by Calculated Risk on 11/19/2009 11:39:00 PM

Thursday, November 19, 2009

More on FHA Loans

David Streitfeld at the NY Times adds some color: Easy Loans in Expensive Areas

In January, Mike Rowland was so broke that he had to raid his retirement savings to move [to San Francisco] from Boston.Hopefully this will work out for Mr. Rowland and friends, but now for the chilling quote:

A week ago, he and a couple of buddies bought a two-unit apartment building for nearly a million dollars. They had only a little cash to bring to the table but, with the federal government insuring the transaction, a large down payment was not necessary.

“It was kind of crazy we could get this big a loan,” said Mr. Rowland, 27. “If a government official came out here, I would slap him a high-five.”

...

For decades, most F.H.A. loans were in low-cost states like Texas and Michigan. ... The Economic Stimulus Act of 2008 helped change that by temporarily doubling the maximum loan the F.H.A. insured, to $729,750. A two-unit property like the one bought by Mr. Rowland and his friends can be insured for up to $934,200.

Mr. Bedar, Mr. Rowland and the third partner in their property, Jordan Kurland, are all in the technology field, but their dreams of wealth do not feature stock options.This will end well ... (sorry for sarcasm)

“We’re banking on real estate,” said Mr. Kurland, 24. “Everyone expects prices to keep going up.”

Note: The MBA National Delinquency Survey showed 15.04% of FHA insured loans were delinquent as of the end of Q3, and another 3.32% were in the foreclosure process. The FHA Early Warning System shows that delinquencies are rising steadily on loans originated over the last two years. Not good.

On Negative T Bills

by Calculated Risk on 11/19/2009 09:30:00 PM

There was some buzz earlier today about short term T bill rates turning slightly negative. This happened last year too, but for different reasons ...

From the Financial Times: Short-term US interest rates turn negative

Short-term US interest rates turned negative on Thursday as banks frantically stockpiled government securities in order to polish their balance sheets for the end of the year.John Jansen at Across the Curve explains:

...

The scramble has been exacerbated by the fact that all leading US banks ... will this year close their books at the same time – at the end of December.

excerpted with permission

I do not speak to[o] often of the T bill market but yields in that market continue to collapse. In one recent conversation a market participant noted that bill yields are negative out to February. There are a couple of factors at work here. There is a massive wall of liquidity, a pile of cash which needs a home. That is driving yields lower.And more from John: More on Negative T Bills

Typically as the year end approaches clients tend to unwind profitable trades and reduce balance sheet. I think that some of that deleveraging process has created new piles of cash and that money needs a place to park.

Others are preparing to beautify their balance sheet by having some pristine government paper on the books over year end. Some of that trade has begun as investors purchase paper which will carry them into 2010.

In my closing post I noted that T bill rates are in negative territory and gave some reasons for that. Here is an excerpt from David Ader of CRT on that same topic;No worries ...

“We instead take our cue from activity in the financing markets, where year end is playing its hand – Jan bills are trading negative. The story here is not a new one as we saw bills negative at the end of the last quarter, but exacerbated by a more intense year end. We say that because 1) it’s clearly the talking point on funding desks, 2) EVERYONE has a Dec 31 year end as we have no investment banks any longer, and 3) as bank holding companies there’s a likelihood that former IBs, too, need to show cash in something other than a mattress.”

Another analyst whom I read suggested that an exacerbating factor was the maturity of some cash management bills which were not replaced.

Whatever the case, I am certain that the present circumstance is not an indicator of financial stress as plunging bill rates have been in the past.

States: Seriously Delinquent Mortgages vs. Unemployment Rate

by Calculated Risk on 11/19/2009 06:45:00 PM

Here is a scatter graph comparing the seriously delinquency rate for mortgage loans vs. unemployment rate for all states. The seriously delinquent rate include 90+ days delinquent loans, and loans in the foreclosure process for Q3 2009 (Source: MBA). Click on graph for larger image in new window.

Click on graph for larger image in new window.

There is a relationship between delinquency rates and the unemployment rate.

Florida really stands out because of state specific foreclosure laws. Arizona and Nevada also have higher than expected foreclosure rates - possibly because of high investor activity during the housing bubble.

As the unemployment rate continues to rise, the mortgage delinquency rate will increase too.

For more on the MBA National Delinquency Survey, see:

Mortgage Delinquencies and Foreclosures by Period Past Due

by Calculated Risk on 11/19/2009 03:49:00 PM

Click on graph for larger image in new window.

