by Calculated Risk on 4/24/2009 12:24:00 PM

Friday, April 24, 2009

Geithner News Conference at 4:30 PM ET

UPDATE: CNBC is reporting that Treasury Stress Test white paper will be released at 2 PM ET.

The Treasury white paper on the stress tests will probably be released prior to Geithner's news conference.

From Eric Dash at the NY Times: Edgy Banks Start to Get Word Today on Stress Tests

After a two-month wait, the nation’s 19 largest banks will start learning on Friday how they fared in important federal examinations — and which among them will need another bailout from the government or private investors.Dash discusses several individual banks in the article. But what does "fate will be decided by regulators" mean? I thought preprivatization was off the table.

...

The Federal Reserve intends to disclose, in general terms, how it conducted the stress tests on Friday afternoon, but the government will not publicly reveal the results until May 4.

...

Analysts are already betting that the stress tests will show that banks need to raise significant amounts of new capital ... the 19 banks subject to stress tests are starting to divide into three groups: the strong that can weather the storm; the weak that will need new, perhaps significant, support; and the ones on the verge, whose fate will be decided by regulators.

Also from Bloomberg: Emanuel Says Stress Tests Will Reveal ‘Gradation’

... Rahm Emanuel said stress tests on the biggest 19 U.S. banks will reveal a “gradation,” with some being “very, very healthy” and others needing assistance.

...

Emanuel said that President Barack Obama has “100 percent” confidence in Federal Reserve Chairman Ben S. Bernanke.

Home Sales: The Distressing Gap

by Calculated Risk on 4/24/2009 11:07:00 AM

Real Time Economics at the WSJ excerpted some analyst comments about the existing home sales report yesterday: Economists React: ‘Plunge Is Over’ in Existing-Home Sales. A few comments from analysts:

"Home sales have stabilized following the post-Lehmans plunge..."As I've noted before, I believe this "stabilization" discussion in existing home sales analysis is all wrong.

"This is a bit disappointing but the big picture is still clear; the plunge in sales following the Lehman blowup is over."

"The weaker-than-expected result does not change the broad trend in sales, however, which continues to point to a tenuous stabilization..."

"Although home resales were down in March, one can make a reasonable argument that resales are bottoming ..."

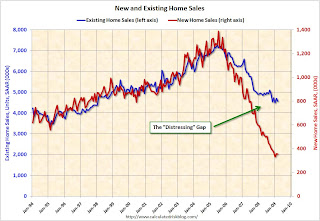

Close to half of existing home sales are distressed sales: REO sales (foreclosure resales) or short sales. This has created a gap between new and existing sales as shown in the following graph that I've jokingly labeled the "Distressing" gap.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales (left axis) and new home sales (right axis) through March.

I believe this gap was caused by distressed sales - in many areas home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.

Over time, as we slowly work through the distressed inventory of existing homes, I expect existing home sales to fall further. See Existing Home Sales: Turnover Rate

So I believe those analysts looking at the existing home sales report for stability are looking in the wrong place. The first "signs of stability" in the housing market will be declining inventory (see 3rd graph here), a bottom in new home sales (see previous post), and the gap between new and existing home sales closing.

New Home Sales: 356 Thousand SAAR in March

by Calculated Risk on 4/24/2009 10:00:00 AM

The Census Bureau reports New Home Sales in March were at a seasonally adjusted annual rate (SAAR) of 356 thousand. This is slightly below the upwardly revised rate of 358 thousand in February. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. This is the lowest sales for March since the Census Bureau started tracking sales in 1963. (NSA, 34 thousand new homes were sold in March 2009; the previous low was 36 thousand in March 1982).

As the graph indicates, sales in March 2009 are substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in March 2009 were at a seasonally adjusted annual rate of 356,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.And one more long term graph - this one for New Home Months of Supply.

This is 0.6 percent (±19.0%)* below the revised February rate of 358,000 and is 30.6 percent (±10.7%) below the March 2008 estimate of 513,000.

There were 10.7 months of supply in March - significantly below the all time record of 12.5 months of supply set in January.

There were 10.7 months of supply in March - significantly below the all time record of 12.5 months of supply set in January.The seasonally adjusted estimate of new houses for sale at the end of March was 311,000. This represents a supply of 10.7 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

Although sales were at a March record low, there are positives in this report - especially considering the upward revisions for previous months. It appears the months-of-supply has peak, and there is a reasonable chance that new home sales has bottomed for this cycle - however any recovery in sales will be modest because of the huge overhang of existing homes for sale. I'll have more soon.

