by Calculated Risk on 1/15/2010 08:03:00 PM

Friday, January 15, 2010

Bank Failure #4 in 2010: Barnes Banking Company, Kaysville, Utah

Crestfallen bank expiring

Mortally wounded

by Soylent Green is People

From the FDIC: FDIC Creates a Deposit Insurance National Bank of Kaysville, Utah to Protect Insured

Depositors of Barnes Banking Company, Kaysville, UtahNo one wanted this one.

Barnes Banking Company, Kaysville, Utah, was closed today by the Utah Department of Financial Institutions, which appointed Federal Deposit Insurance Corporation (FDIC) as receiver. ....

The FDIC will mail checks directly to customers with CDs and IRAs. ...

As of September 30, 2009, Barnes Banking Company had $827.8 million in total assets and $786.5 million in total deposits. ...

The cost to the FDIC's Deposit Insurance Fund is estimated to be $271.3 million. Barnes Banking Company is the fourth bank to fail this year and the first in Utah. The last FDIC-insured institution closed in the state was America West Bank, Layton, on May 1, 2009.

Bank Failures 2&3 for 2010: Illinois & Minnesota

by Calculated Risk on 1/15/2010 07:11:00 PM

Whistling past the graveyard

Our first Friday FAIL

by Soylent Green is People

From the FDIC: First American Bank, Elk Grove Village, Illinois Assumes All of the Deposits of Town Community Bank and Trust, Antioch, Illinois

Town Community Bank and Trust, Antioch, Illinois, was closed today by the Illinois Department of Financial Professional Regulation, Division of Banking, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: First State Bank of St. Joseph, St. Joseph, Minnesota, Assumes All of the Deposits of St. Stephen State Bank, St. Stephen, Minnesota

As of September 30, 2009, Town Community Bank and Trust had approximately $69.6 million in total assets and $67.4 million in total deposits....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $17.8 million. ... Town Community Bank and Trust is the second FDIC-insured institution to fail in the nation this year, and the first in Illinois. The last FDIC-insured institution closed in the state was Independent Bankers' Bank, Springfield, on December 18, 2009.

St. Stephen State Bank, St. Stephen, Minnesota, was closed today by the Minnesota Department of Commerce, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...They may be small, but they count!

As of September 30, 2009, St. Stephen State Bank had approximately $24.7 million in total assets and $23.4 million in total deposits. First State Bank of St. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $7.2 million.... St. Stephen State Bank is the third FDIC-insured institution to fail in the nation this year, and the first in Minnesota. The last FDIC-insured institution closed in the state was Prosperan Bank, Oakdale, on November 6, 2009.

Short Sale Fraud, BofA 2010 Foreclosure Forecast, and more HAMP

by Calculated Risk on 1/15/2010 03:35:00 PM

[T]here appears to be yet a new mortgage fraud out there today, allegedly perpetuated by agents of, yes, the big banks. ... Since many second lien holders are getting very little, they are now allegedly requesting money on the side from either real estate agents or the buyers in the short sale. When I say "on the side," I mean in cash, off the HUD settlement statements, so the first lien holder doesn't see it.First lien holders are afraid of short sale fraud, but the biggest concerns are sales to related parties and under-the-table kick backs to the seller. Hopefully Olick's story will lead to an investigation.

Throughout the country, estimates of homes being taken back by Bank of America range from 11,000 to 14,000 a month in the early part of this year to 29,000 to 35,000 by November and December, said John Ciresi, vice president and portfolio manager for Bank of America in Towson, Md.

...

The system became "clogged" by a voluntary moratorium on foreclosures while banks met the requirements of President Obama's Making Home Affordable mortgage plan program and by state legislation requiring mediation before banks can start the foreclosure process, Ciresi said ...

Ciresi anticipates a rise in the foreclosure rate in 2010 because 60 percent of loan modifications failed and went into foreclosure. It's a combination of property devaluation and people losing their jobs, he said.

Bank of America is getting 40,000 new offers a month on short sales, or homes offered for less than the mortgage balance, Ciresi said.

