by Calculated Risk on 10/20/2009 04:12:00 PM

Tuesday, October 20, 2009

HAMP Modification Documents

For those interested, here are some Wells Fargo (America's Servicing Corporation) HAMP documentation (pdf) (ht Dave).

A few notes:

DataQuick: California Mortgage Defaults Trend Down in Q3

by Calculated Risk on 10/20/2009 01:30:00 PM

There is a lot of interesting data in the DataQuick report. A few key points:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Notices of Default (NOD) by year through 20091 in California from DataQuick.

1 2009 estimated as total NODs to date, plus Q3 NODs (as estimate for Q4).

Clearly 2009 is on pace to break the record of 2008. I'd expect something close to 500 thousand NODs for the entire year.

From DataQuick: California Mortgage Defaults Trend Down Again

The number of mortgage default notices filed against California homeowners fell last quarter compared with the prior three-month period, the result of lenders' evolving foreclosure policies, an uncertain legislative environment and an uptick in the number of mortgages being renegotiated, a real estate information service reported.

A total of 111,689 default notices were sent out during the July-through-September period. That was down 10.3 percent from 124,562 for the prior quarter, and up 18.5 percent from 94,240 in third quarter 2008, according to San Diego-based MDA DataQuick.

The number of recorded default notices peaked in the first quarter of this year at 135,431, although that number was inflated by deferred activity from the prior four months.

"It may well be that lenders have intentionally slowed down the pace of formal foreclosure proceedings. If so, it's not out of the goodness of their hearts. It's because they've concluded that flooding the market with cheap foreclosures in this economic environment may not be in their best financial interest. Trying to keep motivated, employed homeowners in their homes might be the most cost-efficient way to stem losses," said John Walsh, DataQuick president.

...

While most foreclosure activity was still concentrated in affordable inland communities, the foreclosure problem continued to slowly migrate into more expensive areas. The state's most affordable sub-markets, which represent 25 percent of the state's housing stock, accounted for 52.2 percent of all default activity a year ago. In third-quarter 2009 it fell to 42.9 percent.

...

Although 111,689 default notices were filed last quarter, they involved 108,372 homes because some borrowers were in default on multiple loans (e.g. a primary mortgage and a line of credit). Multiple default recordings on the same home are trending down, DataQuick reported.

...

Trustees Deeds recorded, or the actual loss of a home to foreclosure, totaled 50,013 during the third quarter. That was up 9.5 percent from 45,667 for the prior quarter, and down 37.1 percent from 79,511 for third-quarter 2008, which was the all-time peak.

In the last real estate cycle, Trustees Deeds peaked at 15,418 in third-quarter 1996. The state's all-time low was 637 in the second quarter of 2005, MDA DataQuick reported.

emphasis added

MBA's Chief Economist Brinkmann on State of Housing

by Calculated Risk on 10/20/2009 12:08:00 PM

Emile Brinkmann, MBA Chief Economist, testified today before the Senate Committee on Banking, Housing and Urban Affairs at a hearing titled, "The State of the Nation's Housing Market." Here are some excerpts:

"... Whenever I am asked when the housing market will recover, I explain that the economy and the housing market are inextricably linked. The number of people receiving paychecks will drive the demand for houses and apartments and the recovery will begin when unemployment stops rising. ...Edit: this is correct in terms of housing units, but it is important to note that housing investment leads the economy both into and out of a recession, and, in recent recessions, employment lags. I'd argue the recovery in housing investment has already started, but it will be a very sluggish recovery.

... Prior to the onset of this recession, the housing market was already weakened due in part to the heavy use of loans like pay option ARMs and stated income loans by borrowers for whom these loans were not designed. Together with rampant fraud by some borrowers buying multiple properties and speculating on continued price increases, this led to very high levels of construction to meet that increased demand, demand that turned out to be unsustainable. When that demand disappeared, a large number of houses were stranded without potential buyers. The resulting imbalance in supply and demand drove prices down, particularly in the most overbuilt markets like California, Florida, Arizona, and Nevada - markets that had previously seen some of the nation's largest price increases.Unfortunately the MBA didn't take the lead in trying to halt the spread of these products (Option ARMs and Stated Income loans).

emphasis added

Thus the nature of the problem has shifted. A year ago, subprime ARM loans accounted for 36 percent of foreclosures started, the largest share of any loan type despite being only 6 percent of the loans outstanding. Now prime fixed-rate loans represent the largest share of foreclosures initiated.We're all subprime now!

Unfortunately, the consensus is that unemployment will continue to get worse through the middle of next year before it slowly begins to improve. While we have seen certain good signs like a stabilization of home prices and millions of borrowers refinancing into lower rates, we still face major challenges.My estimate is an increase of 35 bps for mortgage rates (relative to the Ten Year Treasury yield).

