by Calculated Risk on 3/05/2013 04:45:00 PM

Tuesday, March 05, 2013

Market Update

Click on graph for larger image.

By request - following the new high on the Dow today - here are a couple of stock market graphs. The first graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today. The S&P 500 was first at this level in July 2007, just before the recession started. We can't call it a "lost decade" for stocks any more.

Another note: A new high doesn't tell us much. Over the last 50 years (starting in 1963) there were 27 years with new highs. If we excluded the miserable '00s, there were new highs in 26 of 38 years. So new highs are not unusual.

The second graph (click on graph for larger image) is from Doug Short and shows the S&P 500 since the 2007 high ...

Trulia: Asking House Prices increased in February, Inventory not expected to bottom in 2013

by Calculated Risk on 3/05/2013 12:39:00 PM

Press Release: Trulia Reports Asking Home Price Gains Accelerating While Housing Inventory No Longer in Free Fall

Since bottoming 12 months ago, national asking home prices rose 7.0 percent year-over-year (Y-o-Y) in February. Seasonally adjusted, asking prices also increased 1.4 percent month-over-month (M-o-M) and 3.0 percent quarter-over-quarter (Q-o-Q) – marking two post-recession highs. Asking prices locally are up in 90 of the 100 largest U.S. metros, rising fastest in Phoenix, Las Vegas, and Oakland.More on inventory from Jed Kolko, Trulia Chief Economist: Rising Prices Mean Falling Inventory … in the Short Term

Meanwhile, rent increases are slowing down. In February, rents rose just 3.2 percent Y-o-Y. This is a notable decrease from three months ago, in November, when rents were up 5.4 percent Y-o-Y. Among the 25 largest rental markets, rents rose the most in Houston, Oakland, and Miami, while falling slightly in San Francisco and Las Vegas.

...

Inventory Will Not Turn Around in 2013 Even Though Decline Is Slowing Down

Inventory falls most sharply just after prices bottom, creating an “inventory spiral”: rising prices reduce inventory as would-be home sellers hold off in the hopes of selling later at a higher price, and falling inventory boosts prices further as buyers compete for a limited number of for-sale homes. Nationally, the annualized rate of inventory decline was 23 to 29 percent from March to September 2012, the months after home prices first bottomed one year ago, but has softened to a 14 to 21 percent rate since October [1]

emphasis added

Inventory and prices affect each other in three ways:These are important points on inventory, and I now think inventory will not bottom this year (this is why I've been tracking inventory weekly). This probably means more price appreciation in 2013 than most analysts expect (I think the consensus was around 3% price increase in 2013), and this is also positive for new home sales.

1.Less inventory leads to higher prices. That’s because buyers are competing for a limited number of for-sale homes.In the short term, the first two reasons create an “inventory spiral”: less inventory leads to higher prices, which leads to less inventory, and so on. But the inventory spiral can’t go on forever because eventually rising prices will encourage homeowners to sell and builders to build, which add to inventory and breaks the spiral. The critical question for the housing market – especially for buyers fighting over tight inventories – is how long until that kicks in? How long do prices have to rise before sellers and builders start adding to inventory?

2.Higher prices lead to less inventory – at least in the short term. Everyone wants to buy at the bottom; no one wants to sell at the bottom. When prices start to rise, buyers get impatient while many would-be sellers want to hold out in the hopes of selling later at a higher price.

3.Higher prices lead to more inventory – in the long term. As prices keep rising, more homeowners decide it’s worthwhile to sell, especially those who get back above water, which adds to inventory. Also, builders take rising prices as a cue to rev up construction activity, which also adds to inventory.

...

How long until inventory turns positive, rather than becoming just less negative? ... it could be at least another year until national inventory starts expanding. Of course, inventory will probably turn up this spring and summer because of the regular seasonal pattern, but the underlying trend will be less inventory than is typical for each season, not more.

Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a seasonally adjusted basis.

ISM Non-Manufacturing Index indicates faster expansion in February

by Calculated Risk on 3/05/2013 10:00:00 AM

The February ISM Non-manufacturing index was at 56.0%, up from 55.2% in January. The employment index decreased in February to 57.2%, down from 57.5% in January. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: February 2013 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in February for the 38th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 56 percent in February, 0.8 percentage point higher than the 55.2 percent registered in January. This indicates continued growth at a slightly faster rate in the non-manufacturing sector. This month's reading also reflects the highest NMI™ since February 2012, when the index registered 56.1 percent. The Non-Manufacturing Business Activity Index registered 56.9 percent, which is 0.5 percentage point higher than the 56.4 percent reported in January, reflecting growth for the 43rd consecutive month. The New Orders Index increased by 3.8 percentage points to 58.2 percent, and the Employment Index decreased 0.3 percentage point to 57.2 percent, indicating growth in employment for the seventh consecutive month. The Prices Index increased 3.7 percentage points to 61.7 percent, indicating prices increased at a faster rate in February when compared to January. According to the NMI™, 13 non-manufacturing industries reported growth in February. The majority of respondents' comments reflect a growing optimism about the trend of the economy and overall business conditions."

emphasis added

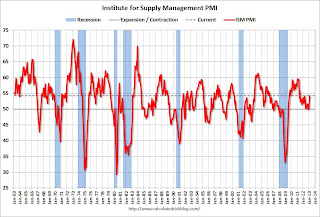

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 55.0% and indicates faster expansion in February than in January.

