by Calculated Risk on 3/09/2020 04:47:00 PM

Monday, March 09, 2020

Seattle Real Estate in February: Sales up 5.2% YoY, Inventory down 32.5% YoY

The Northwest Multiple Listing Service reported NWMLS brokers report brisk activity, noting “too early to tell” if coronavirus will soften sales

“It’s still too early to tell if the broadening effects of the coronavirus will sideline buyers,” said Matthew Gardner, chief economist at Windermere Real Estate. “What we do know is that news of the virus led equity markets sharply lower and this caused mortgage rates to drop significantly. Therefore, the question is whether buyers will put their search on hold until the virus has abated, or if they will decide to move forward so they don’t miss out on near historic low mortgage rates,” he added.There were 5,265 sales in February 2020, up 2.3% from 5,145 sales in February 2019.

...

Inventory remained tight. At month end, there were 7,655 active listings in the 23 counties included in the MLS report. That was a 32% drop from the year ago total of 11,275. All but two counties (San Juan and Douglas) reported declines. Thurston County had the largest year-over-year drop, at 45.7%, followed by Snohomish (down 42%) and King (down 40.7%).

There is only 1.45 months of supply area-wide, according to Northwest MLS data.

emphasis added

The press release is for the Northwest. In King County, sales were up 5.4% year-over-year, and active inventory was down 40.7% year-over-year.

In Seattle, sales were up 5.2% year-over-year, and inventory was down 32.5% year-over-year.. This puts the months-of-supply in Seattle at just 1.3 months.

Black Knight Mortgage Monitor for January; "Cash-out lending hit a more than 10-year high at the end of 2019"

by Calculated Risk on 3/09/2020 01:43:00 PM

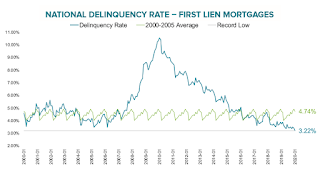

Black Knight released their Mortgage Monitor report for January last week. According to Black Knight, 3.22% of mortgages were delinquent in January, down from 3.75% in January 2019. Black Knight also reported that 0.46% of mortgages were in the foreclosure process, down from 0.51% a year ago.

This gives a total of 3.73% delinquent or in foreclosure.

Press Release: Black Knight Mortgage Monitor: Despite 6.5-Year High in Refinance Lending, Servicers Struggle to Retain and Recapture Borrowers; 80% of Refinance Borrower Business Lost

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage performance, housing and public records datasets. This month, in light of a marked increase in refinance activity in Q4 2019, Black Knight looked into servicers’ retention of refinancing borrowers. As Black Knight Data & Analytics President Ben Graboske explained, despite refinance lending hitting a 6.5-year high, servicers are facing challenges in retaining the business of refinancing borrowers.

“Despite a surge in refinance lending driven by low rates, servicers continue to struggle in their efforts to recapture refinancing borrowers, with only one in five being retained by servicers in Q4 2019,” said Graboske. “Retention rates rose along with refinance volumes early last year, hitting an 18-month high in Q2 2019, but retention rates have since fallen in each of the past two quarters. Fewer than one in four borrowers refinancing to lower their rate or term – business which has been historically easier to retain – stayed with their servicer post-refinance in Q4 2019. A large driver has been a recent failure to retain 2018 vintage mortgages, which goes to show just how quickly lender/borrower relationships can evaporate without the right data and tools for servicers to early on identify clients in their portfolios with sufficient tappable equity, and act to retain them. Borrowers who left for ‘greener pastures’ received an average 0.08% lower interest rate than those who stayed, strengthening the need for tools to ensure rate pricing is competitive. Retention challenges are even more pronounced among cash-out refinances, for which retention rates fell from 19% in Q3 2019 to just 17% in Q4 2019, the lowest in more than four years. At the same time, cash-out lending hit a more than 10-year high at the end of 2019, with some 600,000 borrowers pulling an estimated $41B in equity from their homes, the largest quarterly volume since 2007.