The most immediate challenge is what will happen to interest rates when the Federal Reserve terminates its program for purchasing Fannie Mae and Freddie Mac mortgage-backed securities in March. The Federal Reserve has purchased the vast majority of MBS issued by these two companies this year and in September purchased more than 100% of the Fannie and Freddie MBS issued that month. The benefit has been that mortgage rates have been held lower than what they otherwise would have been without the purchase program, but there is growing concern over where rates may go once the Federal Reserve stops buying and what this will mean for borrowers. While the most benign estimates are for increases in the range of 20 to 30 basis points, some estimates of the potential increase in rates are several times those amounts.

The extension of the Fed's MBS purchase program to March gives the Obama administration time to announce its interim and, perhaps, long-term recommendations for Fannie and Freddie in February's budget release.One of the concerns is privatizing profits and socializing losses - exactly what happened with Fannie and Freddie. This proposal has some positive features - especially restricting insurance to "the safest types of mortgages". That would be prime fixed and ARM loans only, with no risk layering. Subprime would be excluded. Alt-A should disappear.

All of this, however, points to the need to begin replacing Fannie Mae and Freddie Mac with a long-term solution. MBA has been working on this problem for over a year now and recently released its plan for rebuilding the secondary market for mortgages.

MBA's plan envisions a system composed of private, non-government credit guarantor entities that would insure mortgage loans against default and securitize those mortgages for sale to investors. These entities would be well-capitalized and regulated, and would be restricted to insuring only a core set of the safest types of mortgages, and would only be allowed to hold de minimus portfolios. The resulting securities would, in turn, have a federal guarantee that would allow them to trade similar to the way Ginnie Mae securities trade today. The guarantee would not be free. The entities would pay a risk-based fee for the guarantee, with the fees building up an insurance fund that would operate similar to the bank deposit insurance fund. Any credit losses would be borne first by private equity in the entities and any risk-sharing arrangements put in place with lenders and private mortgage insurance companies. In the event one of these entities failed, the insurance fund would cover the losses. Only if the insurance fund were exhausted, would the government need to intervene.

It appears - although it isn't explicitly stated - that no other entities could securtize mortgages. That would be a key.

Housing and the Economy

by Calculated Risk on 10/20/2009 10:10:00 AM

Just a quick comment ...

Probably the best leading indicator for the economy is investment in housing1.

We can use new home sales, housing starts (usually single-family starts), or residential investment (from the BEA GDP report), as indicators of housing.

We can probably also use the NAHB builder confidence index.

Those expecting a "V-shaped" or immaculate recovery - with unemployment falling sharply in 2010 - are clearly expecting single family housing starts to rebound quickly to a rate significantly above 1 million units per year.

Not. Gonna. Happen.

There are just too many excess housing units for a rapid recovery in new home sales and single family housing starts. Yes, new home inventory has declined significantly, and existing home inventory has also decreased (although still very high). But there are also a record number of vacant rental units - with the vacancy rate approaching 11% - and the housing inventory includes these units too.

Notice what is not included as a leading indicator: existing home sales.

The sale of an existing home adds a little to the economy (some commissions and fees), and sometimes some added spending on improvements. Only the improvements add to the housing stock (not commissions). And right now marginal buyers have very little to spend on improvements (see this story).

Those looking at existing home sales for economic guidance are confusing activity with accomplishment.

1I've written about this extensively, but I'll put up another post on housing investment leading the economy soon.

Housing Starts in September: Moving Sideways

by Calculated Risk on 10/20/2009 08:30:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 590 thousand (SAAR) in September, up 0.5% from the revised August rate, and up sharply from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have move sideways for four months.

Single-family starts were at 501 thousand (SAAR) in September, up 3.9% from the revised August rate, and 40 percent above the record low in January and February (357 thousand). Just like for total starts, single-family starts have been at this level for four months.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Building Permits:Note that single-family completions of 464 thousand are below the level of single-family starts (501 thousand). This suggests residential construction employment maybe be near a bottom.

Privately-owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 573,000. This is 1.2 percent (±1.8%)* below the revised August rate of 580,000 and is 28.9 percent (±2.2%) below the September 2008 estimate of 806,000.

Single-family authorizations in September were at a rate of 450,000; this is 3.0 percent (±1.0%) below the revised August figure of 464,000.

Housing Starts:

Privately-owned housing starts in September were at a seasonally adjusted annual rate of 590,000. This is 0.5 percent (±9.9%)* above the revised August estimate of 587,000, but is 28.2 percent (±6.7%) below the September 2008 rate of 822,000.

Single-family housing starts in September were at a rate of 501,000; this is 3.9 percent (±9.3%)* above the revised August figure of 482,000.

Housing Completions:

Privately-owned housing completions in September were at a seasonally adjusted annual rate of 693,000. This is 10.2 percent (±10.4%)* below the revised August estimate of 772,000 and is 39.6 percent (±5.7%) below the September 2008 rate of 1,148,000.