CoreLogic: House Prices up 9.7% Year-over-year in January

by Calculated Risk on 3/05/2013 09:00:00 AM

Notes: This CoreLogic House Price Index report is for January. The recent Case-Shiller index release was for December. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Home Price Index Rises by Almost 10 Percent Year Over Year in January

Home prices nationwide, including distressed sales, increased on a year-over-year basis by 9.7 percent in January 2013 compared to January 2012. This change represents the biggest increase since April 2006 and the 11th consecutive monthly increase in home prices nationally. On a month-over-month basis, including distressed sales, home prices increased by 0.7 percent in January 2013 compared to December 2012. The HPI analysis shows that all but two states, Delaware and Illinois, are experiencing year-over-year price gains.

Excluding distressed sales, home prices increased on a year-over-year basis by 9.0 percent in January 2013 compared to January 2012. On a month-over-month basis, excluding distressed sales, home prices increased 1.8 percent in January 2013 compared to December 2012. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that February 2013 home prices, including distressed sales, are expected to rise by 9.7 percent on a year-over-year basis from February 2012 and fall by 0.3 percent on a month-over-month basis from January 2013, reflecting a seasonal winter slowdown.

...

“The HPI showed strong growth during the typically slow winter season,” said Mark Fleming, chief economist for CoreLogic.

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.7% in January, and is up 9.7% over the last year.

The index is off 26.4% from the peak - and is up 10.1% from the post-bubble low set in February 2012.

The second graph is from CoreLogic. The year-over-year comparison has been positive for eleven consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for eleven consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).This is the largest year-over-year increase since 2006.

Since this index is not seasonally adjusted, it was expected to decline on a month-to-month basis in January - instead the index increased, and, considering seasonal factors, this month-to-month increase was very strong.

Monday, March 04, 2013

Tuesday: ISM Service Index

by Calculated Risk on 3/04/2013 09:09:00 PM

The kids are alright! From the WSJ: Young Adults Retreat From Piling Up Debt

Young people are racking up larger amounts of student debt than ever before, but fresh data suggest they are becoming warier of borrowing in general: Total debt among young adults dropped in the last decade to the lowest level in 15 years.Student debt is a significant problem, but less overall debt is good news.

A typical young U.S. household—defined as one led by someone under age 35—had $15,000 in total debt in 2010, down from $18,000 in 2001 and the lowest since 1995, according to a recent Pew Research Center report and government data. Total debt includes mortgage loans, credit cards, auto lending, student loans and other consumer borrowing.

In addition, fewer young adults carried credit-card balances and 22% didn't have any debt at all in 2010—the most since government tracking began in 1983.

The lower overall debt comes despite an increase in student borrowing, which ballooned to $966 billion last year from $253 billion at the end of 2003, according to the Federal Reserve.

Tuesday economic releases:

• At 10:00 AM ET, Trulia Price Rent Monitors for February. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• Also at 10:00 AM, ISM non-Manufacturing Index for February. The consensus is for a decrease to 55.0 from 55.2 in January. Note: Above 50 indicates expansion, below 50 contraction.

Existing Home Inventory is only up 3.4% year-to-date in early March

by Calculated Risk on 3/04/2013 03:24:00 PM

Dude, Where's my inventory?

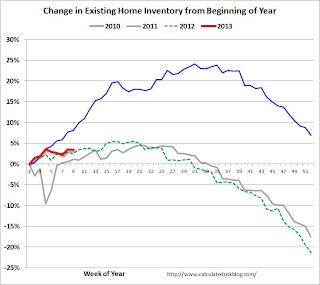

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'll be tracking inventory weekly for the next few months.

If inventory does bottom, we probably will not know for sure until late in the year. In normal times, there is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The NAR data is monthly and released with a lag. However Ben at Housing Tracker (Department of Numbers) kindly sent me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year.

In 2010 (blue), inventory followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

So far - through early March - it appears inventory is increasing at a sluggish rate. Housing Tracker reports inventory is down -23.2% compared to the same week in 2012 - still falling fast year-over-year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

The key will be to see how much inventory increases over the next few months. In 2010, inventory was up 8% by early March, and up 15% by the end of March.

For 2011 and 2012, inventory only increased about 5% at the peak and then declined for the remainder of the year.

So far in 2013, inventory is only up 3.4%. If inventory doesn't increase more soon, then the bottom for inventory might not be until 2014.

Fannie Mae Mortgage Serious Delinquency rate declined in January, Lowest since early 2009

by Calculated Risk on 3/04/2013 02:02:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in January to 3.18% from 3.29% in December 2012. The serious delinquency rate is down from 3.90% in January 2012, and this is the lowest level since March 2009.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac has not reported for January yet.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

Although this indicates some progress, the "normal" serious delinquency rate is under 1%. At the recent pace of improvement, it will take several years until the rates are back to normal.

Update: Seasonal Pattern for House Prices

by Calculated Risk on 3/04/2013 09:53:00 AM

There has always been a clear seasonal pattern for house prices, but the seasonal differences have been more pronounced in recent years.

