by Calculated Risk on 1/22/2013 09:07:00 PM

Tuesday, January 22, 2013

Suspending the Debt Ceiling

Earlier on Existing Home Sales:

• Existing Home Sales: Another Solid Report

• Existing Home Sales in December: 4.94 million SAAR, 4.4 months of supply

• Existing Home Sales graphs

And on apartments: NMHC Apartment Survey: Market Conditions Loosen Slightly

From CNBC: GOP Moves to Suspend Debt Ceiling Until May

House Speaker John Boehner indicated Tuesday that Republicans will vote on an extension of the federal debt ceiling to allow Treasury to borrow money until mid-May. ...After the "sequester" comes the "continuing resolution" on March 27th. Note: Congress decided last September to extend spending authority for six months with a "continuing resolution".

... the next moment of high political and market drama will occur when the so-called "sequester" or automatic across the board spending cuts, kicks in on March 1.

I expect something will be worked out on the sequester, but there is a strong possibility the “continuing resolution" will lead to a government shutdown. A government shutdown would be disruptive, but probably not catastrophic since most of the government expenditures would continue.

Of course I think they should suspend the debt ceiling permanently (the debt ceiling is about paying the bills). From Ezra Klein: Suspending the debt ceiling is a great idea. Let’s do it forever!

Wednesday economic releases:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• 8:45 AM, LPS will released their "First Look" report on December mortgage performance

• At 10:00 AM, FHFA House Price Index for November 2012. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.7% increase in house prices.

• During the day: The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

ATA Trucking Index increases 2.8% in December

by Calculated Risk on 1/22/2013 06:11:00 PM

This is a minor indicator that I follow.

From ATA: ATA Truck Tonnage Index Jumped 2.8% in December

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 2.8% in December after surging 3.9% in November. (The 3.9% gain in November was revised from a 3.7% increase ATA reported on December 18, 2012.) The back-to-back increases in November and December were by far the best of gains of 2012. As a result, the SA index equaled 121.6 (2000=100) in December versus 118.3 in November. Despite the solid monthly increase, compared with December 2011, the SA index was off 2.3%, the worst year-over-year result since November 2009. For all of 2012, tonnage was up 2.3%. In 2011, the index increased 5.8%.Note from ATA:

...

“December was better than anticipated in light of the very difficult year-over-year comparison,” ATA Chief Economist Bob Costello said. In December 2011, the index surged 6.4% from the previous month. Costello anticipates more sluggishness in the index this year, especially early in the year, as the economy continues to face several headwinds.

“As paychecks shrink for all households due to higher taxes, I’m expecting a weak first quarter for tonnage and the broader economy” Costello said. “Since trucks account for the vast majority of deliveries in the retail supply chain, any reduction in consumer spending will have ramifications on truck tonnage levels.”

emphasis added

Trucking serves as a barometer of the U.S. economy, representing 67% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.2 billion tons of freight in 2011. Motor carriers collected $603.9 billion, or 80.9% of total revenue earned by all transport modes.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

Overall the index has been mostly moving sideways this year due to the slowdown in manufacturing. The spike down in October was related to Hurricane Sandy.

Philly Fed: State Coincident Indexes increased in 36 States in December

by Calculated Risk on 1/22/2013 04:15:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for December 2012. In the past month, the indexes increased in 32 states, decreased in 10, and remained stable in eight for a one-month diffusion index of 44. Over the past three months, the indexes increased in 41 states, decreased in seven, and remained stable in two (New Mexico and Wisconsin) for a three-month diffusion index of 68. For comparison purposes, the Philadelphia Fed has also developed a similar coincident index for the entire United States. The Philadelphia Fed’s U.S. index rose 0.2 percent in December and 0.6 percent over the past three months.Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

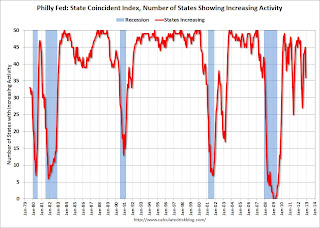

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In December, 36 states had increasing activity, down from 45 in November(including minor increases). This measure has been and up down over the last few years since the recovery has been sluggish.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession. The map was all green early in 2012, than started to turn red, and is mostly green again.

NMHC Apartment Survey: Market Conditions Loosen Slightly

by Calculated Risk on 1/22/2013 01:45:00 PM

From the National Multi Housing Council (NMHC): Expansion Moderates for Apartment Markets in January

After a seven-quarter run, expansion moderated for apartment markets according to the National Multi Housing Council’s (NMHC) January Quarterly Survey of Apartment Market Conditions. For the first time since 2010, two of the four indexes – Market Tightness (45) and Sales Volume (49) – dipped below 50, though just barely. The two financing indexes show continued improvement for the 8th consecutive quarter, as the Equity Financing (56) and Debt Financing (57) Indexes remained above the breakeven level of 50.

