by Calculated Risk on 7/02/2010 04:18:00 PM

Friday, July 02, 2010

Fewest Teen Jobs added in June since 1951

According to the BLS, only 497,000 teens (ages 16 to 19) found jobs in June 2010 NSA (June is the key months for summer employment). This is the fewest teen jobs added in June since 1951. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of teens looking for work (lowest since 1954) and the number of teens found jobs in June (data is not seasonally adjusted).

This partially explains the large drop in participation rate in June - an extremely low number of teenagers joined the workforce, and this resulted in 256,000 teens leaving the workforce on a seasonally adjusted basis - of the total 652,000 total people leaving the workforce (seasonally adjusted).

Teens not looking for jobs - because the job market is so bad - actually helped push down the unemployment rate!

Earlier employment posts today:

Personal Bankruptcy Filings up 14% in first 6 months of 2010

by Calculated Risk on 7/02/2010 01:45:00 PM

From the American Bankruptcy Institute: Consumer Bankruptcy Filings up 14 percent through First Half of 2010

U.S. consumer bankruptcy filings totaled 770,117 nationwide during the first six months of 2010 (Jan. 1-June 30), a 14 percent increase over the 675,351 total consumer filings during the same period a year ago, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). The consumer filings for the first half of 2010 represent the highest total since 2005, when Congress enacted the Bankruptcy Abuse Prevention and Consumer Protection Act to try and stem the tide of filings, although the number of monthly consumer filings has been steadily decreasing since March.

"Years of rising consumer debt and low savings rates, combined with the housing and unemployment crises, are causing bankruptcy levels not seen since the 2005 amendments to the Bankruptcy Code," said ABI Executive Director Samuel J. Gerdano. "We expect that there will be more than 1.6 million new bankruptcy filings by year end."

The overall June consumer filing total of 126,270 was 8.5 percent more than the 116,365 consumer filings recorded in June 2009.

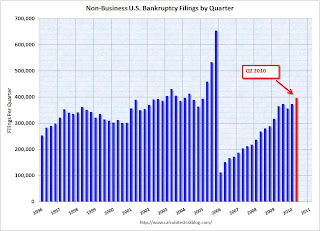

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter using monthly data from the ABI and previous quarterly data from USCourts.gov.

Excluding 2005, when the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005" was enacted (really a pro-lender act), the record year was in 2003 when 1.62 million personal bankruptcies were filed. This year will be close to that level.

Employment Report: Temporary Help and Diffusion Index

by Calculated Risk on 7/02/2010 11:47:00 AM

This post is a little more technical ...

Temporary Help

From the BLS report:

Within professional and business services, employment continued to increase in temporary help services (+21,000). Employment in temporary help has risen by 379,000 since a recent low in September 2009.The following graph was used early this year as the basis for some optimistic employment forecasts.

This graph is a little complicated. The red line is the three month average change in temporary help services (left axis). This is shifted four months into the future.

This graph is a little complicated. The red line is the three month average change in temporary help services (left axis). This is shifted four months into the future.The blue line (right axis) is the three month average change in total employment (excluding temporary help services).

Unfortunately the data on temporary help services only goes back to 1990, but it does appear that temporary help leads employment by about four months.

The thinking is that before companies hire permanent employees following a recession, employers will first increase the hours worked of current employees (hours worked decreased slightly in June) and also hire temporary employees. After the number of temporary workers increased sharply late last year, some people thought this might be signaling the beginning of a strong employment recovery.

I was skeptical and joked that "We're all temporary now!" - and now temporary hiring is growing at a slower pace and it appears the hoped for surge in overall hiring didn't happen.

Note that the temporary hiring for the Census is excluded from this graph.

Diffusion Index

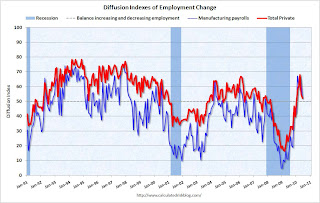

The BLS diffusion index for total private employment decreased to 52.2 from 54.8 in May. For manufacturing, the diffusion index is at 52.4; down sharply from 62.2 in May.

The BLS diffusion index for total private employment decreased to 52.2 from 54.8 in May. For manufacturing, the diffusion index is at 52.4; down sharply from 62.2 in May.Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.The increase in the diffusion index earlier this year was one of the clear positives in the monthly employment reports. The decrease in the diffusion index in June (almost falling to 50%), is disappointing.