Even in normal times house prices tend to be stronger in the spring and early summer than in the fall and winter. Recently there has been a stronger than normal seasonal pattern because conventional sales are following the normal pattern (more sales in the spring and summer), but distressed sales (foreclosures and short sales) happen all year. So distressed sales have had a larger negative impact on prices in the fall and winter.

However, house prices - not seasonally adjusted (NSA) - have been pretty strong over the last few months - at the start of the normally weak months.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller Composite 20 index since 2001 (both Case-Shiller and CoreLogic through December). The seasonal pattern was smaller back in the early '00s, and increased since the bubble burst.

The CoreLogic index was positive in both the November and December reports (CoreLogic is a 3 month weighted average, with the most recent month weighted the most).

Case-Shiller NSA turned negative month-to-month in the October report (also a three month average, but not weighted), but was only slightly negative in November and turned positive in the December report. This shows that the "off-season" for prices has been pretty strong this year.

The second graph shows the seasonal factors for the Case-Shiller composite 20 index. The factors started to change near the peak of the bubble, and really increased during the bust.

The second graph shows the seasonal factors for the Case-Shiller composite 20 index. The factors started to change near the peak of the bubble, and really increased during the bust.

Note: I was one of several people to question this change in the seasonal factor - and this led to S&P Case-Shiller reporting the NSA numbers.

It appears the seasonal factor has stopped increasing, and I expect that over the next several years - as the percent of distressed sales decline - the seasonal factors will slowly move back towards the previous levels.

Fed's Yellen: Challenges Confronting Monetary Policy

by Calculated Risk on 3/04/2013 08:53:00 AM

From Fed Vice Chair Janet Yellen: Challenges Confronting Monetary Policy. A few excerpts on asset purchases and what a "Substantial Improvement in the Outlook for the Labor Market" means:

The first imperative will be to judge what constitutes a substantial improvement in the outlook for the labor market. Federal Reserve research concludes that the unemployment rate is probably the best single indicator of current labor market conditions. In addition, it is a good predictor of future labor market developments. Since 1978, periods during which the unemployment rate declined 1/2 percentage point or more over two quarters were followed by further declines over the subsequent two quarters about 75 percent of the time.CR Notes: Defining a "substantial improvement" is helpful in trying to determine when the Fed when end the asset purchase program. Obviously the program will continue for some time ...

That said, the unemployment rate also has its limitations. As I noted before, the unemployment rate may decline for reasons other than improved labor demand, such as when workers become discouraged and drop out of the labor force. In addition, while movements in the rate tend to be fairly persistent, recent history provides several cases in which the unemployment rate fell substantially and then stabilized at still-elevated levels. For example, between the fourth quarter of 2010 and the first quarter of 2011, the unemployment rate fell 1/2 percentage point but was then little changed over the next two quarters. Similarly, the unemployment rate fell 3/4 percentage point between the third quarter of 2011 and the first quarter of 2012, only to level off over the subsequent spring and summer.

To judge whether there has been a substantial improvement in the outlook for the labor market, I therefore expect to consider additional labor market indicators along with the overall outlook for economic growth. For example, the pace of payroll employment growth is highly correlated with a diverse set of labor market indicators, and a decline in unemployment is more likely to signal genuine improvement in the labor market when it is combined with a healthy pace of job gains.

The payroll employment data, however, also have shortcomings. In particular, they are subject to substantial revision. When the Labor Department released its annual benchmarking of the establishment survey data last month, it revised up its estimate of employment in December 2012 by 647,000.

In addition, I am likely to supplement the data on employment and unemployment with measures of gross job flows, such as job loss and hiring, which describe the underlying dynamics of the labor market. For instance, layoffs and discharges as a share of total employment have already returned to their pre-recession level, while the hiring rate remains depressed. Therefore, going forward, I would look for an increase in the rate of hiring. Similarly, a pickup in the quit rate, which also remains at a low level, would signal that workers perceive that their chances to be rehired are good--in other words, that labor demand has strengthened.

I also intend to consider my forecast of the overall pace of spending and growth in the economy. A decline in unemployment, when it is not accompanied by sufficiently strong growth, may not indicate a substantial improvement in the labor market outlook. Similarly, a convincing pickup in growth that is expected to be sustained could prompt a determination that the outlook for the labor market had substantially improved even absent any substantial decline at that point in the unemployment rate.

emphasis added

Sunday, March 03, 2013

Sunday Night Futures

by Calculated Risk on 3/03/2013 09:29:00 PM

I thought US Fiscal Policy was the biggest question mark for 2013, and that fiscal policy posed the biggest downside risk to the US economy (I still think fiscal policy is the biggest risk).

First there was the "fiscal cliff", and then the threat of default and not paying the bills (aka "debt ceiling"), then "sequestration", followed by the March 27th threat to shut down the government (really just a small portion of the government, but will be very disruptive). As I've noted several times, the deficit is declining fairly quickly, and the key risk is too much deficit reduction too quickly (this can't be repeated enough).

Hopefully something will be worked out to reverse the "sequestration" cuts, and maybe the government shutdown will be avoided ...

From the WaPo: Deal to avert government shutdown likely, officials say

Congress returns to work this week with no plan to reverse across-the-board spending cuts that took effect Friday, but with hope on both sides of the aisle of averting an end-of-the-month showdown that could result in a government shutdown.Weekend:

...

It would provide funding through the end of the fiscal year on Sept. 30 ...