Click on graph for larger image in new window.

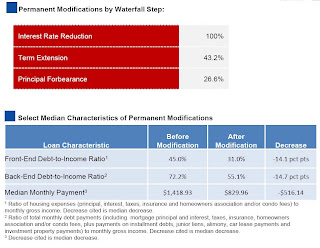

Click on graph for larger image in new window.The top slide shows the waterfall steps for modifications: first the servicer lowers the interest rate (for a few years only), then they extend the term, and if that doesn't get the DTI down to 31%, the servicer forbears some principal (not forgive - this is a balloon payment).

The further down the waterfall, the worse off the borrower. As reader ghostfaceinvestah noted in the comments:

"Remember, under HAMP, principal forbearance is the last step to lower payments when interest rate reductions aren't enough. These people are the really desperate ... They won't be paying off those loans, ever."The second part of the slide shows the DTI before and after the modification. The average HAMP borrower had total DTI of 72.2% before the modification (how did they eat?). Usually anything above 40% would be considered high. After the modification, these borrowers still had a back end DTI over 55%. They just have too much debt.

HAMP: 66,465 Permanent Mods

by Calculated Risk on 1/15/2010 12:21:00 PM

From Treasury: Administration Releases December Loan Modification Repot, Update on Conversion Drive Click on graph for larger image in new window.

Click on graph for larger image in new window.

Just over 66,000 modifications are now permanent, and this shows about a 43% failure rate (loans permanent divided by loans permanent + loans no longer active)

Here is the link at Treasury. See here for a list of reports.

If there were 270,000 cumulative HAMP trial modifications in July - how come there were only 66,465 permanent mods and 48,924 disqualified modifications by the end of December? The numbers don't add up.

What happened to the other 150,000+ modifications? I guess they have all been extended until the end of January.

And of the 787,231 active trial modifications, are all the borrowers current? My understanding was the HAMP data would show how many trial modifications had started, and the redefault rate by month. That key data is still missing.

Note: Nice misspelling in the press release title. I like "repot" for modifications!

JPMorgan on Modifications

by Calculated Risk on 1/15/2010 10:39:00 AM

Here is an exchange between Meredith Whitney and Jamie Dimon on the JPMorgan conference call this morning (ht Brian):

Whitney: [W]e're reaching a critical point in terms of all of the loan modification efforts and this is an industry question but then how it specifically affects your Company, given the fact that the industry feedback and statistics on the loan modification efforts are not good, so you question what's the next initiative and the issue of principal forbearance. How much momentum do you think that has, can you comment on what stage we are in terms of obviously the extension ends [soon] with the last slug is over in February, so where do you think we are in terms of the government’s efforts to influence banks to do certain things?A few comments:

Dimon: Well remember we do modifications of our own and we do the government modifications and I do think they're kind of new, it was complex, and I think people will get better at it over time, Meredith. We have not thought of a better way to do it than loan by loan, which is does the person want to live there, can they afford to live there, and we really think that the payment, how much you're paying is more important than principal. Even if you are going to do something on principal, to do it right you have to do it loan by loan and it effectively comes a similar kind of thing. The difficulty is the loan by loan part and we've asked the government and I think they tried to streamline a little bit to have programs because there's too much paperwork involved in it so a lot of the reasons we're not getting to final modifications half the time we don't finish the paperwork, so they need the lower payments but they weren't finishing the paperwork so we're trying to get better at it, honestly, we rack our brains to figure out if there's a better way to do it and you can do it more macro than loan by loan but once you start talking about macro, you're going to get involved in a lot of issues about whether the people live there, whether they have the ability to pay, whether they were honest when they first told people how much their incomes were, so we're working through it.

Whitney: Okay, do you get a sense that there's something right behind HAMP, that there’s another solution for the government or is it more your efforts?

Dimon: We're trying to do this, look, we're trying to have ideas and they are trying to have ideas but if we had a brilliant one we would be very supportive of doing it. We want to do the right thing for the people.

Whitney: Okay, so a point of clarification on your answer, issue of principal forbearance is not something that people should be overly concerned about with respect to reserves and capital for the bank?

