by Calculated Risk on 7/24/2009 05:47:00 PM

Friday, July 24, 2009

Bank Failure #58: Waterford Village Bank, Clarence, New York

Bankers caught breaking their trust

"Acting stupidly"

by Soylent Green is People

From the FDIC: Evans Bank, National Association, Angola, New York, Assumes All of the Deposits of Waterford Village Bank, Clarence, New York

Waterford Village Bank, Clarence, New York, was closed today by the New York State Banking Department, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...It is Friday and New York is on the FDIC map (not counting Lehman, Bear Stearns, etc.)

As of March 31, 2009, Waterford Village Bank had total assets of $61.4 million and total deposits of approximately $58 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $5.6 million. ... Waterford Village Bank is the 58th FDIC-insured institution to fail in the nation this year, and the first in New York. The last FDIC-insured institution to be closed in the state was Reliance Bank, White Plains, March 19, 2004.

Market and Bank Watch

by Calculated Risk on 7/24/2009 04:00:00 PM

Both Corus and Guaranty Bank (Texas) are on the mat being counted out.

Financial Guaranty has even agreed to be seized.

Apparently Corus bidders have a couple more weeks. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

The S&P 500 is up 44.7% from the bottom (303 points), and still off 37.4% from the peak (586 points below the max).

This puts the recent rally into perspective. The S&P 500 first hit this level in Sept 1997; about 12 years ago. The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Double Up to Catch Up!

by Calculated Risk on 7/24/2009 01:50:00 PM

From the NY Times: California Pension Fund Hopes Riskier Bets Will Restore Its Health (ht several)

[Joseph A. Dear, the fund’s new head of investments] wants to embrace some potentially high-risk investments in hopes of higher returns. He aims to pour billions more into beaten-down private equity and hedge funds. Junk bonds and California real estate also ride high on his list. And then there are timber, commodities and infrastructure.The post title is an old gambling saying. Actually now is probably a better time to buy some of these assets than a few years ago.

That’s right, he wants to load up on many of the very assets that have been responsible for the fund’s recent plunge.

The Surge in Rental Units

by Calculated Risk on 7/24/2009 11:36:00 AM

Please see this earlier post for graphs of the homeownership rate, and homeowner and rental vacancy rates.

The supply of rental units has been surging: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).

The total number of rental units (red and blue) bottomed in Q2 2004, and started climbing again. Since Q2 2004, there have been over 4.3 million units added to the rental inventory.

Note: please see caution on using this data - this number might be a little too high, but the concepts are the same even with a lower increase.

This increase in units has more than offset the recent strong migration from ownership to renting, so the rental vacancy rate is now at a record 10.6%.

Where did these approximately 4.3 million rental units come from?

The Census Bureau's Housing Units Completed, by Intent and Design shows 1.1 million units completed as 'built for rent' since Q2 2004. This means that another 3.2 million or so rental units came mostly from conversions from ownership to rentals.

These could be investors buying REOs for cash flow, condo "reconversions", builders changing the intent of new construction (started as condos but became rentals), flippers becoming landlords, or homeowners renting their previous homes instead of selling.

This huge surge in rental supply has pushed down rents, and pushed the rental vacancy rate to record levels.

Yes, people are doubling up with friends and family during the recession, and some renters are now buying again, but the main reason for the record vacancy rate is the surge in supply.

Q2: Homeowner Vacancy Rate Declines, Rental Vacancy Rate at Record High

by Calculated Risk on 7/24/2009 10:36:00 AM

This morning the Census Bureau reported the homeownership and vacancy rates for Q2 2009. Here are a few graphs ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

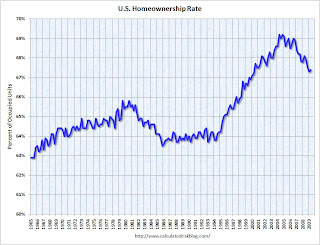

The homeownership rate increased slightly to 67.4% and is now at the levels of Q2 2000.

Note: graph starts at 60% to better show the change.

The homeownership rate increased in the '90s and early '00s because of changes in demographics and "innovations" in mortgage lending. The increase due to demographics (older population) will probably stick, so I expect the rate to decline to the 66% to 67% range - and not all the way back to 64% to 65%.

The homeowner vacancy rate was 2.5% in Q2 2009. This is the lowest vacancy rate since mid-2006, but still very high. A normal rate for recent years appears to be about 1.7%.

This is the lowest vacancy rate since mid-2006, but still very high. A normal rate for recent years appears to be about 1.7%.

