries are always enlightening and frequently amusing.

And now from the archetypical eeyore himself, Professor Roubini writes: "The Biggest Slump in US Housing in the Last 40 Years"…or 53 Years?

"At this point there no doubt on whether the housing sector is contracting ... I have also argued before that the effects of housing on US economic growth and the role of housing in tipping the US economy into a recession in early 2007 are more significant than the role that the tech sector bust in 2000 played in tipping the economy into a recession in 2001."Read Nouriel's piece for his analysis, but here is his conclusion:

"... the simple conclusion from the analysis above is that this is indeed the biggest housing slump in the last four or five decades: every housing indictor is in free fall, including now housing prices. By itself this slump is enough to trigger a US recession: its effects on real residential investment, wealth and consumption, and employment will be more severe than the tech bust that triggered the 2001 recession. And on top of the housing bust, US consumers are facing oil above $70, the delayed effects of rising Fed Fund and long term rates, falling real wages, negative savings, high debt ratios and higher and higher debt servicing ratios. This is the tipping point for the US consumer and the effects will be ugly. Expect the great recession of 2007 to be much nastier, deeper and more protracted than the 2001 recession."Eeyore indeed. Did I mention Eeyore is also a very intelligent animal?

NAR: Existing-Home Sales Down With Softening Prices

by Calculated Risk on 8/23/2006 10:42:00 AM

The AP reports:

"Sales of previously owned homes plunged in July to the lowest level in 2 1/2 years and the inventory of unsold homes climbed to a new record high, fresh signs that the housing market has lost steam."The National Association of Realtors (NAR) reports: Existing-Home Sales Down With Softening Prices

Click on graph for larger image.

Existing-home sales were down in July, while home prices in many areas are slightly below year-ago levels, according to the National Association of Realtors®.

Total existing home sales – including single-family, townhomes, condominiums and co-ops – dropped 4.1 percent to a seasonally adjusted annual rate1 of 6.33 million units in July from a downwardly revised pace of 6.60 million June, and were 11.2 percent below the 7.13 million-unit level in July 2005.

David Lereah, NAR’s chief economist, said higher interest rates dampened sales but that price softening is good news for the housing market because it is drawing buyers. “Many potential home buyers have been on the sidelines, some ‘kicking the tires,’ but mostly waiting for sellers to compromise on prices and terms,” he said. “Now sellers in many areas of the country are pricing to reflect current market realities. As a result, there could be some lift to home sales, but it’ll likely take some months for price appreciation to rise.”

The national median existing-home price for all housing types was $230,000 in July, up 0.9 percent from July 2005 when the median was $228,000. The median is a typical market price where half of the homes sold for more and half sold for less.

Total housing inventory levels rose 3.2 percent at the end of July to 3.86 million existing homes available for sale, which represents a 7.3-month supply at the current sales pace.Existing Home Sales are a trailing indicator. The sales are reported at close of escrow, so July sales reflects agreements reached in May and June.

As I've noted before, usually 6 to 8 months of inventory starts causing pricing problem - and over 8 months a significant problem. With current inventory levels at 7.3 months of supply, inventories are now in the danger zone and prices are falling in many areas.

MBA: Mortgage Rates Decline

by Calculated Risk on 8/23/2006 12:22:00 AM

The Mortgage Bankers Association (MBA) reports: Mortgage Rates Decline

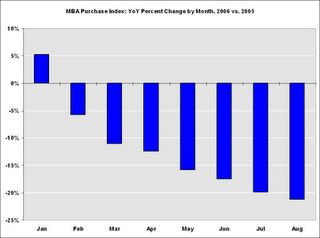

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 561.5, an increase of 0.1 percent on a seasonally adjusted basis from 561.2 one week earlier. On an unadjusted basis, the Index decreased 1.2 percent compared with the previous week and was down 25.1 percent compared with the same week one year earlier.Mortgage rates declined:

The seasonally-adjusted Purchase Index decreased by 1 percent to 382.2 from 385.9 the previous week and the Refinance Index increased by 1.3 percent to 1608.5 from 1587.5 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.38 percent from 6.54 percent ...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for one-year ARMs decreased to 5.91 percent from 5.97 percent ...

| Total | -25.1% |

| Purchase | -20.9% |

| Refi | -30.5% |

| Fixed-Rate | -23.3% |

| ARM | -29.5% |

Purchase activity continues to fall and is about at 2003 levels. So far, August 2006 purchase activity is off 21.2% from August 2005.

Purchase activity continues to fall and is about at 2003 levels. So far, August 2006 purchase activity is off 21.2% from August 2005.Purchase activity was especially strong in the Summer and early Fall of 2005, and that makes the comparisons look ugly. Still, year-to-date purchase activity is off 12.7% compared to 2005 and appears to be getting worse.

Interest rates on a 30 year mortgage have fallen from a peak of 6.86%, just two months ago, to 6.38% last week. These declining rates have probably helped boost refinance activity.