First, on the market ...

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Reader Yuri asked me if the number of 30 day delinquencies is decreasing. He was curious if the overall number of delinquencies is increasing because of the loan modifications and other actions that are limiting the outflow - but that that overall increase might be masking some improvement for the inflow of new delinquencies. This graph shows the delinquencies by time period (30, 60, 90 day, and in foreclosure) for all loans.\

This graph shows the delinquencies by time period (30, 60, 90 day, and in foreclosure) for all loans.\

The percentage of 30 and 60 day delinquencies have decreased slightly. However the rates are still near record levels.

For the 30 day bucket, there were 3.57% percent delinquent - not much lower than the high in Q1 of 3.77%. For 60 days, the rate was 1.67% - also below the high in Q1.

Clearly most of the increase was in the 90 day and in foreclosure buckets. And that is why the modification programs are so important. The second graph provides the same data for prime fixed rate mortgages. Both the 30 and 60 day buckets are still at record levels, although the rate of increase has slowed.

The second graph provides the same data for prime fixed rate mortgages. Both the 30 and 60 day buckets are still at record levels, although the rate of increase has slowed.

Since prime fixed rate mortgages account for about 2/3s of the mortgage market, a large portion of future foreclosures will probably be from these loans.

Hotel RevPAR off 15.7 Percent

by Calculated Risk on 11/19/2009 01:14:00 PM

From HotelNewsNow.com: New Orleans leads ADR, RevPAR declines in STR weekly numbers

Overall, in year-over-year measurements, the industry’s occupancy fell 6.4 percent to end the week at 52.6 percent, ADR dropped 9.9 percent to US$95.86, and RevPAR decreased 15.7 percent to finish at US$50.47.

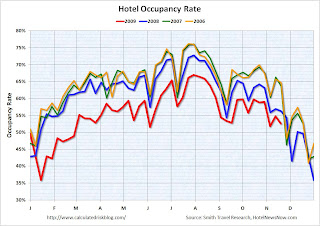

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the occupancy rate by week for each of the last four years (2006 through 2009 labeled by start of month).

Notes: the scale doesn't start at zero to better show the change. Thanksgiving was late in 2008 (and will be late in 2009), so the dip doesn't line up with the previous years.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

This is a two year slump for the hotel industry. Although occupancy is off 6.4% compared to 2008, occupancy is off about 18% compared to 2006 and 2007.

Smith Travel Research released an updated hotel forecast 2011 can’t get here too soon .

Occupancy: 2009 will end at -8.8 percent (revised from -8.4 percent); 2010 figures will be down 0.2 percent (revised from -0.6 percent); and 2011 will be up 2.4 percent.Here is a PDF of the new forecast (free registration required)

Average daily rate: 2009 will close down 8.9 percent (revised from -9.7 percent); 2010 will be down 3.4 percent (unchanged from previous forecast); and 2011 will be up 5.5 percent.

“In the current cycle, it’s increasingly easy to predict supply and a little easier to predict demand,” [Mark Lomanno, STR’s president] said. “What is difficult is predicting rate growth ... how aggressive the industry will be in raising rates is virtually impossible to predict.”

...

Revenue per available room: 2009’s RevPAR will decline 17.0 percent (revised from 17.1 percent; it will drop 3.6 percent in 2010 (revised from -4.0 percent) before jumping 5.5 percent in 2011.

Supply: The number of guestrooms will end 2009 up 3.2 percent (revised from +3.0 percent); up 1.8 percent in 2010; and up 0.8 percent in 2011.

“The construction pipeline will mostly be built between now and early 2011,” Lomanno said.

...

Demand: Room demand in 2009 will be down 6.0 percent (revised from -5.5 percent) before turning positive in 2010 at +1.6 percent (revised from +1.3 percent). Demand will grow 3.2 percent in 2011, according to the STR forecast.

...

“Clearly commercial real estate will be a second shoe dropping in 2010,” [Randy Smith, STR’s co-founder and chairman] said. “That’s going to be a process that will hurt demand for the hotel industry. A huge chunk of demand for our industry will continue to be wiped out as long as the construction industry is on its back.”

The good news is the supply of new hotels is slowing sharply. The bad news is that means less construction employment - and also negatively impacts hotel occupancy.