“The pace of improvement in the apartment industry is moderating, but the expansion remains solid,” said Mark Obrinsky, NMHC’s Vice President for Research and Chief Economist. “Lease-up demand is seasonally weak in January, which would fully explain the small drop in the Market Tightness Index. Beyond that, markets were quite tight three months ago, and remain tight today. New construction has picked up considerably since its 2009 low, but is still playing catch-up with the increase in demand for apartment residences.”

...

Market Tightness Index declined to 45 from 56. The change ends an 11-quarter run for the index at 50 or higher. Fifty-nine percent of respondents said that markets were unchanged, reflecting stable demand conditions. One quarter of respondents saw markets as looser, up from 14 percent in October, while 16 percent viewed markets as tighter.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tightening from the previous quarter. This quarterly decline followed eleven consecutive quarters with tighter market conditions.

The recent Reis data showed apartment vacancy rates fell in Q4 2012 to 4.5%, down from 4.7% in Q3 2012. As Obrinsky noted, markets are still tight, but this might suggest the vacancy rate will stop declining (caveat: this is just one quarter of survey data and the index might bounce back).

On supply: Even though multifamily starts have been increasing, completions lag starts by about a year - so the builders are still trying to catch up. There will be many more completions in 2013 than in 2012, increasing the supply.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010. This survey now suggests vacancy rates might stop falling - a possible significant market change - although apartment markets are still tight, so rents will probably continue to increase.

Existing Home Sales: Another Solid Report

by Calculated Risk on 1/22/2013 12:14:00 PM

Here is how Reuters reported on existing home sales: Existing Home Sales Unexpectedly Fall 1 Percent

U.S. home resales unexpectedly fell in December as fewer people put their properties on the market, although not by enough to derail the boost housing will likely provide to the economy this year.There is so much wrong with that sentence. First, for those reading the correct site, the forecast was for 4.97 million sales on a seasonally adjusted annual rate basis, and inventory decling to 1.87 million. The NAR reported sales of 4.94 million and inventory of 1.82 million. Hard to call that "unexpected" (although sales were below the less accurate "consensus" forecast).

But far more important is that flat or even declining existing home sales is the wrong place to look for a "housing recovery". As the number of distressed sales decline, the number of total sales might decline too - but the number of conventional sales is increasing! An increase in conventional sales would be good news, not bad news. Although I have limited confidence in the NAR survey, the NAR reported:

Distressed homes - foreclosures and short sales - accounted for 24 percent of December sales ... below the 32 percent share in December 2011.Using the NAR surveys and sales reports would suggest 3.75 million conventional sales in December 2012 (SAAR), up 26% from 2.98 conventional sales in December 2011. That is a significant increase.

Also fewer distressed sales probably means more housing starts and new home sales - and that is the key for housing providing a "boost" to the economy in 2013.

Finally, when we look at the existing home sales report, the key number is inventory. And inventory is at the lowest level since January 2001, and months-of-supply fell to 4.4 months - the lowest since May 2005.

For those looking at the correct numbers, this was the expected report - and it was solid.

Important note: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Click on graph for larger image.

Click on graph for larger image.This graph shows inventory by month since 2004. In 2005 (dark blue columns), inventory kept rising all year - and that was a clear sign that the housing bubble was ending.

This year (dark red for 2012) inventory is at the lowest level for the month of December since 2000, and inventory is sharply below the level in December 2005 (not counting contingent sales). The months-of-supply has fallen to 4.4 months. Since months-of-supply uses Not Seasonally Adjusted (NSA) inventory, and Seasonally Adjusted (SA) sales, I expect months-of-supply to start increasing in February.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in December (red column) are above 2007 through 2011. Sales are well below the bubble years of 2005 and 2006.

Sales NSA in December (red column) are above 2007 through 2011. Sales are well below the bubble years of 2005 and 2006.Earlier:

• Existing Home Sales in December: 4.94 million SAAR, 4.4 months of supply

• Existing Home Sales graphs

Existing Home Sales in December: 4.94 million SAAR, 4.4 months of supply

by Calculated Risk on 1/22/2013 10:00:00 AM

The NAR reports: Existing-Home Sales Slip in December, Prices Continue to Rise; 2012 Totals Up

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, declined 1.0 percent to a seasonally adjusted annual rate of 4.94 million in December from a downwardly revised 4.99 million in November, but are 12.8 percent above the 4.38 million-unit level in December 2011.

The preliminary annual total for existing-home sales in 2012 was 4.65 million, up 9.2 percent from 4.26 million in 2011. It was the highest volume since 2007 when it reached 5.03 million and the strongest increase since 2004.

...

Total housing inventory at the end of December fell 8.5 percent to 1.82 million existing homes available for sale, which represents a 4.4-month supply at the current sales pace, down from 4.8 months in November, and is the lowest housing supply since May of 2005 when it was 4.3 months, which was near the peak of the housing boom.

