by Calculated Risk on 9/27/2019 02:14:00 PM

Friday, September 27, 2019

Reis: Apartment Vacancy Rate unchanged in Q3 at 4.7%

Reis reported that the apartment vacancy rate was at 4.7% in Q3 2019, unchanged from 4.7% in Q2, and unchanged from 4.7% in Q3 2018. The vacancy rate peaked at 8.0% at the end of 2009, and bottomed at 4.1% in 2016.

From economist Barbara Byrne Denham at Reis:

The apartment vacancy rate was flat in the quarter at 4.7%. In the third quarter of 2018 it was also 4.7%. Overall vacancy has changed 0.3% in last two years.

Both the national average asking rent and effective rent, which nets out landlord concessions, increased 0.8% in the third quarter. At $1,484 per unit (asking) and $1,413 per unit (effective), the average rents have increased 3.8% from the third quarter of 2018.

...

Apartment occupancy growth was subdued in the third quarter, although fundamentals remain healthy. That is, demand growth increased in line with supply growth, and rent growth held steady at just below 1% in the quarter. Despite a deceleration in the overall economy, the demand for apartments should continue at this pace as the housing market takes the brunt of any and all uncertainty. New and existing homes sales have improved in the last month, but condo and coop sales were lower than a year ago. The back-and-forth in the two markets should continue this year and next as consumers exercise caution given so much uncertainty on the trade war and global front. Still, the housing vs. apartment markets are not a zero-sum game. As long as job growth remains healthy, the demand for both will stay positive shoring up home prices and rents equally.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The vacancy rate had mostly moved sideways for the last two years - after increasing from the low in 2016..

Apartment vacancy data courtesy of Reis.

Q3 GDP Forecasts: Around 2.0%

by Calculated Risk on 9/27/2019 11:19:00 AM

From Merrill Lynch:

The data sliced 0.3pp from 3Q GDP tracking, bringing us down to 1.9% qoq saar. [Sept 27 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 2.1% for 2019:Q3 and 1.8% for 2019:Q4. [Sept 27 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2019 is 2.1 percent on September 27, up from 1.9 percent on September 18. [Sept 27 estimate]CR Note: These estimates suggest real GDP growth will be around 2.0% annualized in Q3.

Philly Fed: State Coincident Indexes increased in 40 states in August

by Calculated Risk on 9/27/2019 10:41:00 AM

From the Philly Fed:

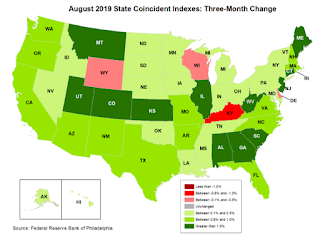

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for August 2019. Over the past three months, the indexes increased in 46 states and decreased in four, for a three-month diffusion index of 84. In the past month, the indexes increased in 40 states, decreased in six states, and remained stable in four, for a one-month diffusion index of 68.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

The map is mostly green on a three month basis, but there are some red states.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In July, 41 states had increasing activity (graph includes minor increases).

Personal Income increased 0.4% in August, Spending increased 0.1%

by Calculated Risk on 9/27/2019 08:38:00 AM

The BEA released the Personal Income and Outlays report for August:

Personal income increased $73.5 billion (0.4 percent) in August according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $77.7 billion (0.5 percent) and personal consumption expenditures (PCE) increased $20.1 billion (0.1 percent).The August PCE price index increased 1.4 percent year-over-year and the August PCE price index, excluding food and energy, increased 1.8 percent year-over-year.

Real DPI increased 0.4 percent in August and Real PCE increased 0.1 percent. The PCE price index increased less than 0.1 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through August 2019 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was at expectations, and the increase in PCE was below expectations.

Note that core PCE inflation was up 1.8% YoY.

Using the two-month method to estimate Q2 PCE growth, PCE was increasing at a 2.8% annual rate in Q3 2019. (using the mid-month method, PCE was increasing at 2.3%). This suggests slower PCE growth in Q3 than in Q2.