This leaves the homeowner vacancy rate about 0.8% above normal, and with approximately 75 million homeowner occupied homes; this gives about 600 thousand excess vacant homes.

The rental vacancy rate increased to a record 10.6% in Q2 2009.  It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 10.6% to 8%, there would be 2.6% X 40 million units or about 1.04 million units absorbed.

It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 10.6% to 8%, there would be 2.6% X 40 million units or about 1.04 million units absorbed.

These excess units will keep pressure on rents and house prices for some time.

Guaranty Financial: Probably "Not be able to continue as a going concern"

by Calculated Risk on 7/24/2009 08:02:00 AM

To start BFF off ...

Guaranty Financial Group filed an 8-K with the SEC last night (ht Russ). Here are a few excerpts:

[T]he Company no longer believes that it will be possible for the Company or the Bank to raise sufficient capital to comply with the Orders to Cease and Desist described in the Company’s Current Report on Form 8-K filed on April 8, 2009. In light of these developments, the Company believes that it is probable that it will not be able to continue as a going concern.That is more than your typical 'going concern' warning.

emphasis added

Current stockholders will get nothing:

The Company continues to cooperate with the OTS and the FDIC as they pursue potential alternatives for the business of the Bank. Any such transaction would not be expected to result in the receipt of any proceeds by the stockholders of the Company.The bank has consented to be seized:

[T]he OTS has directed that the Board of Directors of the Bank consent to the OTS exercising its statutory authority to appoint the FDIC as receiver or conservator for the Bank. ... The Board has complied with the OTS demand for such consent, but the appointment of a receiver or conservator has not yet occurred.Its subsidiary, Guaranty Bank, is deep in the hole:

[T]he Bank’s core capital ratio stood at negative 5.78% as of March 31, 2009. The Bank’s total risk based capital ratio as of March 31, 2009 stood at negative 5.52%. Both of these ratios result in the Bank being considered critically under-capitalized under regulatory prompt corrective action standards.It is just a matter of when. Guaranty Financial will be the largest bank failure this year with approximately $14 billion in assets.

Here is a story from Brendan Case at the Dallas Morning News: Guaranty Bank may face federal control

California Budget: Misery Loves Company

by Calculated Risk on 7/24/2009 12:51:00 AM

One of the key elements of the new California budget is to have the state use money that is normally allocated to cities. This is a crushing blow to the finances of many cities. Here is an example from the O.C. Register: State revenue raids could bankrupt city, officials say

Placentia city officials are howling in effort to keep state hands out of their coffers. The plan to seize millions could bankrupt the city, they say.

"We may have to declare bankruptcy – that's how serious this is," said City Administrator Troy Butzlaff. "This is something the system can't endure. We just avoided bankruptcy by doing all the right things; by cutting back, by getting concessions from staff, by cutting $4.5 million over last year's budget."

...

Butzlaff said earlier this week the state legislators' budget proposals could take roughly $900,000 from gas tax money, $800,000 from property tax money, and $400,000 from the Redevelopment Agency.

...

"Some of my cities are in good shape, some are teetering on the edge," [State Sen. Bob Huff, R- Diamond Bar] said. "It's not fair for the state to outsource its miseries to the local level."

Thursday, July 23, 2009

More on Foreclosure Modification Scams

by Calculated Risk on 7/23/2009 09:22:00 PM

From Matt Padilla at the O.C. Register: DA raids Ladera homes tied to alleged loan-aid scam

Investigators with the Orange County District Attorney early Thursday morning searched three Ladera Ranch homes tied to an alleged foreclosure rescue scam.Once again some of these scamsters are former subprime mortgage brokers. I bet many people hope Ms. Henderson is successful!

...

Attorney General Jerry Brown last week said he has filed suit against the men for allegedly charging homeowners $4,000 in upfront fees and then failing to get them cheaper payments on their home loans.

...

Earlier in the week District Attorney Tony Rackauckas told a group of community leaders his office is expanding investigations into real estate fraud.

Elizabeth Henderson, an assistant DA who spoke at the same event in Garden Grove, said 30% of the cases handled by the office’s major fraud unit are tied to real estate, up from an average 10% in past years ...

“We want to send people to jail,” she said.

Report: Corus Bank may be Seized by early August

by Calculated Risk on 7/23/2009 07:14:00 PM

Another preview for BFF ...

From Bloomberg: Lubert-Adler Said to Mull Bid for Chicago’s Corus Bankshares

Lubert-Adler Partners LP, the Philadelphia-based private-equity firm, is among at least four investors weighing bids for Corus Bankshares Inc. ... The Federal Deposit Insurance Corp. has indicated that the bank ... may be seized as soon as Aug. 6, the people said.It is just a matter of when ...