Listed inventory is 21.6 percent below a year ago when there was a 6.4-month supply. Raw unsold inventory is at the lowest level since January 2001 when there were 1.78 million homes on the market.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in December 2012 (4.94 million SAAR) were 1.0% lower than last month, and were 12.8% above the December 2011 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory declined to 1.82 million in December down from 1.99 million in November. This is the lowest level of inventory since January 2001. Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January.

According to the NAR, inventory declined to 1.82 million in December down from 1.99 million in November. This is the lowest level of inventory since January 2001. Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 21.6% year-over-year in December from December 2011. This is the 22nd consecutive month with a YoY decrease in inventory.

Inventory decreased 21.6% year-over-year in December from December 2011. This is the 22nd consecutive month with a YoY decrease in inventory.Months of supply declined to 4.4 months in December, the lowest level since May 2005.

This was below expectations of sales of 5.10 million, but right at Tom Lawler's forecast. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing. I'll have more later ...

Chicago Fed "Economic Growth Moderated in December"

by Calculated Risk on 1/22/2013 08:38:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Growth Moderated in December

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) decreased to +0.02 in December from +0.27 in November. Two of the four broad categories of indicators that make up the index decreased from November, and only two of the four categories made positive contributions to the index in December.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, edged up from –0.13 in November to –0.11 in December—its tenth consecutive reading below zero. December’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity "moderated" in December, and growth was slightly below trend (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Monday, January 21, 2013

Tuesday: Existing Home Sales

by Calculated Risk on 1/21/2013 09:16:00 PM

The Asian markets are mixed tonight with the Nikkei index up 0.3% and the Shanghai Composite index down slightly.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P and DOW futures are up slightly (fair value).

Oil prices have moved up recently with WTI futures at $95.41 per barrel and Brent at 111.88 per barrel. Gasoline prices are moving sideways.

Tuesday economic releases:

• At 8:30 AM ET, Chicago Fed National Activity Index for December. This is a composite index of other data.

• At 10:00 AM, Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for sales of 5.10 million on seasonally adjusted annual rate (SAAR) basis. Economist Tom Lawler estimates the NAR will report sales at 4.97 million SAAR.

• Also at 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for January. The consensus is for a a reading of 5 for this survey, unchanged from December (Above zero is expansion).

Existing Home Inventory up 2% in mid-January

by Calculated Risk on 1/21/2013 07:08:00 PM

One of key questions for 2013 is Will Housing inventory bottom in this year?.

If inventory does bottom, we probably will not know for sure until late in the year. In normal times, there is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The NAR data is monthly and released with a lag. However Ben at Housing Tracker (Department of Numbers) kindly sent me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year.

In 2010 (blue), inventory followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

So far - and this is very early - it appears inventory is increasing at a more normal rate.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

The key will be to see how much inventory increasses over the next few months. In 2010, inventory was up 8% by early March, and up 15% by the end of March.

For 2011 and 2012, inventory only increased about 5% at the peak.

So far in 2013, inventory is up 2%, and the next several weeks will be very interesting for inventory!

2012 Preliminary Existing Homes: Sales up about 9%, Inventory down 19%

by Calculated Risk on 1/21/2013 03:35:00 PM

As a follow up to the post on New Home sales ... On Tuesday, the NAR will release the Existing Home Sales report for December. It looks like sales will be up over 9% in 2012, and inventory will be off over 19%.

One of my 10 question for 2013 was: Question #8 for 2013: Will Housing inventory bottom in 2013?. Here was my conclusion:

If prices increase enough then some of the potential sellers will come off the fence, and some of these underwater homeowners will be able to sell. It might be enough for inventory to bottom in 2013.I'm looking at some data for clues if inventory is now at or near the bottom (I'll have more later today or this week).

Right now my guess is active inventory will bottom in 2013, probably in January. At the least, the rate of year-over-year inventory decline will slow sharply. It will be very interesting to see how much inventory comes on the market during the spring selling season!

This table shows the annual sales rate, inventory, and months-of-supply for the last six years (2012 estimated). Note that inventory and months-of-supply are for December.

| Existing Home Sales | |||||

|---|---|---|---|---|---|

| Annual Sales | Annual Change | Annual Inventory | Annual Change | Months-of-Supply | |

| 2007 | 5,040,000 | 3,520,000 | 8.9 | ||

| 2008 | 4,110,000 | -18.5% | 3,130,000 | -11.1% | 10.4 |

| 2009 | 4,340,000 | 5.6% | 2,740,000 | -12.5% | 8.8 |

| 2010 | 4,190,000 | -3.5% | 3,020,000 | 10.2% | 9.4 |

| 2011 | 4,260,000 | 1.7% | 2,320,000 | -23.2% | 8.2 |

| 12012 | 4,660,000 | 9.4% | 1,870,000 | -19.4% | 4.5 |

| 1 Estimates for 2012 | |||||

Existing home sales did not collapse as far as new home sales because of all the distressed sales. As the number of distressed sales declines, new home sales will increase - and it is possible that total existing home sales will stay flat or even decline. That will not be bad news for the housing market - the key is that the number of conventional sales has been increasing.

