by Calculated Risk on 4/06/2013 10:23:00 AM

Saturday, April 06, 2013

Schedule for Week of April 7th

Note: I'll post a summary of last week soon.

The key report this week is the March retail sales report on Friday.

The FOMC minutes for the March meeting will be released on Wednesday.

Fed Chairman Ben Bernanke will speak on Monday and Friday (several regional Fed presidents will also speak this week).

7:15 PM ET, Speech by Fed Chairman Ben Bernanke, Stress-Testing Banks: What Have We Learned? , At the 2013 Financial Markets Conference, Atlanta, Georgia

7:30 AM ET: NFIB Small Business Optimism Index for March. The consensus is for a decrease to 90.6 from 90.8 in February.

10:00 AM: Job Openings and Labor Turnover Survey for February from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for February from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in January to 3.693 million, up from 3.612 million in December. number of job openings (yellow) has generally been trending up, and openings are up 8% year-over-year compared to January 2012.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for February. The consensus is for a 0.5% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: FOMC Minutes for Meeting of March 19-20, 2013

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 365 thousand from 385 thousand last week. The "sequester" budget cuts appear to be impacting weekly claims.

8:30 AM: Producer Price Index for March. The consensus is for a 0.2% decrease in producer prices (0.2% increase in core).

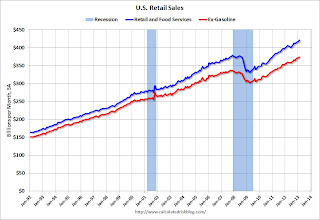

8:30 AM ET: Retail sales for March will be released.

8:30 AM ET: Retail sales for March will be released.This graph shows monthly retail sales and food service, seasonally adjusted (total and ex-gasoline) through February. Retail sales are up 27.2% from the bottom, and now 11.2% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to be unchanged in March (following the large increases in January and February), and to increase 0.1% ex-autos.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for April). The consensus is for a reading of 79.0, up from 78.6.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for February. The consensus is for a 0.4% increase in inventories.

12:30 PM: Speech by Fed Chairman Ben Bernanke, Creating Resilient Communities, At the 2013 Federal Reserve System Community Development Research Conference, Washington, D.C.

Friday, April 05, 2013

Bank Failure #5 in 2013: Gold Canyon Bank, Gold Canyon, Arizona

by Calculated Risk on 4/05/2013 08:35:00 PM

From the FDIC: First Scottsdale Bank, National Association, Scottsdale, Arizona, Assumes All of the Deposits of Gold Canyon Bank, Gold Canyon, Arizona

As of December 31, 2012, Gold Canyon Bank had approximately $45.2 million in total assets and $44.2 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $11.2 million. ... Gold Canyon Bank is the fifth FDIC-insured institution to fail in the nation this year, and the first in Arizona.Hmmm ... someone make a joke about Gold ...

Earlier on the employment report:

• March Employment Report: 88,000 Jobs, 7.6% Unemployment Rate

• Employment Report Comments and more Graphs

• All Employment Graphs

AAR: Rail Traffic "mixed" in March

by Calculated Risk on 4/05/2013 04:30:00 PM

From the Association of American Railroads (AAR): AAR Reports Mixed Rail Traffic for March, Declines for Week Ending March 30

Intermodal traffic in March 2013 totaled 933,208 containers and trailers, up 0.5 percent (4,859 units) compared with March 2012. That percentage increase represents the smallest year-over-year monthly gain for intermodal since August 2011.

Carloads originated in March 2013 totaled 1,117,427, down 0.5 percent (5,969 carloads) compared with the same month last year. While it was a decline, March had the lowest year-over-year monthly dip in carloads since January of 2012. Carloads excluding coal and grain were up 3.4 percent (19,965 carloads) in March 2013 over March 2012.

“U.S. rail traffic continues to mirror the overall economy: not great, not terrible, anticipating a better future,” said AAR Senior Vice President John T. Gray. “Petroleum and petroleum products continues to lead traffic gains, while coal and grain have seen better days. Intermodal volume in March was up just 0.5 percent over last year, but it was still the highest-volume March in history and built on even stronger gains earlier in the quarter.”

emphasis added

Click on graph for larger image.

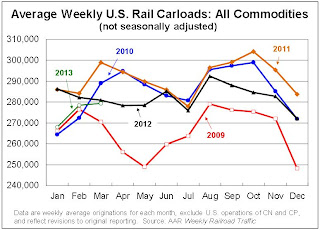

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Green is 2013.