Dimon: No, I think if there's a macro government force on something like that you could have a fairly significant effect on loan loss reserves and losses, etc.

Whitney: But is that a real, any momentum?

Dimon: Honestly Meredith you probably know as well as we do.

Whitney: I don't know. I can't help myself on that one.

And more on JPMorgan's results from the WSJ: J.P. Morgan Chase Profit Surges to $3.3 Billion

Chief Financial Officer Michael Cavanagh was largely silent when asked by reporters when the bank might be done setting aside money for further losses, and when business and consumers would start borrowing again.Update: And more JPMorgan from HousingWire: JP Morgan Posts Q4 Profit Despite Mortgage Losses

"There are signs that things are stabilizing, but ... the dramatic nature of the financial crisis we went through and the extraordinary responses" make the current environment different from previous economic recoveries, he said during a conference call. "We remain cautious."

Chairman and Chief Executive James Dimon said in a news release, "While we are seeing some stability in delinquencies, consumer-credit costs remain high, and weak employment and home prices persist. Accordingly, we remain cautious."

Industrial Production, Capacity Utilization Increase in December

by Calculated Risk on 1/15/2010 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.6 percent in December. The gain primarily resulted from an increase of 5.9 percent in electric and gas utilities due to unseasonably cold weather. Manufacturing production edged down 0.1 percent, while the output of mines rose 0.2 percent. The change in the overall index was revised up in October, but it was revised down in November; for the fourth quarter as a whole, total industrial production increased at an annual rate of 7.0 percent. At 100.3 percent of its 2002 average, output in December was 2.0 percent below its year-earlier level. Capacity utilization for total industry edged up to 72.0 percent in December, a rate 8.9 percentage points below its average for the period from 1972 to 2008.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series is up from the record low set in June (the series starts in 1967), and still below the level of last year.

Note: y-axis doesn't start at zero to better show the change.

Industrial production is still 10.7% below the level of December 2007.

CPI, Rents and Real Earnings

by Calculated Risk on 1/15/2010 08:33:00 AM

From the BLS report on the Consumer Price Index this morning:

On a seasonally adjusted basis, the December Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent ... the indexes for rent and owners' equivalent rent were unchanged ...Owners' equivalent rent (OER) declined slightly in December, and has decreased at about a 1% annualized rate since peaking four months ago. OER is important because it is the largest component of CPI.

The index for all items less food and energy rose 0.1 percent in December after being unchanged in November.

Based on reports of falling rents - and a record high apartment vacancy rate, OER will probably decline fall for some time, keeping core CPI low and possibly negative next year. Also - falling rents will push up the price-to-rent ratio, and put additional pressure on house prices.

The BLS also reported on declining real earnings in 2009:

Real average hourly earnings did not change from November to December ... Real average hourly earnings fell 1.3 percent, seasonally adjusted, from December 2008 to December 2009. A 0.3 percent decline in average weekly hours combined with the decrease in real average hourly earnings resulted in a 1.6 percent decrease in real average weekly earnings during this period.

Krugman: Bankers Without a Clue

by Calculated Risk on 1/15/2010 12:02:00 AM

Krugman: Bankers Without a Clue

... the bankers’ testimony showed a stunning failure, even now, to grasp the nature and extent of the current crisis. And that’s important: It tells us that as Congress and the administration try to reform the financial system, they should ignore advice coming from the supposed wise men of Wall Street, who have no wisdom to offer.There is much more in the piece, but that is the crux. The bankers are apparently clueless, or if they have any inkling about what happened, they will not say it. The first morning of hearings were a waste of time.

The question now is will the Financial Crisis Inquiry Commission be a waste?

I'll try to help ... first, start from the bottom, not the top. Don't interview any more bankers or heads of regulatory agencies, at least not yet.

1) Regulators: My first suggestion is that the Commission start interviewing - in private - the field examiners at the Fed, FDIC, OCC and OTS. There is no need to publicly embarrass any examiner. The various Inspector General reports on bank failures would provide a starting point (see Eric Dash's article in the NY Times: Post-Mortems Reveal Obvious Risk at Banks).

