by Calculated Risk on 3/09/2013 01:11:00 PM

Saturday, March 09, 2013

Schedule for Week of March 10th

Earlier:

• Summary for Week Ending March 8th

The key reports for this week will be the February retail sales report on Wednesday, and February Industrial Production on Friday.

Also for manufacturing, the March NY Fed (Empire state) survey will be released on Friday.

For prices, CPI and PPI for February will be released.

No releases scheduled.

7:30 AM ET: NFIB Small Business Optimism Index for February. The consensus is for an increase to 89.5 from 88.0 in December.

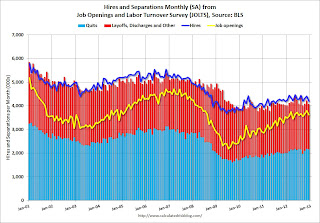

10:00 AM: Job Openings and Labor Turnover Survey for January from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for January from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in December to 3.617 million, down from 3.790 million in November. The number of job openings (yellow) has generally been trending up, but openings are only up 2% year-over-year compared to December 2011.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

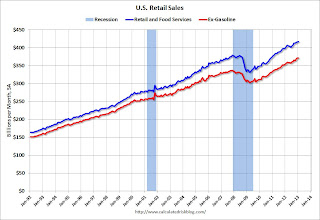

8:30 AM ET: Retail sales for February will be released.

8:30 AM ET: Retail sales for February will be released.This graph shows monthly retail sales and food service, seasonally adjusted (total and ex-gasoline) through January. Retail sales are up 25.7% from the bottom, and now 9.9% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to increase 0.5% in February (boosted by higher gasoline prices), and to increase 0.5% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for January. The consensus is for a 0.3% increase in inventories.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 350 thousand from 340 thousand last week.

8:30 AM: Producer Price Index for February. The consensus is for a 0.6% increase in producer prices (0.1% increase in core).

8:30 AM: Consumer Price Index for February. The consensus is for a 0.5% increase in CPI in February (due to higher gasoline prices) and for core CPI to increase 0.2%.

8:30 AM: NY Fed Empire Manufacturing Survey for March. The consensus is for a reading of 8.5, down from 10.0 in February (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.This shows industrial production since 1967 through January.

The consensus is for a 0.3% increase in Industrial Production in February, and for Capacity Utilization to increase to 79.3%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for March). The consensus is for a reading of 77.7, up from 77.6.