Earlier employment posts today:

Employment-Population Ratio, Part Time Workers, Unemployed over 26 Weeks

by Calculated Risk on 7/02/2010 09:53:00 AM

Here are a few more graphs based on the employment report ...

Percent Job Losses During Recessions, aligned at Bottom Click on graph for larger image.

Click on graph for larger image.

This graph shows the job losses from the start of the employment recession, in percentage terms - but this time aligned at the bottom of the recession.

The current recession bounced along the bottom for a few months - so the choice of bottom is a little arbitrary (plus or minus a month or two).

The dotted line shows the impact of Census hiring. In June, there were 339,000 temporary 2010 Census workers on the payroll. The number of Census workers will continue to decline - and the gap between the solid and dashed red lines will be mostly closed in three or four months.

Employment-Population Ratio

The Employment-Population ratio decreased to 58.5% in June from 58.7% in May. This had been increasing after plunging since the start of the recession, and the recovery in the Employment-Population ratio was considered a good sign - but the ratio has now decreased for two consecutive months. This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

Note: the graph doesn't start at zero to better show the change.

The Labor Force Participation Rate decreased to 64.7% from 65.0% in May. This is the percentage of the working age population in the labor force. This decline is very disappointing, and the rate is well below the 66% to 67% rate that was normal over the last 20 years.

The reason the unemployment rate declined was because people left the workforce - and that is not good news. As the employment picture improves, people will return to the labor force, and that will put upward pressure on the unemployment rate.

Part Time for Economic Reasons  From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (some times referred to as involuntary part-time workers), at 8.6 million, was little changed over the month but was down by 525,000 over the past 2 months. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) was at 8.63 million in June. This slight decline was a little bit of good news.

The all time record of 9.24 million was set in October.

These workers are included in the alternate measure of labor underutilization (U-6) that was at 16.5% in June.

Unemployed over 26 Weeks

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.According to the BLS, there are 6.751 million workers who have been unemployed for more than 26 weeks and still want a job. This is a record 4.39% of the civilian workforce. (note: records started in 1948). It does appear the increases are slowing ... perhaps because people are giving up.

Summary

The underlying details of the employment report were mixed. The positives: the economy added 100 thousand payroll jobs ex-Census (still weak but better than in May), the unemployment rate decreased to 9.5%, the number of part time workers (for economic reasons) decreased slightly helping to push down U-6 to 16.5% (from 16.6%).

Negatives include the declines in the participation rate and employment-population rate, the slight decrease in hourly wages, the decline in average hours worked, and a record percent of workers unemployed for more than 26 weeks. The number of long term unemployed is one of the key stories of this recession, especially since many of them are now losing their unemployment benefits.

Overall this was a weak report.

Earlier employment post today:

June Employment Report: 100K Jobs ex-Census, 9.5% Unemployment Rate

by Calculated Risk on 7/02/2010 08:30:00 AM

From the BLS:

Total nonfarm payroll employment declined by 125,000 in June, and the unemployment rate edged down to 9.5 percent, the U.S. Bureau of Labor Statistics reported today. The decline in payroll employment reflected a decrease (-225,000) in the number of temporary employees working on Census 2010. Private-sector payroll employment edged up by 83,000.Census 2010 hiring decreased 225,000 in June. Non-farm payroll employment increased 100,000 in June ex-Census.

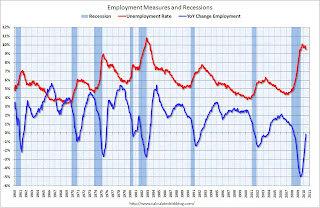

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 125 thousand in June. The economy has lost 170 thousand jobs over the last year, and 7.5 million jobs since the recession started in December 2007.

Ex-Census hiring, the economy added 100,000 jobs in June. The unemployment rate fell to 9.5 percent.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).The dotted line is ex-Census hiring. The two lines will rejoin later this year when the Census hiring is unwound.

For the current employment recession, employment peaked in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

The decrease in the unemployment rate was because of a decline in the participation rate - and that is not good news. Although better than May, this is still a weak report. I'll have much more soon ...

Thursday, July 01, 2010

Employment Report: Which payroll number to use?

by Calculated Risk on 7/01/2010 09:56:00 PM

Reading some of the employment preview articles tonight, I can see there will be some confusion just like last month. In May there were three payroll numbers commonly reported:

This created some confusion because I reported the underlying trend as +20,000 ex-Census, and many other reports used the private sector hiring of +41,000.