“Lenders and servicers should take note – there are currently 44.7 million homeowners with equity available to tap via cash-out refinance or HELOC, with the average homeowner having $119K in equity. At $6.2 trillion, total tappable equity – the amount available to homeowners with mortgages to borrow against while still retaining at least 20% equity in their homes – hit its highest year-end total on record. What’s more, the same falling interest rates that have reheated the housing market have also increased the rate of equity growth for the third consecutive quarter. Tappable equity grew 9.0% year-over-year in Q4 2019, the highest such growth rate since Q3 2018. Refinance lending is up 250% year-over-year, cash-out lending is at a 10-year high and 75% of homeowners with tappable equity have first lien interest rates at or above today’s prevailing rate. Taking all of this into account, improving the retention and recapture of this business is of critical importance. Data-driven portfolio retention strategies that help determine borrowers’ motivations for refinancing can go a long way in this regard.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows the National Delinquency Rate.

From Black Knight:

• Mortgage delinquencies fell by 5.4% month-over month to the lowest level on record since Black Knight began reporting the metric in 2000The second graph shows Black Knight's estimate of equity withdrawn (cash-out):

• At 3.22%, the national delinquency rate is down 14% from the same time last year

• With annual declines picking up in recent months and tax refund season on the horizon, we could see delinquencies push downward even further

• Approximately 600K homeowners pulled $41 billion in equity via cash-outs in Q4, the largest such volume since mid-2009There is much more in the mortgage monitor.

• With rates falling below 3.5% in early 2020, cash-out refinance activity is likely to remain strong in coming months

• Cash-out origination volumes have increased in each of the past three quarters

• However, outsized growth in rate/term lending has suppressed the cash-out share of refinance lending, which edged below 50% in Q4 2019 for the first time in three years

Going on Recession Watch

by Calculated Risk on 3/09/2020 11:39:00 AM

I'm not forecasting a recession, just moving to Recession Watch for the first time since 2006. Note: In early 2007, I moved from Recession Watch to forecasting a recession that started in December 2007.

As I noted in Predicting the Next Recession, the usual leading indicators are not useful if there is "a pandemic, significant military conflict, disruption of energy supplies for any reason, a major natural disaster (meteor strike, super volcano, etc), and a number of other low probability reasons".

The reason I'm moving to Recession Watch now is a combination of the COVID-19 pandemic, and the response to the pandemic of the current administration.

Leadership is key in a crisis. Information should be clear, transparent, and accurate. Action should be proactive.

Usually the CDC leads the world in responding to a health crisis. However, the CDC was caught flat-footed this time. Testing for COVID-19 should already be ubiquitous and free for all (not just those with insurance). It appears testing will increase dramatically over the next several weeks, but the administration still needs to make testing free for all (otherwise the uninsured will avoid the test and spread the disease).

And the administration should have fiscal policies ready to go to address the economic impact of the health crisis. Here are my suggestions: Fiscal Policies to Address COVID-19. There is news out this morning that White House advisers will have a list of policy options for Mr. Trump today. My sense is the administration will slow track a fiscal response and try to embrace ineffective policies. For example, enacting corporate tax cuts would be bad policy - it would take many months to have an impact, and the cuts would target the wrong segment of the economy.

Before predicting a recession, we need to see how this unfolds. Perhaps COVID-19 will be seasonal like the flu and the economy will bounce back in the Summer. If that is the case, we will have time to prepare for a probable resurgence of the disease in the Fall. But that is a thin thread to pin our hopes.

Oil Prices

by Calculated Risk on 3/09/2020 09:37:00 AM

From CNBC: Oil prices plunge as much as 30% after OPEC deal failure sparks price war

Oil prices plunged after OPEC’s failure to strike a deal with its allies regarding production cuts caused Saudi Arabia to slash its prices as it reportedly gets set to ramp up production, leading to fears of an all-out price war.

Click on graph for larger image

Click on graph for larger imageThe first graph shows WTI spot oil prices from the EIA. (Prices today added).

According to Bloomberg, WTI is at $32.55 per barrel today, and Brent is at $35.68.

Prices collapsed in 2008 due to the financial crisis, and then increased as the economy recovered. Oil prices collapsed again in 2014 and 2015, mostly due to oversupply.