Commodities with the biggest carload increases in March included petroleum and petroleum products, up 54.3 percent or 19,295 carloads; crushed stone, gravel and sand, up 11.9 percent or 8,380 carloads; motor vehicles and parts, up 6.1 percent or 4,127 carloads; and coke, up 11.4 percent or 1,550 carloads. Commodities with carload declines last month included grain, down 20.1 percent or 16,971 carloads; coal, down 2 percent or 8,963 carloads; metallic ores, down 13.2 percent or 2,908 carloads; and chemicals, down 1.3 percent or 1,581 carloads.Note that building related commodities were up.

The second graph is for intermodal traffic (using intermodal or shipping containers):

Graphs and excerpts reprinted with permission.

Graphs and excerpts reprinted with permission.Intermodal traffic was weaker in March, but still on track for a record year in 2013:

After a stellar February, U.S. intermodal traffic came back to earth in March. U.S. railroads originated 933,208 containers and trailers in March 2013, up just 0.5% (4,859 units) over March 2012. (The comparable numbers were 10.5% and 93,231 units in February.) That’s the smallest year-over-year monthly increase since August 2011. On the other hand, March 2013’s weekly average of 233,302 containers and trailers is the highest average for any March in history.Earlier on the employment report:

• March Employment Report: 88,000 Jobs, 7.6% Unemployment Rate

• Employment Report Comments and more Graphs

• All Employment Graphs

Employment Report Comments and more Graphs

by Calculated Risk on 4/05/2013 01:57:00 PM

The 88 thousand payroll jobs added in March is from the establishment survey (a survey of businesses for payroll jobs), but the unemployment rate is from the household survey. To help understand the decline in the unemployment rate, here is some data from the household survey.

The "Population" is the Civilian Noninstitutional Population, or the number of people 16 and over who are "not inmates of institutions (for example, penal and mental facilities and homes for the aged) and who are not on active duty in the Armed Forces". This is increasing every month, and increased 167 thousand in March.

The Civilian Labor Force is based on the percentage of people who say they are either employed or unemployed. This yields the participation rate (the percentage of the civilian noninstitutional population that is in the labor force). The participation rate has declined recently due to both demographic reasons and the weak recovery from the financial crisis. Separating out the two reasons is difficult, see: Understanding the Decline in the Participation Rate and Further Discussion on Labor Force Participation Rate and Labor Force Participation Rate Update.

If the participation rate increases, then it would take more jobs to reduce the unemployment rate. If the participation rate continues to decline (or just flat lines for a couple of years), then it takes fewer jobs to reduce the unemployment rate.

According to the household survey, the economy lost 206 thousand jobs (the establishment survey is MUCH better for payroll jobs added), and there were 290 thousand fewer people unemployed - so the unemployment rate declined to the lowest level since December 2008. We'd prefer to see the unemployment rate decline because of more jobs, as opposed to less participation.

| Employment Status, Household Data (000s) | |||

|---|---|---|---|

| Feb | Mar | Change | |

| Population | 244,828 | 244,995 | 167 |

| Civilian Labor Force | 155,524 | 155,028 | -496 |

| Participation Rate | 63.52% | 63.28% | -0.24% |

| Employed | 143,492 | 143,286 | -206 |

| Unemployed | 12,032 | 11,742 | -290 |

| Unemployment Rate | 7.74% | 7.57% | -0.17% |

Employment-Population Ratio, 25 to 54 years old

Click on graph for larger image.

Click on graph for larger image.Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

This ratio should probably move close to 80% as the economy recovers. The ratio was unchanged at 75.9% in March. The participation rate for this group declined slightly to 81.1%. The decline in the participation rate for this age group is probably mostly due to economic weakness, whereas most of the decline in the overall participation rate is probably due to demographics.

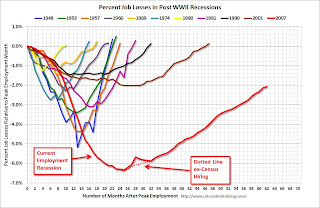

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

This financial crisis recession was much deeper than other post WWII recessions, and the recovery has been slower (the recovery from the 2001 recession was slow too). However, if we compare to other financial crisis recoveries, this recovery has actually been better than most.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) fell by 350,000 over the month to 7.6 million. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers decline in March to 7.64 million from 7.99 million in February. This is the few part time for economic reasons since November 2008.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 13.8% in March. This is the lowest level for U-6 since December 2008.

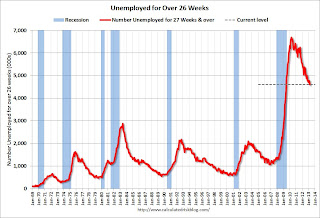

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 4.61 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 4.8 million in February. This is trending down, but is still very high. This is the fewest long term unemployed since June 2009. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In March 2013, state and local governments added 7,000 jobs and state and local employment has increased 8,000 so far in 2013.