Ford: "Turning the tide in North America"

by Calculated Risk on 4/24/2009 08:36:00 AM

From CNBC: Ford Loss Narrower than Expected

Ford Motors posted a smaller-than-expected first-quarter loss and said it was on track to at least break even in 2011 and did not expect to seek U.S. government loans ...Ford is probably being helped by the threat of bankruptcy at GM and Chrysler. At the same time Ford is increasing production, GM is considering shutting down factories for several weeks - so I wouldn't read too much into the Ford increase in production.

"We are really turning the tide in North America," Mulally said, adding that the industry may have hit bottom.

In response to that, Ford will increase production in the U.S. by 25 percent in the second quarter, he added.

Meanwhile, durable goods orders were down in March, the seventh decline in the past eight months.

Bloomberg Video about BofA CEO Ken Lewis and Merrill

by Calculated Risk on 4/24/2009 01:07:00 AM

A late night thread ...

Here is the letter from Cuomo to Congress today (2.0 MB PDF). And a Bloomberg discussion:

Thursday, April 23, 2009

NY Times Norris: "Subprime Loans, Corporate-Style"

by Calculated Risk on 4/23/2009 10:09:00 PM

From Floyd Norris at the NY Times: Subprime Loans, Corporate-Style, Will Fuel Defaults

It appears that defaults on leveraged loans and corporate bonds will soon rise to levels not seen since the Great Depression.Just another area with rapidly rising defaults. Norris also discusses toggle-PIKs (kind of like Option ARMs for corporations).

...

The default rate on leveraged loans and speculative grade bonds is rising rapidly. “We expect the default rate to get to the range of 14 percent by the end of the year,” said Kenneth Emery, a senior vice president of Moody’s. That compares to peak default rates of 10 to 12 percent during the last two recessions ...

How did we get into this mess? The story is remarkably similar to the tale of subprime mortgages.

Note: PIK stands for Payment-in-kind (i.e. pay interest with more debt). These were used in the '80s LBO craze with predictable results (high defaults). Toggle means the borrower has the choice of paying in cash or PIK.

There were negatively amortizing loans everywhere: Option ARMs for homeowners, toggle PIKs for corporations, and of course interest reserves for Construction & Development loans (always common, but are blowing up on lenders).

AmEx: Conference Call Comments

by Calculated Risk on 4/23/2009 07:10:00 PM

From Brian on AmEx Conference Call:

They expect to see writeoff rates climb from 8.5% to 10.5-11.0% in Q2 and up another 50 BP in Q3 and flattening out in Q4. Part of the driver of writeoff rates is their denominator is falling fairly quickly as charge volumes decline (denominator for CC cos will drop faster than for mortgages and other loan categories). They are assuming 9.7% unemployment in December 09.And some CC comments:

They are seeing some improvement in early stage DQ and roll rates. There is probably some seasonality involved, but they also think that there is some non seasonal improvement. 30DQ increase for last 4 Q’s (starting with Q2 08) are +10BP, +60BP, +80BP, +40BP – so it isn’t going down, it’s just another second derivative thing.

Analyst: American Express has more exposure as we all know in California and Florida and some of the housing states where you have higher income as well and I think credit maybe started to go bad in the fourth quarter of '07, maybe a little bit ahead of the competition because of your exposure in some of those states, and as you looked closely and I think tightened sooner than others did because of that, when you're looking at your roll rates improving and understanding there's seasonality and it's too early to get too constructive on that, but are you seeing signs of improvement in more so in states that went bad earlier because of the tightening? You know, where are you seeing that improvement?

AmEx: I would say that early in the cycle I think that housing was a significant driver of higher delinquencies and writeoff rates and we certainly did see that in states that had larger drops in housing. However, at this juncture, I really think that unemployment has taken over as the primary driver of delinquency and writeoff rates, so I think that's what we will need to see for a real turn. I think stabilization in the housing market will be important. I think consumer confidence will be critically important, people have to feel comfortable that we are going to retain their job and when those things start to happen, I think is when we will really start to see some notable improvements.

emphasis added

Wells Fargo and Auction Rate Securities

by Calculated Risk on 4/23/2009 06:31:00 PM

A friend called me up early last year and told me that she had just put a significant amount of money in Auction Rate Securities with Wells Fargo. She started to tell me what a great deal it was, and I interrupted her: "Hang up. Call Wells Fargo. Get out now." She called Wells Fargo immediately, and she couldn't sell - and she has been stuck in this "investment" ever since.