• Summary for Week Ending March 1st

• Schedule for Week of March 3rd

The Asian markets are mixed tonight with the Nikkei up 0.8%, and Shanghai Composite down 1.5%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 5 and DOW futures are down 40 (fair value).

Oil prices have moved down a little recently with WTI futures at $90.61 per barrel and Brent at $110.55 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are down a few cents over the last week after increasing more than 50 cents per gallon from the low last December.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Q4 2012 GDP Details: Commercial Real Estate investment very low, Single Family investment increases

by Calculated Risk on 3/03/2013 04:30:00 PM

Here is some investment data from the BEA (Note: The BEA released the underlying details for the Q4 second GDP report on Friday). The first graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased slightly, but from a very low level.

Investment in offices is down about 55% from the recent peak (as a percent of GDP). With the high office vacancy rate, investment will probably not increase significantly (as a percent of GDP) for several years - even though there has been some increase in the Architecture Billings Index lately.

Click on graph for larger image.

Click on graph for larger image.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 63% from the peak (note that investment includes remodels, so this will not fall to zero). The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment peaked at 0.32% of GDP in Q2 2008 and is down about 73%. With the hotel occupancy rate close to normal, it is possible that hotel investment will increase this year.

The second graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

The second graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

Usually the most important components are investment in single family structures followed by home improvement.

Investment in single family structures is now increasing after mostly moving sideways for almost three years (the increase in 2009-2010 was related to the housing tax credit).

Investment in home improvement was at a $159 billion Seasonally Adjusted Annual Rate (SAAR) in Q4 (about 1.0% of GDP), still above the level of investment in single family structures of $143 billion (SAAR) (or 0.9% of GDP). Single family structure investment will probably overtake home improvement as the largest category of residential investment later this year.

Brokers' commissions increased slightly in Q4 as a percent of GDP. And investment in multifamily structures increased in Q4. This is a small category, and even though investment is increasing, the positive impact on GDP will be relatively small.

These graphs show there is currently very little investment in offices, malls and lodging. And residential investment is starting to pickup, but from a very low level.

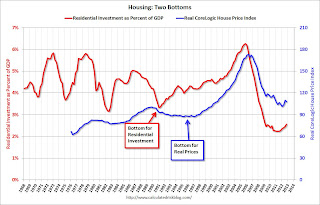

Housing: The Two Bottoms

by Calculated Risk on 3/03/2013 10:34:00 AM

Last year when I wrote The Housing Bottom is Here and Housing: The Two Bottoms, I pointed out there are usually two bottoms for housing: the first for new home sales, housing starts and residential investment, and the second bottom is for house prices.

For the bottom in activity, I presented a graph of Single family housing starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

When I posted that graph, the bottom wasn't obvious to everyone. Now it is, and here is another update to that graph.

Click on graph for larger image.

Click on graph for larger image.

The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

For the current housing bust, the bottom was spread over a few years from 2009 into 2011. This was a long flat bottom - something a number of us predicted given the overhang of existing vacant housing units.

We could use any of these three measures to determine the first bottom, and then use the other two to confirm the bottom. But this says nothing about prices.

The second graph compares RI as a percent of GDP with the real (adjusted for inflation) CoreLogic house price index through December.

The second graph compares RI as a percent of GDP with the real (adjusted for inflation) CoreLogic house price index through December.

Although the CoreLogic data only goes back to 1976, look at what happened following the early '90s housing bust. RI as a percent of GDP bottomed in Q1 1991, but real house prices didn't bottom until Q4 1996 (real prices were mostly flat for several year). Something similar happened in the early 1980s - first activity bottomed, and then real prices - although the two bottoms were closer in the '80s.

Now it appears activity bottomed in 2009 through 2011 (depending on the measure) and house prices bottomed in early 2012.

Saturday, March 02, 2013

Unofficial Problem Bank list declines to 808 Institutions

by Calculated Risk on 3/02/2013 04:11:00 PM

Here is the unofficial problem bank list for Mar 1, 2013.

Changes and comments from surferdude808:

There was only one removal this week to the Unofficial Problem Bank List. After removal, the list holds 808 institutions with assets of $298.1 billion. From last week, assets fell by $4.7 billion with $4.0 billion of the decline in assets during the fourth quarter. A year ago, the list held 959 institutions with assets of $385.4 billion. According to an SEC filing, the FDIC terminated the action against Bank of Granite, Charlotte, NC ($717 million Ticker: FNBN).Earlier:

This week the FDIC issued industry results for the fourth quarter including an update on the Official Problem Bank List. While the FDIC does not disclose institutions on the official list, they provided an institution count of 651 with assets of $233 billion. During the quarter, the official list declined by 43 institutions and assets dropped $29 billion. Since the last FDIC release, the unofficial list declined by 66 institutions and assets dropped $36.9 billion. After the FDIC released problem bank figures for the second quarter of 2010, the unofficial list has been higher since while it was lower at the time of prior quarterly releases. The upside tracking difference peaked at 185 institutions and assets of $72.6 billion when second quarter of 2012 figures were released. With the current release, the differences have been reduced to 157 institutions and assets of $65.0 billion.