More on Banning ‘Naked’ CDS

by Calculated Risk on 7/23/2009 06:07:00 PM

Note: Credit Default Swap (CDS) is an insurance contract for a credit instrument. A naked CDS is when someone buys insurance for an underlying asset that they do not own (like buying fire insurance on a neighbor's house). A put option on a stock is somewhat similar - and you don't have to own the stock to buy the put, but the exchange sets the liquidity rules for traders. And that is probably what will happen with CDS: My guess is non-exchange naked CDS trading will be banned.

From Bloomberg: ‘Naked’ Default Swaps May Be Banned in House Bill

“The question of banning naked credit-default swaps is on the table,” Frank, a Massachusetts Democrat, said during an interview on Bloomberg Television today. The legislative proposal will be released next week, Frank said.

...

“Frank has indicated to me he wants a total ban on naked credit default swaps,” [House Agriculture Committee Chairman Collin] Peterson said in a statement through a spokesman today. “While the Agriculture Committee had concerns about this proposal when we considered it in February, I am inclined to support it because I would rather err on the side of caution when it comes to these instruments.”

Credit-default swaps do “perform a useful function” in the economy, Frank said, and there may be “alternatives to banning naked credit-default swaps” if most derivatives are moved to a regulated exchange.

“If we can get rules where almost every derivative is traded on an exchange, and those that aren’t because they are just too unique” are backed by extra capital, he said, “then that may do it.”

...

Geithner said that while comprehensive oversight is needed, a ban would be inappropriate.

Bloomberg's Weil on Proposed New FASB Mark-to-Market Initiative

by Calculated Risk on 7/23/2009 03:56:00 PM

From Jonathan Weil at Bloomberg: Accountants Gain Courage to Stand Up to Bankers (ht James, Michael)

The scope of the FASB’s initiative, which has received almost no attention in the press, is massive. All financial assets would have to be recorded at fair value on the balance sheet each quarter, under the board’s tentative plan.I'll believe it when I see it!

This would mean an end to asset classifications such as held for investment, held to maturity and held for sale, along with their differing balance-sheet treatments. Most loans, for example, probably would be presented on the balance sheet at cost, with a line item below showing accumulated change in fair value, and then a net fair-value figure below that. For lenders, rule changes could mean faster recognition of loan losses, resulting in lower earnings and book values.

And on how this would apply to CIT:

[CIT] said in a footnote to its last annual report that its loans as of Dec. 31 were worth $8.3 billion less than its balance sheet showed. The difference was greater than CIT’s reported shareholder equity. That tells you the company probably was insolvent months ago, only its book value didn’t show it.And for those looking for a market graph:

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Real Estate: Commercial and Residential Prices

by Calculated Risk on 7/23/2009 02:02:00 PM

Here is a comparison of the Moody's / Real Capital Analytics CRE price index and the Case-Shiller composite 20 index.

Notes: Beware of the "Real" in the title - this index is not inflation adjusted - that is the name of the company (an unfortunate choice for a price index). Moody's CRE price index is a repeat sales index like Case-Shiller. Click on graph for larger image in new window.

Click on graph for larger image in new window.

CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

This shows residential leading CRE (although we usually talk about residential investment leading CRE investment, but in this case also for prices), and this also shows that prices tend to fall faster for CRE than for residential.

There has been some discussion recently of the “de-stickification” of house prices in areas of heavy foreclosure activity. Price behavior for foreclosure resales is probably similar to CRE because there is no emotional attachment to the property. But prices in bubble areas like coastal California, with little foreclosure activity, will probably exhibit more stickiness and decline, in real terms, over a longer period than the high foreclosure areas.

Hotel RevPAR Off 17.5% YoY

by Calculated Risk on 7/23/2009 12:30:00 PM

From HotelNewsNow.com: STR reports US performance for week ending 18 July 2009

In year-over-year measurements, the industry’s occupancy fell 8.9 percent to end the week at 66.2 percent. Average daily rate dropped 9.4 percent to finish the week at US$97.33. Revenue per available room for the week decreased 17.5 percent to finish at US$64.41.Although the occupancy rate was off 8.9 percent compared to last year, the occupancy rate is off about 13 percent compared to the same week in 2006 and 2007. This is a multi-year slump ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 8.0% from the same period in 2008.

The average daily rate is down 9.4%, and RevPAR is off 17.5% from the same week last year.

Note: Business travel is off much more than leisure travel - so the summer months will probably not be as weak as other times of the year. September will be a real test for business travel.