Currently demand has weakened due to the COVID-19 pandemic, and Saudi Arabia is apparently going to increase production.

The second graph shows the year-over-year change in WTI based on data from the EIA.

The second graph shows the year-over-year change in WTI based on data from the EIA.Six times since 1987, oil prices have increased 100% or more YoY. And several times prices have almost fallen in half YoY.

Currently WTI is down 42% year-over-year.

Weather Adjusted Employment Gains in February

by Calculated Risk on 3/09/2020 08:39:00 AM

The weather boosted employment gains in again in February. The question is: how much?

The BLS reported 190 thousand people were employed in non-agriculture industries, with a job, but not at work due to bad weather. The average for February over the previous 10 years was 380 thousand. The median was 294 thousand.

The BLS also reported 667 thousand people were usually full time employees, but were working part time in February due to bad weather. The average for February over the previous 10 years was 2.02 million. The median was 1.08 million.

Both of the series suggest weather negatively impacted employment less than usual (boosting seasonally adjusted employment).

The San Francisco Fed estimates Weather-Adjusted Change in Total Nonfarm Employment (monthly change, seasonally adjusted). They use local area weather to estimate the impact on employment. For February, the BLS reported 273 thousand jobs added, the San Francisco Fed estimates that weather adjusted employment gains were 240 thousand. Still solid, but there have been weather related gains the last three months of close to 160 thousand.

So we should expect some payback in coming months.

Sunday, March 08, 2020

Sunday Night Futures; Oil Prices Collapse

by Calculated Risk on 3/08/2020 06:18:00 PM

For health updates please see the CDC website: Coronavirus Disease 2019.

A huge economic story is the collapse in oil prices.

Weekend:

• Schedule for Week of March 8, 2020

• Fiscal Policies to Address COVID-19

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 112 and DOW futures are down 930 (fair value).

Oil prices were down over the last week with WTI futures at $30.23 per barrel and Brent at $31.97 barrel. A year ago, WTI was at $56, and Brent was at $66 - so oil prices are down about 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.36 per gallon. A year ago prices were at $2.47 per gallon, so gasoline prices are down 11 cents per gallon year-over-year.

Fiscal Policies to Address COVID-19

by Calculated Risk on 3/08/2020 12:40:00 PM

First, some good news on the flu from the CDC:

"Key indicators that track flu activity remain high but decreased for the third week in a row. Severity indicators (hospitalizations and deaths) remain moderate to low overall …"It appears flu season is starting to wind down, and that will lessen the burden on our healthcare professionals.

And on testing, Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases said on Meet the Press this morning:

"early on, there were some missteps" … "But right now I believe 1.1 million tests have already been sent out. By Monday there’ll be an additional 400,000."IMPORTANT: See the entire interview with Dr. Fauci here: Fauci: Those 'vulnerable' to coronavirus should limit travel and crowd exposure (second video is full interview). Listen to his comments on testing! (first couple of minutes). Dr. Fauci is transparent, honest and factual.

Test kits are just one part of the equation on testing. We also need testing capacity. Tests need to be ubiquitous, and free for all. Medicare is already paying for the tests, and most insurance companies have said they will pay for the tests. The Federal Government needs to step up and pay for the tests for the uninsured (with no citizenship requirement).

Currently qualifying for a test is too restrictive (due to the lack of test kits and capacity). It should be easy to qualify (those that have symptoms, or close contact with someone with COVID-19, or healthcare workers and first responders, or staff at retirement communities and those that frequent those communities should all be able to obtain tests on demand).

On fiscal policy:

1) The Federal Government should immediately announce that tests are free for the uninsured.

2) For those that test positive (but don't need hospitalization), the experts should determine how to isolate them. If their employers will not pay for their time off, then the government should pay. We don't want people avoiding tests because of the costs or the fear of lost income.

3) Sick people should not go to work. If the company does not pay for sick leave, the Government could have a program of sharing part of the sick leave (say 50% with the company). This is important for part time workers. Companies like Trader Joe's have already announced that part time employees can take sick leave.