Because the FDIC does not publish the official list, a proxy or unofficial list can be developed by reviewing press releases and published formal enforcement actions issued by the three federal banking regulators, reviewing SEC filings, or through media reports and company announcements describing that the bank is under a formal enforcement action. For the most part, the official problem bank list is comprised of banks with a safety & soundness CAMELS composite rating of 4 or 5 (the banking regulators use the FFIEC rating system known as CAMELS, which stands for the components that receive a rating including Capital adequacy, Asset quality, Management quality, Earnings strength, Liquidity strength, and Sensitivity to market risk. A composite rating is assigned from the components, but it does not result from a simple average of the components. The composite and component rating scale is from 1 to 5, with 1 being the strongest). Customarily, a banking regulator will only issue a safety & soundness formal enforcement when a bank has a composite CAMELS rating of 4 or 5, which reflects an unsafe & unsound financial condition that if not corrected could result in failure. There is high positive correlation between banks with a safety & soundness composite rating of 4 or worse and those listed on the official list. For example, many safety & soundness enforcement actions state in their preamble that an unsafe & sound condition exists, which is the reason for action issuance.

Since 1991, the banking regulators have statutorily been required to publish formal enforcement actions. For many reasons, the banking regulators have a general discomfort publishing any information on open banks especially formal enforcement actions, so not much energy is expended on their part ensuring the completeness of information in the public domain or making its retrieval simple. Given the difficulty for easy retrieval of all banks operating under a safety & soundness formal enforcement action, the unofficial list fills this void as a matter of public interest.

All of the banks on the unofficial list have received a safety & soundness formal enforcement action by a federal banking regulator or there is other information in the public domain such as an SEC filing, media release, or company statement that describe the bank being issued such an action. No confidential or non-public information supports any bank listed and a hypertext link to the public information is provided in the spreadsheet listing. The publishers make every effort to ensure the accuracy of the unofficial list and welcome all feedback and any credible information to support removal of any bank listed erroneously.

• Summary for Week Ending March 1st

• Schedule for Week of March 3rd

Schedule for Week of March 3rd

by Calculated Risk on 3/02/2013 01:11:00 PM

Earlier:

• Summary for Week Ending March 1st

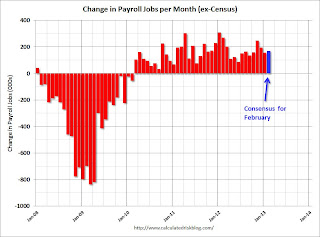

The key report this week is the February employment report on Friday.

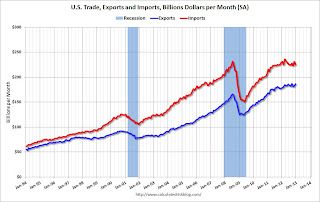

Other key reports include the ISM service index on Tuesday, and the Trade Balance report on Thursday.

Also, the Federal Reserve will release the Q4 Flow of Funds report on Thursday.

8:00 AM ET: Speech by Fed Vice Chair Janet Yellen, "Challenges Confronting Monetary Policy", At the 29th National Association for Business Economics Policy Conference, Washington, D.C.

10:00 AM: ISM non-Manufacturing Index for February. The consensus is for a decrease to 55.0 from 55.2 in January. Note: Above 50 indicates expansion, below 50 contraction.

10:00 AM: Trulia Price Rent Monitors for February. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 173,000 payroll jobs added in February. Even with the new methodology, the report still isn't that useful in predicting the BLS report.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for January. The consensus is for a 2.2% decrease in orders.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts. Analysts will look for signs of an impact from the recent tax increases.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 355 thousand from 344 thousand last week. This is pre "sequester", and unemployment claims will probably increase soon.

8:30 AM: Trade Balance report for January from the Census Bureau.

8:30 AM: Trade Balance report for January from the Census Bureau. Exports increased in December, and imports decreased and the trade deficit fell sharply.

The consensus is for the U.S. trade deficit to increase to $43.0 billion in January from $38.5 billion in December.

12:00 PM: Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

3:00 PM: Consumer Credit for January from the Federal Reserve. The consensus is for credit to increase $15.0 billion in January.

8:30 AM: Employment Report for February. The consensus is for an increase of 171,000 non-farm payroll jobs in February; the economy added 157,000 non-farm payroll jobs in January.

8:30 AM: Employment Report for February. The consensus is for an increase of 171,000 non-farm payroll jobs in February; the economy added 157,000 non-farm payroll jobs in January. The consensus is for the unemployment rate to decrease to 7.8% in February.

The second employment graph shows the percentage of payroll jobs lost during post WWII recessions through January.

The economy has added 6.1 million private sector jobs since employment bottomed in February 2010 (5.5 million total jobs added including all the public sector layoffs).

The economy has added 6.1 million private sector jobs since employment bottomed in February 2010 (5.5 million total jobs added including all the public sector layoffs).There are still 2.7 million fewer private sector jobs now than when the recession started in 2007.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for January. The consensus is for a 0.4% increase in inventories.

Summary for Week ending March 1st

by Calculated Risk on 3/02/2013 08:38:00 AM

It was interesting week. In testimony to Congress, Fed Chairman Ben Bernanke made it clear he will keep the "pedal to the metal" with monetary policy. Meanwhile, Congress keeps tapping on the fiscal policy brakes, this time with "sequestration" budget cuts.

However, even with conflicting policy, the economy is doing OK - at least so far in 2013.