All three numbers have meaning, but the number consistent with previous reports (after removing temporary Census workers) was +20,000.

Tomorrow some sites will report private sector payroll jobs only - and that is not the correct method to remove the temporary Census workers and is inconsistent with previous reports (unless they were reporting private sector jobs only). Government hiring counts, especially since state and local governments might be cutting back later this year.

I will use the headline number and adjust by the number of temporary Census hires (the number will be reported here).

Housing: Timing for reported increase in Months-of-Supply and Decrease in House Prices

by Calculated Risk on 7/01/2010 07:10:00 PM

Some housing statistics are released with a long lag. Here is an overview ...

Earlier today, the NAR reported that the NAR's Pending Home Sales Index (PHSI) declined to a record low 77.6 in May. Although there is some variability, the PHSI usually leads existing home sales by about 45 to 60 days, so this suggests existing home sales will decline sharply in July. Of course we already knew this since tax credit buyers had to close by June 30th before the closing extension.

Note: The closing date for the tax credit was extended until Sept 30th, but that will only boost sales in July a little. (See from Reuters: US Congress Backs Home Tax Credit Extension)

In January 2009, the Pending Home Sales Index fell to a then record low 80.4. Two months later, existing home sales in March 2009 were at a 4.61 million rate. We can use that to estimate sales and months of supply in July.

If we assume sales fall a little little lower level in July 2010 than in March 2009 (because of the new record low PHSI), to say a 4.5 million sales rate, and that inventory stays about the same as in May 2010, say 3.9 million units for sale, the months-of-supply in July will be:

3.9 million units of inventory divided by 4.5 million existing sales (SAAR) times 12 months = 10.4 months of supply.

Maybe sales will be a little higher, or inventory a little lower, but the months-of-supply should be close to double digits in July.

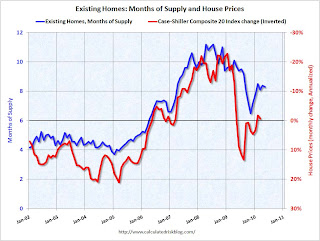

Earlier I posted this graph showing the relationship between months-of-supply and the change in house prices (change in house prices plotted inverted to show the relationship): Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows months of supply from NAR, and the annualized change in the Case-Shiller Composite 20 house price index (inverted).

Below 6 months of supply (blue line) house prices are typically rising (red line, inverted).

Above 6 months of supply house prices are usually falling (although there were many programs to support house prices over the last year).

Since the months-of-supply will probably be close to 10 months this summer, house prices will probably be falling again. I don't expect dramatic price declines later this year because prices are much closer to normal now, based on price-to-rent and price-to-income measures, than in 2007 and 2008. But I do expect falling house prices.

However it will take some time for this to show up in the house price indexes. The Case-Shiller index is a three month average and is released with a two month lag (the release this week was for a three month average ending in April).

The first Case-Shiller release with July prices will be released at the end of September - and that will include the months of May, June and July! And prices will be up in May and June.

The Corelogic data for July will also be released in September. There are other repeat sales measures (like from Radar Logic and Clear Capital), but in general it will be a long wait before reported house prices are falling.

U.S. Light Vehicle Sales 11.1 Million SAAR in June

by Calculated Risk on 7/01/2010 03:43:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 11.08 million SAAR in June. That is up 14% from June 2009 (when sales were very low), and down 4.6% from the May sales rate. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for June (red, light vehicle sales of 11.08 million SAAR from Autodata Corp).

The second graph shows light vehicle sales since the BEA started keeping data in 1967. Note: dashed line is current month sales rate.

Note: dashed line is current month sales rate.

Auto sales have recovered from the low levels of early 2009, but are below the lowest point of the '90/'91 recession (even with a larger number of registered drivers).

This was below most forecasts of around 11.4 million SAAR.

Hotel Occupancy Rate increases compared to same week in 2009

by Calculated Risk on 7/01/2010 02:40:00 PM

From HotelNewsNow.com: STR reports US results for week ending 26 June 2010

In year-over-year measurements, the industry's occupancy last week increased 6.8 percent to 69.7 percent. Average daily rate rose 1.1 percent to US$98.79. Revenue per available room rose 7.9 percent to US$68.88.The following graph shows the four week moving average for the occupancy rate by week for 2008, 2009 and 2010 (and a median for 2000 through 2007).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notes: the scale doesn't start at zero to better show the change.