I think most of the state and local government layoffs are over. Of course the Federal government layoffs are ongoing with many more layoffs expected due to the sequestration spending cuts.

Overall this was a weak report, but there were a few positives including the upward revisions to the January and February reports, the decline in the long term unemployed, and the decline in part time workers to list a few.

Trade Deficit declined in February to $43 Billion

by Calculated Risk on 4/05/2013 10:55:00 AM

Note: I'll have more on the employment report soon.

The Department of Commerce reported:

[T]otal February exports of $186.0 billion and imports of $228.9 billion resulted in a goods and services deficit of $43.0 billion, down from $44.5 billion in January, revised. February exports were $1.6 billion more than January exports of $184.4 billion. February imports were $0.1 billion more than January imports of $228.9 billion.The trade deficit was below the consensus forecast of $44.8 billion.

The first graph shows the monthly U.S. exports and imports in dollars through January 2013.

Click on graph for larger image.

Click on graph for larger image.Exports increased in February, and imports were essentially flat, so the deficit declined.

Exports are 12% above the pre-recession peak and up 3.2% compared to February 2012; imports are slightly below the pre-recession peak, and up 2% compared to February 2012.

The second graph shows the U.S. trade deficit, with and without petroleum, through February.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The decrease in the trade deficit in February was mostly due to a decrease in the volume of petroleum imports.

Oil averaged $95.96 per barrel in February, up from $94.08 in January, but down from $103.63 in February 2012.

The trade deficit with China increased to $23.4 billion in February, up from $19.4 billion in February 2012. Most of the trade deficit is still due to oil and China.

The trade deficit with the euro area was $8.1 billion in January, up from $5.8 billion in February 2012. This is another sign of weakness in the euro area.

March Employment Report: 88,000 Jobs, 7.6% Unemployment Rate

by Calculated Risk on 4/05/2013 08:30:00 AM

From the BLS:

Nonfarm payroll employment edged up in March (+88,000), and the unemployment rate was little changed at 7.6 percent, the U.S. Bureau of Labor Statistics reported today. ...The headline number was well below expectations of 193,000 payroll jobs added. However employment for January and February were revised higher.

...

The change in total nonfarm payroll employment for January was revised from +119,000 to +148,000, and the change for February was revised from +236,000 to +268,000.

Click on graph for larger image.

Click on graph for larger image.NOTE: This graph is ex-Census meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes.

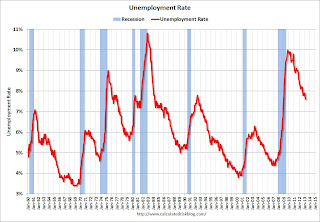

The second graph shows the unemployment rate.

The unemployment rate decreased to 7.6% from 7.7% in February.

The unemployment rate is from the household report and the household report showed a sharp decline in the labor force - and that meant a lower unemployment rate.

The unemployment rate is from the household report and the household report showed a sharp decline in the labor force - and that meant a lower unemployment rate.The labor force (household survey) declined from 155.524 million to 155.028 million - a decline of 496 thousand.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate decreased to 63.3% in March (blue line). This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.The Employment-Population ratio was also declined to 58.5% in March (black line). I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was a disappointing employment report and worse than expectations. I'll have much more later ...

Thursday, April 04, 2013

Friday: Employment Report, Trade Deficit

by Calculated Risk on 4/04/2013 09:06:00 PM

First, from CNBC: Nikkei Surges Past 13,000 on BOJ Surprise

Japan's benchmark Nikkei index traded nearly 4 percent higher on Friday while the yen plunged to a three-and-a-half-year low against the greenback ... The BOJ's shock therapy program to meet its 2 percent inflation target includes doubling the monetary base and purchasing long-dated government bonds. It plans to inject $1.4 trillion into the economy in less than two years.And from the WSJ: Money Spigot Opens Wider

The Bank of Japan's new leaders delivered on their pledge to radically overhaul its strategy to revive Japan's economy, unveiling a package of easy-money policies Thursday so aggressive in scale and tactics that it surprised investors.Friday economic releases:

... "This is an entirely new dimension of monetary easing, both in terms of quantity and quality,'' the Bank of Japan's new governor, Haruhiko Kuroda, said Thursday. The BOJ said the programs would continue at least two years.

The strategy seeks to broadly change Japanese behavior and attitudes that have contributed to depressed spending, wages and prices over the past two decades.