From the LA Times: Wells Fargo accused of securities fraud by state lawsuit

California today sued investment subsidiaries of Wells Fargo & Co. for securities fraud, alleging that the San Francisco financial services company misled investors by selling $1.5 billion worth of risky securities that it peddled as being as safe as cash.My friend was also told these securities were "as good as cash" and she could get her money back with eight days notice. It is especially irritating to see a Wells Fargo spokesperson say:

The securities "were sold to customers on the basis that they were like cash and people could get their money back in eight days," Atty. Gen. Jerry Brown said in an interview. "Now, it turns out they were not like cash and people can't get their money back even after many, many months, and they're mad as hell."

"We fully understand and deeply regret the effects this prolonged liquidity crisis has had on our clients," Charles W. Daggs, chief executive of Wells Fargo Investments, said in a statement.Yeah, hoocoodanode?

"Wells Fargo could not have predicted these extraordinary circumstances, and even with the benefit of hindsight is not responsible for them."

Federal Reserve Assets Continue to Increase

by Calculated Risk on 4/23/2009 04:40:00 PM

The Federal Reserve released the Factors Affecting Reserve Balances today. Total assets increased to $2.2 trillion.

The Term Asset-Backed Securities Loan Facility (TALF) is off to a slow start, with just under $6.4 billion in assets.

Click on graph for larger image in new window.

After spiking last year to $2.31 trillion the week of Dec 18th, the Federal Reserve assets then declined somewhat. Now the Federal Reserve is starting to expand their balance sheet again.

Three trillion here we come!

Note: the graph shows Total Factors Supplying Federal Reserve Funds and is an available series that is close to assets.

Most of the increase this week in factors supplying reserve funds came from the Fed buying MBS (increased by $75 billion). This is still pushing down mortgage rates: see Freddie Mac: Long-term rates Now Lower than Short-term

Freddie Mac (NYSE:FRE) today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 4.80 percent with an average 0.7 point for the week ending April 23, 2009, down from last week when it averaged 4.82 percent. Last year at this time, the 30-year FRM averaged 6.03 percent.

Report: Chrysler Bankruptcy Could Happen Next Week

by Calculated Risk on 4/23/2009 03:36:00 PM

From the NY Times: U.S. Is Said to Prepare Filing for Chrysler Bankruptcy

The Treasury Department is preparing a Chapter 11 bankruptcy filing for Chrysler that could come as soon as next week ...This appears to be a prepackaged bankruptcy with the U.S. government providing DIP (Debtor-In-Possession) financing.

It sounds like Fiat would buy Chrysler's assets out of bankruptcy and the U.S. would be responsible for pensions and retiree health care benefits. According to the article, the only unresolved issue is what happens to Chrysler’s lenders.

Hotel Occupancy Off 11%

by Calculated Risk on 4/23/2009 01:55:00 PM

From HotelNewsNow.com: STR reports U.S. data for week ending 18 April 2009

In year-over-year measurements, the industry’s occupancy fell 10.7 percent to end the week at 57.4 percent. Average daily rate dropped 10.3 percent to finish the week at US$97.25. Revenue per available room [RevPAR] for the week decreased 19.9 percent to finish at US$55.83.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 11.1% from the same period in 2008.

The average daily rate is down 10.3%, so RevPAR is off 19.9% from the same week last year.

When the Q1 advance GDP report is released on Wednesday (April 29th), I expect to see a sharp in decline in non-residential structure investment. The underlying details will be released a couple of days later, and I expect investment in lodging to be hit especially hard. Why build new hotels when the occupancy rate is 57%?

BofA CEO Lewis: Excerpts from Testimony

by Calculated Risk on 4/23/2009 12:22:00 PM

UPDATE: Here is the letter from Cuomo to Congress (2.0 MB PDF). (Updated - linked to wrong letter initially)

It was widely rumored that there was some sort of backroom deal holding the BofA and Merrill deal together. From CNBC: BofA's Lewis Says He Was Told To Be Quiet on Merrill

Bank of America Chief Executive Kenneth Lewis told the New York attorney general he believed former Treasury Secretary Henry Paulson and Fed Chairman Ben Bernanke wanted him to keep quiet about the worsening terms of the bank's acquisition of Merrill Lynch, according to testimony reviewed by The Wall Street Journal.Here are some excerpt of Lewis' testimony before New York's attorney general in February from the WSJ: 'It Wasn't Up to Me': Excerpts From Ken Lewis's Testimony

