by Calculated Risk on 1/15/2010 03:35:00 PM

Friday, January 15, 2010

Short Sale Fraud, BofA 2010 Foreclosure Forecast, and more HAMP

[T]here appears to be yet a new mortgage fraud out there today, allegedly perpetuated by agents of, yes, the big banks. ... Since many second lien holders are getting very little, they are now allegedly requesting money on the side from either real estate agents or the buyers in the short sale. When I say "on the side," I mean in cash, off the HUD settlement statements, so the first lien holder doesn't see it.First lien holders are afraid of short sale fraud, but the biggest concerns are sales to related parties and under-the-table kick backs to the seller. Hopefully Olick's story will lead to an investigation.

Throughout the country, estimates of homes being taken back by Bank of America range from 11,000 to 14,000 a month in the early part of this year to 29,000 to 35,000 by November and December, said John Ciresi, vice president and portfolio manager for Bank of America in Towson, Md.

...

The system became "clogged" by a voluntary moratorium on foreclosures while banks met the requirements of President Obama's Making Home Affordable mortgage plan program and by state legislation requiring mediation before banks can start the foreclosure process, Ciresi said ...

Ciresi anticipates a rise in the foreclosure rate in 2010 because 60 percent of loan modifications failed and went into foreclosure. It's a combination of property devaluation and people losing their jobs, he said.

Bank of America is getting 40,000 new offers a month on short sales, or homes offered for less than the mortgage balance, Ciresi said.

Click on graph for larger image in new window.

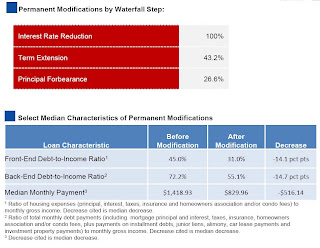

Click on graph for larger image in new window.The top slide shows the waterfall steps for modifications: first the servicer lowers the interest rate (for a few years only), then they extend the term, and if that doesn't get the DTI down to 31%, the servicer forbears some principal (not forgive - this is a balloon payment).

The further down the waterfall, the worse off the borrower. As reader ghostfaceinvestah noted in the comments:

"Remember, under HAMP, principal forbearance is the last step to lower payments when interest rate reductions aren't enough. These people are the really desperate ... They won't be paying off those loans, ever."The second part of the slide shows the DTI before and after the modification. The average HAMP borrower had total DTI of 72.2% before the modification (how did they eat?). Usually anything above 40% would be considered high. After the modification, these borrowers still had a back end DTI over 55%. They just have too much debt.