New Home sales in January were at the highest level since July 2008, auto sales were up again in February, the ISM manufacturing index for February was at the highest level since June 2011, weekly initial unemployment claims declined, and consumer sentiment increased. All were better than expected, and it appears the economy was improving before the sequestration budget cuts on March 1st - even with the payroll tax increase this year (although personal consumption expenditures were only up slightly in January).

Also Case-Shiller reported that house prices were up 6.8% in 2012 and finished the year strong. This year-over-year increase strongly suggests house prices bottomed in early 2012.

The ongoing housing recovery and solid auto sales (both leading indicators) suggest the economy will continue to grow for next few years.

Here is a summary of last week in graphs:

• New Home Sales at 437,000 SAAR in January

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 437 thousand. This was up from a revised 378 thousand SAAR in December (revised up from 369 thousand).

January is seasonally the weakest month of the year for new home sales, so January has the largest positive seasonal adjustment. Also this was just one month with a sales rate over 400 thousand - and we shouldn't read too much into one month of data. But this was the highest level since July 2008 and it is clear the housing recovery is ongoing.

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale was just above the record low. The combined total of completed and under construction is also just above the record low.

This was above expectations of 381,000 sales in January. This is the strongest sales rate since 2008. This was another solid report.

• U.S. Light Vehicle Sales increase to 15.4 million annual rate in February

Based on an estimate from AutoData Corp, light vehicle sales were at a 15.38 million SAAR in February. That is up 7% from February 2012, and up about 1% from the sales rate last month.

Based on an estimate from AutoData Corp, light vehicle sales were at a 15.38 million SAAR in February. That is up 7% from February 2012, and up about 1% from the sales rate last month.This was above the consensus forecast of 15.2 million SAAR (seasonally adjusted annual rate).

Note: dashed line is current estimated sales rate.

This is another positive sign for the economy going forward.

• ISM Manufacturing index increases in February to 54.2

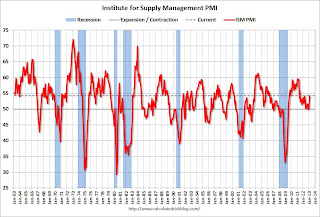

The ISM manufacturing index indicated expansion in February. PMI was at 54.2% in February, up from 53.1% in January. The employment index was at 52.6%, down from 54.0%, and the new orders index was at 57.8%, up from 53.3% in January.

The ISM manufacturing index indicated expansion in February. PMI was at 54.2% in February, up from 53.1% in January. The employment index was at 52.6%, down from 54.0%, and the new orders index was at 57.8%, up from 53.3% in January.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 52.8% and suggests manufacturing expanded at a faster pace in February.

• Personal Income declined 3.6% in January, Spending increased 0.2%

The BEA reported: "Personal income decreased $505.5 billion, or 3.6 percent ... in January, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $18.2 billion, or 0.2 percent."

The BEA reported: "Personal income decreased $505.5 billion, or 3.6 percent ... in January, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $18.2 billion, or 0.2 percent."The dashed red lines are the quarterly levels for real PCE. Personal spending increased about as expected in January.

Ignore the sharp decline in income and decline in the saving rate - that decline was because some people took income in December to avoid higher taxes in 2013.

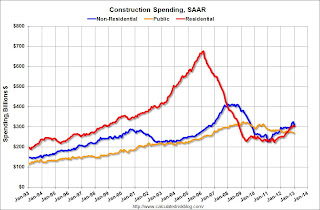

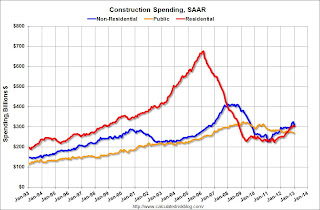

• Construction Spending declined in January

The Census Bureau reported that overall construction spending decreased in January:

The Census Bureau reported that overall construction spending decreased in January: The U.S. Census Bureau of the Department of Commerce announced today that construction spending during January 2013 was estimated at a seasonally adjusted annual rate of $883.3 billion, 2.1 percent below the revised December estimate of $902.6 billion. The January figure is 7.1 percent above the January 2012 estimate of $824.7 billion.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 55% below the peak in early 2006, and up 37% from the post-bubble low. Non-residential spending is 25% below the peak in January 2008, and up about 37% from the recent low.

Private residential spending is 55% below the peak in early 2006, and up 37% from the post-bubble low. Non-residential spending is 25% below the peak in January 2008, and up about 37% from the recent low.Public construction spending is now 17% below the peak in March 2009 and at the lowest level since 2006 (not inflation adjusted).

The second graph shows the year-over-year change in construction spending.

On a year-over-year basis, private residential construction spending is now up 22%. Non-residential spending is up 4% year-over-year mostly due to energy spending (power and electric). Public spending is down 3% year-over-year.

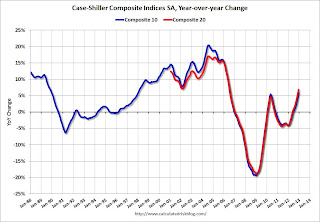

• Case-Shiller: Comp 20 House Prices increased 6.8% year-over-year in December

From S&P: Home Prices Closed Out a Strong 2012 According to the S&P/Case-Shiller Home Price Indices

From S&P: Home Prices Closed Out a Strong 2012 According to the S&P/Case-Shiller Home Price IndicesThe first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 30.0% from the peak, and up 0.9% in December (SA). The Composite 10 is up 6.2% from the post bubble low set in March (SA).

