by Calculated Risk on 1/31/2011 09:13:00 PM

Monday, January 31, 2011

Auto Sales to Disappoint?

Light vehicle sales for January - to be announced tomorrow - are expected to increase to 12.6 million (Seasonally Adjusted Annual Rate), from 12.5 million in December.

There were a couple of articles out today suggesting sales slowed at the end of the month.

From Bloomberg (ht jb):

Ford Motor Co. said the U.S. industrywide auto sales rate may be lower in January than December ...From Reuters: Auto sales seen losing momentum in January

U.S. auto sales lost momentum in the final weeks of January, auto executives and a leading analyst cautioned on Monday ... J.D. Power forecast a January sales rate of between 11.5 million and 12 million vehicles, down sharply from the outlook for 12.2 million it had given just 10 days before.We will know tomorrow. Blame it on the snow?

... on Monday Chrysler Chief Executive Sergio Marchionne said that industry-wide sales had fallen off in the final weeks of the month, which typically account for the bulk of sales.

"We've seen a softening of the U.S. market in the last couple of weeks," Marchionne told reporters ...

QE2 Speculation and Summary

by Calculated Risk on 1/31/2011 04:40:00 PM

Some random thoughts ...

• QE2 Changes: I'm hearing speculation that the Fed might taper off the QE2 purchases of treasury securities to "promote a smooth transition in markets". Currently the plan is to purchase $600 billion in Treasury securities by the end of Q2 or about $75 billion per month. The speculation is that the size will remain the same ($600 billion), but that the Fed will taper off the purchases through the end of Q3 or so.

That is what the Fed did with previous purchase programs. In August 2009 for Treasury securities:

To promote a smooth transition in markets as these purchases of Treasury securities are completed, the Committee has decided to gradually slow the pace of these transactions and anticipates that the full amount will be purchased by the end of October.And the same decision in September 2009 for MBS:

Committee will gradually slow the pace of these purchases in order to promote a smooth transition in markets and anticipates that they will be executed by the end of the first quarter of 2010.• Egypt. I continue to read the Al Jazeera Egypt live blog (the link changes for each day Egypt time). Hopefully there will be a positive and peaceful outcome for the Egyptian people.

A common email question is about the impact on the U.S. economy. My view is this could impact the U.S. by pushing up oil prices, especially if 1) protests spreads to larger oil producers in the Middle East, or 2) the Suez canal is closed. Both seem unlikely in the short term, although my view could change with events. Oil prices have already risen, also from the WSJ: Brent Crude Tops $100. Here is some analysis from Professor Hamilton at Econbrowser: Geopolitical unrest and world oil markets

• Q4 2010: Homeownership Rate Falls to 1998 Levels

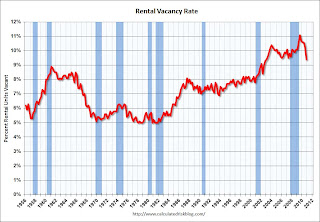

This is based on the Housing Vacancies and Homeownership survey. What is important about this survey is the trends for the homeownership rate, and homeowner and rental vacancy rates. This shows a sharp drop in the rental vacancy rate as many households move from owning to renting and also suggests the excess housing inventory is being absorbed.

In the Graph Gallery: Homeownership rate, Homeowner vacancy rate, Rental vacancy rate.

• The Chicago PMI was Strong, the Dallas Fed Index was Weak. The Chicago PMI is far more useful as an indicator for the economy the the Dallas Fed index, and the Chicago PMI was very strong (including for employment). I expect the ISM manufacturing index tomorrow to show strong expansion in January (similar to December).

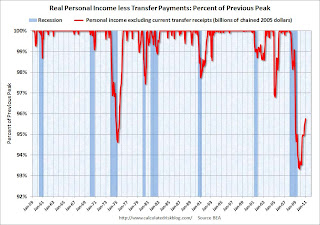

• Personal Income and Outlays Report for December. Includes graph for Real PCE, Personal Saving and Real Personal Income less Transfer Payments. Personal consumption has been increasing faster than personal income - that probably isn't sustainable.

• From the Federal Reserve The January 2011 Senior Loan Officer Opinion Survey on Bank Lending Practices. In general banks have stopped tightening standards (they are already very tight), and demand has stopped falling (there is little demand for loans) - and a special question showed banks are more "upbeat" on delinquencies and charge-offs in 2011 ...

• Some research from the San Francisco Fed: Estimating the Macroeconomic Effects of the Fed's Asset Purchases

• Some research from the Cleveland Fed: High Unemployment after the Recession: Mostly Cyclical, but Adjusting Slowly

And from the weekend:

• Summary for Week ending January 29th

• Schedule for Week of January 30th

• BLS Employment Revisions on Feb 4th

Fed: Little Change in Lending Standards in January Loan Officer Survey, Outlook "more upbeat"

by Calculated Risk on 1/31/2011 02:00:00 PM

In general banks have stopped tightening standards (they are already very tight), and demand has stopped falling (there is little demand for loans) - and a special question showed banks are more "upbeat" on delinquencies and charge-offs ...

From the Federal Reserve The January 2011 Senior Loan Officer Opinion Survey on Bank Lending Practices

Overall, the January survey indicated that a modest net fraction of banks continued to ease standards and terms for commercial and industrial (C&I) loans over the fourth quarter while banks reported small mixed changes in their lending policies for other types of loans to businesses and households. Similarly, the respondents reported a moderate increase in demand for C&I loans but little change, on balance, in demand for other types of loans.And here is a special question "on banks' outlook for asset quality in 2011":

The January survey included a set of special questions that asked banks about their outlook for delinquencies and charge-offs across major loan categories in the current year, assuming that economic activity progresses in line with consensus forecasts. This special question has been asked once each year during the past five years. In the January survey, expectations were significantly more upbeat than in past years. Moderate to large net fractions of banks reported that they expected improvements in delinquency and charge-off rates during 2011 in every major loan category.Here is the full report.