Single-family housing completions in September were at a rate of 464,000; this is 8.3 percent (±14.3%)* below the revised August figure of 506,000.

It appears that single family starts bottomed in January. However, as expected, it appears starts are now moving sideways - and will probably stay near this level until the excess existing home inventory is reduced.

NRF: Economy Impacting Holiday Spending Plans for Two-Thirds of Families

by Calculated Risk on 10/20/2009 12:12:00 AM

From the National Retail Federation: Economy to Impact Two-Thirds of Families this Holiday Season, According to NRF Survey

Retailers are about to embark on the holiday season of the serious bargain hunter. According to NRF’s 2009 Holiday Consumer Intentions and Actions Survey, conducted by BIGresearch, U.S. consumers plan to spend an average of $682.74 on holiday-related shopping, a 3.2 percent drop from last year’s $705.01.And this will mean few seasonal retail hires too.

It comes as no surprise that the economy was an overriding theme throughout this year’s survey. Two-thirds of Americans (65.3%) say the economy will affect their holiday plans this year, with the majority of these consumers saying they’re adjusting by simply spending less ...

Retailers are compensating for soft sales this holiday season by cutting back on inventory. ... “In anticipation of weak demand, many retailers scaled back on inventory levels to prevent unplanned markdowns at the end of the season,” said NRF President and CEO Tracy Mullin ...

“While the economic climate has shown some improvement from last holiday season, retailers are not out of the woods yet,” said Phil Rist, Executive Vice President, Strategic Initiatives, BIGresearch. “With a variety of factors still up in the air, including uncertainty over job security, many Americans just aren’t buying into the talk of recovery.”

The NRF is so depressing ...

Monday, October 19, 2009

WSJ: IRS Examining Many Suspicious First-Time Homebuyer Tax Credit Claims

by Calculated Risk on 10/19/2009 08:48:00 PM

John Mckinnon at the WSJ reports: Home-Buyer Credit Is Focus of Inquiry

The Internal Revenue Service is examining more than 100,000 suspicious claims for the first-time home-buyer tax break ...The tax credit is completely refundable, even if the homebuyer has no tax liability - and this makes it a target for fraud. From the IRS:

"[The tax credit is] fully refundable, meaning the credit will be paid out to eligible taxpayers, even if they owe no tax or the credit is more than the tax owed."Also, the credit is separate from the closing, and the WSJ article suggests this is contributing to the "widespread" fraud.

Bonnie Speedy, national director of AARP Tax-Aide ... suggested that abuse of the home-purchase credit appeared to be widespread ...And - not mentioned in the article - the homebuyers are required to pay back the tax credit if they do not own and live in the home for three years ... so there will probably be more fraud in the future. More IRS:

The obligation to repay the credit on a home purchased in 2009 arises only if the home ceases to be your principal residence within 36 months from the date of purchase. The full amount of the credit received becomes due on the return for the year the home ceased being your principal residence.I hope these people stretching to buy - like the buyer mentioned in the previous post paying 54% of her income for her house, including multiple jobs - realize they have to pay back the entire credit if they don't own and occupy the home for three years.

emphasis added

An FHA Loan Example, Einhorn Speech, and More

by Calculated Risk on 10/19/2009 05:21:00 PM

Denise works three jobs so she can afford her new house. She makes $2470 a month but pays $1328 to service her mortgage. That means 54% of her income goes to the house, leaving her with $285 a week to live on. Doable, but tight. She’s breaking the 30% rule and then some, not to mention she’s still spending out of pocket to renovate the yard, fix the roof and paint.Apparently 20 year old Denise bought the home for $155,000, and according to the comments, obtained an additional $28,000 on a "203K HUD supplemental loan to renovate the home" for a total of $183,000.

Not exactly up to the new proposed FSA standards of affordability!

The government has doled out billions to 687 banks [1] over the past year through a program meant to bolster already “healthy” banks. But an increasing number of those are troubled. Four banks in particular are foundering, including one that has acknowledged its executives cooked its books.Paul has the details.

Moody’s: CRE Prices Off 41 Percent from Peak, Off 3% in August

by Calculated Risk on 10/19/2009 02:59:00 PM

From Bloomberg: U.S. Commercial Property Values Fall 3% in August (ht James)

The Moody’s/REAL Commercial Property Price Indices fell 3 percent in August from July, bringing the market’s decline to almost 41 percent since its peak in October 2007, Moody’s Investors Service said in a statement today. ...Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

“We can’t call a bottom at this point, but it’s an encouraging sign to see the deceleration in the decline,” said Connie Petruzziello, a Moody’s analyst and co-author of the commercial property price report.

...

August was the 11th consecutive month the commercial property index fell.

The August report was based on prices for 73 properties that sold during the month and for which Moody’s has previous price records.

Notes: Beware of the "Real" in the title - this index is not inflation adjusted - that is the name of the company (an unfortunate choice for a price index). Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - only 73 repeat sales in August - and that can impact prices.

