by Calculated Risk on 2/24/2020 09:40:00 PM

Monday, February 24, 2020

Tuesday: Case-Shiller House Prices

From Matthew Graham at Mortgage News Daily: Important Lessons From Near-Record Low Mortgage Rates

Mortgage rates continue to carve out the unlikeliest of victories in 2020 with significant help from coronavirus. The epidemic has taken a year that was almost certain to start off with a steady move toward higher rates and turned it into one of the strongest starts on record. In fact, when it comes to the combination of ground covered and levels achieved, no other year has started off any better. [Most Prevalent Rates For Top Tier Scenarios 30YR FIXED - 3.375 - 3.5%]Tuesday:

emphasis added

• At 9:00 AM ET, FHFA House Price Index for December 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 9:00 AM, S&P/Case-Shiller House Price Index for December. The consensus is for a 2.8% year-over-year increase in the Comp 20 index for December.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for February.

House Prices and Inventory

by Calculated Risk on 2/24/2020 01:06:00 PM

Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

This graph below shows existing home months-of-supply (from the NAR) vs. the seasonally adjusted month-to-month price change in the Case-Shiller National Index (both since January 1999).

There is a clear relationship, and this is no surprise (but interesting to graph).

If months-of-supply is high, price decline. If months-of-supply is low, prices rise.

In the existing home sales report released last week, the NAR reported months-of-supply at 3.1 months in January.

My current expectation is inventory will hold at low levels or decrease this year, and house price growth will increase compared to 2019.

Dallas Fed: "Texas Manufacturing Expansion Continues"

by Calculated Risk on 2/24/2020 10:35:00 AM

From the Dallas Fed: Texas Manufacturing Expansion Continues

Growth in Texas factory activity accelerated further in February, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose six points to 16.4, suggesting stronger output growth than last month.Another soft report from the Dallas Fed.

Other measures of manufacturing activity pointed to continued expansion in February, though demand growth decelerated. The new orders index fell nine points to 8.4, down from a 15-month high in January but still slightly above average. Similarly, the growth rate of orders index fell but remained above average, edging down from 6.1 to 3.6. The capacity utilization and shipments indexes held steady at 11.3 and 8.5, respectively.

Perceptions of broader business conditions were slightly more optimistic in February. The general business activity index edged up to 1.2 and the company outlook index ticked up to 3.6, though both readings remain slightly below average. The index measuring uncertainty regarding companies’ outlooks moved up eight points to 11.0 after receding in the prior two months.

Labor market measures suggested flat employment levels and slightly longer workweeks this month. The employment index stayed near zero for a second month in a row, coming in at -0.9.

emphasis added

"Chicago Fed National Activity Index Points to an Uptick in Economic Growth in January"

by Calculated Risk on 2/24/2020 09:13:00 AM

From the Chicago Fed: Chicago Fed National Activity Index Points to an Uptick in Economic Growth in January

The Chicago Fed National Activity Index (CFNAI) increased to –0.25 in January from –0.51 in December. All four broad categories of indicators that make up the index increased from December, but only one of the four categories made a positive contribution to the index in January. The index’s three-month moving average, CFNAI-MA3, moved up to –0.09 in January from –0.23 in December.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in January (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, February 23, 2020

Sunday Night Futures

by Calculated Risk on 2/23/2020 07:03:00 PM

Note: Most analysts are forecasting that the novel coronavirus will be contained sometime in Q2 (perhaps on the assumption that the virus is seasonal like SARS or the flu). However there are significant downside risks to this view. The CDC has expanded travel advisories to include South Korea, Japan and Hong Kong - and Italy is having a significant outbreak.

From Goldman Sachs tonight:

Despite a negligible hit to aggregate US activity from supply chain production disruptions under our baseline scenario, we have nevertheless increased our estimated growth drag from the coronavirus given the slower than expected pickup in Chinese activity and travel. We now estimate a 0.8pp growth drag in Q1 (from 0.5-0.6pp previously), with positive growth effects of about 0.3pp in Q2, 0.3-0.4pp in Q3, and 0.1pp in Q4 as activity normalizes. While this would imply a modest hit to annual-average GDP growth of 0.1pp, the risks are clearly skewed to the downside until the outbreak is contained. Based on our estimates, we have taken down our Q1 annualized GDP growth forecast by 0.2pp to 1.2%.Weekend:

• Schedule for Week of February 23, 2020

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for January. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for February.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 38 and DOW futures are down 318 (fair value).

Oil prices were down over the last week with WTI futures at $52.11 per barrel and Brent at $56.95 barrel. A year ago, WTI was at $54, and Brent was at $66 - so oil prices are down year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.47 per gallon. A year ago prices were at $2.47 per gallon, so gasoline prices are unchanged year-over-year.