On a 4-week basis, occupancy is up 5.4% compared to last year (the worst year since the Great Depression) and still 7.7% below normal. About half way back ...

Last year leisure travel held up better than business travel and leisure travel (summer) is the key for the next couple of months.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Construction Spending declined in May

by Calculated Risk on 7/01/2010 12:25:00 PM

Overall construction spending declined in May, and private construction spending, both residential and non-residential, also decreased. From the Census Bureau: May 2010 Construction at $841.9 Billion Annual Rate

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during May 2010 was estimated at a seasonally adjusted annual rate of $841.9 billion, 0.2 percent below the revised April estimate of $843.3 billion.

...

Spending on private construction was at a seasonally adjusted annual rate of $536.3 billion, 0.5 percent below the revised April estimate of $538.9 billion. Residential construction was at a seasonally adjusted annual rate of $260.8 billion in May, 0.4 percent below the revised April estimate of $261.7 billion. Nonresidential construction was at a seasonally adjusted annual rate of $275.6 billion in May, 0.6 percent below the revised April estimate of $277.2 billion.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Private residential construction spending appears to have bottomed in early 2009, but has only increased gradually since then. Residential spending is now 61% below the peak of early 2006.

Private non-residential construction spending is now 33% below the peak of late 2008.

Residential spending will probably exceed non-residential later this year (or early 2011), but that will be mostly because of weakness in non-residential construction, as opposed to any significant increase in residential spending.

General Motors: Sales up 10.7% compared to June 2009

by Calculated Risk on 7/01/2010 11:00:00 AM

From MarketWatch: General Motors U.S. June sales rise 10.7%.

General Motors Co. said Thursday that June U.S. sales rose 10.7% to 195,380 vehicles from 176,571 in the year-ago period.This seems very weak considering GM was in bankruptcy last June.

This is based on an easy comparison in several ways: in June 2009 U.S. light vehicle sales fell almost 30% to 9.7 million (SAAR) from 13.8 million (SAAR) in June 2008. The sharp decline last year was due to the financial crisis, the recession, and of course the Chrysler and GM bankruptcy filings (Chrysler filed for bankruptcy at the end of April, 2009 and GM filed for bankruptcy on June 1, 2009).

I'll add reports from the other major auto companies as updates to this post.

Update 1: From MarketWatch: Ford total sales rise 13.3% to 175,895 units

Update 2: From MarketWatch: Chrysler U.S. June sales jump 35% to 92,482 units

Update 3: From MarketWatch: Toyota U.S. June sales rise 6.8% to 140,604 units

NOTE: Once all the reports are released, I'll post a graph of the estimated total June sales (SAAR: seasonally adjusted annual rate) - usually around 4 PM ET. Most estimates are for a decrease to 11.4 million in June from the 11.6 million SAAR in May.

ISM Mfg index shows slower expansion in June, Pending Home sales collapse

by Calculated Risk on 7/01/2010 10:00:00 AM

A two-in-one post ...

PMI at 56.2% in June down from 59.7% in May.

From the Institute for Supply Management: June 2010 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in June for the 11th consecutive month, and the overall economy grew for the 14th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.And from the NAR: Pending Home Sales Drop as Expected

The report was issued today by Norbert J. Ore, CPSM, C.P.M., chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The manufacturing sector continued to grow during June; however, the rate of growth as indicated by the PMI slowed when compared to May. The lower reading for the PMI came from a slowing in the New Orders and Production Indexes. We are now 11 months into the manufacturing recovery, and given the robust nature of recent growth, it is not surprising that we would see a slower rate of growth at this time. The sector appears to be solidly entrenched in the recovery. Comments from the respondents remain generally positive, but expectations have been that the second half of the year will not be as strong in terms of the rate of growth, and June appears to validate that forecast."

...

ISM's New Orders Index registered 58.5 percent in June, which is a decrease of 7.2 percentage points when compared to the 65.7 percent reported in May.

...

ISM's Employment Index registered 57.8 percent in June, which is 2 percentage points lower than the 59.8 percent reported in May.

emphasis added

The Pending Home Sales Index, a forward-looking indicator, dropped 30.0 percent to 77.6 based on contracts signed in May from a reading of 110.9 in April ... NAR chief economist Lawrence Yun said, “The sharp decline in contract signings in May is a natural result with similar low levels of sales activity anticipated in June.”Both the ISM index and pending home sales were below consensus.