Mr. Lewis: I remember, for some reason, we wanted to follow up and see if any progress -- as I recall, we actually, had not agreed to call a MAC [material adverse condition] after the conversation that we had, and so I tried to get in touch with Hank, and, as I recall, I got a number that was somebody at the Treasury kind of guard-like thing. He had a number for Hank, and Hank was out, I think, on his bike, and he -- this is vague; I won't get the words exactly right -- and he said, "I'm going to be very blunt, we're very supportive of Bank of America and we want to be of help, but" -- I recall him saying "the government," but that may or may not be the case -- "does not feel it's in your best interest for you to call a MAC, and that we feel strongly," -- I can't recall if he said "we would remove the board and management if you called it" or if he said "we would do it if you intended to." I don't remember which one it was, before or after, and I said, "Hank, let's deescalate this for a while. Let me talk to our board." And the board's reaction was one of "That threat, okay, do it. That would be systemic risk."This raises serious questions and will probably lead to shareholder lawsuits.

Q: Did you ask for any agreement from them?

Mr. Lewis: There was a point after that that the board brought up the fact that we're relying on the words that obviously has some very prominent people and honorable people, but, boy, what if they don't come through? So I called Bernanke -- I don't know why I called him versus Hank -- and said, "Would you be willing to put something in writing?" And he said, "Let me think about it." As I recall, he didn't call me back, but Hank called me back. And Hank said two things: He said, "First, it would be so watered down, it wouldn't be as strong as what we were going to say to you verbally, and secondly this would be a disclosable event and we do not want a disclosable event."

More on Existing Home Sales

by Calculated Risk on 4/23/2009 11:12:00 AM

To add to the previous post, here is another way to look at existing homes sales - monthly, Not Seasonally Adjusted (NSA): This graph shows NSA monthly existing home sales for 2005 through 2009. Sales (NSA) were lower in March 2009 than in March 2008.

This graph shows NSA monthly existing home sales for 2005 through 2009. Sales (NSA) were lower in March 2009 than in March 2008.

Again - a significant percentage of recent sales were foreclosure resales, and although these are real sales, I think existing home sales could fall even further when foreclosure resales start to decline sometime in the future. The second graph shows inventory by month starting in 2004.

The second graph shows inventory by month starting in 2004.

Inventory levels were flat during the bubble, but started increasing at the end of 2005.

Inventory levels increased sharply in 2006 and 2007, but have been below the year ago level for the last eight months. Inventory in March 2009 was below the levels in March 2007 and 2008 (this is the 2nd consecutive month with inventory levels below 2 years ago).

It is important to watch inventory levels very carefully. If you look at the 2005 inventory data, instead of staying flat for most of the year (like the previous bubble years), inventory continued to increase all year. That was one of the key signs that led me to call the top in the housing market!

Note: there is probably a substantial shadow inventory – homeowners wanting to sell, but waiting for a better market - so existing home inventory levels will probably stay elevated for some time. There is also the possibility of some REOs being held off the market.

The third graph shows the year-over-year change in existing home inventory. This shows the YoY change has turned negative.

This shows the YoY change has turned negative.

If the trend of declining year-over-year inventory levels continues in 2009 that will be a positive for the housing market. Prices will probably continue to fall until the months of supply reaches more normal levels (in the 6 to 8 month range), and that will take some time.

I'll have more on Existing Home sales tomorrow after New Home sales are released.

Existing Home Sales Decline in March

by Calculated Risk on 4/23/2009 10:00:00 AM

The NAR reports: March Existing-Home Sales Slip but First-Time Buyers Rise

Existing-home sales – including single-family, townhomes, condominiums and co-ops – declined 3.0 percent to a seasonally adjusted annual rate of 4.57 million units in March from a downwardly revised level of 4.71 million in February, and were 7.1 percent lower than the 4.92 million-unit pace in March 2008.

...

Total housing inventory at the end of March fell 1.6 percent to 3.74 million existing homes available for sale, which represents a 9.8-month supply at the current sales pace, compared with a 9.7-month supply in February.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in March 2009 (4.57 million SAAR) were 3.0% lower than last month, and were 7.1% lower than March 2008 (4.92 million SAAR).

It's important to note that about 45% of these sales were foreclosure resales or short sales. Although these are real transactions, this means activity (ex-distressed sales) is under 3 million units SAAR.

The second graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.74 million in March. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.