Click on graph for larger image in new window.

Click on graph for larger image in new window.CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

This shows residential leading CRE (although we usually talk about residential investment leading CRE investment, but in this case also for prices), and this also shows that prices tend to fall faster for CRE than for residential.

Campbell Surveys: ‘Mini-Boom’ in Existing Home Market

by Calculated Risk on 10/19/2009 02:21:00 PM

Excerpts posted with permission from Campbell Surveys

In September the housing market took a major turn to the upside, according to respondents to the Campbell/Inside Mortgage Finance Monthly Survey of Real Estate Market Conditions. Real estate agent survey respondents reported average residential property prices rose 6% from August to September ...As we've discussed before, there is a buying frenzy right now in the existing home market, especially at the low end. Unfortunately existing home sales add little to the economy (compared to new home sales). And the impact is even less than usual right now because many of the marginal buyers are using the first-time homebuyer tax credit as their downpayment, and have little additional money to spend on furniture or upgrades.

The reported month-to-month price increase of 6% was driven by high demand for REO –also commonly referred to as foreclosed properties--according to transaction data reported by survey respondents. ...

The average price for non-distressed properties remained nearly constant between August and September. ...

Strong demand for moderately priced REO caused time-on-market for these properties to decline markedly. In August, damaged REO stayed on the market an average of 9.4 weeks; by September, time-on-market had declined to 7.0 weeks. For move-in ready REO, time-on-market declined from 8.0 weeks in August to 5.9 weeks in September. In contrast, average time-on-market for non-distressed properties rose from 13.0 weeks in August to 14.2 weeks in September.

First–time homebuyer demand for properties continued to be strong in the month of September. First-time homebuyers accounted for 42% of home purchase transactions in September. ...

Many agents indicated an REO buying frenzy in local markets, especially California. “Entry level REO's are taken by the storm! Many multiple offers!” exclaimed a California agent. “Low inventory and high demand are resulting in 20-60 offers on most properties in the entry level to moderate price points. First-time homebuyers have difficulty competing with investors and high down-payment buyers,” reported another real estate agent located in California. “Banks and listing agents are pricing these REO's at liquidation prices to encourage a bidding war and it's working,” wrote a real estate agent located in Florida.

Despite reporting strong increases in both average prices and number of transactions, real estate agents responding to the survey gave a hint of looming problems caused by rising unemployment. For the third month in a row, the survey’s inventory index showed rising inventories of short sale properties, while inventories of REO properties were flat or declining.

emphasis added

For the economy, the numbers to track are housing starts, new home sales, and residential investment - not existing home sales.

NAHB: Builder Confidence Decreases Slightly in October

by Calculated Risk on 10/19/2009 01:00:00 PM

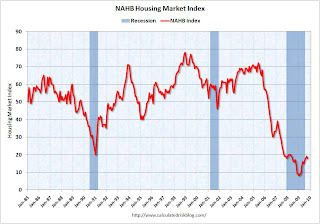

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) decreased to 18 in October from 19 in September. The record low was 8 set in January. Note that Traffic of Prospective Buyers declined sharply.

This is still very low - and this is what I've expected - a long period of builder depression.

Note: any number under 50 indicates that more builders view sales conditions as poor than good. This second graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the October release for the HMI and the August data for starts (September starts will be released tomorrow).

This second graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the October release for the HMI and the August data for starts (September starts will be released tomorrow).

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month. Those expecting a sharp rebound in starts are probably wrong.

Press release from the NAHB (added): Builder Confidence Slips in October

“This is the first time since November of 2008 that all three component indexes of the HMI have declined,” noted NAHB Chief Economist David Crowe. “Clearly, builders are experiencing the effects of the expiring tax credit on their sales activity, since it would be virtually impossible at this point to complete a new home sale in time to take advantage of that buyer incentive before Nov. 30.”

...

Each of the HMI’s component indexes recorded declines in October. The component gauging current sales conditions fell one point to 17, while the component gauging sales expectations for the next six months declined two points to 27 and the component gauging traffic of prospective buyers fell three points to 14.

On a regional basis, the Northeast was the only part of the country to record an improvement in its HMI score, with a one-point gain to 25. Meanwhile, the Midwest and South each recorded one-point declines to 18 and the West recorded a four-point decline to 14.

Bloomberg: FDIC Failed to Limit CRE Loans

by Calculated Risk on 10/19/2009 09:55:00 AM

Bloomberg reviewed 23 recent Inspector General reports of bank failures and concluded that the FDIC "failed to enforce its own guidelines to rein in excessive commercial real estate lending" (CRE).

From Bloomberg: FDIC Failed to Limit Commercial Real-Estate Loans, Reports Show (hts Mike in Long Island, Ron at WallStreetPit)

... The FDIC’s Office of Inspector General analyzed 23 lenders taken over by regulators from August 2008 to March and found that for 20, the agency’s examiners didn’t identify the issue early enough or should have taken stronger supervisory action after recognizing the banks had dangerously high levels of the loans before they failed. ...This is recurring theme. The examiners in the field, for both the FDIC and the Fed, recognized problems fairly early, but the agencies failed to take aggressive action.

