by Calculated Risk on 3/13/2013 05:37:00 PM

Wednesday, March 13, 2013

DataQuick: February Home Sales in SoCal highest in Six Years, Strong Investor Buying

One of the housing markets I follow closely is southern California. I highlighted a couple of key points in this article: 1) Activity is picking up, especially in the move-up markets, 2) there is evidence of strong investor buying, and 3) foreclosure resales are at the lowest level since 2007.

From DataQuick: Southland Home Sales at Six-Year High; Median Price Up Again Yr/Yr

Southern California logged the highest February home sales in six years last month amid relatively strong sales of mid- to high-end properties and a record share of homes sold to absentee buyers. ...Cash buying is strong in many areas. Economist Tom Lawler sent me the following comments and table today. From Tom Lawler:

A total of 15,945 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 0.7 percent from 16,058 sales in January, and up 1.0 percent from 15,780 sales in February 2012, according to San Diego-based DataQuick. ... Last month’s sales were the highest for the month of February since 17,680 homes sold in February 2007, but they were 9.9 percent below the February average of 17,696 sales. The low for February sales was 10,777 in 2008, while the high was 26,587 in 2004.

“Our January and February stats certainly indicate housing remains a big target for investors. But typically those two months don't offer much insight into how the market will behave the rest of the year. These are sales that closed in January and February, meaning many of the buyers were out home shopping during the holiday season late last year. That's when many traditional buyers and sellers drop out of the market, leaving a relatively high concentration of very motivated market participants, especially investors,” said John Walsh, DataQuick president.

“March and April will offer a better view of how broader market trends are shaping up this year. One of the real wild cards will be how many more homes go up for sale. More people who've long been thinking of selling will be tempted to list their homes at today's higher prices. Fewer people will be underwater and therefore could at least break even on a sale. Some investors who've held for a while will consider cashing in. A meaningful rise in the supply of homes on the market should at least tame price appreciation.”

Move-up markets continued to show big sales gains from a year earlier. The number of homes sold in February for between $300,000 and $800,000 – a range that would include many first-time move-up buyers – rose 33.4 percent year-over-year. The number that sold for $500,000 or more jumped 54.0 percent from one year earlier, while sales of $800,000-plus homes increased 62.7 percent compared with February 2012.

Last month foreclosure resales – properties foreclosed on in the prior 12 months – accounted for 15.8 percent of the Southland resale market. That was down from a revised 17.2 percent the month before and down from 32.6 percent a year earlier. In recent months foreclosure resales have been at the lowest level since September 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 22.0 percent of Southland resales last month. That was down from an estimated 24.0 percent the month before and 26.9 percent a year earlier.

Investor and cash buying was at or near all-time highs.

Absentee buyers – mostly investors and some second-home purchasers – bought a record 31.4 percent of the Southland homes sold in February. That was up from 30.4 percent the prior month and up from 29.9 percent a year earlier. ... Buyers paying with cash accounted for 35.6 percent of last month's home sales, compared with 33.7 percent both the month before and a year earlier. The peak was 35.8 percent last December.

Emphasis added

"While distressed sales, and especially foreclosure sales, have fallen considerably in most markets over the last year, the all-cash share of transactions in aggregate doesn’t appear to have fallen, and in some markets it has even reason. This suggests that investor buying of non-distressed properties has increased significantly over the last year.

(Note: all save for So. California are MLS based; also, the Las Vegas number for February 2013 is an estimate based on press reports that the all-cash share last month was “nearly” 60%. For some reason the GLVAR has stopped posting its press release on monthly sales)"

| All Cash Home Sales | ||

|---|---|---|

| 13-Feb | 12-Feb | |

| Las Vegas | 59.5% | 53.2% |

| Toledo | 46.7% | 48.7% |

| Phoenix | 46.1% | 49.9% |

| Sacramento | 39.5% | 33.7% |

| So. Cal (DQ) | 35.6% | 33.7% |

| Des Moines | 21.9% | 28.8% |

| Mid-Atlantic | 22.8% | 23.5% |

| Tucson | 39.5% | 39.0% |

| Omaha | 24.1% | 22.7% |

FHFA: Over 1 Million HARP Refinances in 2012

by Calculated Risk on 3/13/2013 03:23:00 PM

Note: HARP is the program that allows borrowers with loans owned or guaranteed by Fannie Mae or Freddie Mac - and with high loan-to-value (LTV) ratios - to refinance at low rates. Fannie or Freddie are already responsible for the loan, and allowing the borrower to refinance lowers the default risk.

