by Calculated Risk on 1/07/2020 11:19:00 AM

Tuesday, January 07, 2020

Reis: Mall Vacancy Rate Increased in Q4 2019

Reis reported that the vacancy rate for regional malls was 9.7% in Q4 2019, up from 9.4% in Q3 2019, and up from 9.0% in Q4 2018. This is above the peak following the great recession of 9.4% in Q3 2011, and up from the cycle low of 7.8% in Q1 2016.

For Neighborhood and Community malls (strip malls), the vacancy rate was 10.2% in Q4, up from 10.1% in Q3, and unchanged from 10.2% in Q4 2018. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011, and the low was 9.8% in Q2 2016.

Comments from Reis:

The Retail Vacancy Rate rose 0.1% in the fourth quarter as overall occupancy declined by 175,000 square feet due to the closure of 16 Kmart stores in 13 metros; Asking and Effective Rent growth was 0.1% in the quarter – the lowest since 2012.

The Mall Vacancy Rate rose 0.3% to 9.7% in the fourth quarter. Asking and Effective Rent growth was flat.

...

The fourth quarter looks like it could be the start of a declining retail market. For more than two years we had remarked how the retail statistics were defying anecdotal reports of a “retail apocalypse.” But this recent data shows that the scales may have tipped as both the retail and the Mall vacancy rate increased in the quarter. The retail rent growth was a scant 0.1% while Mall rents were flat.

...

Thus, our outlook remains cautious: if vacancies continue to rise, they should not do so at a rapid rate given how slowly the numbers have moved over the last two years. Rents should stay flat for the next few quarters. Indeed, consumers continue to buy more clothing and other goods on-line, but they are also spending more on fitness, entertainment and eating out in establishments that lease retail space. We expect these trends to continue in 2020.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Recently the regional mall vacancy rates have increased significantly from an already elevated level.

Mall vacancy data courtesy of Reis

ISM Non-Manufacturing Index increased to 55.0% in December

by Calculated Risk on 1/07/2020 10:06:00 AM

The December ISM Non-manufacturing index was at 55.0%, up from 53.9% in November. The employment index decreased to 55.2%, from 55.5%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: December 2019 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in December for the 119th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.This suggests faster expansion in December than in November.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: "The NMI® registered 55 percent, which is 1.1 percentage points higher than the November reading of 53.9 percent. This represents continued growth in the non-manufacturing sector, at a slightly faster rate. The Non-Manufacturing Business Activity Index rose to 57.2 percent, a 5.6-percentage point increase compared to the November reading of 51.6 percent, reflecting growth for the 125th consecutive month. The New Orders Index registered 54.9 percent, 2.2 percentage points lower than the reading of 57.1 percent in November. The Employment Index decreased 0.3 percentage point in December to 55.2 percent from the November reading of 55.5 percent. The Prices Index reading of 58.5 percent is the same as the November figure, indicating that prices increased in December for the 31st consecutive month. According to the NMI®, 11 non-manufacturing industries reported growth. The non-manufacturing sector had an uptick in growth in December. The respondents are positive about the potential resolution on tariffs. Capacity constraints have eased a bit; however, respondents continue to have difficulty with labor resources."

emphasis added

Trade Deficit decreased to $43.1 Billion in November

by Calculated Risk on 1/07/2020 08:42:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $43.1 billion in November, down $3.9 billion from $46.9 billion in October, revised.

November exports were $208.6 billion, $1.4 billion more than October exports. November imports were $251.7 billion, $2.5 billion less than October imports.

Click on graph for larger image.

Click on graph for larger image.Exports increased and imports decreased in November.

Exports are 26% above the pre-recession peak and unchanged compared to November 2018; imports are 8% above the pre-recession peak, and down 4% compared to November 2018.

In general, trade both imports and exports have moved more sideways or down recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that the U.S. exported a slight net positive petroleum products in September, October and November.

Oil imports averaged $51.92 per barrel in November, down from $52.00 in October, and down from $57.54 in November 2018.

The trade deficit with China decreased to $26.4 billion in November, from $37.9 billion in November 2018.

Monday, January 06, 2020

Tuesday: Trade Deficit, ISM non-Mfg

by Calculated Risk on 1/06/2020 08:35:00 PM

Tuesday:

• At 8:30 AM ET, Trade Balance report for November from the Census Bureau. The consensus is the trade deficit to be $43.9 billion. The U.S. trade deficit was at $47.2 billion in October.

• At 10:00 AM, the ISM non-Manufacturing Index for December. The consensus is for an increase to 54.5 from 53.9.

• Early, Reis Q4 2019 Mall Survey of rents and vacancy rates.

Update: The Changing Mix of Light Vehicle Sales

by Calculated Risk on 1/06/2020 05:33:00 PM

SUVs to the left of me, SUVs to the right. It made me look at the changing mix of vehicle sales over time (between passenger cars and light trucks / SUVs).

The first graph below shows the mix of sales since 1976 (Blue is cars, Red is light trucks and SUVs) through December 2019.

Click on graph for larger image.

The mix has changed significantly. Back in 1976, most light vehicles were passenger cars - however car sales have trended down over time.

Note that the big dips in sales are related to economic recessions (early '80s, early '90s, and the Great Recession of 2007 through mid-2009).

Over time the mix has changed toward more and more light trucks and SUVs.

Only when oil prices are high, does the trend slow or reverse.

Recently oil prices have been somewhat steady, and the percent of light trucks and SUVs is up to 73%.