“It’s often we’ll see in our reports that the FDIC detected problems in the bank in a timely fashion, but in some cases forceful corrective action wasn’t required by the FDIC to be taken quickly enough,” Jon Rymer, the FDIC’s inspector general, said in a telephone interview.

Here are two related posts: Inspector General: FDIC saw risks at IndyMac in 2002 and Federal Reserve Oversight and the Failure of Riverside Bank of the Gulf Coast

The from a state regulator:

“We should have been more strict,” Joseph Smith, North Carolina’s bank commissioner and chairman of the Conference of State Bank Supervisors, said in a telephone interview. ...I believe the regulators should have clamped down on CRE lending in 2006 - and the FDIC was aware of the problem. Here is a proposed interagency guidance on CRE lending from January 13, 2006.

“Had we required the reduction of CRE lending, it would have been thought of as an intrusion by regulators into the businesses of banks and to the operations of local economies,” Smith said. “Yes, it would have been the right thing to do. It would have caused a firestorm then. That might have been better than a firestorm now.”

Concentrations of CRE loans may expose institutions to unanticipated earnings and capital volatility in the event of adverse changes in the general commercial real estate market. ... The proposed guidance reinforces existing guidelines for real estate lending and provides criteria for identifying institutions with CRE loan concentrations that may warrant greater supervisory scrutiny.The final comments from Joseph Smith provide a clue as to the real problem. The examiners in the field were finding the problems, but the regulators were failing to act because "it would cause a firestorm" and it would be "thought of as an intrusion by regulators".

U.K. FSA: "More intrusive and interventionist style of regulation"

by Calculated Risk on 10/19/2009 08:40:00 AM

The Financial Services Authority (FSA) today sets out proposals for the major reforms required in the UK mortgage market to ensure that it works better for consumers and is sustainable for all market participants.They are going to ban stated income loans, limit risk layering (a key problem), limit arrears charges, hold mortgage lenders personally accountable, and require affordability tests.

The proposals, published in the mortgage market review discussion paper, reflect the FSA’s changed approach to a more intrusive and interventionist style of regulation.

...

“The paper sets out the main findings of the FSA’s comprehensive analysis of the mortgage market. It clearly shows a rapid explosion in mortgage products; the emergence of high risk lending strategies which typically focused on higher risk borrowers; relaxed credit standards; and a mutual assumption by too many borrowers and lenders that the good times could not end.

“The FSA needs to ensure that firms only lend to people who can afford to pay the money back. The reforms that we have announced today will ensure that the mortgage market works better for consumers and that it is sustainable for firms.”

...

The discussion paper is out for discussion until 30 January 2010 and the FSA will be actively seeking views from consumer groups and industry. A feedback statement will be published in March. Implementation will be phased ...

•Affordability tests: the DP proposes making the lender ultimately responsible in every sale for verifying affordability. It also proposes that in each case a lender should assess the consumer’s ability to repay, i.e. calculate the free disposable income a consumer has to pay for the mortgage.

•Self-certification: the DP proposes requiring verification of income for all mortgage applications;

• Toxic combinations: the DP discusses whether a type of product regulation likely to be more effective in protecting consumers would be to prohibit loans to borrowers that exhibit certain multiple high-risk characteristics, such as prohibiting loans to credit-impaired borrowers that are also at high loan-to-income.

• Arrears: the FSA will publish specific proposals in January to toughen up rules on arrears handling as well as banning administration charges where a borrower is adhering to an arrangement to repay arrears; and prohibiting the charging of early redemption charges on arrears fees.

• Requiring all mortgage advisers to be personally accountable to the FSA; DP proposes extending the Approved Persons regime to mortgage advisers who deal with consumers and to advisers and/or arrangers who are responsible for overseeing compliance ...

emphasis added

This is a good model for the U.S.

For amusement, here is The Times headline: Homebuyers face questions on alcohol spending

Homebuyers could be forced to provide detailed information about the amount of money they spend on alcohol each month to qualify for a new mortgage under a new clampdown on reckless lending. ... It said lenders should delve deeper into homebuyers' personal spending including the amount they spend on alcohol and tobacco.

Sunday, October 18, 2009

Weekend Summary

by Calculated Risk on 10/18/2009 09:23:00 PM

Some long posts earlier, so here is a summary:

... Almost 51 million square feet of office space in Los Angeles County, Orange County and the Inland Empire is now empty -- more than 17% of the total.

[T]he Financial Services Authority ... plans to tighten up regulation and crack down on risky lending ...

The FSA's Mortgage Market Review, published tomorrow, will focus on the third of the market considered "higher risk". ... Among the report's proposals, the financial regulator is expected to call for an end to self-certification mortgages and rule that responsibility for income verification be transferred from mortgage brokers to lenders.