2012 New Home sales will be up about 20% from 2011

by Calculated Risk on 1/21/2013 10:08:00 AM

On Friday, the Census Bureau will release the New Home Sales report for December. It looks like sales will be up close to 20% in 2012, the first year-over-year increase since 2005.

This table shows the annual sales rate for the last eight years (2012 estimated).

| Annual New Home Sales | ||

|---|---|---|

| Year | Sales (000s) | Change in Sales |

| 2005 | 1,283 | 6.7% |

| 2006 | 1,051 | -18.1% |

| 2007 | 776 | -26.2% |

| 2008 | 485 | -37.5% |

| 2009 | 375 | -22.7% |

| 2010 | 323 | -13.9% |

| 2011 | 306 | -5.3% |

| 20121 | 367 | 19.9% |

| 1 Estimate for 2012 | ||

Even with the sharp increase in sales, 2012 will still be the third lowest year for new home sales since the Census Bureau started tracking sales in 1963. The two lowest years were 2010 and 2011.

A key question looking forward is how much sales will increase over the next few years. My initial guess was sales would rise to around 800 thousand per year, but others think the peak may be closer to 700 thousand.

Note: For 2013, estimates are sales will increase to around 450 to 460 thousand, or another 22% to 25% on an annual basis.

For the period 1980 through 2000, new homes sales averaged 664 thousand per year, with peaks at 750 thousand in 1986 (annual) and over 800 thousand in the late '90s - and two deep "busts" in the early '80 and early '90s.

For the period 1980 through 2000, new homes sales averaged 664 thousand per year, with peaks at 750 thousand in 1986 (annual) and over 800 thousand in the late '90s - and two deep "busts" in the early '80 and early '90s.I think the demographics support close to 800 thousand per year, but even if sales only rise to the average of 664 thousand for the '80s and '90s, sales would still increase over 80% from the 2012 level.

For now I'll stick with my guess that sales will more than double from the 2012 level in a few years - but even a lower level would be a significant contribution to GDP and employment growth over the next few years.

LA area Port Traffic: Little impact from strike in December

by Calculated Risk on 1/21/2013 08:22:00 AM

Note: Clerical workers at the ports of Long Beach and Los Angeles went on strike starting Nov 27th and ending Dec 5th. The strike impacted port traffic for November and early December, but traffic bounced back quickly following the strike.

I've been following port traffic for some time. Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for December. LA area ports handle about 40% of the nation's container port traffic. Some of the LA traffic was routed to other ports in early December, so this data might not be as useful this month.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up slightly and outbound traffic down slightly compared to the rolling 12 months ending in November.

In general, inbound and outbound traffic has been mostly moving sideways recently.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March.

For the month of December, loaded outbound traffic was down 2% compared to December 2011, and loaded inbound traffic was down 5% compared to December 2011.

Maybe outbound traffic was impacted more by the strike than inbound, but it appears the strike had little impact on overall traffic in December.

Sunday, January 20, 2013

Flashback to 2007: Tanta on "Sound bankers"

by Calculated Risk on 1/20/2013 05:03:00 PM

Note: Tanta wrote the following post on May 8, 2007. Ownit had filed for bankruptcy a few months earlier, Countrywide was purchased by BofA in 2008, and Bear Stearns collapsed in March 2008 - both after Tanta wrote this post.

From Doris "Tanta" Dungey, May 2007:

CR used to like to quote this one every now and again, back in the days when this blog was just a little back-water hand-wringer in a sea of housing and mortgage bulls:

"A sound banker, alas, is not one who foresees danger and avoids it, but one who, when he is ruined, is ruined in a conventional way along with his fellows, so that no one can really blame him."It's amazing how ever-fresh this particular avoidance of blame is. There's the CEO of Countrywide:

John Maynard Keynes, "Consequences to the Banks of a Collapse in Money Values", 1931

"I've been doing this for 54 years," Mozilo recently said during a speech in Beverly Hills, California. For many years, he said, "standards never changed: verification of employment, verification of deposit, credit report."There's Tom Marano of Bear Stearns:

But then new players came in with aggressive lending policies. Names like Ameriquest, New Century, NovaStar Financial and Ownit Mortgage Solutions set a new, lowered standard, changing the rules of the game, Mozilo said.

"Traditional lenders such as ourselves looked around and said, 'Well, maybe there's a (new) paradigm here. Maybe we've just been wrong. Maybe you can originate these loans safely without verifications, without documentation,"' Mozilo said.

But Tom Marano, who heads the mortgage business at Bear Stearns, disputed the contention that Wall Street pressure led to the loosening of credit standards. Investment banks, he said, do not directly make many loans.And there is our famous Bill Dallas of Ownit Mortgage:

“If enough independent companies set standards, that becomes the market,” he said. “Wall Street’s role is largely one where we assess risk, we purchase loans.”