The second graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.74 million in March. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.Typically inventory increases slightly in March, and then really increases over the next few months of the year until peaking in the summer. This decrease in inventory was small, and the next few months will be key for inventory.

Also, most REOs (bank owned properties) are included in the inventory because they are listed - but not all. Recently there have been stories about a substantial number of unlisted REOs - this is possible, but not confirmed.

The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.Months of supply was up slightly at 9.8 months.

Even though the inventory level decreased, sales also decreased, so "months of supply" increased slightly.

I'll have more on existing home sales soon ...

Unemployment Claims: Continued Claims at Record

by Calculated Risk on 4/23/2009 08:49:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending April 18, the advance figure for seasonally adjusted initial claims was 640,000, an increase of 27,000 from the previous week's revised figure of 613,000. The 4-week moving average was 646,750, a decrease of 4,250 from the previous week's unrevised average of 651,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending April 11 was 6,137,000, an increase of 93,000 from the preceding week's revised level of 6,044,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 646,750.

Continued claims are now at 6.14 million - the all time record.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.This normalizes the data for changes in insured employment, and shows the initial unemployment and continued claims are both at the highest level since the early '80s.

This is another very weak report and shows continued weakness for employment.

Wednesday, April 22, 2009

Chysler Pier Loan Negotiations

by Calculated Risk on 4/22/2009 11:16:00 PM

I'm surprised this is playing out in public ...

First the government offered $1.0 billion, and no equity interest in the new Chrysler, to a consortium of debtholders (mostly banks with pier loans: JPMorgan Chase, Goldman Sachs, Morgan Stanley and Citigroup).

The banks countered with $4.5 billion, and a 40% equity interest.

From CNBC: Treasury Raises Offer to Chrysler Lenders

Treasury has offered the lenders $1.5 billion of first-lien debt and a 5 percent equity stake in a restructured Chrysler ...It will be interesting to see if the banks budge (and by how much). They claim they can get more than 65 cents on the dollar in liquidation - or $4.5 billion. Just 7 more days ...

Stress Test: Capital Needs May be Disclosed

by Calculated Risk on 4/22/2009 06:53:00 PM

From Bloomberg: U.S. May Reveal Each Bank’s Capital Needs After Tests

The Obama administration may direct banks that are judged to be short of capital after stress tests to disclose how they are going to get additional funds when the government reveals the results on May 4, according to a person familiar with the matter.It only makes sense for banks short of capital to explain how they will raise the additional funds. The answer will probably be more money from the TARP!

The government would release a bank-by-bank assessment, while the lenders would say how they plan to shore up their finances ...

Regulators conducting the stress tests are increasingly focusing on the quality of loans banks made after finding wide variations in underwriting standards...

On the variations in quality of loans, just look at the DataQuick delinquency report earlier today - even when you account for subprime vs. prime lenders, there was a clearly a wide disparity in underwriting standards. Hopefully this wasn't a surprise to the regulators.

Housing Bust and Geographical Mobility

by Calculated Risk on 4/22/2009 05:55:00 PM

From the Census Bureau: Residential Mover Rate in U.S. is Lowest Since Census Bureau Began Tracking in 1948

The U.S. Census Bureau announced today that the national mover rate declined from 13.2 percent in 2007 to 11.9 percent in 2008 — the lowest rate since the bureau began tracking these data in 1948.

In 2008, 35.2 million people 1 year and older changed residences in the U.S. within the past year, representing a decrease from 38.7 million in 2007 and the smallest number of residents to move since 1962.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the percent of people that moved to a different county - in the same states or to another state.

Note: data is missing for a few years in the mid-70s.

The recent collapse is probably related to the housing bust. It is very difficult for homeowners with negative equity to move.

From the NY Times today: As Housing Market Dips, More in U.S. Are Staying Put

The declines appeared to be directly related to the housing slump and the recession.For a few earlier posts on the housing bust and mobility:

“It represents a perfect storm halting migration at all levels, since it involves deterrents in local housing-related moves and longer distance employment-related moves,” said William H. Frey, a demographer with the Brookings Institution.

More on the Housing Bust and Labor Mobility June 2008

Research: Housing Busts and Household Mobility October 2008

Northern Trust's Kasriel: Are we there yet?

by Calculated Risk on 4/22/2009 03:56:00 PM

From Paul Kasriel and Asha Bangalore at Northern Trust: Are We There Yet?

