by Calculated Risk on 5/02/2019 07:47:00 PM

Thursday, May 02, 2019

Friday: Employment Report

My April Employment Preview

Goldman: April Payrolls Preview

Friday:

• At 8:30 AM: Employment Report for April. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 3.8%.

• At 10:00 AM: the ISM non-Manufacturing Index for April. The consensus is for a reading of 57.2, up from 56.1.

Hotels: Occupancy Rate Decreased Year-over-year

by Calculated Risk on 5/02/2019 05:42:00 PM

From HotelNewsNow.com: STR: U.S. hotel results for week ending 27 April

The U.S. hotel industry reported negative year-over-year results in the three key performance metrics during the week of 21-27 April 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 22-28 April 2018, the industry recorded the following:

• Occupancy: -1.4% to 68.9%

• Average daily rate (ADR): -1.4% to US$128.66

• Revenue per available room (RevPAR): -2.9% to US$88.59

STR analysts attribute steep performance declines in many major markets to group business decreases on Easter Sunday and the Monday that followed. The corresponding days from 2018 were non-holiday dates.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

A decent start for 2019, close - to-date - compared to the previous 4 years.

Seasonally, the occupancy rate will mostly move sideways during the Spring, and then increase during the Summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Goldman: April Payrolls Preview

by Calculated Risk on 5/02/2019 02:50:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls increased 195k in April (vs. consensus of 190k), as lower jobless claims and resilient employment surveys suggest that the pace of job growth remains solid.. …

We expect an unchanged unemployment rate in tomorrow’s report (3.8%; consensus also expects 3.8%). … We estimate a 0.2% rise in average hourly earnings (mom sa) that leaves the year-over-year rate unchanged at 3.2%

emphasis added

April Employment Preview

by Calculated Risk on 5/02/2019 11:17:00 AM

On Friday at 8:30 AM ET, the BLS will release the employment report for April. The consensus is for an increase of 180,000 non-farm payroll jobs in April, and for the unemployment rate to be unchanged at 3.8%.

Last month, the BLS reported 196,000 jobs added in March.

Here is a summary of recent data:

• The ADP employment report showed an increase of 275,000 private sector payroll jobs in April. This was below the consensus expectations of 180,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index decreased in April to 52.4%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll decreased about 5,000 in April. The ADP report indicated manufacturing jobs increased 5,000 in April.

The ISM non-manufacturing employment index for April will be released tomorrow.

• Initial weekly unemployment claims averaged 213,000 in April, about the same as in March. For the BLS reference week (includes the 12th of the month), initial claims were at 193,000, down from 216,000 during the reference week the previous month.

The significant decrease during the reference week suggests a stronger employment report in April than in March.

• The final April University of Michigan consumer sentiment index decreased to 97.2 from the March reading of 98.4. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Conclusion: In general these reports suggest a solid employment report. My guess is the headline employment increase will be above expectations (primarily based on strong ADP report and low level of unemployment claims during reference).

BEA: April Vehicles Sales decline to 16.4 Million SAAR

by Calculated Risk on 5/02/2019 09:49:00 AM

The BEA released their estimate of April vehicle sales this morning. The BEA estimated sales of 16.43 million SAAR in April 2019 (Seasonally Adjusted Annual Rate), down 5.8% from the March sales rate, and down 4.5% from April 2018.

With the weak sales in April, sales in 2019 are averaging 16.7 million (average of seasonally adjusted rate), down 2.3% compared to the same period in 2018.

This graph shows light vehicle sales since 2006 from the BEA (blue) and an estimate for April (red).

This was below the consensus forecast for April.

A small decline in sales this year isn't a concern - I think sales will move mostly sideways at near record levels.

This means the economic boost from increasing auto sales is over (from the bottom in 2009, auto sales boosted growth every year through 2016).

Note: dashed line is current estimated sales rate of 16.43 million SAAR.

Weekly Initial Unemployment Claims at 230,000

by Calculated Risk on 5/02/2019 08:32:00 AM

The DOL reported:

In the week ending April 27, the advance figure for seasonally adjusted initial claims was 230,000, unchanged from the previous week's unrevised level of 230,000. The 4-week moving average was 212,500, an increase of 6,500 from the previous week's unrevised average of 206,000The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 212,500.

This was well above the consensus forecast.