"I will not use my fighting power in an incremental manner," Mr. Kuroda said at a news conference following the central bank's two-day meeting. "Our stance is to take all the policy measures imaginable at this point to achieve the 2% target in two years."

• 8:30 AM ET, the Employment Report for March will be released. The consensus is for an increase of 193,000 non-farm payroll jobs in March; the economy added 236,000 non-farm payroll jobs in February. The consensus is for the unemployment rate to be unchanged at 7.7% in March.

• Also at 8:30 AM, Trade Balance report for February from the Census Bureau. The consensus is for the U.S. trade deficit to increase to $44.8 billion in February from $44.4 billion in January.

• At 3:00 PM, Consumer Credit for February from the Federal Reserve. The consensus is for credit to increase $16.0 billion in February.

Fed's Yellen: Communication in Monetary Policy

by Calculated Risk on 4/04/2013 05:55:00 PM

Fed Vice Chair Janet Yellen gave an overview about the importance of communication in monetary policy today: Communication in Monetary Policy. Here are a few excerpts related to the eventual exit plan:

The Federal Reserve's ongoing asset purchases continually add to the accommodation that the Federal Reserve is providing to help strengthen the economy. An end to those purchases means that the FOMC has ceased augmenting that support, not that it is withdrawing accommodation. When and how to begin actually removing the significant accommodation provided by the Federal Reserve's large holdings of longer-term securities is a separate matter. In its March statement, the FOMC reaffirmed its expectation that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the current asset purchase program ends and the economic recovery has strengthened. Accordingly, there will likely be a substantial period after asset purchases conclude but before the FOMC starts removing accommodation by reducing asset holdings or raising the federal funds rate.Here are the "exit principles" that Yellen discussed from the June 2011 minutes: Exit Strategy Principles.

To guide expectations concerning the process of normalizing the size and composition of the Federal Reserve's balance sheet, at its June 2011 meeting, the FOMC laid out what it called "exit principles." [Note: see below for "exit principles"] In these principles, the FOMC indicated that asset sales would likely follow liftoff of the federal funds rate. It also noted that, in order to minimize the risk of market disruption, the pace of asset sales during this process could be adjusted up or down in response to changes in either the economic outlook or financial conditions. For example, changes in the pace or timing of asset sales might be warranted by concerns over market functioning or excessive volatility in bond markets. While normalization of the Federal Reserve's portfolio is still well in the future, the FOMC is committed to clear communication about the likely path of the balance sheet.

There will come a time when the FOMC begins the process of returning the federal funds rate to a more normal level. In their individual projections submitted for the March FOMC meeting, 13 of the 19 FOMC participants saw the first increase in the target for the federal funds rate as most likely to occur in 2015, and another expected it to occur in 2016. But the course of the economy is uncertain, and the Committee added the thresholds for unemployment and inflation, in part, to help guide the public if economic developments warrant liftoff sooner or later than expected. As the time of the first increase in the federal funds rate moves closer, in my view it will be increasingly important for the Committee to clearly communicate about how the federal funds rate target will be adjusted.

emphasis added

Employment Situation Preview

by Calculated Risk on 4/04/2013 02:13:00 PM

On Friday, at 8:30 AM ET, the BLS will release the employment report for March. The consensus is for an increase of 193,000 non-farm payroll jobs in March, and for the unemployment rate to be unchanged at 7.7%.

Here is a summary of recent data:

• The ADP employment report showed an increase of 158,000 private sector payroll jobs in March. This was below expectations of 205,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, although the methodology changed last year. In general this suggests employment growth below expectations.

• The ISM manufacturing employment index increased in March to 54.2%, up from 52.6% in February. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS reported payroll jobs for manufacturing increased by a few thousand in March.

The ISM non-manufacturing (service) employment index decreased in March to 53.3%, down from 57.2% in February. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for services, suggests that private sector BLS reported payroll jobs for services increased almost 150,000 in March.

Added together, the ISM reports suggests about 150,000 jobs added in March.

• Initial weekly unemployment claims averaged about 354,000 in March. This was about the same as in February.

For the BLS reference week (includes the 12th of the month), initial claims were at 341,000; down from 366,000 in February. The recent increase in claims (probably due to the sequestration budget cuts) was probably before the reference week (when the BLS conducts the employment surveys).

• The final February Reuters / University of Michigan consumer sentiment index increased to 78.6, up from the February reading of 77.6. This is frequently coincident with changes in the labor market and stock market, but also strongly related to gasoline prices and other factors. This might suggest a stronger employment report, but the level still suggests a weak labor market. Note: the preliminary index dipped suggests some weakness mid-month.