From the FHFA:

The Federal Housing Finance Agency (FHFA) today released its December 2012 Refinance Report, which shows that with the number of mortgages refinanced through the Home Affordable Refinance Program (HARP) in the fourth quarter, nearly 1.1 million HARP refinances were completed in 2012 and nearly 2.2 million were completed since HARP was implemented in April 2009. The 2012 HARP performance surpassed previous estimates for the program.Note: the automated system wasn't released until the end of March - and there were some issues with that system - so HARP refinances didn't really pickup until sometime in Q2. This program saw more participation than most analysts expected (I was more optimistic).

...

In December, 25 percent of loans refinanced through HARP had loan-to-value ratios greater than 125 percent.

In December, 18 percent of HARP refinances for underwater borrowers were for shorter-term 15- and 20-year mortgages, which build equity faster than traditional 30-year mortgages.

These "underwater" borrowers are current (most took out loans 5 to 7 years ago), and they will probably stay current with the lower interest rate.

This table shows the number of HARP refinances by LTV in 2012 compared to 2011. Clearly there was a sharp increase in activity. Note: Here is the December report.

| HARP Activity | |||

|---|---|---|---|

| 2012 | 2011 | Since Inception | |

| Total HARP | 1,074,755 | 438,228 | 2,165,021 |

| LTV >80% to 105% | 605,946 | 373,093 | 1,598,978 |

| LTV >105% to 125% | 240,665 | 65,135 | 337,899 |

| LTV >125% | 228,144 | 0 | 228,144 |

Zillow forecasts Case-Shiller House Price index to increase 8.0% Year-over-year for January

by Calculated Risk on 3/13/2013 12:37:00 PM

The Case-Shiller house price indexes for January will be released Tuesday, March 26th. Zillow has started forecasting the Case-Shiller almost a month early - and I like to check the Zillow forecasts since they have been pretty close.

Zillow Forecast: January Case-Shiller Composite-20 Will Be Up 8% Year-Over-Year

[W]e predict that next month’s Case-Shiller data (January 2013) will show that the 20-City Composite Home Price Index (non-seasonally adjusted [NSA]) increased 8.0 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) increased 7.2 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from December to January will be 0.8 percent for both the 20-City Composite and the 10-City Composite Home Price Indices (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for January will not be released until Tuesday, March 26th.The following table shows the Zillow forecast for January.

...

To forecast the Case-Shiller indices we use past data from Case-Shiller, as well as the Zillow Home Value Index (ZHVI), which is available more than a month in advance of Case-Shiller numbers, paired with foreclosure resale numbers, which we also have available more than a month prior to Case-Shiller numbers. Together, these data points enable us to reliably forecast the Case-Shiller 10-City and 20-City Composite indices. The ZHVI does not include foreclosure resales and shows home values for January 2013 up 6.2 percent from year-ago levels. We expect home value appreciation to moderate in 2013, rising only 3.3 percent from January 2013 to January 2014. Further details on our forecast can be found here and Zillow’s full January 2013 report can be found here.

| Zillow January Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | Jan 2012 | 147.99 | 149.47 | 135.22 | 136.75 |

| Case-Shiller (last month) | Dec 2012 | 158.49 | 158.73 | 145.95 | 146.26 |

| Zillow Forecast | YoY | 7.2% | 7.2% | 8.0% | 8.0% |

| MoM | 0.1% | 0.8% | 0.0% | 0.8% | |

| Zillow Forecasts1 | 158.6 | 160.1 | 146.0 | 147.6 | |

| Current Post Bubble Low | 146.46 | 149.47 | 134.07 | 136.75 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 8.3% | 7.1% | 8.9% | 7.9% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Retail Sales increased 1.1% in February

by Calculated Risk on 3/13/2013 08:45:00 AM

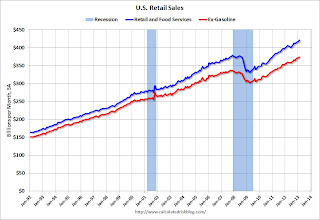

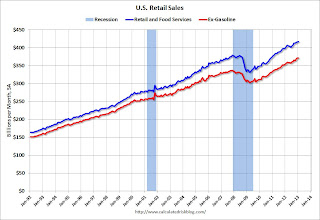

On a monthly basis, retail sales increased 1.1% from January to February (seasonally adjusted), and sales were up 4.6% from February 2012. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for February, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $421.4 billion, an increase of 1.1 percent from the previous month and 4.6 percent (±0.7%) above February 2012. ...The December 2012 to January 2013 percent change was revised from +0.1 percent to +0.2 percent.

