by Calculated Risk on 1/29/2011 02:18:00 PM

Saturday, January 29, 2011

Schedule for Week of January 30th

NOTE: The current weekly schedule is available all week in the menu bar above.

The key report for this week will be the January employment report to be released on Friday, Feb 4th.

Other key reports include the quarterly Housing Vacancies and Homeownership report to be released on Monday, the ISM manufacturing index on Tuesday, vehicle sales on Tuesday, and the ISM non-manufacturing (service) index on Thursday. Fed Chairman Ben Bernanke will speak on Thursday.

8:30 AM: Personal Income and Outlays for December. The consensus is for a 0.4% increase in personal income and a 0.5% increase in personal spending, and for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for January. The consensus is for a decrease to a still strong 65.0 (down from 66.8 in December).

10:00 AM: Housing Vacancies and Homeownership report for Q4. This report contains an estimate for the homeownership rate, and for the homeowner and rental vacancy rates.

Click on graphs for larger image in graph gallery.

Click on graphs for larger image in graph gallery.The Q3 2010 homeownership rate was at 66.9% - about the level of early 1999.

For this report, the homeowner vacancy rate was at 2.5% in Q3 2010 (down from a peak of 2.9%) and the rental vacancy rate was at 10.3% in Q3 2010, down from a peak of 11.1%. Both vacancy rates probably fell further in Q4.

10:30 AM: Dallas Fed Manufacturing Survey for January. The Texas production index showed expansion last month (at 12.8), and is expected to show expansion again in January.

12:00 PM: Atlanta Fed President Dennis Lockhart speaks at Miami Dade College

2:00 PM: The January 2011 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve. The October survey showed banks have stopped tightening standards (they are already very tight), and demand has stopped falling (there is little demand for loans).

10:00 AM: ISM Manufacturing Index for January. The consensus is for an increase to 57.9 from 57.0 in December.

10:00 AM: Construction Spending for December. The consensus is for a 0.1% increase in construction spending.

All day: Light vehicle sales for January. Light vehicle sales are expected to increase to 12.6 million (Seasonally Adjusted Annual Rate), from 12.5 million in December.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the December sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the December sales rate. Edmunds is forecasting:

"Edmunds.com analysts predict that January's Seasonally Adjusted Annualized Rate (SAAR) will be 12.57 million, up from 12.48 in December 2010."

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has declined over the last few weeks suggesting weak home sales through the first few months of 2011.

8:15 AM: The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for +150,000 payroll jobs in January, down from the stunning +297,000 jobs reported in December.

5:30 PM: Fed Governor Elizabeth Duke speaks at the University of North Carolina "My Journey from Community Banker to Central Banker"

8:30 AM: The initial weekly unemployment claims report will be released. The number of initial claims had been trending down over the last couple of months, although claims increased sharply last week to 454,000. The consensus is for a decline to 420,000.

10:00 AM: Manufacturers' Shipments, Inventories and Orders for December. The consensus is for a 1.0% increase in orders.

10:00 AM: ISM non-Manufacturing Index for December. The consensus is for a slight decrease to 57.0 from 57.1 in December.

12:30 PM: Fed Chairman Ben Bernanke will speak at the National Press Club Luncheon in Washington, D.C. "The Economic Outlook and Macroeconomic Policies"

8:00 PM: Minneapolis Fed President Narayana Kocherlakota speaks at the University of Minnesota.

8:30 AM: Employment Report for January.

The consensus is for an increase of 150,000 non-farm payroll jobs in January, after the disappointing 103,000 jobs added in December.

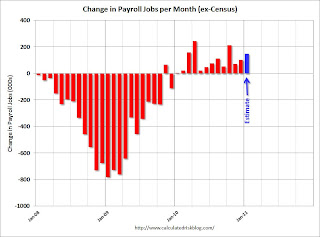

The consensus is for an increase of 150,000 non-farm payroll jobs in January, after the disappointing 103,000 jobs added in December. This graph shows the net payroll jobs per month (excluding temporary Census jobs) since the beginning of the recession. The estimate for January is in blue.

The consensus is for the unemployment rate to increase to 9.5% from 9.4% in December. Note: The annual benchmark revision will be released with this report, and the preliminary estimate "indicates a downward adjustment to March 2010 total nonfarm employment of 366,000."