Ask the examiners what they saw and when - according to the Inspector General's reports, the field examiners were warning about lending problems in 2002 and 2003.

Follow the trail. Did this information generate warnings inside the organizations? If so, why wasn't action taken? Was the action blocked by political appointees?

And more background:

2) Understand the originate to distribute model. Understand the entire process from the perspective of each participant from independent mortgage broker to Wall Street firms to investors, and the role of credit agencies, automated underwriting, and other "improvements" in the process.

Put points 1 & 2 together. That is a start.

Thursday, January 14, 2010

Manhattan Apartment Rents Decline 9.4%

by Calculated Risk on 1/14/2010 09:22:00 PM

From Bloomberg: Manhattan Apartment Rents Drop 9.4% Amid Job Cuts (ht Brian)

Manhattan apartment rents dropped 9.4 percent in the fourth quarter from a year earlier ... according to a report today by broker Prudential Douglas Elliman Real Estate and appraiser Miller Samuel Inc. A separate tally by broker Citi-Habitats Inc. showed the average apartment price declined 7.3 percent for the year.Just more on falling rents although it sounds like the inventory in Manhattan is down a little , but overall the vacancy rate is at record levels ...

The effective decline in Manhattan apartment costs was likely greater than either broker reported because the figures don’t reflect concessions such as a free month’s rent ...

Last week from Reuters: U.S. apartment vacancy rate hits 30-year high

The Census Bureau will report the overall Q4 vacancy rate on February 2nd, and I expect another new record (above the 11.1% in Q3).

LA Area Port Traffic in December

by Calculated Risk on 1/14/2010 06:15:00 PM

Note: this is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports. LA area ports handle about 40% of the nation's container port traffic.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Loaded inbound traffic was 2.9% above December 2008. (-9.2% over last three months)

Loaded outbound traffic was 35.9% above December 2008. (+14.5% three months average) This was an easy YoY comparison for exports, because U.S. exports fell off a cliff in November 2008.

It took a little longer for imports to decline sharply because the ships were already underway.

Exports recovered somewhat earlier this year, however export growth has been sluggish since May. Last year (2009) was the 3rd best year for export traffic at LA area ports, behind 2007 and 2008.

For imports, traffic is at about the December 2003 level, and 2009 was the weakest year for import traffic since 2002.

Note: Imports usually peak in the August through October period (as retailers import goods for the holidays) and then decline at the end of the year.

Hotel RevPAR off 10.4 Percent

by Calculated Risk on 1/14/2010 03:48:00 PM

From HotelNewsNow.com: STR: Los Angeles-Long Beach leads weekly numbers

Overall, in year-over-year measurements, the industry’s occupancy decreased 3.9 percent to end the week at 40.5 percent. ADR dropped 6.8 percent to finish the week at US$91.85. RevPAR for the week fell 10.4 percent to finish at US$37.21.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the occupancy rate by week for 2008, 2009 and 2010 - plus an average (dashed line) for 2005 through 2007.

2010 is in Red - and it has just started (see far left).

Notes: the scale doesn't start at zero to better show the change.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

The above graph shows two key points:

The HotelNewsNow press release also has this graph on occupancy variance compared to 2009.

The HotelNewsNow press release also has this graph on occupancy variance compared to 2009.This shows that business travel (mid-week) was off more than leisure travel (weekends).

Business travel fell off a cliff in late 2008 with the financial crisis, and has been off significantly more than leisure travel. It is surprising, given the easy comparison to 2009, mid-week travel is still off more than weekend travel. This is something to watch carefully.

This is just one week, but it suggests businesses might still be tightening their travel budgets.