BEA: December Vehicles Sales decreased to 16.7 Million SAAR

by Calculated Risk on 1/06/2020 12:41:00 PM

The BEA released their estimate of December vehicle sales this morning. The BEA estimated light vehicle sales of 16.70 million SAAR in December 2019 (Seasonally Adjusted Annual Rate), down 2.3% from the November sales rate, and down 3.9% from December 2019.

Light vehicle sales in 2019 were 16.97 million, down 1.4% from 17.21 million in 2018.

This graph shows light vehicle sales since 2006 from the BEA (blue) and an estimate for December (red).

Note: The GM strike might have impacted sales in October.

A small decline in sales last year isn't a concern - I think sales will move mostly sideways at near record levels.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate of 16.70 million SAAR.

Sales have been decreasing slightly, but are still at a high level.

2019 was the 7th best year for vehicle sales following 2016 (best year), 2015, 2000, 2018, 2017 and 2001.

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 1/06/2020 11:29:00 AM

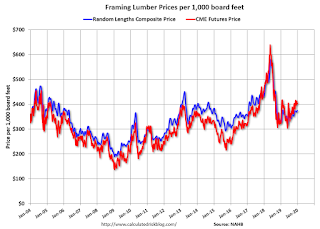

Here is another monthly update on framing lumber prices. Lumber prices declined sharply from the record highs in early 2018, and have increased a little lately.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through Jan 3, 2020 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 14% from a year ago, and CME futures are up 25% year-over-year.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

The trade war was a factor in the sharp decline with reports that lumber exports to China had declined by 40%. Now, with a pickup in housing, lumber prices are moving up again.

Reis: Office Vacancy Rate unchanged in Q4 at 16.8%

by Calculated Risk on 1/06/2020 09:44:00 AM

Reis reported that the office vacancy rate was at 16.8% in Q4, unchanged from 16.8% in Q3 2019. This is up from 16.7% in Q4 2018, and down from the cycle peak of 17.6%.

From Reis Senior Economist Barbara Byrne Denham:

The office vacancy rate was unchanged at 16.8% in the fourth quarter. It was 16.7% in the fourth quarter of 2018 and 16.4% at year-end 2017.

Both the national average asking rent and effective rent, which nets out landlord concessions, increased 0.5% in the fourth quarter. At $34.31 per square foot (asking) and $27.87 per square foot (effective), the average rents have increased 2.6% and 2.7%, respectively, from the fourth quarter of 2018. This was close to the 2.7% growth rate in 2018 and above the 1.8% growth rate in 2017.

Net absorption jumped to 12.2 million SF in the quarter, 35% above the 9.0 million SF in the third quarter. Likewise, construction was 12.5 million SF, 6% higher than the 11.8 million SF completed in the third quarter. With new completions of just under 40 million SF in all of 2019, overall office supply growth trailed the 2018 addition of 49 million SF. However, net absorption of 30.1 million SF in 2019 was much stronger than the 24.0 million SF in 2018. Nevertheless, vacancy is 0.1% higher than a year ago.

...

Many remain concerned about the fate of WeWork’s occupancies as the co-working company had over-expanded and may need to reconsider some of its office leases. This could raise vacancies in a few metros, but it’s too early to draw any conclusions.

The 2019 results extend the protracted expansion to nine years – a near decade that has been dogged by sluggish growth relative to both the apartment sector and historical expansions. The 16.8% vacancy rate is one-third higher than the low vacancy of 12.6% in 2007 and more than twice the rate (8.3%) in 2000. Likewise, annual rent growth of 2.7% is above the low national inflation rate of 1.8%, but well below peak rent growth of 10.5% and 12.3% in those respective years.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.8% in Q4. The office vacancy rate had been mostly moving sideways at an elevated level, but has increased over the last two years.

Office vacancy data courtesy of Reis.

Sunday, January 05, 2020

Sunday Night Futures

by Calculated Risk on 1/05/2020 07:06:00 PM

Weekend:

• Schedule for Week of January 5, 2020

Monday:

• Early: Reis Q4 2019 Office Survey of rents and vacancy rates.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 13 and DOW futures are down 120 (fair value).

Oil prices were up over the last week with WTI futures at $63.65 per barrel and Brent at $69.31 barrel. A year ago, WTI was at $48, and Brent was at $56 - so oil prices are up about 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.58 per gallon. A year ago prices were at $2.23 per gallon, so gasoline prices are up 35 cents year-over-year.

Hotels: A Solid Year for Occupancy Rate in 2019, STR Projects further small Occupancy Decline in Q1 2020

by Calculated Risk on 1/05/2020 01:27:00 PM

From HotelNewsNow.com: 2019’s weak growth trajectory to continue in Q1 2020

“Q1 2020 should see the fourth consecutive quarterly decline in the national occupancy level and the largest such decline … since Q3 2018,” [said] Mark Woodworth, senior managing director and head of lodging research for CBRE Hotel’s Americas Research …From HotelNewsNow.com: STR: US hotel results for week ending 28 December

For Q1 2020, STR is projecting a 0.6% increase in RevPAR, pushed up exclusively by average daily rate, which is expected to increase 1.1% year over year as occupancy decreases 0.5%.

emphasis added

The U.S. hotel industry reported negative year-over-year results in the three key performance metrics during the week of 22-28 December 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 23-29 December 2018, the industry recorded the following:

• Occupancy: -4.9% to 48.5%

• Average daily rate (ADR): -2.6% to US$127.92

• Revenue per available room (RevPAR): -7.4% to US$62.00

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The average occupancy rate in 2019 was just behind the record rate in 2018 and essentially tied with 2017. Another solid year for hotels.

Seasonally, the 4-week average of the occupancy rate will decline into January.

Data Source: STR, Courtesy of HotelNewsNow.com