MBA Forecasts Foreclosures to Peak in 2011

by Calculated Risk on 11/19/2009 11:08:00 AM

On the MBA conference call concerning the "Q3 2009 National Delinquency Survey", MBA Chief Economist Jay Brinkmann said this morning:

Note: Many more questions this time!

A few graphs ...

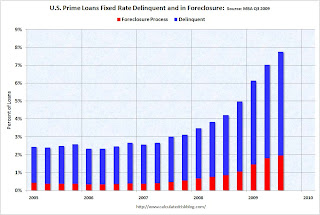

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the delinquency and in foreclosure rates for all prime loans.

Prime loans account for about 76% of all loans.

"We're all subprime now!" NOTE: Tanta first wrote this saying in 2007 in response to the 'contained to subprime' statements.

The second graph shows just fixed rate prime loans (about two-thirds of all loans).

The second graph shows just fixed rate prime loans (about two-thirds of all loans).Prime ARMs have a higher delinquency rate than Prime FRMs, but the foreclosure crisis has now spread to Prime fixed rate loans.

Note that even in the best of times (with rapidly rising home prices in 2005), just over 2% of prime FRMs were delinquent or in foreclosure. However the cure rate was much higher back then since a delinquent homeowner could just sell their home.

The third graph shows the delinquency and in foreclosure process rates for subprime loans.

The third graph shows the delinquency and in foreclosure process rates for subprime loans. Although the increases have slowed, about 40% of subprime loans are delinquent or in foreclosure.

And a final comment: historically house prices do not bottom until after foreclosure activity peaks in a certain area. Since the subprime crisis delinquency rates might be peaking, it would not be surprising if prices are near a bottom in the low end areas. But in general I'd expect further declines in house prices - especially in mid-to-high end areas.

MBA: Record 14.4 Percent of Mortgage Loans in Foreclosure or Delinquent in Q3

by Calculated Risk on 11/19/2009 10:00:00 AM

The MBA reports a record 14.4 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2009. This is an increase from 13.2% in Q2 2009.

From the MBA: Delinquencies Continue to Climb in Latest MBA National Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties rose to a seasonally adjusted rate of 9.64 percent of all loans outstanding as of the end of the third quarter of 2009, up 40 basis points from the second quarter of 2009, and up 265 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The non-seasonally adjusted delinquency rate increased 108 basis points from 8.86 percent in the second quarter of 2009 to 9.94 percent this quarter.

Top Line Results

The delinquency rate breaks the record set last quarter. The records are based on MBA data dating back to 1972.

The delinquency rate includes loans that are at least one payment past due but does not include loans somewhere in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 4.47 percent, an increase of 17 basis points from the second quarter of 2009 and 150 basis points from one year ago. The combined percentage of loans in foreclosure or at least one payment past due was 14.41 percent on a non-seasonally adjusted basis, the highest ever recorded in the MBA delinquency survey.

The percentage of loans on which foreclosure actions were started during the third quarter was 1.42 percent, up six basis points from last quarter and up 35 basis points from one year ago.

The percentages of loans 90 days or more past due, loans in foreclosure, and foreclosures started all set new record highs. The percentage of loans 30 days past due is still below the record set in the second quarter of 1985.

Increases Driven by Prime and FHA Loans

“Despite the recession ending in mid-summer, the decline in mortgage performance continues. Job losses continue to increase and drive up delinquencies and foreclosures because mortgages are paid with paychecks, not percentage point increases in GDP. Over the last year, we have seen the ranks of the unemployed increase by about 5.5 million people, increasing the number of seriously delinquent loans by almost 2 million loans and increasing the rate of new foreclosures from 1.07 percent to 1.42 percent,” said Jay Brinkmann, MBA’s Chief Economist.

“Prime fixed-rate loans continue to represent the largest share of foreclosures started and the biggest driver of the increase in foreclosures. 33 percent of foreclosures started in the third quarter were on prime fixed-rate and loans and those loans were 44 percent of the quarterly increase in foreclosures. The foreclosure numbers for prime fixed-rate loans will get worse because those loans represented 54 percent of the quarterly increase in loans 90 days or more past due but not yet in foreclosure.

“The performance of prime adjustable rate loans, which include pay-option ARMs in the MBA survey, continue to deteriorate with the foreclosure rate on those loans for the first time exceeding the rate for subprime fixed-rate loans. In contrast, both subprime fixed-rate and subprime adjustable rate loans saw decreases in foreclosures.