Click on graph for larger image.

Click on graph for larger image.Sales for December were revised up to a 0.2% gain.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 27.2% from the bottom, and now 11.2% above the pre-recession peak (not inflation adjusted)

Retail sales ex-autos increased 1.0%. Retail sales ex-gasoline increased 0.6%.

Excluding gasoline, retail sales are up 23.5% from the bottom, and now 11.0% above the pre-recession peak (not inflation adjusted).

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.Retail sales ex-gasoline increased by 4.8% on a YoY basis (4.6% for all retail sales).

This was above the consensus forecast of a 0.5% increase. Although higher gasoline prices boosted sales, retail sales ex-gasoline increased 0.6% - suggesting some pickup in the economy in February.

MBA: Mortgage Applications decrease, Mortgage Rates highest since August 2012

by Calculated Risk on 3/13/2013 07:00:00 AM

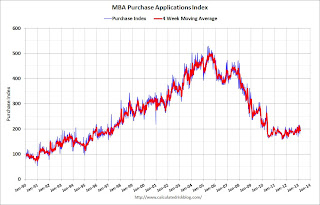

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 5 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier.

...

“The announcement of stronger than anticipated job growth last week led to an increase in interest rates, with the 30 year fixed mortgage rate in our survey reaching the highest level in more than six months,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “Refinance applications declined as a result, but remain high given the steady flow of HARP applications.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.81 percent, the highest rate since August 2012, from 3.70 percent, with points remaining unchanged at 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year, and 76 percent of all mortgage applications are for refinancing.

Refinance activity will probably slow in 2013.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last six months.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last six months.This index will probably continue to increase as conventional home purchase activity increases.

Tuesday, March 12, 2013

Wednesday: Retail Sales

by Calculated Risk on 3/12/2013 08:59:00 PM

Retail sales for February will be released tomorrow. One of the key questions is how much the payroll tax hike is slowing personal consumption expenditures this year, and the report tomorrow might give some hints.

However, since gasoline prices increased sharply in February (from an average of $3.39 per gallon in January to $3.74 per gallon in February), gasoline sales will push up the headline number for retail sales - so it will be important to look at the details.

Another complicating factor is that the fiscal agreement was reached at a very late date, delaying tax refunds this year - and that has impacted sales at some retailers such as Walmart.

From Merrill Lynch analysts on retail sales:

We expect a weak retail sales report in February. Although the headline should show modest improvement in spending, the guts of the report likely will reveal weakness. We forecast total retail sales to increase 0.6%, owing to higher gasoline prices and a pickup in building material sales. Core control retail sales, which nets out autos, gasoline and building materials, is likely to decline 0.3%. ... There are four factors weighing on consumption in February: delayed tax refunds, burden of higher gasoline prices, poor weather conditions and lower take-home pay from the payroll tax hike in January. ... Looking ahead, a key question will be whether this softness in consumer spending persists. This likely will be determined by the pace of job growth, and hence labor income, and the impact of wealth appreciation on consumer confidence. In our view, the risk is that consumer spending will remain sluggish over the next few months.Wednesday economic releases:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for February will be released. The consensus is for retail sales to increase 0.5% in February (boosted by higher gasoline prices), and to increase 0.5% ex-autos.

• At 10:00 AM, the Manufacturing and Trade: Inventories and Sales (business inventories) report for January. The consensus is for a 0.3% increase in inventories.

Jim the Realtor: Here is what it looks like at an open house

by Calculated Risk on 3/12/2013 06:47:00 PM

Long time readers remembers when Jim the Realtor brought us stories of all the foreclosures in San Diego. Times have changed. The video today shows the buying frenzy ... amazing.

Q4 2012: Mortgage Equity Withdrawal less negative

by Calculated Risk on 3/12/2013 03:41:00 PM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW", but there is little MEW right now - and normal principal payments and debt cancellation.