This will be another busy week with two key housing reports: Housing starts on Tuesday, and Existing home sales on Friday. I expect single family starts to be about the same as last month (the number to watch), and existing home sales to be higher than last month (based on regional reports).

U.S. Bank v. Ibanez: More fun with foreclosures

by Calculated Risk on 10/18/2009 04:34:00 PM

CR Note: This is a guest post from albrt.

Another interesting foreclosure decision came down this week – U.S. Bank v. Ibanez by Massachusetts Land Court Judge Keith Long. The case is about securitized subprime mortgages that were foreclosed in mid 2007. The originating banks had assigned the notes and mortgages “in blank,” and the documents were then given to a custodian who kept them safely filed away while the securitization machine went to work. The mortgages were assigned to pools, and the pool trustees eventually sought to foreclose on these particular mortgages.

The pool trustees used a non-judicial process called a “power of sale.” In states that allow non-judicial foreclosures, banks can legally take back a house and sell it with little or no oversight if they follow the steps of the statute carefully. The Massachusetts statute required the banks to give notice of who held the mortgage. The pool trustees in Ibanez named the wrong party on the notices because they had not updated the assignment stamps on the documents at the time they advertised the sale.

The pool trustees were not able to get title insurance for the properties after the sales, so they filed complaints with the land court asking to have their titles validated. Judge Long held that the foreclosure sales were void. The pool trustees asked the court to reconsider, and filed a lot of paperwork explaining the securitization process. Judge Long held that the foreclosure sales were still void, and also made some interesting comments along the way about the representations in the securitization documents.

Ibanez is a trial court decision, but it is apparently expected to have significant influence in Massachusetts because of the special nature of the court. The Massachusetts Land Court has the job of examining titles and conclusively certifying who owns land. This is different from most states, where private parties record title documents with a local official, but the local official usually has very limited power to decide whether the document is any good. In most states, courts will look at the records and quiet title as between the parties who are in court, but the courts will not necessarily preclude another party from coming in later and challenging the title on a different basis. I don’t practice in Massachusetts, but I would expect that because the Massachusetts Land Court is specialized and its judgments are conclusive, the judges probably try not to differ too much in their interpretation of the law. I would expect the basic points of Judge Long’s decision in Ibanez to be followed by other land court judges unless the case is overturned on appeal.

Please note that Judge Long invalidated the foreclosures, not the mortgages. In all likelihood, the holders of the mortgages will be able to go back and foreclose eventually, but they will spend some additional time and money doing it. This gentleman has been following the case and has provided some local commentary, and has also graciously posted a copy of the Ibanez decision .

There were a few points in the case that I thought were worth discussing further:

Non-judicial foreclosure. The foreclosure in this case was done using an abbreviated process without much oversight from a judge. The Massachusetts statute on powers of sale allows the bank to enter the property, publish notices, and then sell the property on a specified date at least thirty days later. If the bank is not able to use the accelerated process, it takes three years for the bank to get clear title in Massachusetts. Any time during the three year period the former borrower has a right of redemption, which means the borrower can come back, pay the bank whatever is due on the mortgage, and get the property back.

More than half the states have accelerated foreclosure processes that have little or no involvement by the court, including states that allow “deeds of trust” instead of mortgages. Banks generally like non-judicial foreclosures because they are faster and cheaper. But if the bank screws up a non-judicial foreclosure, the sale may be invalid and the bank may be liable for problems caused by the invalid sale. Many states allow either judicial or non-judicial foreclosures. If there is something wrong with the transaction, for example questionable assignments as in the Ibanez case, the bank may want to consider a judicial foreclosure. If there is a judge handling the case, the judge will usually have the power to consider evidence and decide whether the foreclosing bank really is the owner of the mortgage. Once the judge decides who owns the mortgage, the foreclosure should be able to go forward. Situations where the mortgage completely disappears and the borrower gets to keep the house without paying should be rare.

On the other hand, this gentleman has an interesting if somewhat speculative point:

The true holder of the Note was insured by AIG so they are covered. AIG and the banks were bailed out by taxpayers. So, unless the American tax payer can produce a “blue-ink” original Note, no one has standing to foreclose.The process of figuring out whether an insurance company should be able to collect from somebody else after the insurance company pays a claim is called “subrogation.” When the word subrogation appears in a legal pleading, well, let’s just say it tends to complicate the case a little bit. It seems to me this gives the average borrower something to talk about when explaining to a judge why he or she wants to see the original note. I have not seen a case where a borrower could show that the holder of the note had been bailed out by AIG or the taxpayers, but it must have happened. In fact, I would say it seems to have happened a lot.