4) We need to proactively expand unemployment insurance. (Note: There would be triggers for this program, so if we get lucky, and COVID-19 is seasonal, then this program would have minimal fiscal impact.) The idea is to increase the amount paid (based on various triggers) and to include parents with school closures (to help with child care).

4a) Based on certain triggers, the Federal Government would pay an additional 60% of whatever the state is paying for unemployment insurance (if the state is paying $300 per week, the Federal government would add $180 per week). (Note: The 60% is just an arbitrary number). The requirement that people are looking for work would be waived (this is not a financial issue - it is a health issue)

Triggers could be based on an increase in the 4-week average of unemployment claims above a certain threshold (like 250K), or industry triggers (workers in leisure industries such as airlines, hotels, etc. could qualify), or there could be geographical triggers based on a serious regional outbreak of the virus. So this wouldn't go into effect until certain triggers happen.

4b) On school closures, the Federal Government would pay a parent both the state share and the 60% extra. School closures are easy to verify. There should be a "reduction in hours" clause, so a person can keep working during a school closure, and still receive some benefits.

4c) There should be a provision to extend the benefits (entirely paid by the Federal government) if the crisis is still ongoing.

This type of program is targeted and builds confidence. One of the concerns during a downturn is that people will slow their spending because they become worried about their financial situation if they lose their job. This will alleviate that fear somewhat.

5) Based on economic data, the Federal Government should be prepared to get money to everyone. One suggestion is to significantly lower payroll tax withholding, from former Fed economist Claudia Sahm:

The easiest way is to cut federal tax withholding for the next two months. In 1992, George H. W. Bush issued an executive order, employers used the new withholding tables, and within weeks people got a bump in their paychecks. It worked, people spent the money.It is important to be proactive on fiscal policy so that we are prepared if the situation deteriorates quickly.

Saturday, March 07, 2020

Schedule for Week of March 8, 2020

by Calculated Risk on 3/07/2020 08:11:00 AM

This will be a light week for economic data.

The key report scheduled for this week is February CPI.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for February.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for February from the BLS. The consensus is for no change in CPI, and a 0.2% increase in core CPI.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, down from 216 thousand the previous week.

8:30 AM: The Producer Price Index for February from the BLS. The consensus is for a 0.1% decrease in PPI, and a 0.2% increase in core PPI.

12:00 PM: Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for March).

Friday, March 06, 2020

High Frequency Data: Movie Box Office

by Calculated Risk on 3/06/2020 06:27:00 PM

There are some sectors that will be hit hard over the next several months: hotels, airlines, restaurants, movie theaters, sporting events, and convention centers. People will probably avoid these places as part of social distancing.

I already track weekly hotel occupancy data from STR, and the occupancy data is starting to show some impact from COVID-19. I'll also be posting updates on monthly visitor and convention traffic in Las Vegas.

For high frequency data, I'm going to start tracking domestic box office numbers from Box Office Mojo every Friday.

This data shows cumulative domestic box office for this year (red) and the previous four years.

This data is through the week ending March 5, 2020.

There are many factors impacting box office numbers, but this will give an idea if people are avoiding theaters.

Currently 2020 is tracking close to 2019.

Q1 GDP Forecasts: 0.7% to 3.1%

by Calculated Risk on 3/06/2020 02:52:00 PM

From Merrill Lynch:

We mark to market our 1Q GDP forecast up to 1.5% from 1.0%, while taking down 2Q GDP by 0.6pp to 1.0% and 3Q GDP 0.2pp to 1.4%, reflecting wider disruption from the COVID-19 spread. [Mar 6 estimate]From Goldman Sachs:

emphasis added

Based on the downward revision to January wholesale inventories and the declines in US and global trade volumes, we lowered our Q1 GDP growth forecast by two-tenths to +0.7% (qoq ar). [Mar 6 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 1.7% for 2020:Q1 and 1.3% for 2020:Q2 [Mar 6 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2020 is 3.1 percent on March 6, up from 2.7 percent on March 2. [Mar 6 estimate]CR Note: These early estimates suggest real GDP growth will be between 0.7% and 3.1% annualized in Q1.