by Calculated Risk on 6/27/2013 03:06:00 PM

Thursday, June 27, 2013

Freddie Mac: Mortgage Rates highest since July 2011

From Freddie Mac today: Mortgage Rates Roiling From Taper Talk

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates jumping along with bond yields amid recent Fed remarks that it could begin tapering its bond purchases later this year. The average 30-year fixed-rate mortgage rose from 3.93 percent last week to 4.46 percent this week; the highest it has been since the week of July 28, 2011. ...Mortgage rates have increased for seven consecutive weeks, and spiked higher last week.

30-year fixed-rate mortgage (FRM) averaged 4.46 percent with an average 0.8 point for the week ending June 27, 2013, up from last week when it averaged 3.93 percent. Last year at this time, the 30-year FRM averaged 3.66 percent.

15-year FRM this week averaged 3.50 percent with an average 0.8 point, up from last week when it averaged 3.04 percent. A year ago at this time, the 15-year FRM averaged 2.94 percent.

This graph shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

Click on graph for larger image.

Click on graph for larger image.Currently the 10 year Treasury yield is 2.48% and 30 year mortgage rates are at 4.46% (according to Freddie Mac). Based on the relationship from the graph, if the ten year yield stays in this range, 30 year mortgage rates might move down next week to 4.4% or so in the Freddie Mac survey.

Note: The yellow markers are for the last three years with the ten year yield below 3%. A trend line through the yellow markers only is a little lower, but still over 4.2% at the current 10 year Treasury yield.

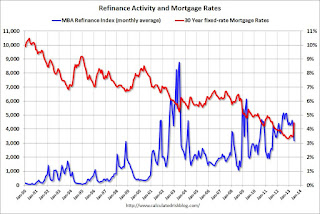

The second graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

The second graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index. The refinance index has dropped sharply recently (down almost 42% over the last 7 weeks) and will probably decline significantly if rates stay at this level.

Kansas City Fed: Regional Manufacturing contracted in June

by Calculated Risk on 6/27/2013 12:29:00 PM

From the Kansas City Fed: Tenth District Manufacturing Survey Fell Modestly

The Federal Reserve Bank of Kansas City released the June Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity fell modestly, although producers’ expectations for future activity continued to increase.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

“We were a bit discouraged to see factory activity decline in June after it expanded slightly in May,” said Wilkerson. “But quite a few contacts lost production or had shipments delayed due to regional storms and flooding, so the downturn appears like it may be temporary.”

The month-over-month composite index was -5 in June, down from 2 in May but equal to -5 in April and March ... Other month-over-month indexes showed mixed results. The production index dropped from 5 to -17, its lowest level since March 2009, and the shipments and new orders indexes also fell markedly. The order backlog and employment indexes increased somewhat but still remain slightly below zero.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through June), and five Fed surveys are averaged (blue, through June) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through May (right axis).

All of the regional surveys - except Kansas City - showed expansion in June, and the Kansas City region was impact by flooding. The ISM index for June will be released Monday, July 1st, and these surveys suggest a reading above 50 (expansion).

Personal Income increase 0.5% in May, Spending increased 0.3%

by Calculated Risk on 6/27/2013 10:33:00 AM

The BEA released the Personal Income and Outlays report for May:

Personal income increased $69.4 billion, or 0.5 percent ... in May, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $29.0 billion, or 0.3 percent.The following graph shows real Personal Consumption Expenditures (PCE) through May (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in May, in contrast to a decrease of 0.1 percent in April. ... The price index for PCE increased 0.1 percent in May, in contrast to a decrease of 0.3 percent in April. The PCE price index, excluding food and energy, increased 0.1 percent, compared with an increase of less than 0.1 percent.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Using the two-month method to estimate Q2 PCE growth (first two months of the quarter), PCE was increasing at a 1.8% annual rate in Q2 2013 (using mid-month method, PCE was increasing at 1.5% rate). This suggests GDP growth will be weaker in Q2 than in Q1.

Last week I posted Four Charts to Track Timing for QE3 Tapering . Here is an update to the inflation charts.

This graph is for PCE prices.

This graph is for PCE prices.The current forecast is for prices to increase 0.8% to 1.2% from Q4 2012 to Q4 2013.

We only have data through May, but so far PCE prices are below this projection - and this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects inflation to pickup, and a key is if the recent decline in inflation is "transitory".

The second graph is for core PCE prices.

The second graph is for core PCE prices.The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

Once again we only have data through May, but so far core PCE prices are below this projection - and, once again, this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects core inflation to pickup too.

It is possible that the FOMC could start to taper QE3 purchases in December, but it would take a pickup in the economy AND an increase in inflation. (September tapering is less likely, but not impossible - but the pickup would have to be significant over the next two months).

NAR: Pending Home Sales index increased in May

by Calculated Risk on 6/27/2013 10:06:00 AM

From the NAR: May Pending Home Sales Reach Highest Level in Over Six Years

The Pending Home Sales Index, a forward-looking indicator based on contract signings, increased 6.7 percent to 112.3 in May from a downwardly revised 105.2 in April, and is 12.1 percent above May 2012 when it was 100.2; the data reflect contracts but not closings.Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in June and July.

Contract activity is at the strongest pace since December 2006 when it reached 112.8; pending sales have been above year-ago levels for the past 25 months.

...

The PHSI in the Northeast was unchanged at 92.3 in May but is 14.3 percent above a year ago. In the Midwest the index jumped 10.2 percent to 115.5 in May and is 22.2 percent higher than May 2012. Pending home sales in the South rose 2.8 percent to an index of 121.8 in May and are 12.3 percent above a year ago. The index in the West jumped 16.0 percent in May to 109.7, but with limited inventory is only 1.1 percent above May 2012.

With limited inventory at the low end and fewer foreclosures, we might see flat existing home sales going forward (the NAR is forecasting a 9% increase this year to 5.07 million sales).

Weekly Initial Unemployment Claims decline to 346,000

by Calculated Risk on 6/27/2013 08:36:00 AM

NOTE: The BEA reported on Personal Income and Outlays for May.

Personal income increased $69.4 billion, or 0.5 percent ... Personal consumption expenditures (PCE) increased $29.0 billion, or 0.3 percent.The consensus was for a 0.2% increase in personal income in May, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.1%. I'll have more on this report soon.

The price index for PCE increased 0.1 percent in May ... The PCE price index, excluding food and energy, increased 0.1 percent

The DOL reports:

In the week ending June 22, the advance figure for seasonally adjusted initial claims was 346,000, a decrease of 9,000 from the previous week's revised figure of 355,000. The 4-week moving average was 345,750, a decrease of 2,750 from the previous week's revised average of 348,500.The previous week was revised up from 354,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 345,750.

The 4-week average has mostly moved sideways over the last few months. Claims were close to the 345,000 consensus forecast.