Bill Dallas, chief executive of Ownit, the nation's 20th-largest subprime lender in 2006, said he saw the handwriting on the wall in April 2005 after he overheard a rival account executive tell a customer how to get a better rate by committing occupancy or income fraud.Sound bankers, to a man.

"I just went, 'We are hosed as an industry,"' Dallas said. "I told our guys, 'We're the problem."

The structure of the industry was part of the problem, he said: "Our account reps are talking to the mortgage broker, the mortgage broker is talking to the borrower, and they're teaching them all the wrong things."

Predicting the Next Recession

by Calculated Risk on 1/20/2013 01:48:00 PM

A few thoughts on the "next recession" ... Forecasters generally have a terrible record at predicting recessions. There are many reasons for this poor performance. In 1987, economist Victor Zarnowitz wrote in "The Record and Improvability of Economic Forecasting" that there was too much reliance on trends, and he also noted that predictive failure was also due to forecasters' incentives. Zarnowitz wrote: "predicting a general downturn is always unpopular and predicting it prematurely—ahead of others—may prove quite costly to the forecaster and his customers".

Incentives motivate Wall Street economic forecasters to always be optimistic about the future (just like stock analysts). Of course, for the media and bloggers, there is an incentive to always be bearish, because bad news drives traffic (hence the prevalence of yellow journalism).

In addition to paying attention to incentives, we also have to be careful not to rely "heavily on the persistence of trends". One of the reasons I focus on residential investment (especially housing starts and new home sales) is residential investment is very cyclical and is frequently the best leading indicator for the economy. UCLA's Ed Leamer went so far as to argue that: "Housing IS the Business Cycle". Usually residential investment leads the economy both into and out of recessions. The most recent recovery was an exception, but it was fairly easy to predict a sluggish recovery without a contribution from housing.

Since I started this blog in January 2005, I've been pretty lucky on calling the business cycle. I argued no recession in 2005 and 2006, then at the beginning of 2007 I predicted a recession would start that year (made it by one month with the Great Recession starting in December 2007). And in 2009, I argued the economy had bottomed and we'd see sluggish growth.

Finally, over the last 18 months, a number of forecasters (mostly online) have argued a recession was imminent. I responded that I wasn't even on "recession watch", primarily because I thought residential investment was bottoming.

Now one of my blogging goals is to see if I can get lucky again and call the next recession correctly. Right now I'm pretty optimistic (see: The Future's so Bright ...) and I expect a pickup in growth over the next few years (2013 will be sluggish with all the austerity).

The next recession will probably be caused by one of the following (from least likely to most likely):

3) An exogenous event such as a pandemic, significant military conflict, disruption of energy supplies for any reason, a major natural disaster (meteor strike, super volcano, etc), and a number of other low probability reasons. All of these events are possible, but they are unpredictable, and the probabilities are low that they will happen in the next few years or even decades.

2) Significant policy error. This might involve premature or too rapid fiscal or monetary tightening (like the US in 1937 or eurozone in 2012). Two examples: not reaching a fiscal agreement and going off the "fiscal cliff" probably would have led to a recession, and Congress refusing to "pay the bills" would have been a policy error that would have taken the economy into recession. Both are off the table now, but there remains some risk of future policy errors.

Note: Usually the optimal path for reducing the deficit means avoiding a recession since a recession pushes up the deficit as revenues decline and automatic spending (unemployment insurance, etc) increases. So usually one of the goals for fiscal policymakers is to avoid taking the economy into recession. Too much austerity too quickly is self defeating.

1) Most of the post-WWII recessions were caused by the Fed tightening monetary policy to slow inflation. I think this is the most likely cause of the next recession. Usually, when inflation starts to become a concern, the Fed tries to engineer a "soft landing", and frequently the result is a recession. Since inflation is not an immediate concern, the Fed will probably stay accommodative for a few more years.

So right now I expect further growth for the next few years (all the austerity in 2013 concerns me, especially over the next couple of quarters as people adjust to higher payroll taxes, but I think we will avoid contraction). I think the most likely cause of the next recession will be Fed tightening to combat inflation sometime in the future - and residential investment (housing starts, new home sales) will probably turn down well in advance of the recession. In other words, I expect the next recession to be a more normal economic downturn - and I don't expect a recession for a few years.

"The case for deficit optimism"

by Calculated Risk on 1/20/2013 09:56:00 AM

From Ezra Klein: The case for deficit optimism Here’s a secret:

For all the sound and fury, Washington’s actually making real progress on debt.

... Start the clock — and the deficit projections — on Jan. 1, 2011. Congress cut expected spending by $585 billion during the 2011 appropriations process. It cut another $860 billion as part of the resolution to the 2011 debt-ceiling standoff. And it added another $1 trillion in spending cuts as part of the sequester. Then it raised $600 billion in taxes in the fiscal cliff deal.

