by Calculated Risk on 3/02/2013 01:11:00 PM

Saturday, March 02, 2013

Schedule for Week of March 3rd

Earlier:

• Summary for Week Ending March 1st

The key report this week is the February employment report on Friday.

Other key reports include the ISM service index on Tuesday, and the Trade Balance report on Thursday.

Also, the Federal Reserve will release the Q4 Flow of Funds report on Thursday.

8:00 AM ET: Speech by Fed Vice Chair Janet Yellen, "Challenges Confronting Monetary Policy", At the 29th National Association for Business Economics Policy Conference, Washington, D.C.

10:00 AM: ISM non-Manufacturing Index for February. The consensus is for a decrease to 55.0 from 55.2 in January. Note: Above 50 indicates expansion, below 50 contraction.

10:00 AM: Trulia Price Rent Monitors for February. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 173,000 payroll jobs added in February. Even with the new methodology, the report still isn't that useful in predicting the BLS report.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for January. The consensus is for a 2.2% decrease in orders.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts. Analysts will look for signs of an impact from the recent tax increases.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 355 thousand from 344 thousand last week. This is pre "sequester", and unemployment claims will probably increase soon.

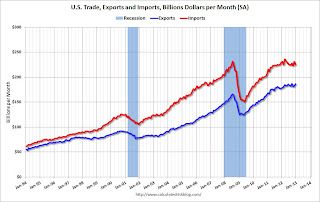

8:30 AM: Trade Balance report for January from the Census Bureau.

8:30 AM: Trade Balance report for January from the Census Bureau. Exports increased in December, and imports decreased and the trade deficit fell sharply.

The consensus is for the U.S. trade deficit to increase to $43.0 billion in January from $38.5 billion in December.

12:00 PM: Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

3:00 PM: Consumer Credit for January from the Federal Reserve. The consensus is for credit to increase $15.0 billion in January.

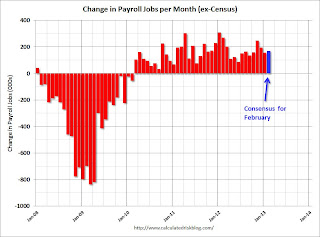

8:30 AM: Employment Report for February. The consensus is for an increase of 171,000 non-farm payroll jobs in February; the economy added 157,000 non-farm payroll jobs in January.

8:30 AM: Employment Report for February. The consensus is for an increase of 171,000 non-farm payroll jobs in February; the economy added 157,000 non-farm payroll jobs in January. The consensus is for the unemployment rate to decrease to 7.8% in February.

The second employment graph shows the percentage of payroll jobs lost during post WWII recessions through January.

The economy has added 6.1 million private sector jobs since employment bottomed in February 2010 (5.5 million total jobs added including all the public sector layoffs).

The economy has added 6.1 million private sector jobs since employment bottomed in February 2010 (5.5 million total jobs added including all the public sector layoffs).There are still 2.7 million fewer private sector jobs now than when the recession started in 2007.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for January. The consensus is for a 0.4% increase in inventories.