Representations and warranties. Judge Long mentioned several times that he was shocked to discover the security offering documents represented to investors that the mortgages had been validly assigned, when in fact the mortgages had not been validly assigned. There is a lot of law here, but Judge Long’s discussion is pretty clear on most points so I won’t try to rehash it. This certainly gives us something to think about when we are wondering why the Fed and the Treasury and all the other wholly-owned subsidiaries of Goldman Sachs are so motivated to overpay for mortgage securities. If the government ends up buying all the bonds at some large fraction of face value, then the government is probably the only party that can sue the securitizers for making misrepresentations like this.

MERS. This case also demonstrates that recorded title documents can get plenty screwed up without any help from a third party like MERS. As Tanta explained, banks have been using third-party custodians to hold original documents for a long time, and the proper assignments didn’t always get made in a timely fashion. In fact, Judge Long seemed to suggest in two footnotes that the banks would have had an easier time in this case if they had used MERS.

Title Insurance. The Ibanez banks brought these cases because they couldn’t get title insurance. For anyone who wants to avoid complications like this, title insurance is the key. Title insurance doesn’t guarantee that you’ll never have any problems – like any insurance company, sometimes title insurers will deny claims and leave you hanging. But for the most part it is the title insurer’s job to figure out if there are problems with your title, and then provide insurance to cover your legal expenses and your losses if any problems come up. The way you get title insurance is different in different states, but the policies are generally standardized in something called “ALTA” format. ALTA stands for “American Land Title Association.”

If you want to buy a house from a bank and the title insurance company thinks the foreclosure sale was no good, the title company most likely won’t insure the title at all. You should not buy a property that a title company won’t insure unless you can afford a good lawyer and are looking for adventure.

It is also possible that the title company will insure the title subject to “Exceptions.” When you get a title policy commitment before the sale, Schedule A will show your proposed coverage, Schedule B will show the Exceptions, and there will also be a list of “Requirements” that need to be completed before the title company will actually issue the policy. Requirements that aren’t completed before closing will generally migrate over to the Exceptions page.

It is very important to understand the Exceptions in you title policy. Sometimes, after careful consideration, you can decide to disregard the Exceptions. For example, my title policy has an Exception for water rights. I live in the city and have city water, so I am not going to spend a lot of time worrying about whether I have a right to drill a well. Maybe I will regret my decision in the Hard Times ahead, but basic plumbing is not one of the technologies I expect to disappear in the Hard Times, so I’m willing to take my chances. The title company also made an Exception for the racial covenants that were placed on my neighborhood in the 1920s. The U.S. Supreme Court has decided those are clearly not enforceable, and the title company doesn’t want to pay for anyone to try to relitigate either side of that question.

If a title company were trying to offer you a policy without covering a bad foreclosure, the exception might look something like this:

Any loss, claim or damage by virtue of the failure of the public records to disclose an assignment of interest from the instrument recorded in Book 107 of Deeds, page 49 to the instrument recorded in Book 109 of Deeds, page 377.This is hard to understand out of context because it is basically a big nominal phrase without a real subject or a verb or an object. The subject and the verb and the object are “We will not provide coverage for __________.” If there are any Exceptions in your title policy that you don’t completely understand, you should probably consult a lawyer.

There is plenty more to talk about, but this is already almost as long as the MERS post, so I’ll stop here. Ibanez appeared several times in the comments this week, but CR was the first person I heard about it from so no hat tips, except to Tanta for having all this figured out a few years ago.

CR Note: This is a guest post from albrt.

Inventory Restocking and Q3 GDP

by Calculated Risk on 10/18/2009 02:43:00 PM

Professors Hamilton and Krugman have mentioned that Q3 GDP will probably be reasonably strong, see Hamilton's No L and Krugman's A smidgen of optimism. I agree.

But I don't think growth in Q3, or even in Q4, are the question. The key question is what happens in early 2010.

The following graph shows the contributions to GDP from changes in private inventories for several recessions. The blue shaded area is the last two quarters of each recession, and the light area is the first four quarters of each recovery. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Red line is the median of the last 5 recessions - and indicates about a 2% contribution to GDP from changes in inventories, for each of the first two quarters coming out of a recession. But this boost is always transitory.

Following the 1969 recession, changes in inventory added 6.2% to GDP in the first quarter of recovery - and GDP increased at an 11.5% (SAAR) that quarter. No one is predicting a quarter like that. But a 1% to 2% contribution from changes in inventories is possible.

And Personal Consumption Expenditures (PCE) will be strong too.

The following graph shows real PCE through August (2005 dollars). Note that the y-axis doesn't start at zero to better show the change. The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

The colored rectangles show the quarters, and the blue bars are the real monthly PCE.

The July and August numbers suggest PCE will grow at about a 3.6% (annualized rate) in Q3, however retail sales suggest less growth in September (July and August were boosted by cash-for-clunkers). So maybe we will see 3% PCE growth in Q3, and that would mean a contribution to GDP of about 2%.