Is the economic recovery at hand? No, we still are mired in a recession that is going to be of the longest duration in the post-WWII era (the previous record was 16 months) and is likely to involve the largest annual average contraction in real GDP for a single year (the record to beat is a decline of 1.9%, which occurred in 1982). But there is a good chance that the worst for the U.S. economy in terms of quarterly contractions in real GDP is behind us, occurring in the fourth quarter of 2008. We currently are forecasting an annualized rate of contraction in real GDP of 3.8% in the first quarter of this year vs. the annualized rate of contraction of 6.3% in the fourth quarter of 2008. So, economic activity still is descending, but our forecast has the rate of descent moderating. We do not expect any growth in real GDP until the fourth quarter of this year.See the research note for much more.

I'm surprised Kasriel has revised up his Q1 GDP forecast all the way to minus 3.8% (from -4.9%). It appears PCE will probably be flat or even slightly positive in Q1, the investment slump in Q1 will be stunning (See Q1 GDP will be Ugly). Also, it appears the inventory correction in Q1 was significant, however trade might be a little more positive than I expected earlier.

Note: Kasriel has revised down his GDP estimate for Q2 (now -3.3% and -1.0% respectively).

DataQuick: Mortgage Defaults Hit Record in California

by Calculated Risk on 4/22/2009 01:38:00 PM

From DataQuick: Golden State Mortgage Defaults Jump to Record High

Lenders filed a record number of mortgage default notices against California homeowners during the first three months of this year, the result of the recession and of lenders playing catch-up after a temporary lull in foreclosure activity ...There is a lot of interesting data in this report. A few key points:

A total of 135,431 default notices were sent out during the January- to-March period. That was up 80.0 percent from 75,230 for the prior quarter and up 19.0 percent from 113,809 in first quarter 2008, according to MDA DataQuick.

Last quarter's total was an all-time high for any quarter in DataQuick's statistics, which for defaults go back to 1992. There were 121,673 default notices filed in second quarter 2008 and 94,240 in third quarter 2008, during which a new state law took effect requiring lenders to take added steps aimed at keeping troubled borrowers in their homes.

"The nastiest batch of California home loans appears to have been made in mid to late 2006 and the foreclosure process is working its way through those. Back then different risk factors were getting piled on top of each other. Adjustable-rate mortgages can be good loans. So can low- down-payment loans, interest-only loans, stated-income loans, etcetera. But if you combine these elements into one loan, it's toxic," said John Walsh, DataQuick president.

The median origination month for last quarter's defaulted loans was July 2006. That's only four months later than the median origination month for defaulted loans a year ago, in first quarter 2008. That suggests a period where underwriting criteria were particularly lax.

Of the 3.7 million home loans made in 2004, less than 1 percent have since resulted in a lender filing a default notice. Of the 3.7 million loans originated in 2005, 4.9 percent have triggered a default notice so far. Of the 3 million in 2006, 8.5 percent have so far resulted in default. A particularly toxic period appears to have been August through November 2006 which had more than a 9 percent default rate. Of the 2.1 million loans made in 2007, it's 4.6 percent - a percentage that's likely to rise significantly during the rest of this year.

The lending institutions with the highest default rates for loans originated in August to November 2006 include ResMAE Mortgage (69.9 percent of loans resulting in a default notice), Master Financial (64.6 percent) and Ownit Mortgage Solutions (63.6 percent). Of the major lenders, IndyMac has a default rate on those loans of 18.9 percent, World Savings 8.0 percent, Countrywide 7.7 percent, Washington Mutual 6.3 percent and Wells Fargo 3.4 percent. Less than 1 percent of the home loans originated in late 2006 by Citibank and Bank of America have since gone into default.

...

While most first quarter 2009 foreclosure activity was still concentrated in affordable inland communities, there are signs that the problem is slowly migrating into other areas. The affordable sub-markets, which represent 25 percent of the state's housing stock, accounted for more than 52.0 percent of all default activity in 2008. Last quarter it fell to 47.5 percent.

emphasis added

Click on graph for larger image in new window.

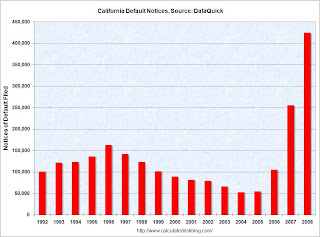

Click on graph for larger image in new window.This graph shows the Notices of Default (NOD) by year through 2008 in California from DataQuick.

With 135,431 default notices filed in Q1 2009 (even with the lenders playing catch-up), 2009 is clearly on pace to break the 2008 record of 424 thousand NODs.