Proposed "Financial Crisis Responsibility Fee"

by Calculated Risk on 1/14/2010 01:07:00 PM

From Treasury: Fact Sheet: Financial Crisis Responsibility Fee

Today, the President announced his intention to propose a Financial Crisis Responsibility Fee that would require the largest and most highly levered Wall Street firms to pay back taxpayers for the extraordinary assistance provided so that the TARP program does not add to the deficit. The fee the President is proposing would:There is much more detail at the link. The proposed fee would be 15 bps of covered liabilities per year.Require the Financial Sector to Pay Back For the Extraordinary Benefits Received: ... Responsibility Fee Would Remain in Place for 10 Years or Longer if Necessary to Fully Pay Back TARP: Raise Up to $117 Billion to Repay Projected Cost of TARP: President Obama is Fulfilling His Commitment to Provide a Plan for Taxpayer Repayment Three Years Earlier Than Required: ... Apply to the Largest and Most Highly Levered Firms: The fee the President is proposing would be levied on the debts of financial firms with more than $50 billion in consolidated assets ... Over sixty percent of revenues will most likely be paid by the 10 largest financial institutions.

Modification Horror Stories

by Calculated Risk on 1/14/2010 11:33:00 AM

Update: Why are so many examples "mortgage brokers"? But the part about extensions not doing favors for homeowners is correct.

From Paul Kiel at ProPublica: Homeowners Say Banks Not Following Rules for Loan Modifications

A few excerpts:

Reynolds was a prime candidate for a loan adjustment and was among the earliest homeowners to receive a trial modification.Just an anecdote, but one of many. And on the length of the trial period:

His mortgage brokerage business had followed the market downward, and as a result, he’d fallen three months behind on his interest-only mortgage. ...

Soon after the loan program was announced last February, Reynolds applied. He received an application in late April and was accepted, making his first payment of about $2,400 (down from $3,300) in May. He made six more payments. ... [In late November, he received an answer: He was denied a permanent loan modification.

The reason? A Chase employee explained to Reynolds that they’d determined his financial difficulties weren’t permanent. In his application, he’d written that he believed that the government’s rescue efforts would “save the U.S. housing market” and that his business “will once again be profitable.” The Chase employee told him that statement indicated his hardship was only temporary.

...

Chase spokeswoman Christine Holevas told ProPublica that Reynolds had been denied "because the skill and ability is still there to earn the income." Since he’d "stated in his letter that business would be picking up," it was "not considered a permanent hardship," Holevas said.

emphasis added

[T]rial modifications routinely last more than six months, homeowners and housing advocates say.The trial period was extended last year from 3 months to 5 months, probably because of the low conversion rate to permanent status, and then extended again in late December to at least the end of January. This isn't doing any favors for the homeowners that will eventually be rejected.

There are a number of adverse consequences of a trial period’s dragging on, said the consumer law center’s Thompson. Because a homeowner is not making a full payment, the balance of the mortgage grows during the trial period. The servicer reports the shortfall to credit reporting agencies, so the homeowner’s credit score can drop. And most importantly, says Thompson, the homeowner isn’t saving money in case the modification fails and the home is foreclosed. "Keeping someone in a trial modification really does not do them a favor," she said.

As I've noted before, HAMP is a fine modification program for the people that qualify and aren't deep underwater on their homes - AND actually get a permanent modification! (added) However the program was oversold - I doubt this program will "reach up to 3 to 4 million at-risk homeowners" as Treasury originally projected. So too many homeowners were allowed in the trial programs without sufficient pre-screening - and the program was started before servicers were really ready.

Retail Sales decline slightly in December

by Calculated Risk on 1/14/2010 08:55:00 AM

On a monthly basis, retail sales decreased 0.3% from November to December (seasonally adjusted), and sales were up 5.4% from December 2008 (easy comparison).  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

This shows that retail sales fell off a cliff in late 2008, and appear to have bottomed, but at a much lower level.

The red line shows retail sales ex-gasoline and shows there has been only a little increase in final demand. The second graph shows the year-over-year change in retail sales since 1993.

The second graph shows the year-over-year change in retail sales since 1993.