• The small business index from Intuit showed 10,000 payroll jobs added, the same as in February. This index remains disappointing.

• And on the unemployment rate from Gallup: Seasonally Unadjusted Unemployment Unchanged in March

Gallup's unadjusted unemployment rate for the U.S. workforce was 8.0% for the month of March, the same as in February, but a modest improvement from 8.4% in March 2012.Note: So far the Gallup numbers haven't been very useful in predicting the BLS unemployment rate.

Gallup's seasonally adjusted U.S. unemployment rate for March was 7.8%, a slight uptick from 7.6% in February, but down since March 2012.

• Conclusion: The employment related data was mixed in March. The ADP and ISM reports suggest a decrease in hiring, the small business index was weak, but weekly claims for the reference week were lower in March than in February when the BLS reported 236,000 payroll jobs were added. There is always some randomness to the employment report, but my guess is the BLS will report somewhat below the consensus of 193,000 jobs added in March.

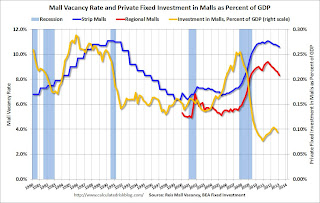

Reis: Mall Vacancy Rate declines in Q1

by Calculated Risk on 4/04/2013 12:02:00 PM

Reis reported that the vacancy rate for regional malls declined to 8.3% in Q1, down from 8.6% in Q4 2012. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate declined slightly to 10.6% in Q1, down from 10.7% in Q4 2012. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Senior Economist Ryan Severino:

[Strip Malls] Yet again, vacancy declined by only 10 bps during the first quarter. Although it is welcome that vacancy continues to decline on an almost quarterly basis, there is still no acceleration in vacancy compression. On a year‐over‐year basis, the vacancy rate declined by only 30 bps. Net absorption continues to outpace new construction, marginally pushing vacancy rates downward. With only 873,000 square feet delivered, even moderate demand for space would result in meaningful declines in the national vacancy rate. Yet despite the dearth of new completions, demand remains insufficient to make a meaningful dent in what is still an elevated vacancy rate.

...

[New construction] With retail sales struggling to recover and muted demand for space, new construction remained near record‐low levels during the quarter. 873,000 square feet were delivered during the first quarter, versus 1.231 million square feet during the fourth quarter. However, this is a slowdown compared to the 2.051 million square feet of retail space that were delivered during the first quarter of 2012. In fact, 873,000 square feet is the fourth‐lowest figure on record since Reis began tracking quarterly data in 1999. With demand for space remaining at abject levels, there exists virtually no incentive to develop new projects. 873,000 square feet is the equivalent of one or two medium‐sized properties.

...

[Regional] Once again, malls outperformed their neighborhood and community shopping center brethren. The national vacancy rate declined by another 30 basis points during the quarter. This is the sixth consecutive quarter with a vacancy decline. Asking rent growth accelerated versus last quarter, growing by another 0.4%. This was the eighth consecutive quarter of asking rent increases. The improvement in mall subsector picked up some pace during the first quarter. The thirty basis point compression in vacancy is the largest since the first quarter of 2003 and the 0.4% asking rent increase is the largest since the first quarter of 2008. However, as we have stated in quarters past, the recovery in the mall subsector is being driven by Dominant/Class A malls, which typically boast luxury retailers and cater to affluent consumers. This belies the fact that the remainder of the mall sector continues to struggle.

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

The yellow line shows mall investment as a percent of GDP through Q4. This has increased from the bottom because this includes renovations and improvements. New mall investment has essentially stopped.

The good news is, as Severino noted, new square footage is near a record low, and with very little new supply, the vacancy rate will probably continue to decline slowly.

Mall vacancy data courtesy of Reis.

Trulia: Asking House Prices increased in March, Rents "flatten"

by Calculated Risk on 4/04/2013 10:00:00 AM

Press Release: Trulia Reports Rents for Single-family Homes Flatten Nationwide

Heading into the spring house hunting season, asking home prices rose 7.2 percent year-over-year (Y-o-Y) nationally in March. Seasonally adjusted, prices rose 1.1 percent month-over-month and 3.5 percent quarter-over-quarter. Regionally, prices rose in 91 of the 100 largest metros.On rents, this is similar to the Reis report yesterday on apartments. It appears that rent increases are slowing.

Nearly 4 million more single-family homes have been added to the rental market since 2005 . This new supply has fully caught up with the increased rental demand during the housing crisis – causing single-family home rents to flatten nationwide. Nationally, rents rose 2.4 percent Y-o-Y. For apartments only rents rose 2.9 percent Y-o-Y, while rents for single-family homes were flat, rising just 0.1 percent Y-o-Y. In Las Vegas, Orange County, Los Angeles, Atlanta, and Phoenix, where investors have actively bought and rented out single-family homes, rents are either falling or flat.