Thursday, September 26, 2019

Friday: Personal Income and Outlays, Durable Goods

by Calculated Risk on 9/26/2019 08:23:00 PM

Friday:

• At 8:30 AM ET, Durable Goods Orders for August from the Census Bureau. The consensus is for a 1.2% decrease in durable goods orders.

• At 8:30 AM, Personal Income and Outlays for August. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for September). The consensus is for a reading of 92.0.

Freddie Mac: Mortgage Serious Delinquency Rate unchanged in August

by Calculated Risk on 9/26/2019 04:51:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in August was 0.61%, unchanged from 0.61% in July. Freddie's rate is down from 0.73% in August 2018.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This matches last month as the lowest serious delinquency rate for Freddie Mac since November 2007.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

I expect the delinquency rate to decline to a cycle bottom in the 0.4% to 0.6% range - so this is close to a bottom.

Note: Fannie Mae will report for August soon.

Merrill on September Employment

by Calculated Risk on 9/26/2019 02:23:00 PM

A few excerpt from a Merrill Lynch research report:

We expect next Friday's Bureau of Labor Statistics (BLS) employment situation report to show that nonfarm payrolls grew by 145k in September following an increase of 130k in August. ... For private payrolls which exclude government workers, we look for an increase of 125k …CR note: I expect temporary Decennial Census Hiring of about 15,000 in September (following 25,000 hires in August).

Since the last employment report, labor market indicators on balance have been reading softer and portend to tepid hiring activity. … Elsewhere, we expect the unemployment rate to hold at 3.7% for the 4th consecutive month

Kansas City Fed: "Tenth District Manufacturing Edged Down in September"

by Calculated Risk on 9/26/2019 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Edged Down in September

The Federal Reserve Bank of Kansas City released the September Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity edged down in September, and expectations for future activity moderated but remained positive.Another weak regional manufacturing report.

“Regional factory activity continued to decline in September, though not as much as last month,” said Wilkerson. “Although the employment index dropped further this month, firms as a whole indicated 2019 employment expectations have increased slightly since the beginning of the year.”

...

The month-over-month composite index was -2 in September, up slightly from -6 in August and similar to -1 in July. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The dip in manufacturing activity was driven by continued declines at durable goods plants, especially from decreases in nonmetallic mineral products, primary metal, computer and electronic products, and transportation equipment manufacturing. While the month-over-month employment index dropped further in September, the production and shipments indexes rebounded considerably. Year-over-year factory indexes were somewhat mixed in September, but the composite index was unchanged at -1. The future composite index remained positive, but slowed from 9 to 5, the lowest future composite index since May 2016.

emphasis added

NAR: "Pending Home Sales Grow 1.6% in August"

by Calculated Risk on 9/26/2019 10:04:00 AM

From the NAR: Pending Home Sales Grow 1.6% in August

Pending home sales increased in August, a welcome rebound after a prior month of declines, according to the National Association of Realtors®. Each of the four major regions reported both month-over-month growth and year-over-year gains in contract activity.This was above expectations of a 0.6% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in September and October.

The Pending Home Sales Index (PHSI), a forward-looking indicator based on contract signings, climbed 1.6% to 107.3 in August, reversing the prior month’s decrease. Year-over-year contract signings jumped 2.5%. An index of 100 is equal to the average level of contract activity.

...

All regional indices are up from July, with the highest gain in the West region. The PHSI in the Northeast rose 1.4% to 94.3 in August and is now 0.7% higher than a year ago. In the Midwest, the index increased 0.6% to 101.7 in August, 0.2% higher than August 2018.

Pending home sales in the South increased 1.4% to an index of 124.4 in August, a 1.8% bump from last August. The index in the West grew 3.1% in August 2019 to 96.4, an increase of 8.0% from a year ago.

emphasis added

Weekly Initial Unemployment Claims increased to 213,000

by Calculated Risk on 9/26/2019 08:38:00 AM

The DOL reported:

In the week ending September 21, the advance figure for seasonally adjusted initial claims was 213,000, an increase of 3,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 208,000 to 210,000. The 4-week moving average was 212,000, a decrease of 750 from the previous week's revised average. The previous week's average was revised up by 500 from 212,250 to 212,750.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 212,000.

This was close to the consensus forecast.