More on Existing Home Inventory

by Calculated Risk on 7/23/2009 10:59:00 AM

Here is another graph of inventory. This shows inventory by month starting in 2004.

Here is another graph of inventory. This shows inventory by month starting in 2004.

Inventory in June 2009 was below the levels in June 2007 and June 2008 (this is the 5th consecutive month with inventory levels below 2 years ago) and almost down to the levels of June 2006.

It is important to watch inventory levels very carefully. If you look at the 2005 inventory data, instead of staying flat for most of the year (like the previous bubble years), inventory continued to increase all year. That was one of the key signs that led me to call the top in the housing market!

Note: there is probably a substantial shadow inventory – homeowners wanting to sell, but waiting for a better market - so existing home inventory levels will probably stay elevated for some time. There are also reports of REOs being held off the market, so inventory is probably under reported.

The second graph shows the year-over-year change in existing home inventory. Prices will probably continue to fall until the months of supply reaches more normal levels (closer to 6 months compared to the current 9.4 months), and that will take some time.

Prices will probably continue to fall until the months of supply reaches more normal levels (closer to 6 months compared to the current 9.4 months), and that will take some time.

However this trend of declining year-over-year inventory levels is a positive for the housing market (while remembering the shadow inventory)

Existing Home Sales increase in June

by Calculated Risk on 7/23/2009 10:00:00 AM

The NAR reports: Existing-Home Sales Up Again

Existing-home sales – including single-family, townhomes, condominiums and co-ops – increased 3.6 percent to a seasonally adjusted annual rate of 4.89 million units in June from a downwardly revised pace of 4.72 million in May, but are 0.2 percent lower than the 4.90 million-unit level in June 2008.

...

Total housing inventory at the end of June fell 0.7 percent to 3.82 million existing homes available for sale, which represents a 9.4-month supply at the current sales pace, down from a 9.8-month supply in May.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in June 2009 (4.89 million SAAR) were 3.6% higher than last month, and were 0.2% lower than June 2008 (4.90 million SAAR).

Here is another way to look at existing homes sales: Monthly, Not Seasonally Adjusted (NSA):

This graph shows NSA monthly existing home sales for 2005 through 2009. For the first time in several years, sales (NSA) were slightly higher in June 2009 than in June 2008.

This graph shows NSA monthly existing home sales for 2005 through 2009. For the first time in several years, sales (NSA) were slightly higher in June 2009 than in June 2008.It's important to note that the NAR says about one-third of these sales were foreclosure resales or short sales. Although these are real transactions, this means activity (ex-distressed sales) is much lower.

The third graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.82 million in June. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.

The third graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.82 million in June. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.Typically inventory increases in June, and peaks in July or August. This decrease in inventory was a little unusual.

Also, many REOs (bank owned properties) are included in the inventory because they are listed - but not all. Recently there have been stories about a substantial number of unlisted REOs and other shadow inventory - so this inventory number is probably low.

The fourth graph shows the 'months of supply' metric for the last six years.

The fourth graph shows the 'months of supply' metric for the last six years.Months of supply declined to 9.4 months.

Sales increased slightly, and inventory decreased, so "months of supply" decreased. A normal market has under 6 months of supply, so this is still very high.

I'll have more soon ...

Note: New Home sales will be released on Monday.

UPS Comments: Sitting at Bottom, No Improvement to date in Q3

by Calculated Risk on 7/23/2009 09:00:00 AM

UPS CEO opening comments on conference call:

“On our last call we told you economic conditions for the second quarter would be slightly worse than the first and UPS performance would reflect those conditions. And that's what happened. The results we announced today are a clear indication of the tough economic environment. As you're aware, the rates of decline of some key economic indicators, like GDP and industrial production, have slowed. Other indicators, like manufacturing and service sector indices, are exhibiting signs of improvement. Most forecasters are saying that we may be at the bottom. Whether or not we're at the bottom is not the main issue; what is important is how long we remain here and what type of recovery we will have. Remember, all these indicators are still well into negative territory, illustrating the challenges that lie ahead. We will continue to manage the Company under the assumption that the economy will stay at this level until definitive signs of improvement materialize.UPS executives went on to say (paraphrasing) that 1) trends in July have shown no improvement to date, 2) don’t have any confidence that trends or volumes will improve materially in Q3, 3) economy sitting here at this bottom.