Together, that’s slightly more than $3 trillion in deficit reduction. ... In fact, that’s about enough to stabilize the nation’s debt-to-GDP ratio over the next decade.

... Obama said ... we have “a health-care problem,” not a spending problem. This is, in general, a fairly uncontroversial point on the right ...

Back in December 2011, I asked Rep. Paul Ryan, budget guru to the House Republicans, for his favorite chart of the year ... He sent me one from the Bipartisan Policy Center showing four lines. One, labeled “discretionary spending,” was drifting down. Another, “mandatory spending,” was also falling. A third, denoting Social Security expenses, was rising a bit, but not by enough to worry anyone. The fourth, health-care spending, was shooting skyward. “Government spending drives the debt, and the growth of government health-care programs drives the spending,” Ryan explained.A few key points:

So here’s the good news: The growth of health-care costs has slowed in recent years. Big time. From 2009 to 2011, which is the most recent data available, health-care costs have grown by less than four percentage points. That’s compared to typical growth of six or seven percentage points through most of the Aughts. ... The $64,000 question — actually, it’s worth trillions of dollars more — is whether this slowdown is a recession-induced blip or the product, at least in part, of cost controls that will persist long after the economy has returned to health. At the moment, there’s evidence to support both views. ...

... the truth is that deficit reduction is going better than you’d think from listening to the sniping in Washington.

1) the deficit as a percent of GDP has been declining and will probably continue to decline over the next several years even without further deficit reduction measures (see the third chart here),

2) the debt to GDP ratio will probably stabilize and may even decline over the next decade,

3) the key long term budget issue is health care costs.

Saturday, January 19, 2013

"Financial Collapse: A 10-Step Recovery Plan"

by Calculated Risk on 1/19/2013 09:34:00 PM

Alan Blinder lists 10 financial commandments to remember - and starts by reminding us that "people do learn. The problem is that they forget — sometimes amazingly quickly."

The old Wall Street saying is "there is no institutional memory". Each new generation of Wall Street wizards figures out a new way to turn lead into gold, and to become wealthy while damaging the financial system. Some of these wizards are probably perfecting their financial alchemy right now.

Maybe next time people will remember Blinder's 10 step plan, but I doubt it: Financial Collapse: A 10-Step Recovery Plan

1. Remember That People ForgetBlinder concludes:

...

2. Do Not Rely on Self-Regulation

...

3. Honor Thy Shareholders

...

4. Elevate Risk Management

...

5. Use Less Leverage

...

6. Keep It Simple, Stupid

...

7. Standardize Derivatives and Trade Them on Exchanges

...

8. Keep Things on the Balance Sheet

...

9. Fix Perverse Compensation

...

10. Watch Out for Consumers

Mark Twain is said to have quipped that while history doesn’t repeat itself, it does rhyme. There will be financial crises in the future, and the next one won’t be a carbon copy of the last. Neither, however, will it be so different that these commandments won’t apply. Financial history does rhyme, but we’re already forgetting the meter.All of these items are important, but I think the key is to watch for excessive speculation using leverage. One thing is certain, there will be another bubble ...

Earlier:

• Schedule for Week of Jan 20th

• Summary for Week Ending Jan 18th

Unofficial Problem Bank list declines to 826 Institutions

by Calculated Risk on 1/19/2013 05:44:00 PM

Here is the unofficial problem bank list for Jan 18, 2012.

Changes and comments from surferdude808:

With the FDIC having a closing for the second consecutive week and the OCC releasing its actions through mid-December 2012, it was a busy week for the Unofficial Problem Bank List. In all, there were 10 removals and four additions, which leave the list holding 826 institutions with assets of $308.7 billion. A year ago the list held 963 institutions with assets of $389.2 billion.Earlier:

First Federal Bank Texas, Tyler, TX ($192 million Ticker: FFBT) merged on an unassisted basis and Evergreen International Bank, Long Beach, CA ($28 million) closed via a voluntary liquidation. The involuntary liquidation or FDIC closing was 1st Regents Bank, Andover, MN ($50 million).

Actions were terminated against Southwest Securities, FSB, Dallas, TX ($1.3 billion Ticker: SWS); Bank of Blue Valley, Overland Park, KS ($662 million Ticker: BVBC); Mountain West Bank, National Association, Helena, MT ($633 million Ticker: MTWF); First Federal Bank, Harrison, AR ($544 million Ticker: FFBH); Tulsa National Bank, Tulsa, OK ($165 million); and RiverWood Bank, Baxter, MN ($157 million). Also, Triumph Savings Bank, SSB, Dallas, TX ($286 million) was removed based on media report provided by a reader. However, the FDIC has not recognized the action termination by press release or in its enforcement action database.

The following four banks joined the list this week -- Citizens Financial Bank, Munster, IN ($1.1 billion Ticker: CITZ); Fieldpoint Private Bank & Trust, Greenwich, CT ($682 million); Delanco Federal Savings Bank, Delanco, NJ ($133 million); and Ben Franklin Bank of Illinois, Arlington Heights, IL ($100 million Ticker: BFFI).