For Q4 2012, the Net Equity Extraction was minus $34 billion, or a negative 1.1% of Disposable Personal Income (DPI). This is the smallest negative "MEW" since Q1 2009. This is not seasonally adjusted.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

There are smaller seasonal swings right now, perhaps because there is a little actual MEW (this is heavily impacted by debt cancellation right now).

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding declined slowly in Q4. Mortgage debt has declined by $1.2 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance. With residential investment increasing, and a slower rate of debt cancellation, it is possible that MEW will turn positive again in the next few quarters.

For reference:

Dr. James Kennedy also has a new method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

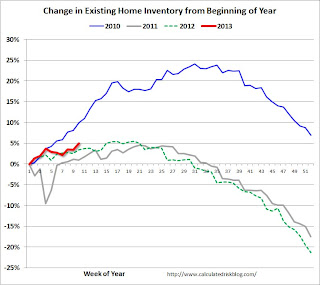

Existing Home Inventory is up 5.0% year-to-date on March 11th

by Calculated Risk on 3/12/2013 12:55:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly this year.

In normal times, there is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The NAR data is monthly and released with a lag. However Ben at Housing Tracker (Department of Numbers) kindly sent me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year.

In 2010 (blue), inventory followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

So far - through March 11th - it appears inventory is increasing at a sluggish rate. Housing Tracker reports inventory is down -22.7% compared to the same week in 2012 - still falling fast year-over-year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

The key will be to see how much inventory increases over the next few months. In 2010, inventory was up 8% by early March, and up 15% by the end of March.

For 2011 and 2012, inventory only increased about 5% at the peak and then declined for the remainder of the year.

So far in 2013, inventory is up 5.0%. I expect smaller year-over-year declines in inventory all through the year, but right now I think inventory will not bottom until 2014.

BLS: Job Openings "little changed" in January

by Calculated Risk on 3/12/2013 10:18:00 AM

From the BLS: Job Openings and Labor Turnover Summary

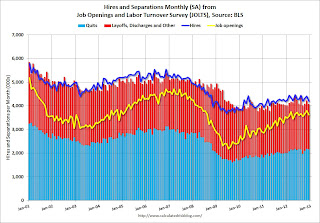

There were 3.7 million job openings on the last business day of January, little changed from December, the U.S. Bureau of Labor Statistics reported today. The hires rate (3.1 percent) and separations rate (3.0 percent) also were little changed in January. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... In January, the quits rate was unchanged at 1.6 percent. The quits rate edged up for total private in January but was unchanged for government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for January, the most recent employment report was for February.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in January to 3.693 million, up from 3.612 million in December. The number of job openings (yellow) has generally been trending up, and openings are up 8% year-over-year compared to January 2012.

Quits increased in January, and quits are up 13% year-over-year and at the highest level since 2008. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report, but the trend suggests a gradually improving labor market.

NFIB: Small Business Optimism Index increases in February, Still Low

by Calculated Risk on 3/12/2013 09:08:00 AM

From the National Federation of Independent Business (NFIB): Small Business Confidence Improves a Bit

The NFIB Small Business Optimism Index increased 1.9 points in February to 90.8. While a nice improvement over the last several reports, the Index remains on par with the 2008 average and below the trough of the 1991-92 and 2001-02 recessions. The direction of February’s change is positive, but not indicative of a surge in confidence among small-business owners. ...

Weak sales is still the top business problem for 18% of owners.

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index increased to 90.8 in February from 88.9 in January.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy. Lack of demand remains the main problem for small business owners.

Monday, March 11, 2013

Tuesday: JOLTS, Small Business Confidence

by Calculated Risk on 3/11/2013 08:17:00 PM

Here is Nomura's current US outlook:

Activity: In the 3 1/2 years since the Great Recession ended, real GDP has grown at a lackluster 2.1% pace and is tracking close to that pace in Q1 2013.Nomura is projecting real GDP to increase 1.9% in 2013 (another sluggish year), and for the unemployment rate to fall to 7.5% in Q4. For housing starts, Nomura is forecasting an increase to 1.02 million starts from 780 thousand in 2012 (a 30% increase).

Lower-income households are in the process of ratcheting down spending in response to a higher tax burden, but aggregate demand is being held up by higher-income spenders reacting to rising wealth from equities and real estate. Fiscal policy remains a source of uncertainty for the outlook, but risks of a policy misstep have diminished. Our forecast for the US economy assumes that half of the 1 March spending cuts will be implemented this year, but it is looking more likely that the full sequester will remain in place. If so, our assumptions for government spending will need to be revisited. Congress is working to complete a continuing resolution (CR) before the 22 March Easter holiday break. The CR is expected to fund the federal government through the end of this fiscal year (30 September).

