by Calculated Risk on 8/23/2006 12:22:00 AM

Wednesday, August 23, 2006

MBA: Mortgage Rates Decline

The Mortgage Bankers Association (MBA) reports: Mortgage Rates Decline

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 561.5, an increase of 0.1 percent on a seasonally adjusted basis from 561.2 one week earlier. On an unadjusted basis, the Index decreased 1.2 percent compared with the previous week and was down 25.1 percent compared with the same week one year earlier.Mortgage rates declined:

The seasonally-adjusted Purchase Index decreased by 1 percent to 382.2 from 385.9 the previous week and the Refinance Index increased by 1.3 percent to 1608.5 from 1587.5 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.38 percent from 6.54 percent ...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for one-year ARMs decreased to 5.91 percent from 5.97 percent ...

| Total | -25.1% |

| Purchase | -20.9% |

| Refi | -30.5% |

| Fixed-Rate | -23.3% |

| ARM | -29.5% |

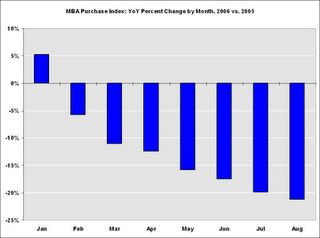

Purchase activity continues to fall and is about at 2003 levels. So far, August 2006 purchase activity is off 21.2% from August 2005.

Purchase activity continues to fall and is about at 2003 levels. So far, August 2006 purchase activity is off 21.2% from August 2005.Purchase activity was especially strong in the Summer and early Fall of 2005, and that makes the comparisons look ugly. Still, year-to-date purchase activity is off 12.7% compared to 2005 and appears to be getting worse.

Interest rates on a 30 year mortgage have fallen from a peak of 6.86%, just two months ago, to 6.38% last week. These declining rates have probably helped boost refinance activity.