Next week, we anticipate the FDIC will release its actions for December 2012.

• Schedule for Week of Jan 20th

• Summary for Week Ending Jan 18th

Summary for Week ending January 18th

by Calculated Risk on 1/19/2013 11:21:00 AM

Most of the data released last week was encouraging. Housing starts were up 28% annually in 2012 - a strong increase, and starts are still very low - and that suggests further increases for starts over the next few years and is good news for the economy. Note: There is a strong seasonal adjustment for housing starts in December (typically a slow month), so I'd use the monthly sales rate with caution - but the annual increase was solid.

There were other positive reports: retail sales in December were stronger than expected, industrial production increased, and weekly unemployment claims fell sharply (although there are strong seasonal adjustments in January). Still, the 4-week average of initial weekly unemployment claims is near the post-recession low.

On the negative side, both the NY Fed (Empire State) and Philly Fed manufacturing indexes indicated contraction in January. Even though housing is picking up, manufacturing remains weak. Another negative was consumer sentiment - probably being impacted by Congress (maybe by the payroll tax increase too) - but it now appears that Congress will pay the bills, so sentiment will probably improve.

It appears that economic growth is picking up, although the fiscal agreement will mean a drag of 1.5 to 2.0 percentage points on GDP growth in 2013 - so we should expect another year of sluggish growth.

Finally, I heard one analyst on CNBC ask why the Fed is staying so accommodative even with a pickup in growth. The answer is simple: the unemployment rate is 7.8% (very high), and inflation is below the Fed's target (see graph below).

And here is a summary of last week in graphs:

• Housing Starts increase sharply to 954 thousand SAAR in December

Click on graph for larger image.

Click on graph for larger image.

Total housing starts were at 954 thousand (SAAR) in December, up 12.1% from the revised November rate of 851 thousand (SAAR). This was well above expectations of 887 thousand starts in December.

Housing starts increased 28.1% in 2012 and even after the sharp increase, the 780 thousand housing starts last year were the fourth lowest on an annual basis since the Census Bureau started tracking starts in 1959 (the three lowest years were 2009 through 2011). This was also the fourth lowest year for single family starts since 1959.

Starts averaged 1.5 million per year from 1959 through 2000. Demographics and household formation suggests starts will return to close to that level over the next few years. That means starts will come close to doubling from the 2012 annual level.

Since residential investment and housing starts are usually the best leading indicator for economy, this suggests the economy will continue to grow over the next couple of years.

• Retail Sales increased 0.5% in December

On a monthly basis, retail sales increased 0.5% from November to December (seasonally adjusted), and sales were up 4.7% from December 2011.

On a monthly basis, retail sales increased 0.5% from November to December (seasonally adjusted), and sales were up 4.7% from December 2011.Sales for November were revised up to a 0.4% gain.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 25.4% from the bottom, and now 9.7% above the pre-recession peak (not inflation adjusted)

This was above the consensus forecast of a 0.3% increase, and suggests the initial "soft" reports for December were too pessimistic.

• Fed: Industrial Production increased 0.3% in December

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.From the Fed: Industrial production and Capacity Utilization "Industrial production increased 0.3 percent in December after having risen 1.0 percent in November when production rebounded in the industries that had been negatively affected by Hurricane Sandy in late October. ... Capacity utilization for total industry moved up 0.1 percentage point to 78.8 percent, a rate 1.5 percentage points below its long-run (1972--2011) average."

This graph shows Capacity Utilization. This series is up 12 percentage points from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. This series is up 12 percentage points from the record low set in June 2009 (the series starts in 1967).Capacity utilization at 78.8% is still 1.5 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

Both Industrial Production and Capacity Utilization were slightly above expectations.

• Philly Fed and NY Fed Manufacturing Surveys show contraction in January

From the Philly Fed: January Manufacturing Survey "Manufacturing activity declined moderately this month, according to firms responding to the January Business Outlook Survey. ... The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from

a revised reading of 4.6 in December to ‐5.8 this month". Earlier this week, the Empire State manufacturing survey also indicated contraction in January.

From the Philly Fed: January Manufacturing Survey "Manufacturing activity declined moderately this month, according to firms responding to the January Business Outlook Survey. ... The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from

a revised reading of 4.6 in December to ‐5.8 this month". Earlier this week, the Empire State manufacturing survey also indicated contraction in January.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through January. The ISM and total Fed surveys are through December.

The average of the Empire State and Philly Fed surveys decreased in January, and is back below zero. This suggests another weak reading for the ISM manufacturing index.

• Weekly Initial Unemployment Claims decline to 335,000

The DOL reported: "In the week ending January 12, the advance figure for seasonally adjusted initial claims was 335,000, a decrease of 37,000 from the previous week's revised figure of 372,000. The 4-week moving average was 359,250, a decrease of 6,750 from the previous week's revised average of 366,000."