Providing a buffer against fiscal headwinds, the housing recovery continues to deepen. Home price increases are providing support for household confidence and we expect the wealth effect from real estate to help support aggregate demand.

Inflation: Our forecast for consumer price inflation to remain below 2% for the forecast horizon reflects the effects of a substantial output gap that has emerged from three years of sub-par growth in the economy, and limited risks from commodity prices.

Policy: We expect the FOMC to maintain its current longer-term asset purchase program through Q3 2013, and then begin to taper purchases as the recovery strengthens and outlook improves convincingly. Upcoming negotiations in Washington over the reprogramming of spending cuts and the budget are likely to prove very contentious.

Risks: Fiscal policy missteps and slower global growth remain the dominant risks to the outlook.

Tuesday economic releases:

• At 7:30 AM ET, NFIB Small Business Optimism Index for February. The consensus is for an increase to 90.1 from 88.9 in January.

• At 10:00 AM, Job Openings and Labor Turnover Survey for January from the BLS. The number of job openings has generally been trending up, but openings were only up 2% year-over-year in December.

Lawler: Table of Short Sales and Foreclosures for Selected Cities in February

by Calculated Risk on 3/11/2013 03:26:00 PM

Economist Tom Lawler sent me the table below of short sales and foreclosures for several selected cities in February.

Look at the right two columns in the table below (Total "Distressed" Share for Feb 2013 compared to Feb 2012). In every area that has reported distressed sales so far, the share of distressed sales is down year-over-year - and down significantly in most areas.

Also there has been a decline in foreclosure sales just about everywhere. Look at the middle two columns comparing foreclosure sales for Feb 2013 to Feb 2012. Foreclosure sales have declined in all these areas, and some of the declines have been stunning (the Nevada sales were impacted by the new foreclosure law).

Also there has been a shift from foreclosures to short sales. In all of these areas, short sales now out number foreclosures.

I think this is important: Imagine that the number of total existing home sales doesn't change over the next year - some people would argue that is "bad" news and the housing market isn't recovering. But also imagine that the share of distressed sales declines 20%, and conventional sales increase to make up the difference. That would be a positive sign - and that is what appears to be happening.

An example would be Sacramento (I posted data on Sacramento earlier today). In Sacramento, total sales were down 14% in Feb 2013 compared to Feb 2012, but conventional sales were up 42%! I'd say that is a positive sign.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 13-Feb | 12-Feb | 13-Feb | 12-Feb | 13-Feb | 12-Feb | |

| Las Vegas | 37.9% | 29.3% | 10.2% | 42.0% | 48.1% | 71.3% |

| Reno | 37.0% | 28.0% | 13.0% | 42.0% | 50.0% | 70.0% |

| Phoenix | 15.0% | 28.1% | 13.8% | 23.3% | 28.8% | 51.4% |

| Sacramento | 30.3% | 31.9% | 13.5% | 33.9% | 43.8% | 65.8% |

| Mid-Atlantic (MRIS) | 13.6% | 16.4% | 12.1% | 17.5% | 25.6% | 33.9% |

| Hampton Roads | 34.2% | 36.0% | ||||

| Charlotte | 15.9% | 18.7% | ||||

| Memphis* | 27.8% | 36.6% | ||||

| *share of existing home sales, based on property records | ||||||

Update: The Recession Probability Chart

by Calculated Risk on 3/11/2013 12:10:00 PM

Last November, I mentioned a recession probability chart from the St Louis Fed that was making the rounds, and that some people were misusing the chart to argue a new recession was starting in the US. Below is an update to the chart.

A few weeks later - also in November - the author, University of Oregon Professor Jeremy Piger, posted some FAQs and data for the chart online. Professor Piger writes:

2. How should I interpret these probabilities as a recession signal?

Historically, three consecutive months of smoothed probabilities above 80% has been a reliable signal of the start of a new recession, while three consecutive months of smoothed probabilities below 20% has been a reliable signal of the start of a new expansion. For an analysis of the performance of the model for identifying new turning points in real time, see:

Chauvet, M. and J. Piger, “A Comparison of the Real-Time Performance of Business Cycle Dating Methods,” Journal of Business and Economic Statistics, 2008.