“The foreclosure rate on FHA loans also increased, despite having a large increase in the number of FHA-insured loans outstanding. The number of FHA loans outstanding has increased by about 1.1 million over the last year. This increase in the denominator depresses the delinquency and foreclosure percentages. If we assume these newly-originated loans are not the ones defaulting and remove the big denominator increase from the calculation results, the foreclosure rate would be1.76 percent rather than 1.31 percent reported.

....

“The outlook is that delinquency rates and foreclosure rates will continue to worsen before they improve. First, it is unlikely the employment picture will get better until sometime next year and even then jobs will increase at a very slow pace. Perhaps more importantly, there is no reason to expect that when the economy begins to add more jobs, those jobs will be in areas with the biggest excess housing inventory and the highest delinquency rates. Second, the number of loans 90 days or more past due or in foreclosure is now a little over 4 million as compared with 3.9 million new and previously occupied homes currently for sale, although there is likely some overlap between the two numbers. The ultimate resolution of these seriously delinquent loans will put added pressure on the hardest hit sections of the country.”

Weekly Initial Unemployment Claims: 505,000

by Calculated Risk on 11/19/2009 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Nov. 14, the advance figure for seasonally adjusted initial claims was 505,000, unchanged from the previous week's revised figure of 505,000. [Revised from 502,000] The 4-week moving average was 514,000, a decrease of 6,500 from the previous week's revised average of 520,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending Nov. 7 was 5,611,000, a decrease of 39,000 from the preceding week's revised level of 5,650,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 6,500 to 514,000, and is now 144,750 below the peak in April.

The level is still very high suggesting continuing job losses in November.

Wednesday, November 18, 2009

The Failure of Regulatory Oversight

by Calculated Risk on 11/18/2009 10:33:00 PM

This is a recurring theme: a bank fails, the Inspector General reviews the failure and discovers that the field examiners saw problems starting around 2002, and ... nothing happened for years.

We saw this with the Federal Reserve and the failure of Riverside Bank of the Gulf Coast, and with the FDIC / OTS and the failure of IndyMac.

Eric Dash at the NY Times has more: Pathology of a Crisis

At bank after bank, the examiners are discovering that state and federal regulators knew lenders were engaging in hazardous business practices but failed to act until it was too late. At Haven Trust, for instance, regulators raised alarms about lax lending standards, poor risk controls and a buildup of potentially dangerous loans to the boom-and-bust building industry. Despite the warnings — made as far back as 2002 — neither the bank’s management nor the regulators took action. Similar stories played out at small and midsize lenders from Maryland to California.This is screaming for an open and transparent Congressional investigation (or something like the Pecora Commission, ht Mock Turtle). After the examiners discovered problems at the banks in a timely fashion, what happened next? Were further actions blocked by supervisors? Did examiners feel each bank was an isolated incident? How will the new regulatory structure solve this problem?

And a chilling quote from Eric Dash's article:

“Hindsight is a wonderful thing,” said Timothy W. Long, the chief bank examiner for the Office of the Comptroller of the Currency. “At the height of the economic boom, to take an aggressive supervisory approach and tell people to stop lending is hard to do.”But isn't that the regulator's job?

Note: Alison Vekshin at Bloomberg had an excellent article last month on the same topic: FDIC Failed to Limit Commercial Real-Estate Loans, Reports Show

MBA: Purchase Applications Fall to 12 Year Low

by Calculated Risk on 11/18/2009 08:30:00 PM

Another busy day and I skipped the MBA market index earlier ... note: The MBA Q3 delinquency report will be released tomorrow.

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume decreased 2.5 percent on a seasonally adjusted basis from one week earlier. ...It appears the post home buyer tax credit slump is in full swing. The tax credit was extended and the eligibility expanded, but interest will probably wane (you can only pull so much demand forward).

The Refinance Index decreased 1.4 percent from the previous week and the seasonally adjusted Purchase Index decreased 4.7 percent from one week earlier. The seasonally adjusted Purchase Index has declined for six consecutive weeks and is at its lowest level since November 1997.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.83 percent from 4.90 percent, with points increasing to 1.17 from 1.03 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the lowest contract rate observed by the survey since mid-May of this year.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

Note: The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007, even though activity was actually declining.

One million Workers to Exhaust Unemployment Benefits in January

by Calculated Risk on 11/18/2009 05:42:00 PM

Yogi Berra

From the NY Times (edit): Jobless Benefits Set to Expire Unless Congress Acts

About one million laid-off workers will see their unemployment benefits end in January ...Note: I'm surprised that any lawmakers were "surprised". The expiration date was in the recent bill, and I mentioned that another extension would be coming soon.