...

“Investors bought up cheap houses in hard-hit markets and rented them out to people who lost their homes to foreclosure or delayed first-time homeownership,” said Jed Kolko, Trulia’s Chief Economist. “With four million more rental homes now than during the bubble, supply has expanded to meet demand, and rents are flat or falling in markets where investors are most active.”

Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a seasonally adjusted basis.

Weekly Initial Unemployment Claims increase to 385,000

by Calculated Risk on 4/04/2013 08:37:00 AM

The DOL reports:

In the week ending March 30, the advance figure for seasonally adjusted initial claims was 385,000, an increase of 28,000 from the previous week's unrevised figure of 357,000. The 4-week moving average was 354,250, an increase of 11,250 from the previous week's unrevised average of 343,000.The previous week was unrevised at 357,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 354,250 - the highest level since February.

Weekly claims were above the 350,000 consensus forecast. Note: This appears to be the beginning of the impact of the "sequestration" budget cuts.

Wednesday, April 03, 2013

Thursday: Weekly Unemployment Claims, Mall Vacancy Survey

by Calculated Risk on 4/03/2013 10:28:00 PM

On the March employment report from economist Sven Jari Stehn at Goldman Sachs:

Our forecast for the March employment report is a 175,000 gain in nonfarm payrolls (below the current Bloomberg consensus of a 195,000 gain), a stable 7.7% unemployment rate (in line with the consensus), and a 0.1% gain in average hourly earnings (below the consensus of 0.2%). The reasoning for our below-consensus payroll forecast is threefold.I'll post an employment preview tomorrow.

1. The tone of the March US labor market indicators has, on balance, softened. ...

2. Special factors are likely to weigh on March payrolls. We expect a small hit of roughly 10,000 from sequestration in Friday's report. ... Separately, a negative contribution from the normalization of February's outsized employment gain in motion picture and sound recording industries appears likely. ...

3. Payrolls have outpaced broader labor market measures. ... While actual payroll growth has averaged around 200,000 over the last four months, the broader labor market dataflow has only been consistent with payroll growth of around 150,000 during this period.

Thursday economic releases:

• 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 350 thousand from 357 thousand last week. The "sequester" budget cuts appear to be impacting weekly claims.

• Early, Reis Q1 2013 Mall Survey of rents and vacancy rates will be released.

• At 10:00 AM, Trulia House Price Rent Monitors for March. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• At 5:00 PM, Speech by Fed Vice Chair Janet Yellen, Communication in Monetary Policy, At the 50th Anniversary Conference of the Society of American Business Editors and Writers, Washington, D.C.

Fannie Mae: Mortgage Serious Delinquency rate declined in February, Lowest since February 2009

by Calculated Risk on 4/03/2013 05:18:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in February to 3.13% from 3.18% in January. The serious delinquency rate is down from 3.82% in February 2012, and this is the lowest level since February 2009.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Earlier Freddie Mac reported that the Single-Family serious delinquency rate declined in February to 3.15% from 3.20% in January. Freddie's rate is down from 3.57% in February 2012, and this is the lowest level since July 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

Although this indicates some progress, the "normal" serious delinquency rate is under 1%. At the recent pace of improvement, it will take several years until the rates are back to normal. At the recent rate of improvement, the serious delinquency rate will be under 1% in 2017 or so.

Fed's Williams: Expects to Meet "test for substantial improvement in the outlook for the labor market by this summer"

by Calculated Risk on 4/03/2013 04:05:00 PM

From San Francisco Fed President John Williams: The Economy and the Federal Reserve: Real Progress, but Too Soon to Relax

In the statement issued following the March meeting, our policy committee, the Federal Open Market Committee, or FOMC, stated that it would continue its securities purchases “until the outlook for the labor market has improved substantially in a context of price stability.” It also stated that “in determining the size, pace, and composition of its asset purchases, the Committee will continue to take appropriate account of the likely efficacy and costs of such purchases as well as the extent of progress toward its economic objectives.”Williams is a key player on the FOMC and I always pay attention to his remarks. Of course the economy could weaken over the next few months, as Williams notes: "There are still obstacles to our progress, including the effects of budget cuts coming out of Washington and the sluggish recovery plaguing many of our trading partners abroad, especially in Europe." - but it is possible that the FOMC will start to reduce their asset purchases later this year.