The DOL reported: "In the week ending January 12, the advance figure for seasonally adjusted initial claims was 335,000, a decrease of 37,000 from the previous week's revised figure of 372,000. The 4-week moving average was 359,250, a decrease of 6,750 from the previous week's revised average of 366,000."The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 359,250.

This was the lowest level for weekly claims since January 2008, and the 4-week average is near the low since early 2008. Note: Data for January has large seasonal adjustments - and can be very volatile, but this is still good news.

• Key Measures show low inflation in December

This graph shows the year-over-year change for four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, the CPI rose 1.7%, and the CPI less food and energy rose 1.9%. Core PCE is for November and increased 1.5% year-over-year.

This graph shows the year-over-year change for four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, the CPI rose 1.7%, and the CPI less food and energy rose 1.9%. Core PCE is for November and increased 1.5% year-over-year.On a monthly basis, median CPI was at 1.9% annualized, trimmed-mean CPI was at 1.1% annualized, and core CPI increased 1.2% annualized. Also core PCE for November increased 1.6% annualized. These measures suggest inflation is below the Fed's target of 2% on a year-over-year basis.

With this low level of inflation and the current high level of unemployment, the Fed will keep the "pedal to the metal".

• CoreLogic: House Prices up 7.4% Year-over-year in November, Largest increase since 2006

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.The index was up 0.3% in November, and is up 7.4% over the last year.

The index is off 26.8% from the peak - and is up 9.6% from the post-bubble low set in February 2012 (the index is NSA, so some of the increase is seasonal).

The next graph is from CoreLogic.

The year-over-year comparison has been positive for nine consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The year-over-year comparison has been positive for nine consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).This is the largest year-over-year increase since 2006.

Since this index is not seasonally adjusted, it was expected to decline on a month-to-month basis in November - instead the index increased, and, considering seasonal factors, this month-to-month increase was very strong.

• Preliminary January Consumer Sentiment declines to 71.3

The preliminary Reuters / University of Michigan consumer sentiment index for January declined to 71.3 from the December reading of 72.9.

The preliminary Reuters / University of Michigan consumer sentiment index for January declined to 71.3 from the December reading of 72.9.This was below the consensus forecast of 75.0. There are a number of factors that can impact sentiment including unemployment, gasoline prices and other concerns - and, for January, the payroll tax increase and Congress' threat to not pay the bills.

Back in August 2011, sentiment declined sharply due to the threat of default and the debt ceiling debate. Unfortunately it appears Congress is negatively impacting sentiment once again.

Schedule for Week of Jan 20th

by Calculated Risk on 1/19/2013 08:02:00 AM

Note: I'll post a summary for last week soon.

There are two key December housing reports that will be released this week, Existing home sales on Tuesday, and New Home sales on Friday.

For manufacturing, the January Richmond Fed and Kansas City Fed surveys will be released this week.

All US markets will be closed in observance of the Martin Luther King, Jr. Day holiday.

8:30 AM ET: Chicago Fed National Activity Index for December. This is a composite index of other data.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for sales of 5.10 million on seasonally adjusted annual rate (SAAR) basis. Sales in November 2012 were 5.04 million SAAR.

Economist Tom Lawler estimates the NAR will report sales at 4.97 million SAAR.

A key will be inventory and months-of-supply.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for January. The consensus is for a a reading of 5 for this survey, unchanged from December (Above zero is expansion).

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: FHFA House Price Index for November 2012. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.7% increase in house prices.

During the day: The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 360 thousand from 335 thousand last week.

9:00 AM: The Markit US PMI Manufacturing Index Flash. This release might provide hints about the ISM PMI for January. This consensus is for a decrease to 54.0 from 54.2 in December.

10:00 AM: Conference Board Leading Indicators for December. The consensus is for a 0.4% increase in this index.

11:00 AM: Kansas City Fed regional Manufacturing Survey for January. The consensus is for a reading of 2, up from -2 in December (below zero is contraction).

10:00 AM: New Home Sales for December from the Census Bureau.

10:00 AM: New Home Sales for December from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the November sales rate.

The consensus is for an increase in sales to 388 thousand Seasonally Adjusted Annual Rate (SAAR) in December from 377 thousand in November.

Friday, January 18, 2013

Bank Failure #2 in 2013: 1st Regents Bank, Andover, Minnesota

by Calculated Risk on 1/18/2013 09:20:00 PM

Nor all of First Regent’s men

Can save it again

by Soylent Green is People

From the FDIC: First Minnesota Bank, Minnetonka, Minnesota, Assumes All of the Deposits of 1st Regents Bank, Andover, Minnesota

As of September 30, 2012, 1st Regents Bank had approximately $50.2 million in total assets and $49.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $10.5 million. ... 1st Regents Bank is the second FDIC-insured institution to fail in the nation this year, and the first in Minnesota.A Friday tradition continues ...