Retail sales increased by 5.4% on a YoY basis. The year-over-year comparisons are much easier now since retail sales collapsed in October 2008. Retail sales bottomed in December 2008.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for December, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $353.0 billion, a decrease of 0.3 percent (±0.5%)* from the previous month, but 5.4 percent (±0.5%) above December 2008. Total sales for the 12 months of 2009 were down 6.2 percent (±0.2%) from 2008. Total sales for the October through December 2009 period were up 1.9 percent (±0.3%) from the same period a year ago. The October to November 2009 percent change was revised from +1.3 percent (±0.5%) to +1.8 percent (±0.2%).It appears retail sales might have bottomed, and there has been little pickup in final demand.

Weekly Initial Unemployment Claims

by Calculated Risk on 1/14/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Jan. 9, the advance figure for seasonally adjusted initial claims was 444,000, an increase of 11,000 from the previous week's revised figure of 433,000. The 4-week moving average was 440,750, a decrease of 9,000 from the previous week's revised average of 449,750.

...

The advance number for seasonally adjusted insured unemployment during the week ending Jan. 2 was 4,596,000, a decrease of 211,000 from the preceding week's revised level of 4,807,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 9,000 to 440,750. This is the lowest level since August 2008.

The decline in the 4-week average is good news, although the level is still relatively high and suggests continued job losses, or at best, minimal job gains. The current level is still mostly above the level of the previous two "jobless" recoveries.

RealtyTrac: 2009 was Record Year for Foreclosure Filings

by Calculated Risk on 1/14/2010 12:43:00 AM

Press Release: RealtyTrac® year-end report shows record 2.8 million U.S. Properties with foreclosure filings in 2009 (ht Ann)

RealtyTrac® ... today released its Year-End 2009 Foreclosure Market Report™, which shows a total of 3,957,643 foreclosure filings — default notices, scheduled foreclosure auctions and bank repossessions — were reported on 2,824,674 U.S. properties in 2009, a 21 percent increase in total properties from 2008 and a 120 percent increase in total properties from 2007. The report also shows that 2.21 percent of all U.S. housing units (one in 45) received at least one foreclosure filing during the year, up from 1.84 percent in 2008, 1.03 percent in 2007 and 0.58 percent in 2006.AP is reporting that RealtyTrac expects 3 to 3.5 million foreclosures in 2010.

Foreclosure filings were reported on 349,519 U.S. properties in December, a 14 percent jump from the previous month and a 15 percent increase from December 2008 — when a similar monthly jump in foreclosure activity occurred. Despite the increase in December, foreclosure activity in the fourth quarter decreased 7 percent from the third quarter, although it was still up 18 percent from the fourth quarter of 2008.

“As bad as the 2009 numbers are, they probably would have been worse if not for legislative and industry-related delays in processing delinquent loans,” said James J. Saccacio, chief executive officer of RealtyTrac

emphasis added

There should be a pickup in foreclosure activity in February when the trial modifications end, however I think the themes in 2010 will be short sales (although NODs1 count as filings) and higher priced foreclosures (but fewer in that range) - so the total filings in 2010 might be a little lower than RealtyTrac expects - but it will definitely be a busy year.

1NODs: Notice of Default

Wednesday, January 13, 2010

Jon Stewart on Wall Street Bonuses

by Calculated Risk on 1/13/2010 10:04:00 PM

From Jon Stewart at the Daily Show (click here if embed doesn't load) (ht MrM)

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| Clusterf#@k to the Poor House - Wall Street Bonuses | ||||

| www.thedailyshow.com | ||||

| ||||

S&P Downgrades California

by Calculated Risk on 1/13/2010 07:05:00 PM

From Bloomberg: California’s Credit Cut by S&P Amid Budget Deficit

California’s credit rating on $64 billion of general obligation bonds was cut by Standard & Poor’s today as [California] faces strains over a $20 billion budget deficit.More from Tom Petruno at the LA Times: California's debt rating cut to A-minus by S & P on budget woes

... the rating was lowered one level to A-, the seventh-highest investment grade. ... the company has a negative outlook on California debt, a sign its standing may decline further. ... S&P’s cut brings its rating on California closer to that of Moody’s Investors Service and Fitch Ratings. Moody’s rates the state Baa1 and Fitch at BBB.