Add in positive contributions from net exports, an increase in residential investment (for the first time since Q4 2005), some increase in equipment and software investment - and Q3 should look pretty healthy. Yes, investment in non-residential structures will be ugly, but overall private investment will be positive (first time since Q3 2007).

However, I expect early 2010 to be a different story.

Although I expect solid GDP growth in Q3 (and probably OK in Q4), I think GDP growth in 2010 will be sluggish, with downside risks.

McClatchy: "How Moody's sold its ratings"

by Calculated Risk on 10/18/2009 12:21:00 PM

Kevin Hall at McClatchy Newspapers writes: How Moody's sold its ratings -- and sold out investors (ht Atrios)

A McClatchy investigation has found that Moody's punished executives who questioned why the company was risking its reputation by putting its profits ahead of providing trustworthy ratings for investment offerings.How can securities be rated AAA one day, and junk the next?

Instead, Moody's promoted executives who headed its "structured finance" division, which assisted Wall Street in packaging loans into securities for sale to investors. It also stacked its compliance department with the people who awarded the highest ratings to pools of mortgages that soon were downgraded to junk.

The rating agencies pocketed the fees, and investors (including the Fed) still use their ratings. As Atrios jokes: "Not sure there have been negative consequence for them, so call it a win!"

Offices: See-Through Buildings in LA

by Calculated Risk on 10/18/2009 09:38:00 AM

From Roger Vincent at the LA Times: Southern California's vast desolation indoors

... Almost 51 million square feet of office space in Los Angeles County, Orange County and the Inland Empire is now empty -- more than 17% of the total. ... "These vacancies are a direct reflection on unemployment," said Joe Vargas, an executive vice president at Cushman & Wakefield. "Companies continue to reduce their workforce, or they are not hiring."Usually the unemployment rate and the office vacancy rate tend to peak around the same time. So, as the unemployment rate continues to rise into 2010, the office vacancy rate will probably increase too.

...

Real estate rentals are a lagging indicator of the economy, so the shrinking-space trend is expected to persist well into next year even if the nation's financial outlook continues to improve.

...

Cushman & Wakefield's Vargas predicts Southern California will remain a tenant's market through mid-2010 and perhaps longer if employment doesn't start picking up.

"This is certainly the worst downturn we've seen," Vargas said. "We're not going to see real improvement until job growth occurs."

On a national basis, Reis' forecast is for the office vacancy rate to peak at 18.2 percent in 2010 (currently 16.5%), and for rents to continue to decline through 2011.

Saturday, October 17, 2009

U.K.: FSA to Tighten up Mortgage Regulation, Ban Stated Income Loans

by Calculated Risk on 10/17/2009 10:12:00 PM

From the Telegraph: Era of cheap mortgages is over, British homeowners warned

[T]he Financial Services Authority ... plans to tighten up regulation and crack down on risky lending ...The terms are different in the U.K.: "Self certification" is stated income, "second charge" is a second mortgage, and "buy-to-let" is a rental unit.

The FSA's Mortgage Market Review, published tomorrow, will focus on the third of the market considered "higher risk". ... Among the report's proposals, the financial regulator is expected to call for an end to self-certification mortgages and rule that responsibility for income verification be transferred from mortgage brokers to lenders.

...

Second charge and buy-to-let mortgages, neither of which are regulated by the FSA, are expected to be brought under its supervision. In addition, sub-prime, interest-only, and 125pc mortgages will all be subjected to closer scrutiny and higher capital requirements.

Subprime, interest only (IO) and 125 percent loan-to-value (LTV) are the same.

There is no purpose for self certification (stated income) loans and these should be banned everywhere. Self certification means "buyer underwritten" as opposed to "lender unwritten" - and that makes no sense. Tanta wrote a couple of great posts on this in 2007: Just Say No To Stated Income and What's Really Wrong With Stated Income .

About time ...

HUD Inspector General's Report on FHA Lender Approval Process

by Calculated Risk on 10/17/2009 06:35:00 PM

Just a follow-up to the previous post - here is the HUD Inspector General's report on the FHA single-family lender approval process (ht MrM) Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph from the Inspector General's report shows the number of approved FHA lenders by year. In 2008 there were 3,297 lender applications approved by the FHA, more than triple the number in 2007.

And 2009 is on pace for a similar number of approvals as 2008 (another 3,000+ lenders).

From the report:

Congressional concerns brought about in part by media coverage has raised concerns that former subprime lenders and brokers are obtaining approval to participate in the FHA program and that they will be responsible for FHA insurance of loans to people unlikely to make their payments.And from the results:

Our audit objective was to determine whether the application process for Title II provided effective controls to ensure approval of only those lenders that complied with FHA requirements ...

Finding 1: FHA's Lender Approval Process Did Not Ensure That Only Eligible Applicants Were Approved

FHA's lender application process was not adequate to ensure that all of its lender approval requirements were met. This condition occurred because FHA control procedures had been enhanced and automated to handle the recent large increase in the number of lenders applying for the FHA program.