The [recently] added federal benefits were built on a series of previous extensions that are slated to end on Dec. 31 ...

According to projections released Wednesday by the National Employment Law Project, an advocacy group that worked with state officials to develop the numbers, 474,111 unemployed workers will exhaust their state benefits during January ... An additional 581,000 workers will see their federal benefits end in January, according to the study.

Housing Leads the Economy, Existing Home Sales are Irrelevant

by Calculated Risk on 11/18/2009 03:30:00 PM

After reading some of the commentary regarding the housing starts report this morning, it might be useful to reiterate these three points:

Residential investment is reported quarterly by the Bureau of Economic Analysis (BEA) as part of the GDP report. We can also use monthly housing starts and new home sales as indicators of residential investment. I've written extensively about how residential investment is an excellent leading indicator for the economy (also see Dr. Leamer's paper: Housing and the Business Cycle)

This morning several commentators suggested that housing starts were depressed in October because of the expiration of the tax credit (new home buyers had to close by Nov 30th to get the tax credit), and also because of the weather. Probably. But the key point is that housing starts will not increase rapidly because of the large overhang of existing vacant housing units (see 2nd graph here). And that suggests that the economy will not recover quickly either.

Another key point is that existing home sales are largely irrelevant for the economy. This is an important point to remember next week when the NAR announces that existing home sales surged to 5.8 million units or so in October (seasonally adjusted annual rate). Some reporters and analysts will jump on the existing home sales report as evidence of a housing recovery. Others will point to it as showing that the first-time home buyer tax credit is helping the economy.

Both points are wrong.

The only contribution from existing home sales to the economy are some commissions and fees. That is good news for real estate agents and mortgage brokers, but not for the overall economy.

The good news is the level of inventory for new and existing homes is declining. The bad news is the inventory of rental units is at record levels - as is the combined inventory of vacant single family homes and rental units. Residential investment will not increase significantly until this overhang is reduced.

The key to reducing the overall inventory is new household formation (encouraging renters to become owners accomplishes nothing in reducing the overall housing inventory). And the key to new household formation is jobs. And usually the best leading indicator for jobs is residential investment. Somewhat of a circular trap.

And that suggests the recovery will be sluggish and unemployment will stay high for some time.

Quarterly Housing Starts and New Home Sales

by Calculated Risk on 11/18/2009 01:56:00 PM

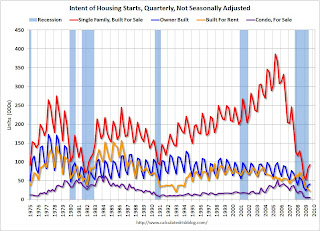

The Census Bureau has released the "Quarterly Starts and Completions by Purpose and Design" report for Q3 2009.

Monthly housing starts (even single family starts) cannot be compared directly to new home sales, because the monthly housing starts report from the Census Bureau includes apartments, owner built units and condos that are not included in the new home sales report.

However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis. The quarterly report shows that there were 93,000 single family starts, built for sale, in Q3 2009, and that is less than the 105,000 new homes sold for the same period. This data is Not Seasonally Adjusted (NSA). This suggests homebuilders are selling more homes than they are starting.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because homebuilders were stuck with “unintentional spec homes” during the housing bust because of the high cancellation rates, but cancellation rates are now much closer to normal. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph provides a quarterly comparison of housing starts and new home sales. In 2005, and most of 2006, starts were higher than sales, and inventories of new homes rose sharply. For the two years starts have been below sales – and new home inventories have been falling. The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Condo starts in Q3 tied the all time record low for Condos built for sale set in Q1 and Q2 of this year (5,000); the previous record was 8,000 set in Q1 1991 (data started in 1975).

Owner built units are above the record low set in Q1 (42,000 units compared to 24,000 units in Q1 2009), however the pickup in owner built starts was probably mostly seasonal (this is NSA data).

Units built for rent were near the record low (23,000 units in Q3 2009 compared to the all time record low of 21,000 units). With the vacancy rate at a record high, the demand for new rental units will stay low for some time.