S&P worries that the state could face a cash crunch in March, before it receives the income tax payments due in April.Possibly more IOU fun for California!

"There could be days in March when they go into a negative cash position," said Gabriel Petek, an S&P analyst in San Francisco.

Although Petek said he didn't believe California would be in jeopardy of missing any payments due on its debt, he said the government might again pay other obligations with IOUs, or the state might again require a short-term loan from Wall Street.

2009 GDP: Britain: Worst decline in 88 Years, Germany: Worst Since WWII

by Calculated Risk on 1/13/2010 03:25:00 PM

From The Times: Britain's recession the steepest for 88 years

Britain's economy fell last year at the sharpest rate since 1921, despite hopes that it finally emerged from recession in the last three months of the year, according to a respected economics forecaster.Wow. The largest one year decline since 1921. Of course, during the Depression, there were a number of bad years in a row.

The National Institute of Economic and Social Research (NIESR) said today that its latest estimate showed that GDP rose by a modest 0.3 per cent in the final three months of 2009 compared with the third quarter.

That means that, for the year as a whole, the economy contracted by 4.8 per cent, a bigger fall than in any year of the Great Depression and the biggest contraction for 88 years.

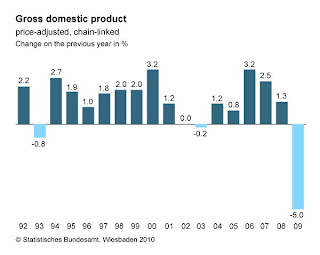

And from Statistischen Bundesamtes Deutschland: Germany experiencing serious recession in 2009 (ht Uwe)

Click on graph for larger image in new window.

Click on graph for larger image in new window.The German economy shrank in 2009 for the first time in six years. With –5.0%, the decline in the price-adjusted gross domestic product (GDP) was larger than ever since World War II. This is shown by first calculations of the Federal Statistical Office (Destatis). The economic slump occurred mainly in the winter half-year of 2008/2009. Over the year, there were signs that the economic development would slightly stabilise on the new, lower level.

Rail Traffic in 2009: Lowest since at least 1988

by Calculated Risk on 1/13/2010 01:00:00 PM

From the Association of American Railroads: Rail Time Indicators. AAR reports that "2009 saw total carload traffic on U.S. railroads at its lowest levels since at least 1988, when the AAR’s data series began." Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows U.S. average weekly rail carloads. It is important to note that excluding coal, traffic is up 6.9% from December 2008, and traffic increased in 12 of the 19 major commodity categories.

Housing: In addition to the decline in coal, two key building materials were also down YoY from December 2008: Forest products and Nonmetallic minerals & prod. (like crushed stone, gravel, sand). This fits with the recent data on housing starts, new home sales, and the NAHB home builder index that shows residential investment is flat and non-residential investment is declining sharply.

From AAR:

• Good riddance to 2009. U.S. freight railroads completed a very difficult year by originating 1,241,293 carloads in December, an average of 248,259 carloads per week. That’s down 4.1% from December 2008’s average of 258,915 carloads per week and down 17.6% from December 2007’s average of 301,466.The AAR report has a number of other graphs for various sectors like autos and housing.

• Rail traffic always falls sharply in late December due to the holidays. This year, unusually heavy early-season snow in parts of the country also negatively affected rail traffic.

• Total U.S. rail carloads in December 2009 were 53,281 lower than in December 2008, mainly because of coal. Coal was down 96,022 carloads in December 2009 from December 2008. That’s equal to 19,200 fewer coal carloads, or around 175 110-car coal trains, per week. Rail carloads excluding coal were 42,741 (6.9%) higher in December 2009 than in December 2008.

• It’s useful to compare current rail traffic levels to the collapsed levels of a yearago. To use a boxing analogy, doing so shows if rail carloads have gotten up off the mat after nearly getting knocked out. And, in fact, for many commodities that seems to be happening. 12 of the 19 major commodity categories tracked by the AAR saw higher carloads in December 2009 than in December 2008.

emphasis added