Click on graph for larger image.

Click on graph for larger image.Here is the current chart from FRED at the St Louis Fed.

Right now, by this method, the odds of the US currently being in a recession are very low (close to zero). Some day I'll be on recession watch again (not in the near future), and this is one of the tools I'll be using.

Sacramento February House Sales: Conventional Sales up 41.4% year-over-year

by Calculated Risk on 3/11/2013 10:06:00 AM

Note: I've been following the Sacramento market to look for changes in the mix of house sales in a distressed area over time (conventional, REOs, and short sales). The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

Over the last two years there was a dramatic shift from REO to short sales, and the percentage of distressed sales declined.

This data suggests continued improvement in the Sacramento market.

In February 2013, 43.8% of all resales (single family homes and condos) were distressed sales. This was down from 44.5% last month, and down from 65.8% in February 2012. This is the lowest percentage of distressed sales - and therefore the highest percentage of conventional sales - since the association started tracking the data.

The percentage of REOs decreased to 13.5%, and the percentage of short sales was unchanged at 30.3%.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been an increase in conventional sales recently, and there were more than twice as many short sales as REO sales in February.

Total sales were down from February 2012, but conventional sales were up 42% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increase.

Active Listing Inventory for single family homes declined 51.1% from last February.

Cash buyers accounted for 39.5% of all sales (frequently investors), and median prices were up sharply year-over-year (the mix has changed).

This continues to move in the right direction, although the market is still in distress. A "normal" market would be mostly blue on the graph, and this market is a long way from "normal". We are seeing a similar pattern in other distressed areas, with a move to more conventional sales, and a shift from REO to short sales. This is a sign of a recovering market.

Sunday, March 10, 2013

Sunday Night Futures

by Calculated Risk on 3/10/2013 10:30:00 PM

Weekend:

• Summary for Week Ending March 8th

• Schedule for Week of March 10th

The Asian markets are mixed tonight with the Nikkei up 0.7%, and Shanghai Composite down 0.3%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures and Dow futures are mostly flat (fair value).

Oil prices are down a little with WTI futures at $91.73 per barrel and Brent at $110.43 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are down about 7 cents over the last two weeks after increasing more than 50 cents per gallon from the low last December.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Business Cycles and Markets

by Calculated Risk on 3/10/2013 02:44:00 PM

I've been asked several times about the recent ECRI recession call (obviously I disagreed with their incorrect recession call in 2011 - I wasn't even on recession watch then and I'm not on recession watch now - and I also think ECRI is wrong about a recession starting in mid-2012). Several people have written about ECRI's call, see Menzie Chinn at Econbrowser, NDD at the Bonddad blog, and Henry Blodget at Business Insider.

It seems to me ECRI is trying to make this an academic exercise and hoping for some significant downward revisions. Right now the data doesn't indicate a recession in 2012, but, as Menzie Chinn notes, "all of these series will be revised, so one wouldn’t want to state definitively we are not in a recession – therein lies the path to embarrassment. But the case still has to be made for recession."

But why do we care? Here is a repeat of a post I wrote in early 2011 (with updated tables and charts):

From 2011 [updates in brackets]: Here is something very different. This is NOT intended as investment advice.

Why is there so much focus on the business cycle? For companies, especially cyclical companies, the reason is obvious – it helps with planning, staffing and investment. [Update: Most cyclical companies are expanding now]

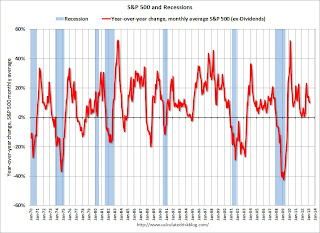

But why are investors so focused on the business cycle? Obviously earnings decline in a recession, and stock prices fall too. The following graph shows the year-over-year (YoY) change in the S&P 500 (using average monthly prices) since 1970. Notice that the market usually declines YoY in a recession.

Note: Because this is “year-over-year” there is a lag to the S&P 500 data. [Graph updated to March 2013]

Click on graph for larger image.

Click on graph for larger image.

So calling a recession isn’t just an academic exercise, there is some opportunity to preserve capital.

Not all downturns in the stock market are associated with recessions. As an example, the 1987 market crash was during an economic expansion. And the stock bubble collapse lasted from March 2000 through early 2003 – and the only official economic recession during that period was 7 months in 2001.