The Composite 20 index is off 29.2% from the peak, and up 0.9% (SA) in December. The Composite 20 is up 7.0% from the post-bubble low set in March (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 5.9% compared to December 2011.

The Composite 20 SA is up 6.8% compared to December 2011. This was the seventh consecutive month with a year-over-year gain since 2010 (when the tax credit boosted prices temporarily). This was the largest year-over-year gain for the Composite 20 index since 2006.

This was at the consensus forecast for a 6.8% YoY increase.

• Weekly Initial Unemployment Claims decrease to 344,000

The following graph shows the 4-week moving average of weekly claims since January 2000.

The DOL reports:

The DOL reports:In the week ending February 23, the advance figure for seasonally adjusted initial claims was 344,000, a decrease of 22,000 from the previous week's revised figure of 366,000. The 4-week moving average was 355,000, a decrease of 6,750 from the previous week's revised average of 361,750.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 355,000 - just above the lowest 4-week average since the recession.

Weekly claims were below the 360,000 consensus forecast.

• Consumer Sentiment improves

The final Reuters / University of Michigan consumer sentiment index for February increased to 77.6. The preliminary reading was 76.3, and the January reading was 73.8.

The final Reuters / University of Michigan consumer sentiment index for February increased to 77.6. The preliminary reading was 76.3, and the January reading was 73.8. This was above the consensus forecast of 76.0, but still low. There are a number of factors that impact sentiment including unemployment, gasoline prices and, for 2013, the payroll tax increase, the default threat from Congress and the "sequester" spending cuts. People will slowly adjust to the payroll tax increase, and the threat of default is now behind us ... and sentiment has improved a little ... but the sequester cuts might hurt sentiment in March.

Friday, March 01, 2013

Bernanke: How are long-term rates likely to evolve over coming years?

by Calculated Risk on 3/01/2013 10:00:00 PM

From Fed Chairman Ben Bernanke: Long-Term Interest Rates. Excerpts:

[W]hy are long-term interest rates currently so low? To help answer this question, it is useful to decompose longer-term yields into three components: one reflecting expected inflation over the term of the security; another capturing the expected path of short-term real, or inflation-adjusted, interest rates; and a residual component known as the term premium. Of course, none of these three components is observed directly, but there are standard ways of estimating them. ...

[H]ow are long-term rates likely to evolve over coming years? It is worth pausing to note that, not that long ago, central bankers would have carefully avoided this topic. However, it is now a bedrock principle of central banking that transparency about the likely path of policy, in general, and interest rates, in particular, can increase the effectiveness of policy. In the present context, I would add that transparency may mitigate risks emanating from unexpected rate movements. Thus, let me turn to prospects for long-term rates, starting with the expected path of rates and then turning to deviations from the expected path that may arise.

If, as the FOMC anticipates, the economic recovery continues at a moderate pace, with unemployment slowly declining and inflation expectations remaining near 2 percent, then long-term interest rates would be expected to rise gradually toward more normal levels over the next several years.

Goldman Sachs on Sequestration Cuts

by Calculated Risk on 3/01/2013 07:22:00 PM

I think these excerpts from a research piece by Goldman Sachs economist Alec Phillips are helpful in understanding the issues:

In 2011, Congress passed and the President signed the Budget Control Act, which raised the debt limit by $2.1 trillion and cut $2.1 trillion from projected spending over the following ten years. Caps on discretionary spending levels were estimated to reduce spending by $900bn compared with baseline projections that assumed spending would growth with inflation. The remainder of the savings was to be achieved by the congressional “super committee.” To motivate the super committee, and to ensure deficit reduction even if it failed, the legislation established $1.2 trillion in automatic cuts through 2021 by means of sequestration if the super committee could not agree on at least that much in deficit reduction. The super committee failed to agree on a deficit reduction package, leaving sequestration to take effect.Of course the sequestration cuts could be changed at any time by an agreement between the President and Congress. It seems unlikely that the House will shut down the government in late March (but you never know), and maybe we will see an agreement to reduce or change the sequestration as part of a "continuing resolution". This isn't as obvious as the debt ceiling debate ...

...

The cuts are not that large in the context of the $3.5 trillion federal budget, but sequestration will nevertheless cause real disruptions because the law to implement the cuts is very prescriptive and because they must be phased in relatively quickly once triggered ...

We estimate that sequestration will reduce annualized growth in 2013 by 0.6 percentage point (on a Q4/Q4 basis), with the greatest effects in Q2 and Q3. We expect the effect on growth to wane somewhat starting in Q42013, as the rate of reduction in federal spending becomes more gradual. Although sequestration will reduce the level of spending further in 2014, the rate of change will be much more gradual by that point so the effect on growth should be much smaller. ...

We expect slightly less of an effect on employment compared to the effect on GDP growth. The Congressional Budget Office estimates that the cuts will reduce employment at the end of 2013 by 750,000, or roughly a 0.5% reduction in employment, similar to the 0.6pp reduction in growth it assumes will result from sequestration in 2013.