Falling Rents and Minneapolis

by Calculated Risk on 11/18/2009 11:25:00 AM

From the BLS report on the Consumer Price Index this morning:

The rent index decreased 0.1 percent, the index for owners' equivalent rent [OER] was unchanged ...The rent index decreased at a -1.3% annualized rate, and OER declined in three of four ranges (only the Northeast Urban Region saw an increase - see Cleveland Fed).

The rent index and OER will probably continue to fall for some time, keeping CPI and core CPI low.

Most of the reports of falling rents are focused on the coasts, but here is a report from MN Reader in Minneapolis:

The Minneapolis rental market was OK through the end of July. It has deteriorated sharply since then. Internal apartment industry figures show an 8.0% physical vacancy rate as of 8/31/09. The economic vacancy rate, which includes free rent offers, etc, was 11.8% as of that same date. Both figures have gone up significantly since then. All landlords in the market are fighting desperately for residents. Effective asking rents are dropping rapidly.

The vacancy losses seem to be caused by (1) home buying using the $8,000 tax credit; (2) job losses/cutbacks among existing residents; and (3) lack of new jobs for residents who would have rented. Unlike the coasts, there is only a small pool of permanent renters in Minneapolis. Most residents will eventually buy — it is only a question of the rate at which they depart. That rate has definitely picked up this year. [A large part] of the rental market is recent college graduates who rent an apartment after they get their first career job. That hiring and renting has not happened this year.

One difference between Minneapolis and warmer climates is that the rental market is extremely seasonal here. There is very little rental traffic during the winter months. Typically, our movements in and out follow a bell-shaped curve, peaking in the summer months. While in-bound traffic drops in the cold months, the out-bound traffic also typically drops as well. The drop off in out-bound traffic did not occur this year. Resident move-outs stayed very high all fall, as people rushed to beat the 11/30th tax credit deadline. The timing of the scheduled end of the credit could not have been worse for us. The extension until the end of April/June means that the bleeding will go on all winter.

AIA: Architecture Billings Index Shows Contraction

by Calculated Risk on 11/18/2009 09:30:00 AM

From the American Institute of Architects : Index remains in negative category despite improvement

Amidst a continued high level of inquiries for possible new projects, the Architecture Billings Index (ABI) reached its highest mark since August 2008, just before the serious credit problems emerged in our economy. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the October ABI rating was 46.1, up sharply from 43.1 in September. This score, however, indicates a continued decline in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry score was 58.5, following the 59.1 mark in September.

“This news could prove to be an early signal towards a recovery for the design and construction industry,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “On the other hand, because we continue to get reports of architecture firms struggling in a competitive marketplace with a continued decline in commercial property values, it is far too early to think we are out of the woods.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on commercial real estate (CRE). This suggests further significant declines in CRE investment through most of 2010, if not longer.

Housing Starts Decline Sharply in October

by Calculated Risk on 11/18/2009 08:30:00 AM

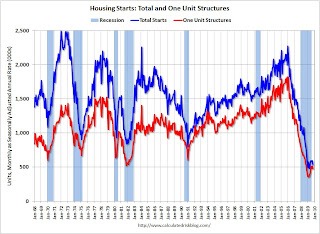

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 529 thousand (SAAR) in October, down 10.6% from the revised September rate, and up from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have move sideways (or down) for five months.

Single-family starts were at 476 thousand (SAAR) in October, down 6.8% from the revised September rate, and 33 percent above the record low in January and February (357 thousand). Just like for total starts, single-family starts have been at this level for five months.

The following graph shows total housing starts and the percent vacant housing units (owner and rental) in the U.S. Note: this is a combined vacancy rate based on the Census Bureau vacancy rates for owner occupied and rental housing. It is very unlikely that there will be a strong rebound in housing starts with a record number of vacant housing units.

It is very unlikely that there will be a strong rebound in housing starts with a record number of vacant housing units.

The vacancy rate has continued to climb even after housing starts fell off a cliff. Initially this was because of a significant number of completions. Also some hidden inventory (like some 2nd homes) have become available for sale or for rent, and lately some households have probably doubled up because of tough economic times.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:It appears that single family starts bottomed in January. However, as expected, it appears starts are now moving sideways - and will probably stay near this level until the excess existing home inventory is reduced.

Privately-owned housing starts in October were at a seasonally adjusted annual rate of 529,000. This is 10.6 percent (±8.7%) below the revised September estimate of 592,000 and is 30.7 percent (±8.3%) below the October 2008 rate of 763,000.

Single-family housing starts in October were at a rate of 476,000; this is 6.8 percent (±7.5%)* below the revised September figure of 511,000.