The responses indicated that banks were least likely to expect improvement in the quality of residential real estate loans this year. About 20 percent of banks, on net, reportedly expect improvement in nontraditional closed-end loans, and about 35 percent of banks indicated they expect improvement in HELOCs. Almost 40 percent of respondents expected improvement for prime closed-end loans. Large banks were somewhat more likely than small banks to report expectations of improvement in the quality of residential real estate loans.

The survey also found that about 50 percent of banks, on net, expected improvement this year in the quality of consumer loans, including both credit card loans and other consumer loans. Similarly, about 55 percent of banks, particularly large banks, expected improvement in the quality of CRE loans.

Chicago PMI Strong, Dallas Fed Index Weak

by Calculated Risk on 1/31/2011 12:05:00 PM

From earlier this morning ...

• From the Chicago Business Barometer™ Gained: The overall index increased to 68.8 from 66.8 in December. This was above consensus expectations of 65.0. Note: any number above 50 shows expansion.

"EMPLOYMENT strengthened to a height not seen since May 1984". The employment index increased sharply to 64.1 from 58.4.

"NEW ORDERS increased to the highest point since December 1983". The new orders index increased to 75.7 from 71.3.

This was a strong report.

• From the Dallas Fed: Texas Manufacturing Activity Flat but Six-Month Outlook Improves

Texas factory activity held steady in January, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, came in at zero, suggesting output was unchanged from December.This is the last of the regional Fed surveys for January. The regional surveys provide a hint about the ISM manufacturing index, as the following graph shows.

...

Labor market indicators continued to reflect expansion, although increases in employment and hours worked abated. The employment index came in at a reading of 9 [down from 16.1 in December], with 21 percent of firms reporting hiring compared with 12 percent reporting layoffs. The hours worked index fell from 14 to 4, while the wages and benefits index rose.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The New York and Philly Fed surveys are averaged together (dashed green, through January), and averaged five Fed surveys (blue, through January) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through December (right axis).

The regional surveys suggest the ISM manufacturing index will in the mid-to-high 50s (fairly strong expansion). The ISM index for January will released tomorrow, Feb 1st. The consensus is for an increase to 57.9 from 57.0 in December.

Q4 2010: Homeownership Rate Falls to 1998 Levels

by Calculated Risk on 1/31/2011 10:00:00 AM

The Census Bureau reported the homeownership and vacancy rates for Q4 2010 this morning.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The homeownership rate was at 66.5%, down from 66.9% in Q3. This is at about the level as 1998.

Note: graph starts at 60% to better show the change.

The homeownership rate increased in the '90s and early '00s because of changes in demographics and "innovations" in mortgage lending. Some of the increase due to demographics (older population) will probably stick, so I've been expecting the rate to decline to around 66%, and probably not all the way back to 64%.

A normal rate for recent years appears to be about 1.7%.

This leaves the homeowner vacancy rate about 1.0% above normal. This data is not perfect, but based on the approximately 75 million homeowner occupied homes, we can estimate that there are close to 750 thousand excess vacant homes.

The rental vacancy rate declined sharply to 9.4% in Q4 2010, from 10.3% in Q3 2010.

This decline fits with the Reis apartment vacancy data and the NMHC apartment survey. This report is nationwide and includes homes for rent.

This decline fits with the Reis apartment vacancy data and the NMHC apartment survey. This report is nationwide and includes homes for rent.

It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 42 million rental units in the U.S. If the rental vacancy rate declined from 9.4% to 8%, then 1.4% X 42 million units or about 600 thousand excess units would have to be absorbed.

This suggests there are still about 1.35 million excess housing units. This number has been steadily declining over the last few quarters, but there is still a long way to go.

Note: Some analysts also add in the increase in "held off market, other" units to track the excess housing units - and that has increased from 2.6 million units at the end of 2005 to 3.6 million units at the end of 2010.

Personal Income and Outlays Report for December

by Calculated Risk on 1/31/2011 08:30:00 AM

The BEA released the Personal Income and Outlays report for December this morning.

Personal income increased $54.5 billion, or 0.4 percent ... Personal consumption expenditures (PCE) increased $69.5 billion, or 0.7 percent.The following graph shows real Personal Consumption Expenditures (PCE) through December (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.4 percent in December, compared with an increase of 0.2 percent in November.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter. Consumption picked up sharply in Q4.

Also personal income less transfer payments increased again in December. This increased to $9,327 billion (SAAR, 2005 dollars) from $9,310 billion in November.

This graph shows real personal income less transfer payments as a percent of the previous peak. This has been slow to recover - and is still 4.3% below the previous peak - but personal income less transfer payments is growing again.

This graph shows real personal income less transfer payments as a percent of the previous peak. This has been slow to recover - and is still 4.3% below the previous peak - but personal income less transfer payments is growing again.Some of the increase in spending came from a decline in the personal saving rate that fell to 5.3% in December.

Personal saving as a percentage of disposable personal income was 5.3 percent in December, compared with 5.5 percent in November.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the December Personal Income report.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the December Personal Income report. When the recession began, I expected the saving rate to rise to 8% or more. With a rising saving rate, consumption growth would be below income growth. But that 8% rate was just a guess. It is possible the saving rate has peaked, or it might rise a little further, but either way most of the adjustment has already happened.

There is still a long way to go. I'd like to see personal income less transfer payments above the pre-recession peak, and I'd like to see personal consumption not growing faster than personal income.

Weekend on U.S. economy:

• Summary for Week ending January 29th

• Schedule for Week of January 30th

• BLS Employment Revisions on Feb 4th