So, what does that mean? I see the benefits of our asset purchases continuing to outweigh the costs by a large margin. I expect that continued asset purchases will be appropriate well into the second half of this year. In making this assessment, I don’t have a specific unemployment or job-gain threshold in mind for cutting back or ending these purchases. Instead, I’m looking for convincing evidence of sustained, ongoing improvement in the labor market and economy. The latest economic news has been encouraging. But it will take more solid evidence to convince me that it’s time to trim our asset purchases. An important rule in both forecasting and policymaking is not to overreact to what may turn out to be just a blip in the data. But, assuming my economic forecast holds true, I expect we will meet the test for substantial improvement in the outlook for the labor market by this summer. If that happens, we could start tapering our purchases then. If all goes as hoped, we could end the purchase program sometime late this year.

It’s important to note that tapering our purchases and even ending the purchase program doesn’t mean that we are removing all the monetary stimulus that comes from our longer-term securities holdings. Instead, even as we cut back our purchases, we’re still adding monetary accommodation and exerting greater downward pressure on interest rates. Economic theory and real-world evidence indicate that it’s not the pace at which we buy securities that matters for influencing financial conditions. Rather, it’s the size and composition of the assets we hold on our balance sheet. So, even when we stop adding to our portfolio, it doesn’t mean we’re tightening policy.

emphasis added

Reis: Apartment Vacancy Rate declined to 4.3% in Q1 2013

by Calculated Risk on 4/03/2013 01:06:00 PM

Reis reported that the apartment vacancy rate fell to 4.3% in Q1, down from 4.5% in Q4 2012. The vacancy rate was at 5.0% in Q1 2012 and peaked at 8.0% at the end of 2009.

Some data and comments from Reis VP of Research Victor Calanog:

Vacancy fell by 20 basis points in the first quarter, dipping to 4.3%. Over the last four quarters, national vacancies have declined by 70 basis points, a far faster pace than any other sector in commercial real estate. The vacancy rate has now fallen by 370 basis points since the cyclical peak of 8.0% observed right after the recession winded down in late 2009. By contrast, office sector vacancies have only fallen by a paltry 60 basis points since fundamentals began recovering five quarters ago.

The sector absorbed over 36,000 units in the first quarter, a relatively healthy rate comparable to the rise in occupied stock from one year ago (in 2012Q1). Deliveries have remained modest at 13,706 units, representing roughly the same pace of inventory growth as previous first quarter periods over the last two years.

Apartment landlords have another quarter or two to enjoy tight supply growth before a large number of new properties come online. Over 100,000 units are expected to enter the market, most scheduled to open their doors in the latter half of the year. With home prices recovering and mortgage rates staying low, it remains to be seen whether demand for apartments will continue to push vacancies down once inventory growth ramps up.

Asking and effective rents both grew by 0.5% during the first quarter. This is the slowest rate of growth for both asking and effective rents since the fourth quarter of 2011; every single quarterly data point in 2012 showed stronger asking and effective rent growth versus what was observed in the current quarter. What does this mean?

Optimists will point out that the first quarter tends to be weak, as most households move during the second and third quarters and bolster leasing activity and rent increases. The seasonal waxing and waning in rent growth was evident in the prior year, when the strongest periods centered around the second and third quarters.

However, given how tight vacancies have become, rent growth ought to be stronger (for perspective, in prior periods when vacancies were in the low to mid‐4s, annual rent growth was well above 4%). Analysts have wondered how rents could keep climbing when jobs are being created at a sluggish rate and wage growth has been relatively stagnant: all of Reis's major markets now boast rent levels well beyond peaks achieved prior to the recession. One answer is that the moribund housing market left households with little choice but to absorb rent hikes, but with the housing market now recovering, does that mean the tide is turning against landlords?

The next few quarters will test the robustness of apartment fundamentals in the face of rising supply growth and rent levels that may have climbed to unsustainable levels.

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

This was another strong quarter for apartments with the vacancy rate falling and rents rising. With more supply coming online later this year, the decline in the vacancy rate should slow.

Apartment vacancy data courtesy of Reis.

ISM Non-Manufacturing Index indicates slower expansion in March

by Calculated Risk on 4/03/2013 10:05:00 AM

The March ISM Non-manufacturing index was at 54.4%, down from 56.0% in February. The employment index decreased in March to 53.3%, down from 57.2% in February. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: March 2013 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in March for the 39th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 54.4 percent in March, 1.6 percentage points lower than the 56 percent registered in February. This indicates continued growth at a slightly slower rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 56.5 percent, which is 0.4 percentage point lower than the 56.9 percent reported in February, reflecting growth for the 44th consecutive month. The New Orders Index decreased by 3.6 percentage points to 54.6 percent, and the Employment Index decreased 3.9 percentage points to 53.3 percent, indicating growth in employment for the eighth consecutive month. The Prices Index decreased 5.8 percentage points to 55.9 percent, indicating prices increased at a slower rate in March when compared to February. According to the NMI™, 15 non-manufacturing industries reported growth in March. The majority of respondents' comments continue to be positive about business conditions; however, there is an underlying concern regarding the uncertainty of the future economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 56.0% and indicates slower expansion in March than in February.