Weekly Initial Unemployment Claims increase to 472,000

by Calculated Risk on 7/01/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending June 26, the advance figure for seasonally adjusted initial claims was 472,000, an increase of 13,000 from the previous week's revised figure of 459,000. The 4-week moving average was 466,500, an increase of 3,250 from the previous week's revised average of 463,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending June 19 was 4,616,000, an increase of 43,000 from the preceding week's revised level of 4,573,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The four-week average of weekly unemployment claims increased this week by 3,250 to 466,500.

The dashed line on the graph is the current 4-week average.

Initial weekly claims have been at about the same level since December 2009. Historically the current level of 472,000, and 4-week average of 466,500, would suggest ongoing weakness in the labor market.

Wednesday, June 30, 2010

Fannie Mae: Serious Delinquency rate declines in April

by Calculated Risk on 6/30/2010 09:55:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Fannie Mae reported today that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business decreased to 5.30% in April, down from 5.47% in March - and up from 3.42% in April 2009.

"Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans."

This is similar to the report from Freddie Mac (although Fannie Mae releases data one month later). Just as for Freddie Mac, some of the earlier rapid increase was probably because of foreclosure moratoriums, and distortions from modification programs because loans in trial mods were considered delinquent until the modifications were made permanent.

More modifications have become permanent (and no longer counted as delinquent) and Fannie Mae is foreclosing again (they have a record number of REOs) - so there has been a slight decline in the delinquency rate.

Lawler: Residential Listings in June

by Calculated Risk on 6/30/2010 05:47:00 PM

CR Note: How the NAR calculates existing home inventory is a bit of a mystery. Housing economist Tom Lawler has been tracking inventory several different ways. The following post is from Tom Lawler:

This morning there were 3,973,439 residential listings on realtor.com, up 1.6% from late May and up 0.3% from a year ago. Listings in California, which declined sharply during 2009, were up 2.3% on the month and up 7.4% from a year ago. States with especially large monthly increases in listings including Washington (14.5%, after an 8.4% drop in May – Washington data are whacky!), Alaska (5.1%), Maine (4.9%), and Colorado (4.3%). Florida listings were up 0.3% on the month but down 9.5% from a year ago.

I’m not sure how often realtor.com listings by states are “refreshed,” or whether the updates are identical across states. However, the realtor.com data appear to “synch up” better to reports from various MLS than do the monthly National Association of Realtor data – which often displays monthly swings completely out of whack with the various “inventory trackers” that I and others follow. The NAR wasn’t willing to give me details of its methodology, but it apparently uses the sample data from various realtor associations/boards/MLS, and it may estimate the national totals with gross-ups based on “months’ supply.” Whatever the case, the monthly NAR numbers appear to have “spurious volatility” unrelated to actual swings in listings.

CR Note: This seems to suggest an increase in inventory in June. Using Realtor.com isn't perfect, but it is a consistent and transparent method.

Market Update

by Calculated Risk on 6/30/2010 04:06:00 PM

The end of Q2 ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

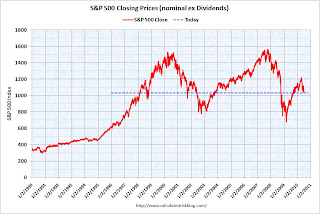

The first graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today. The S&P 500 was first at this level in February 1998; over 12 years ago. And a graph from Doug Short of dshort.com (financial planner).

Click on graph for interactive version in new window.

The graph has tabs to look at the different bear markets - "now" shows the current market - and there is also a tab for the "four bears".

Fed's Lockhart: Sustainable final demand not yet supporting growth

by Calculated Risk on 6/30/2010 01:39:00 PM

From Atlanta Fed President Dennis Lockhart: Recovery and the Challenge of Uncertainty

The central question is whether the recovery that is now well under way will be sustained or will falter, resulting in a slowdown or even a second recession—the so-called double dip.

...

Rising consumer activity surprised many in the first quarter of the year, but in April and May consumers seemed to put away their wallets to a certain extent. ... Business spending on equipment and software has been strong in the first half of the year. ... Manufacturing production is up about 8 percent over the past year through May.

...

Here's a key point about these contributors to recovery—each could be transitory. The economy has not yet arrived at a state where healthy and sustainable final demand is underpinning growth.

