by Calculated Risk on 1/31/2011 08:30:00 AM

Monday, January 31, 2011

Personal Income and Outlays Report for December

The BEA released the Personal Income and Outlays report for December this morning.

Personal income increased $54.5 billion, or 0.4 percent ... Personal consumption expenditures (PCE) increased $69.5 billion, or 0.7 percent.The following graph shows real Personal Consumption Expenditures (PCE) through December (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.4 percent in December, compared with an increase of 0.2 percent in November.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter. Consumption picked up sharply in Q4.

Also personal income less transfer payments increased again in December. This increased to $9,327 billion (SAAR, 2005 dollars) from $9,310 billion in November.

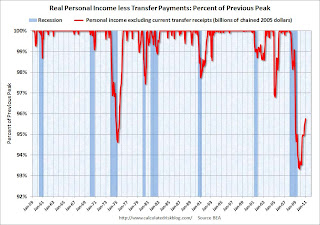

This graph shows real personal income less transfer payments as a percent of the previous peak. This has been slow to recover - and is still 4.3% below the previous peak - but personal income less transfer payments is growing again.

This graph shows real personal income less transfer payments as a percent of the previous peak. This has been slow to recover - and is still 4.3% below the previous peak - but personal income less transfer payments is growing again.Some of the increase in spending came from a decline in the personal saving rate that fell to 5.3% in December.

Personal saving as a percentage of disposable personal income was 5.3 percent in December, compared with 5.5 percent in November.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the December Personal Income report.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the December Personal Income report. When the recession began, I expected the saving rate to rise to 8% or more. With a rising saving rate, consumption growth would be below income growth. But that 8% rate was just a guess. It is possible the saving rate has peaked, or it might rise a little further, but either way most of the adjustment has already happened.

There is still a long way to go. I'd like to see personal income less transfer payments above the pre-recession peak, and I'd like to see personal consumption not growing faster than personal income.

Weekend on U.S. economy:

• Summary for Week ending January 29th

• Schedule for Week of January 30th

• BLS Employment Revisions on Feb 4th