by Calculated Risk on 3/02/2013 08:38:00 AM

Saturday, March 02, 2013

Summary for Week ending March 1st

It was interesting week. In testimony to Congress, Fed Chairman Ben Bernanke made it clear he will keep the "pedal to the metal" with monetary policy. Meanwhile, Congress keeps tapping on the fiscal policy brakes, this time with "sequestration" budget cuts.

However, even with conflicting policy, the economy is doing OK - at least so far in 2013.

New Home sales in January were at the highest level since July 2008, auto sales were up again in February, the ISM manufacturing index for February was at the highest level since June 2011, weekly initial unemployment claims declined, and consumer sentiment increased. All were better than expected, and it appears the economy was improving before the sequestration budget cuts on March 1st - even with the payroll tax increase this year (although personal consumption expenditures were only up slightly in January).

Also Case-Shiller reported that house prices were up 6.8% in 2012 and finished the year strong. This year-over-year increase strongly suggests house prices bottomed in early 2012.

The ongoing housing recovery and solid auto sales (both leading indicators) suggest the economy will continue to grow for next few years.

Here is a summary of last week in graphs:

• New Home Sales at 437,000 SAAR in January

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 437 thousand. This was up from a revised 378 thousand SAAR in December (revised up from 369 thousand).

January is seasonally the weakest month of the year for new home sales, so January has the largest positive seasonal adjustment. Also this was just one month with a sales rate over 400 thousand - and we shouldn't read too much into one month of data. But this was the highest level since July 2008 and it is clear the housing recovery is ongoing.

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale was just above the record low. The combined total of completed and under construction is also just above the record low.

This was above expectations of 381,000 sales in January. This is the strongest sales rate since 2008. This was another solid report.

• U.S. Light Vehicle Sales increase to 15.4 million annual rate in February

Based on an estimate from AutoData Corp, light vehicle sales were at a 15.38 million SAAR in February. That is up 7% from February 2012, and up about 1% from the sales rate last month.

Based on an estimate from AutoData Corp, light vehicle sales were at a 15.38 million SAAR in February. That is up 7% from February 2012, and up about 1% from the sales rate last month.This was above the consensus forecast of 15.2 million SAAR (seasonally adjusted annual rate).

Note: dashed line is current estimated sales rate.

This is another positive sign for the economy going forward.

• ISM Manufacturing index increases in February to 54.2

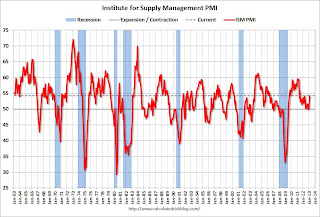

The ISM manufacturing index indicated expansion in February. PMI was at 54.2% in February, up from 53.1% in January. The employment index was at 52.6%, down from 54.0%, and the new orders index was at 57.8%, up from 53.3% in January.

The ISM manufacturing index indicated expansion in February. PMI was at 54.2% in February, up from 53.1% in January. The employment index was at 52.6%, down from 54.0%, and the new orders index was at 57.8%, up from 53.3% in January.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 52.8% and suggests manufacturing expanded at a faster pace in February.

• Personal Income declined 3.6% in January, Spending increased 0.2%

The BEA reported: "Personal income decreased $505.5 billion, or 3.6 percent ... in January, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $18.2 billion, or 0.2 percent."

The BEA reported: "Personal income decreased $505.5 billion, or 3.6 percent ... in January, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $18.2 billion, or 0.2 percent."The dashed red lines are the quarterly levels for real PCE. Personal spending increased about as expected in January.

Ignore the sharp decline in income and decline in the saving rate - that decline was because some people took income in December to avoid higher taxes in 2013.

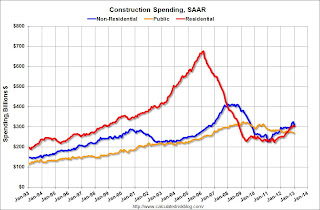

• Construction Spending declined in January

The Census Bureau reported that overall construction spending decreased in January:

The Census Bureau reported that overall construction spending decreased in January: The U.S. Census Bureau of the Department of Commerce announced today that construction spending during January 2013 was estimated at a seasonally adjusted annual rate of $883.3 billion, 2.1 percent below the revised December estimate of $902.6 billion. The January figure is 7.1 percent above the January 2012 estimate of $824.7 billion.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 55% below the peak in early 2006, and up 37% from the post-bubble low. Non-residential spending is 25% below the peak in January 2008, and up about 37% from the recent low.

Private residential spending is 55% below the peak in early 2006, and up 37% from the post-bubble low. Non-residential spending is 25% below the peak in January 2008, and up about 37% from the recent low.Public construction spending is now 17% below the peak in March 2009 and at the lowest level since 2006 (not inflation adjusted).

The second graph shows the year-over-year change in construction spending.

On a year-over-year basis, private residential construction spending is now up 22%. Non-residential spending is up 4% year-over-year mostly due to energy spending (power and electric). Public spending is down 3% year-over-year.

• Case-Shiller: Comp 20 House Prices increased 6.8% year-over-year in December

From S&P: Home Prices Closed Out a Strong 2012 According to the S&P/Case-Shiller Home Price Indices

From S&P: Home Prices Closed Out a Strong 2012 According to the S&P/Case-Shiller Home Price IndicesThe first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 30.0% from the peak, and up 0.9% in December (SA). The Composite 10 is up 6.2% from the post bubble low set in March (SA).

The Composite 20 index is off 29.2% from the peak, and up 0.9% (SA) in December. The Composite 20 is up 7.0% from the post-bubble low set in March (SA).

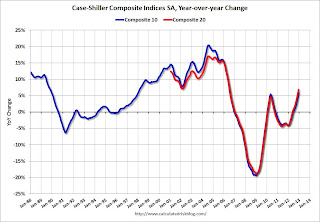

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 5.9% compared to December 2011.

The Composite 20 SA is up 6.8% compared to December 2011. This was the seventh consecutive month with a year-over-year gain since 2010 (when the tax credit boosted prices temporarily). This was the largest year-over-year gain for the Composite 20 index since 2006.

This was at the consensus forecast for a 6.8% YoY increase.

• Weekly Initial Unemployment Claims decrease to 344,000

The following graph shows the 4-week moving average of weekly claims since January 2000.

The DOL reports:

The DOL reports:In the week ending February 23, the advance figure for seasonally adjusted initial claims was 344,000, a decrease of 22,000 from the previous week's revised figure of 366,000. The 4-week moving average was 355,000, a decrease of 6,750 from the previous week's revised average of 361,750.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 355,000 - just above the lowest 4-week average since the recession.

Weekly claims were below the 360,000 consensus forecast.

• Consumer Sentiment improves

The final Reuters / University of Michigan consumer sentiment index for February increased to 77.6. The preliminary reading was 76.3, and the January reading was 73.8.

The final Reuters / University of Michigan consumer sentiment index for February increased to 77.6. The preliminary reading was 76.3, and the January reading was 73.8. This was above the consensus forecast of 76.0, but still low. There are a number of factors that impact sentiment including unemployment, gasoline prices and, for 2013, the payroll tax increase, the default threat from Congress and the "sequester" spending cuts. People will slowly adjust to the payroll tax increase, and the threat of default is now behind us ... and sentiment has improved a little ... but the sequester cuts might hurt sentiment in March.