... I believe the recovery will move ahead at a modest pace and unemployment will gradually come down. Impediments to growth are being removed. Financial market function is being restored. Private balance sheets are being repaired. And necessary structural adjustments are under way.

The past few weeks, however, have seen a slight retrenchment from the mind-set of optimism and growing confidence that prevailed earlier in the year.

...

Several recent sources of uncertainty have clouded the outlook. I will cite four, including the oil spill in the Gulf.

First is European sovereign debt. ... Our financial system here in the United States has rather small and manageable direct exposure to the Greek government and the other sovereign borrowers. But as the situation has evolved, exposure to European banks as well as foreign and local corporations in the affected countries has complicated the estimation of risk.

...

A second source of uncertainty is ongoing state and local fiscal tightening.

...

A third area of uncertainty is commercial real estate. Banks across the country, especially small and regional banks, are heavily exposed to the commercial property sector and face a heavy docket of loan restructurings that may require sizable write-downs.

...

And there is the oil spill, which is, naturally, the central environmental and economic concern here in Louisiana and more broadly in the Gulf region. ...

The economic effect at the national level has been limited. I'm prepared to believe, however, that this relentless environmental disaster is an additional factor holding back consumer and business confidence. The spill disheartens us all and, I believe, makes the public a little more reticent to assume a smooth recovery path.

...

So, to pull this together, a recovery of the national economy is proceeding but not yet with solid and sustainable underpinnings. Inflation appears restrained. The outlook from here is beset by somewhat more than normal uncertainty.

Restaurant Index "Softened" in May

by Calculated Risk on 6/30/2010 11:57:00 AM

This is one of several industry specific indexes I track each month.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

For the second consecutive month, same store sales and customer traffic both declined in May (year-over-year).

This has taken a toll on the positive outlook in the "expectations index" and the overall index showed contraction in May.

Unfortunately the data for this index only goes back to 2002.

Note: Any reading above 100 shows expansion for this index.

From the National Restaurant Association (NRA): Restaurant Industry Outlook Softened in May as Restaurant Performance Index Fell Below 100

The outlook for the restaurant industry softened in May, as the National Restaurant Association’s comprehensive index of restaurant activity fell below 100 for the first time in three months. The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 99.7 in May, down 0.7 percent from April’s level of 100.4.Restaurants are a discretionary expense, and they tend to be 'first in, last out' of a recession for consumer spending (as opposed to housing that is usually first in and first out). Since restaurants both lead and lag recessions, this contraction could be because of the sluggish recovery or might suggest further weakness in consumer spending in the months ahead.

...

Restaurant operators reported a net decline in same-store sales for the second consecutive month in May.

...

Restaurant operators also reported softer customer traffic results in May.

...

Although sales and traffic results softened in May, restaurant operators reported an uptick in capital spending activity.

...

Although restaurant operators remain optimistic about sales growth in the months ahead, their optimism slipped somewhat in recent months.

emphasis added

Chicago PMI shows expansion in June

by Calculated Risk on 6/30/2010 09:45:00 AM

From the Institute for Supply Management – Chicago:

The Chicago Purchasing Managers reported the CHICAGO BUSINESS BAROMETER indicated the breadth of expansion showed little change, and chalked up a ninth month of growth.The overall index declined to 59.1 from 59.7 (just below expectations). Note: any number above 50 shows expansion.

Employment improved to 54.2 after showing a decline (below 50) in May.

The new orders index declined again to 59.1 from 62.7. This is the lowest level this year.

The national ISM manufacturing index will be released tomorrow.

ADP: Private Employment increased 13,000 in June

by Calculated Risk on 6/30/2010 08:15:00 AM

ADP reports:

Nonfarm private employment increased 13,000 from May to June 2010 on a seasonally adjusted basis, according to the ADP National Employment Report®. The estimated change in employment from April to May 2010 was revised up slightly, from the previously reported increase of 55,000 to an increase of 57,000.Note: ADP is private nonfarm employment only (no government jobs).

June’s rise in private employment was the fifth consecutive monthly gain. However, over these five months the increases have averaged a modest 34,000. Recent ADP Report data suggest that, following steady improvement through April, private employment may have decelerated heading into the summer.

This is below the consensus forecast of ADP showing an increase of 60,000 private sector jobs in June.

The BLS reports on Friday, and the consensus is for a decrease of 100,000 payroll jobs in June, on a seasonally adjusted (SA) basis, with the loss of around 250,000 temporary Census 2010 jobs (+150,000 ex-Census).