But it is possible that the direct effect on federal employment may be somewhat smaller than the proportional GDP effect would imply. ... several federal agencies have announced that, at least for FY2013, compensation expenses are likely to be reduced by furloughing federal employees. This means that rather than reducing the number of employees proportionally to the cut, the number of days worked would be reduced instead.

Sequestration has happened before, but not quite on this scale. Meaningful cuts under sequestration were scheduled to take effect in 1986, 1988, and 1990. ... Cuts took effect in each of those years but after allowing the first cut to take effect as planned in FY1986, Congress intervened to reduce the subsequent cuts in FY1988 and FY1990. ...

The key timeframe for action will be late March and April. By late March, Congress will need to pass a new “continuing resolution” (CR) to temporarily extend spending authority, which was last extended before the 2012 election and expires March 27.

U.S. Light Vehicle Sales increase to 15.4 million annual rate in February

by Calculated Risk on 3/01/2013 03:58:00 PM

Based on an estimate from AutoData Corp, light vehicle sales were at a 15.38 million SAAR in February. That is up 7% from February 2012, and up about 1% from the sales rate last month.

This was above the consensus forecast of 15.2 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for February (red, light vehicle sales of 15.38 million SAAR from AutoData).

Click on graph for larger image.

Click on graph for larger image.

This is a solid start to the new year. After three consecutive years of double digit auto sales growth, the growth rate will probably slow in 2013 - but this will still be another positive year for the auto industry.

Even if sales average the January / February rate all year, Total sales would be up about 6% from 2012.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

This shows the huge collapse in sales in the 2007 recession, and that sales have increased significantly from the bottom.

This is another positive sign for the economy going forward.

Construction Spending declined in January

by Calculated Risk on 3/01/2013 12:35:00 PM

Catching up ...

A few key themes:

1) Private residential construction is usually the largest category for construction spending, but there was a huge collapse in spending following the housing bubble (as expected). Private residential is now about even with private non-residential, and residential will probably be the largest category of construction spending in 2013. Usually private residential construction leads the economy, so this is a good sign going forward.

2) Private non-residential construction spending usually lags the economy. There was some increase this time, mostly related to energy and power - but the key sectors of office, retail and hotels are still at very low levels.

3) Public construction spending has declined to 2006 levels (not adjusted for inflation). This has been a drag on the economy for almost 4 years.

The Census Bureau reported that overall construction spending decreased in January:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during January 2013 was estimated at a seasonally adjusted annual rate of $883.3 billion, 2.1 percent below the revised December estimate of $902.6 billion. The January figure is 7.1 percent above the January 2012 estimate of $824.7 billion.Private construction spending decreased due to less spending on power and electric, and public construction spending declined too:

Spending on private construction was at a seasonally adjusted annual rate of $614.2 billion, 2.6 percent below the revised December estimate of $630.9 billion. Residential construction was at a seasonally adjusted annual rate of $304.6 billion in January, nearly the same as the revised December estimate of $304.7 billion. ...

In January, the estimated seasonally adjusted annual rate of public construction spending was $269.0 billion, 1.0 percent below the revised December estimate of $271.7 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 55% below the peak in early 2006, and up 37% from the post-bubble low. Non-residential spending is 25% below the peak in January 2008, and up about 37% from the recent low.

Public construction spending is now 17% below the peak in March 2009 and at the lowest level since 2006 (not inflation adjusted).

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 22%. Non-residential spending is up 4% year-over-year mostly due to energy spending (power and electric). Public spending is down 3% year-over-year.

ISM Manufacturing index increases in February to 54.2, Consumer Sentiment improves

by Calculated Risk on 3/01/2013 10:00:00 AM

The ISM manufacturing index indicated expansion in February. PMI was at 54.2% in February, up from 53.1% in January. The employment index was at 52.6%, down from 54.0%, and the new orders index was at 57.8%, up from 53.3% in January.

From the Institute for Supply Management: February 2013 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in February for the third consecutive month, and the overall economy grew for the 45th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI™ registered 54.2 percent, an increase of 1.1 percentage points from January's reading of 53.1 percent, indicating expansion in manufacturing for the third consecutive month. This month's reading reflects the highest PMI™ since June 2011, when the index registered 55.8 percent. The New Orders Index registered 57.8 percent, an increase of 4.5 percent over January's reading of 53.3 percent, indicating growth in new orders for the second consecutive month. As was the case in January, all five of the PMI™'s component indexes — new orders, production, employment, supplier deliveries and inventories — registered in positive territory in February. In addition, the Backlog of Orders, Exports and Imports Indexes all grew in February relative to January."This was above expectations of 52.8% and suggests manufacturing expanded at a faster pace in February.

Final consumer sentiment for February:

The final Reuters / University of Michigan consumer sentiment index for February increased to 77.6. The preliminary reading was 76.3, and the January reading was 73.8.

The final Reuters / University of Michigan consumer sentiment index for February increased to 77.6. The preliminary reading was 76.3, and the January reading was 73.8. This was above the consensus forecast of 76.0, but still low. There are a number of factors that impact sentiment including unemployment, gasoline prices and, for 2013, the payroll tax increase, the default threat from Congress and the "sequester" spending cuts. People will slowly adjust to the payroll tax increase, and the threat of default is now behind us ... and sentiment has improved a little ... but the sequester cuts might hurt sentiment in March.