Quarterly Starts by Purpose and Design

by Calculated Risk on 2/23/2020 12:54:00 PM

Along with the monthly housing starts for January last week, the Census Bureau released Quarterly Starts by Purpose and Design through Q4 2019.

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Single family starts built for sale (red) were up 18.1% in Q4 2019 compared to Q4 2018.

Owner built starts (orange) were up 15.8% year-over-year.

Condos built for sale were still near the record low.

The 'units built for rent' (blue) and were up 25.3% in Q4 2019 compared to Q4 2018.

Saturday, February 22, 2020

Schedule for Week of February 23, 2020

by Calculated Risk on 2/22/2020 08:11:00 AM

The key reports this week are January New Home sales and the second estimate of Q4 GDP.

Other key reports include Case-Shiller house prices and Personal Income and Outlays for January.

For manufacturing, the February Dallas, Richmond and Kansas City manufacturing surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for January. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for February.

9:00 AM: FHFA House Price Index for December 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM: S&P/Case-Shiller House Price Index for December.

9:00 AM: S&P/Case-Shiller House Price Index for December.This graph shows the year-over-year change for the Case-Shiller National, Composite 10 and Composite 20 indexes, through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 2.8% year-over-year increase in the Comp 20 index for December.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for February.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for January from the Census Bureau.

10:00 AM: New Home Sales for January from the Census Bureau. This graph shows New Home Sales since 1963.

The dashed line is the sales rate for last month.

The consensus is for 715 thousand SAAR, up from 694 thousand in December.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 211 thousand initial claims, up from 210 thousand the previous week.

8:30 AM: Gross Domestic Product, 4th quarter 2019 (Second estimate). The consensus is that real GDP increased 2.1% annualized in Q4, unchanged from the advance estimate.

8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 1.5% decrease in durable goods orders.

11:00 AM: the Kansas City Fed manufacturing survey for February. This is the last of regional manufacturing surveys for February.

8:30 AM ET: Personal Income and Outlays for January. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for a reading of 45.8, up from 42.9 in January.

10:00 AM: University of Michigan's Consumer sentiment index (Final for February). The consensus is for a reading of 100.9.

Friday, February 21, 2020

Hotels: Occupancy Rate Increases Year-over-year

by Calculated Risk on 2/21/2020 04:58:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 15 February

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 9-15 February 2020, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 10-16 February 2019, the industry recorded the following:

• Occupancy: +0.2% to 63.6%

• Average daily rate (ADR): +0.9% to US$133.55

• Revenue per available room (RevPAR): +1.2% to US$85.00

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

2020 is off to a solid start, however, STR notes that the new coronavirus could have a significant negative impact on hotels.

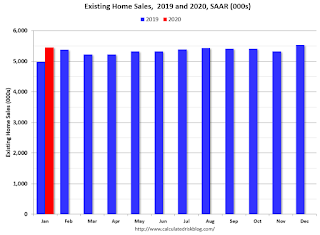

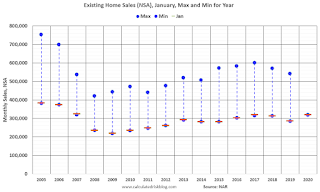

Comments on January Existing Home Sales

by Calculated Risk on 2/21/2020 12:05:00 PM

Earlier: NAR: Existing-Home Sales Decreased to 5.46 million in January

A few key points:

1) Existing home sales were up 9.6% year-over-year (YoY) in January.

2) Inventory is very low, and was down 10.7% year-over-year (YoY) in January. Inventory always decreases sharply in December as people take their homes off the market for the holidays, and then inventory starts to increase in February and March.

3) Sales slumped at the end of 2018 and in January 2019 due to higher mortgage rates, the stock market selloff, and fears of an economic slowdown.

The comparison to January of last year will be the easiest for this year.

Note that existing home sales picked up somewhat in the second half of 2019 as interest rates declined.

Sales NSA in January (318,000) were the highest for January since 2017.

Note that January sales (NSA) are always near the minimum for the year. The maximum is usually in June or July.

Overall this was a solid report. The very low level of inventory will be something to watch in 2020.

Q1 GDP Forecasts: 0.7% to 2.6%

by Calculated Risk on 2/21/2020 11:33:00 AM

From Merrill Lynch:

We are tracking 0.7% qoq saar for 1Q GDP and 2.0% for 4Q. [Feb 21 estimate]From Goldman Sachs:

emphasis added

we raised our Q1 GDP tracking estimate by one tenth to +1.5%. [Feb 19 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.0% for 2020:Q1. News from this week’s data increased the nowcast for 2020:Q1 by 0.6 percentage point. Positive surprises from regional survey and housing data drove most of the increase. [Feb 21 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2020 is 2.6 percent on February 19, up from 2.4 percent on February 14. [Feb 19 estimate]CR Note: These early estimates suggest real GDP growth will be between 0.7% and 2.6% annualized in Q1.