Weekly Unemployment Claims

by Calculated Risk on 7/23/2009 08:30:00 AM

NOTE: The seasonally adjusted weekly claims numbers is being impacted by the layoffs in the automobile industry. Usually auto companies cut back production in the summer, and the numbers are adjusted for that pattern - but this year the companies cut back much earlier. This distortion appears much smaller this week, and is expected to be over soon.

The DOL reports on weekly unemployment insurance claims:

In the week ending July 18, the advance figure for seasonally adjusted initial claims was 554,000, an increase of 30,000 from the previous week's revised figure of 524,000. The 4-week moving average was 566,000, a decrease of 19,000 from the previous week's revised average of 585,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending July 11 was 6,225,000, a decrease of 88,000 from the preceding week's revised level of 6,313,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 19,000, and is now 93,250 below the peak of 15 weeks ago. It appears that initial weekly claims have peaked for this cycle.

The level of initial claims has fallen quickly - but is still very high (over 550K), indicating significant weakness in the job market.

Following the earlier recessions (like '81), weekly claims fell quickly, but in the two most recent recessions, weekly claims declined a little and then stayed elevated for some time. I expect weekly claims to stay elevated following the current recession too.

Wednesday, July 22, 2009

Lawler on Sticky House Prices

by Calculated Risk on 7/22/2009 11:59:00 PM

Note: Thomas Lawler is a former Fannie Mae and Wall Street economist who now writes a newsletter. He did an excellent job calling the housing bubble and bust, and I've quoted him a few times over the years.

From James Hagerty at the WSJ: As Housing Loses its Stickiness, Prices Reach Bottom Quicker

Tom Lawler has a new concept. He calls it the “de-stickification” of house prices.Once again house prices were sticky. Even in the low priced areas with significant foreclosure activity, prices have fallen for several years. The question is how sticky?

Though Mr. Lawler was among the more bearish of housing economists when the market was still bubbling, he recently has been arguing that prices for low- and mid-range homes are stabilizing in many parts of the country ...

Part of the bear case involves the historical observation that it takes many years for house prices to bottom out because they are “sticky,” or slow to adjust downward even when supply surges and demand evaporates. In the past, home prices adjusted slowly in such circumstances because homeowners are stubborn and often don’t need to sell immediately. When Los Angeles had a housing slump in the early 1990s, caused in part by a plunge in aerospace-related employment, the Case-Shiller price index for the city started falling gradually in early 1990 and didn’t hit bottom until 1996.

This time around, Mr. Lawler argues, things are happening a lot faster. That’s partly because banks are dealing with a foreclosure rate not seen at least since the Great Depression. ...

That has forced prices down much more quickly than would have been expected in some of the milder down cycles of the past, Mr. Lawler says. ...

Not that Mr. Lawler sees another housing boom around the corner.

What Lawler is apparently suggesting is that significant foreclosure activity makes prices less sticky in for "low- and mid-range" priced homes - I agree - and I've argued before that some low priced areas could be near the price bottom.

The dynamics will probably be different in the mid-to-high priced areas. With few move-up buyers, I expect prices to fall for some time in the mid-to-high priced range bubble areas (especially in real terms). Of course foreclosure activity is picking up in the high priced areas - see DataQuick's report today - but I think it will still take some time for prices to fall to the market clearing price.

Report: CIT Advisers Pushing for BK after August Swap

by Calculated Risk on 7/22/2009 07:38:00 PM

Note: Comments working! Thanks Ken!

From Bloomberg: CIT Bond Advisers Said to Push for Bankruptcy After August Swap (ht Bob_in_MA)

Even if CIT succeeds in getting 90 percent of the $1 billion of floating-rate notes due Aug. 17 swapped at a discount, the advisers will seek a so-called pre-packaged bankruptcy ... Should the CIT offer ... fail, Houlihan ... will recommend the steering committee let CIT file for bankruptcy before paying the August maturity ...The "Tony Soprano" debt deal was just a delaying tactic. That appeared clear given the terms. And this is why the deal required the onerous 5% upfront fee - and significant overcollaterization - because it was BK if you do, BK if you don't.

S&P Increases Forecast for Subprime Mortgage Losses - Again!

by Calculated Risk on 7/22/2009 06:07:00 PM

From Bloomberg: Subprime-Mortgage Loss Forecast Is Raised by Standard & Poor’s

Standard & Poor’s again boosted its projections for losses from U.S. subprime mortgages backing securities ... Losses on loans backing 2006 securities will reach an average of about 32 percent of the original balances, while losses for similar 2007 bonds will total about 40 percent, the New York-based ratings firm said in a statement today. In February, S&P said the losses would total an average of 25 percent for 2006 bonds and 31 percent for 2007 securities.Ouch!