Although I don’t give investment advice, I think investors should measure their performance with some index. Warren Buffett likes to use the S&P 500 index, so I also used the S&P 500 for this exercise.

Imagine if we could call recessions in real time, and if we could predict recoveries in advance. The following table shows the performance of a buy-and-hold strategy (with dividend reinvestment), compared to a strategy of market timing based on 1) selling when a recession starts, and 2) buying 6 months before a recession ends.

For the buy and sell prices, I averaged the S&P 500 closing price for the entire month (no cherry picking price – just cherry picking the timing with 20/20 hindsight).

I assumed an investor started at four different times, in January of 1970, 1980, 1990, and 2000 [UPDATE: added 2010 start].

| Return from Start Date | Recession Timing Sensitivity | |||||

|---|---|---|---|---|---|---|

| Start Investing | Buy and Hold | Recession Timing | Two Months Early | One Month Early | One Month Late | Two Months Late |

| Jan-70 | 8.92% | 13.09% | 12.15% | 12.81% | 13.01% | 12.46% |

| Jan-80 | 9.90% | 13.52% | 13.37% | 13.38% | 13.71% | 12.97% |

| Jan-90 | 7.80% | 12.30% | 11.91% | 12.20% | 12.23% | 11.65% |

| Jan-00 | 1.37% | 6.88% | 7.49% | 7.22% | 7.02% | 7.17% |

| Jan-10 | 11.18% | 11.18% | --- | --- | --- | --- |

The “recession timing” column gives the annualized return for each of the starting dates. Timing the recession correctly always outperforms buy-and-hold. The last four columns show the performance if the investor is two months early (both in and out), one month early, one month late, and two months late. The investor doesn’t have to be perfect!

Note: This includes dividends, but not taxes. Also I assumed no interest earned when the investor is out of the market (money in the mattress).

The second table provides the same information, but this time in dollars (assuming a $10,000 initial investment). Notice that someone could have bought the S&P 500 index in January 2000, and they’d be up about $150 [March 2013 Update: Up $1,970] now using buy-and-hold even though the market is still below the January 2000 average price of 1425 [Update: Now above January 2000]. The positive return is due to dividends.

| Value based on Start Date | Recession Timing Sensitivity | |||||

|---|---|---|---|---|---|---|

| Start Investing | Buy and Hold | Recession Timing | Two Months Early | One Month Early | One Month Late | Two Months Late |

| Jan-70 | $399,910 | $1,582,190 | $1,120,170 | $1,426,530 | $1,537,910 | $1,257,860 |

| Jan-80 | $228,630 | $520,810 | $499,670 | $500,540 | $549,080 | $447,700 |

| Jan-90 | $56,920 | $116,550 | $108,230 | $114,250 | $115,050 | $103,010 |

| Jan-00 | $11,970 | $21,020 | $22,400 | $21,770 | $21,330 | $21,680 |

| Jan-10 | $13,990 | $13,990 | --- | --- | --- | --- |

Unfortunately forecasters have a terrible record of predicting downturns. The running joke is that forecasters have predicted 9 of the last 5 recessions! Although a forecaster doesn’t have to be perfect, they still have to be right. And that is very rare.

As economist Victor Zarnowitz said way back in 1960: “The record of predicting turning points — changes in the direction of economic activity — is on the whole poor." Forecasting hasn't improved much since then.

As an example, here are some comments from then Fed Chairman Alan Greenspan in 1990 (a recession began in July 1990):

“In the very near term there’s little evidence that I can see to suggest the economy is tilting over [into recession].”I'd say he missed that downturn. Of course Wall Street and Fed Chairmen are notoriously bad at calling downturns.

Chairman Greenspan, July 1990

“...those who argue that we are already in a recession I think are reasonably certain to be wrong.”

Greenspan, August 1990

“... the economy has not yet slipped into recession.”

Greenspan, October 1990

But the track record for calling recoveries isn’t much better. ... Calling recessions is a mug’s game, but I like to play. I was very lucky with the recent recession, but the key wasn’t calling the end in June 2009 (I thought it ended in July), but looking for the bottom in early 2009 (that is why I posted several times in early 2009 that I was looking for the sun).

This is NOT intended as investment advice. I am NOT an investment advisor. Just some (hopefully) fun musing ...

[Final Update: If investors sold when ECRI first made their recession call in Sept 2011, they would have a missed around a 30% increase in the market This shows why trying to add recession timing is difficult; investors have to be correct on the business cycle].