Wednesday, May 01, 2019

Zillow Case-Shiller Forecast: National YoY House Price Gains in March similar to February

by Calculated Risk on 5/01/2019 06:39:00 PM

The Case-Shiller house price indexes for February were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: February Case-Shiller Results and March Forecast: Home Price Growth Slowest Since 2012

Home prices continued to tap on the brakes in February, moderating their earlier breakneck speeds, particularly in pricey West Coast markets. The S&P CoreLogic Case-Shiller National Home Price Index, which tracks home prices nationally and in major metro areas, rose 4% in February from the previous year, a slowdown from 4.2% in January.The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 4.0% in March, the same as in February.

...

Below is Zillow’s Case-Shiller forecast for March. It’s scheduled for release on May 28.

The Zillow forecast is for the 20-City index to decline to 2.6% YoY in March, and for the 10-City index to decline to 2.3% YoY.

The Zillow forecast is for the 20-City index to decline to 2.6% YoY in March, and for the 10-City index to decline to 2.3% YoY.

FOMC Statement: No Change to Policy

by Calculated Risk on 5/01/2019 02:02:00 PM

Information received since the Federal Open Market Committee met in March indicates that the labor market remains strong and that economic activity rose at a solid rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Growth of household spending and business fixed investment slowed in the first quarter. On a 12-month basis, overall inflation and inflation for items other than food and energy have declined and are running below 2 percent. On balance, market-based measures of inflation compensation have remained low in recent months, and survey-based measures of longer-term inflation expectations are little changed.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 2-1/4 to 2-1/2 percent. The Committee continues to view sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective as the most likely outcomes. In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

Voting for the FOMC monetary policy action were: Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; James Bullard; Richard H. Clarida; Charles L. Evans; Esther L. George; Randal K. Quarles; and Eric S. Rosengren.

emphasis added

Construction Spending decreased 0.9% in March

by Calculated Risk on 5/01/2019 11:14:00 AM

From the Census Bureau reported that overall construction spending decreased in March:

Construction spending during March 2019 was estimated at a seasonally adjusted annual rate of $1,282.2 billion, 0.9 percent below the revised February estimate of $1,293.3 billion. The March figure is 0.8 percent below the March 2018 estimate of $1,293.1 billion.Both private and public spending decreased:

Spending on private construction was at a seasonally adjusted annual rate of $961.5 billion, 0.7 percent below the revised February estimate of $968.6 billion. ...

In March, the estimated seasonally adjusted annual rate of public construction spending was $320.7 billion, 1.3 percent below the revised February estimate of $324.7 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending had been increasing - but turned down in the 2nd half of 2018 - and is now 26% below the bubble peak.

Non-residential spending is 11% above the previous peak in January 2008 (nominal dollars).

Public construction spending is just below the previous peak in March 2009, and 23% above the austerity low in February 2014.

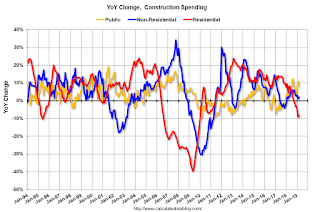

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 8%. Non-residential spending is up 2% year-over-year. Public spending is up 1% year-over-year.

This was well below consensus expectations, and spending for January and February were revised down significantly. A weak report.

ISM Manufacturing index Decreased to 52.8 in April

by Calculated Risk on 5/01/2019 10:05:00 AM

The ISM manufacturing index indicated expansion in April. The PMI was at 52.8% in April, down from 55.3% in March. The employment index was at 52.4%, down from 57.5% last month, and the new orders index was at 51.7%, down from 57.4%.

From the Institute for Supply Management: April 2019 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in April, and the overall economy grew for the 120th consecutive month, say the nation—s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: "The April PMI® registered 52.8 percent, a decrease of 2.5 percentage points from the March reading of 55.3 percent. The New Orders Index registered 51.7 percent, a decrease of 5.7 percentage points from the March reading of 57.4 percent. The Production Index registered 52.3 percent, a 3.5-percentage point decrease compared to the March reading of 55.8 percent. The Employment Index registered 52.4 percent, a decrease of 5.1 percentage points from the March reading of 57.5 percent. The Supplier Deliveries Index registered 54.6 percent, a 0.4-percentage point increase from the March reading of 54.2 percent. The Inventories Index registered 52.9 percent, an increase of 1.1 percentage points from the March reading of 51.8 percent. The Prices Index registered 50 percent, a 4.3-percentage point decrease from the March reading of 54.3 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 55.0%, and suggests manufacturing expanded at a slower pace in April than in March.