by Calculated Risk on 4/03/2013 07:00:00 AM

Wednesday, April 03, 2013

MBA: Mortgage Purchase Applications increase, Refinance Applications decrease

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

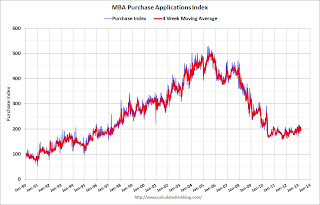

The Refinance Index decreased 6 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier.

...

“Total purchase applications increased last week, due to an almost 7 percent increase in purchase applications for government loans. This was likely driven by borrowers applying for loans prior to the scheduled increase in FHA premiums that took effect on April 1,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “On a year over year basis, purchase applications are up about 4 percent, in line with the trend we are seeing in home sales volumes.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.76 percent from 3.79 percent, with points decreasing to 0.43 from 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

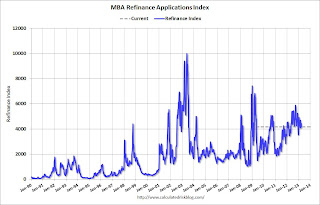

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year.

Refinance activity will probably slow in 2013.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last year.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last year.