Graphs for Duration of Unemployment, Unemployment by Education and Diffusion Indexes

by Calculated Risk on 3/10/2013 11:31:00 AM

Earlier on the employment report:

• February Employment Report: 236,000 Jobs, 7.7% Unemployment Rate

• Employment Report Comments and more Graphs

• All Employment Graphs

A few more employment graphs ...

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, but only the less than 5 weeks is back to normal levels.

The the long term unemployed is around 3.1% of the labor force - and the number (and percent) of long term unemployed remains a serious problem.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment (all four categories are only gradually declining).

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This is a little more technical. The BLS diffusion index for total private employment was at 63.6 in February, down slightly from 64.7 in January. This was the fifth consecutive month over 60. This index has averaged 60.5 over the last 36 months; the best three year period since the '90s.

This is a little more technical. The BLS diffusion index for total private employment was at 63.6 in February, down slightly from 64.7 in January. This was the fifth consecutive month over 60. This index has averaged 60.5 over the last 36 months; the best three year period since the '90s.For manufacturing, the diffusion index increased to 60.6, up from 57.4 in January.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Job growth for both total private employment and manufacturing were fairly widespread in February (both above 60). This is a good sign and suggests many industries are hiring (not just a few).

Earlier:

• Summary for Week Ending March 8th

• Schedule for Week of March 10th

Saturday, March 09, 2013

Unofficial Problem Bank list declines to 805 Institutions

by Calculated Risk on 3/09/2013 05:12:00 PM

Here is the unofficial problem bank list for Mar 8, 2013.

Changes and comments from surferdude808:

The FDIC got back to closing a bank this week and terminated an action. In all, there were three removals this week that leave the Unofficial Problem Bank List at 805 institutions with assets of $296.4 billion. A year ago, the list held 956 institutions with assets of $383.4 billion.Earlier:

FDIC terminated the action against Bank of the Cascades, Bend, OR ($1.3 billion Ticker: CACB). Mojave Desert Bank, National Association, Mojave, CA ($104 million) merged through an unassisted acquisition with Mission Bank, Bakersfield, CA. As hard as it may be to believe, Georgia lost another bank this week, which is the 85th failure in the state at a cost of $11.4 billion since the on-set of the financial crisis. Frontier Bank, LaGrange, GA ($259 million Ticker: FIEC) failed after being under a Consent Order issued on February 15, 2012.

Next week, we anticipate the OCC will release its actions through mid-February 2013.

• Summary for Week Ending March 8th

• Schedule for Week of March 10th

Schedule for Week of March 10th

by Calculated Risk on 3/09/2013 01:11:00 PM

Earlier:

• Summary for Week Ending March 8th

The key reports for this week will be the February retail sales report on Wednesday, and February Industrial Production on Friday.

Also for manufacturing, the March NY Fed (Empire state) survey will be released on Friday.

For prices, CPI and PPI for February will be released.

No releases scheduled.

7:30 AM ET: NFIB Small Business Optimism Index for February. The consensus is for an increase to 89.5 from 88.0 in December.

10:00 AM: Job Openings and Labor Turnover Survey for January from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for January from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in December to 3.617 million, down from 3.790 million in November. The number of job openings (yellow) has generally been trending up, but openings are only up 2% year-over-year compared to December 2011.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Retail sales for February will be released.

8:30 AM ET: Retail sales for February will be released.This graph shows monthly retail sales and food service, seasonally adjusted (total and ex-gasoline) through January. Retail sales are up 25.7% from the bottom, and now 9.9% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to increase 0.5% in February (boosted by higher gasoline prices), and to increase 0.5% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for January. The consensus is for a 0.3% increase in inventories.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 350 thousand from 340 thousand last week.

8:30 AM: Producer Price Index for February. The consensus is for a 0.6% increase in producer prices (0.1% increase in core).

8:30 AM: Consumer Price Index for February. The consensus is for a 0.5% increase in CPI in February (due to higher gasoline prices) and for core CPI to increase 0.2%.

8:30 AM: NY Fed Empire Manufacturing Survey for March. The consensus is for a reading of 8.5, down from 10.0 in February (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.This shows industrial production since 1967 through January.

The consensus is for a 0.3% increase in Industrial Production in February, and for Capacity Utilization to increase to 79.3%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for March). The consensus is for a reading of 77.7, up from 77.6.