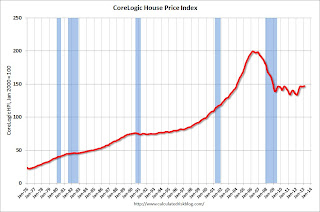

CoreLogic: House Prices up 10.2% Year-over-year in February

by Calculated Risk on 4/03/2013 08:58:00 AM

Notes: This CoreLogic House Price Index report is for February. The recent Case-Shiller index release was for January. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Home Price Index Rises by 10.2 Percent Year Over Year in February: The Biggest Increase in Nearly Seven Years

Home prices nationwide, including distressed sales, increased 10.2 percent on a year-over-year basis by in February 2013 compared to February 2012. This change represents the biggest year-over-year increase since March 2006 and the 12th consecutive monthly increase in home prices nationally. On a month-over-month basis, including distressed sales, home prices increased by 0.5 percent in February 2013 compared to January 2013.

Excluding distressed sales, home prices increased on a year-over-year basis by 10.1 percent in February 2013 compared to February 2012. On a month-over-month basis, excluding distressed sales, home prices increased 1.5 percent in February 2013 compared to January 2013. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that March 2013 home prices, including distressed sales, are also expected to rise by 10.2 percent on a year-over-year basis from March 2012 and rise by 1.2 percent on a month-over-month basis from February 2013.

...

“The rebound in prices is heavily driven by western states. Eight of the top ten highest appreciating large markets are in California, with Phoenix and Las Vegas rounding out the list,” said Dr. Mark Fleming, chief economist for CoreLogic.

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.5% in February, and is up 10.2% over the last year.

The index is off 26.3% from the peak - and is up 10.2% from the post-bubble low set in February 2012.

The second graph is from CoreLogic. The year-over-year comparison has been positive for twelve consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for twelve consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).This is the largest year-over-year increase since 2006.

Since this index is not seasonally adjusted, it was expected to be flat or decline on a month-to-month basis in February - instead the index increased, and, considering seasonal factors, this month-to-month increase was very strong.

ADP: Private Employment increased 158,000 in March

by Calculated Risk on 4/03/2013 08:19:00 AM

Private sector employment increased by 158,000 jobs from February to March, according to the March ADP National Employment Report®, which is produced by ADP® ... in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis. Revisions to job gains in the two prior months were offsetting; February’s gain of 198,000 jobs was revised up by 39,000 to 237,000, and January’s 215,000 gain was revised down by 38,000 to 177,000.This was below the consensus forecast for 205,000 private sector jobs added in the ADP report. Note: The BLS reports on Friday, and the consensus is for an increase of 193,000 payroll jobs in March, on a seasonally adjusted (SA) basis.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth moderated in March. Construction employment gains paused as the rebuilding surge in the wake of Superstorm Sandy ended. Anticipation of Health Care Reform may also be weighing on employment at companies with close to 50 employees. The job market continues to improve, but in fits and starts.”

Note: ADP hasn't been very useful in predicting the BLS report.

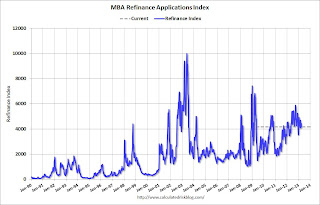

MBA: Mortgage Purchase Applications increase, Refinance Applications decrease

by Calculated Risk on 4/03/2013 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 6 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier.

...

“Total purchase applications increased last week, due to an almost 7 percent increase in purchase applications for government loans. This was likely driven by borrowers applying for loans prior to the scheduled increase in FHA premiums that took effect on April 1,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “On a year over year basis, purchase applications are up about 4 percent, in line with the trend we are seeing in home sales volumes.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.76 percent from 3.79 percent, with points decreasing to 0.43 from 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year.

Refinance activity will probably slow in 2013.

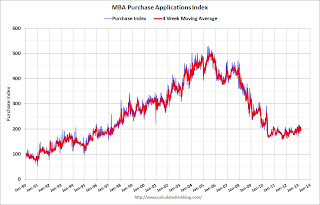

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last year.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last year.