Housing Completions:

Privately-owned housing completions in October were at a seasonally adjusted annual rate of 740,000. This is 1.9 percent (±12.4%)* above the revised September estimate of 726,000, but is 29.9 percent (±9.7%) below the October 2008 rate of 1,055,000.

Single-family housing completions in October were at a rate of 528,000; this is 10.7 percent (±14.5%)* above the revised September figure of 477,000.

Tuesday, November 17, 2009

California Still Faces Large Budget Deficit

by Calculated Risk on 11/17/2009 11:59:00 PM

From the LA Times: California faces a projected deficit of $21 billion

Less than four months after California leaders stitched together a patchwork budget, a projected deficit of nearly $21 billion already looms, according to a report to be released Wednesday by the state's chief budget analyst.The projected deficit includes $6.3 billion for the remainder of the current fiscal year (ends June 30th), and $14.4 billion for the next fiscal year.

The new figure -- the nonpartisan analyst's first projection for the coming budget year -- threatens to send Sacramento back into budgetary gridlock and force more across-the-board cuts in state programs.

It just keeps getting worse ...

Cash for Caulkers?

by Calculated Risk on 11/17/2009 09:56:00 PM

David Leonhardt writes in the NY Times: A Stimulus That Could Save Money

White House officials are now looking at creating a new version of cash for clunkers — this time for home weatherization.This proposal has merit. There are many unemployed construction workers - so this would help with unemployment (a real jobs bill) - and weatherization would save the homeowners money over time.

...

[John] Doerr calls his proposal, which would give households money to pay for weatherization projects, “cash for caulkers.”... The housing bust has idled contractors and construction workers, who could be put to work insulating homes and caulking air leaks. Many households, meanwhile, would save substantial money — not to mention help the climate — by weatherizing their homes, research by McKinsey & Company has shown.

...

The Doerr plan would cost $23 billion over two years. Most of the money would go for incentive payments, generally $2,000 to $4,000, for weatherization projects. The homeowner would always have to pay at least 50 percent of the project’s total cost.

Added: Of course homeowners with negative equity will probably not want to invest in their homes since deferred maintenance is common for "debtowners". (ht Tim waiting for 2012)

The Next Stimulus: "Jobs, jobs, jobs, jobs"

by Calculated Risk on 11/17/2009 07:34:00 PM

From the WaPo: House shifts focus to 'jobs, jobs, jobs, jobs'

"It's jobs, jobs, jobs, jobs," Rep. John B. Larson (D-Conn.) ... said ... "Members of this caucus feel ... that a jobless recovery is just simply unacceptable to us."And Reuters list some possible items "under consideration": U.S. House plans jobs bill before year end

* A transportation bill that could cost up to $500 billionWhy wasn't the the last stimulus package - the one with the inefficient housing tax credit and the "gift" to homebuilders - why wasn't that focused on jobs?

* A tax credit for businesses that create jobs

* Assistance to state governments ...

* Low-interest loans for small businesses

* Another extension of unemployment benefits ...

* An extension of health-insurance subsidies for the jobless

* A transaction tax on over-the-counter trades in unregulated "dark markets"

More on Industrial Production

by Calculated Risk on 11/17/2009 04:54:00 PM

Earlier I posted a graph on capacity utilization: Industrial Production, Capacity Utilization Increase Slightly in October

Spencer at Angry Bear is tracking the recovery in industrial production compared to previous recessions.

As the chart shows, this changes the impression the previous reports had given that this was a normal to strong recovery in industrial output to one that it is a weak recovery.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Graph from Spencer.

It is too early to tell, but those expecting a "V" shaped recovery would expect industrial production to be tracking at or above the "severe recessions" line (since this was the worst recession since the Depression).

Before reading too much into this graph, Spencer cautions that an upward revision to Industrial Production is likely:

Much of the initial estimates of monthly industrial production data is based on electricity consumption data. However, the national average temperature days for October 2009 were extremely low at only 50.8 degrees Fahrenheit. In a quick check of my data base this is the second lowest October reading on record going back to 1921. The lowest was 49.4 degrees in 1925 and the only one I saw below 50 -- the highest was 60.0 in 1963. The norm is around 55 degrees so the October temperature days was some 10% below normal. This strongly implies that the electricity usage would have been significantly below normal in October and consequently the industrial production data estimates are undoubtedly biased downward.