by Calculated Risk on 3/08/2019 08:41:00 AM

Friday, March 08, 2019

February Employment Report: 20,000 Jobs Added, 3.8% Unemployment Rate

From the BLS:

Total nonfarm payroll employment changed little in February (+20,000), and the unemployment rate declined to 3.8 percent, the U.S. Bureau of Labor Statistics reported today. Employment in professional and business services, health care, and wholesale trade continued to trend up, while construction employment decreased.

...

The change in total nonfarm payroll employment for December was revised up from +222,000 to +227,000, and the change for January was revised up from +304,000 to +311,000. With these revisions, employment gains in December and January combined were 12,000 more than previously reported.

...

In February, average hourly earnings for all employees on private nonfarm payrolls rose by 11 cents to $27.66, following a 2-cent gain in January. Over the year, average hourly earnings have increased by 3.4 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 20 thousand in February (private payrolls increased 25 thousand).

Payrolls for December and January were revised up 12 thousand combined.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In February the year-over-year change was 2.509 million jobs.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged in February to 63.2%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.

The Labor Force Participation Rate was unchanged in February to 63.2%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.The Employment-Population ratio was increased to 60.7% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

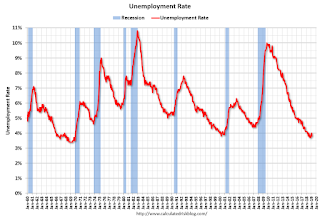

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in February to 3.8%. (Unwinding the bump up from the government shutdown).

This was well below the consensus expectations of 178,000 jobs added, however December and January were up by 12,000 combined. A weak report.

I'll have much more later ...

Thursday, March 07, 2019

Friday: Employment Report, Housing Starts, Speech Fed Chair Powell

by Calculated Risk on 3/07/2019 08:56:00 PM

My February Employment Preview

Goldman: February Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for February. The consensus is for 178,000 jobs added, and for the unemployment rate to decline to 3.9%.

• At 8:30 AM, Housing Starts for January. The consensus is for 1.170 million SAAR, up from 1.078 million SAAR.

• At 10:00 PM, Speech by Fed Chair Jerome Powell, Monetary Policy Normalization and Review, At the 2019 Stanford Institute for Economic Policy Research (SIEPR) Economic Summit, Stanford, California

Goldman: February Payrolls Preview

by Calculated Risk on 3/07/2019 04:17:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls increased 150k in February ... expect a drag of at least 40k from above-average snowfall during the February survey week.

...

We expect the unemployment rate to move back down a tenth to 3.9% in tomorrow’s report ... the return of furloughed government workers should exert downward pressure on the jobless rate … We estimate that average hourly earnings increased 0.4% month-over-month and 3.4% year-over-year.

emphasis added

February Employment Preview

by Calculated Risk on 3/07/2019 02:11:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for February. The consensus is for an increase of 178,000 non-farm payroll jobs in February, and for the unemployment rate to decline to 3.9%.

Last month, the BLS reported 304,000 jobs added in January.

Here is a summary of recent data:

• The ADP employment report showed an increase of 183,000 private sector payroll jobs in February. This was close to consensus expectations of 180,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth close to expectations.

• The ISM manufacturing employment index decreased in February to 53.2%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll was unchanged in February. The ADP report indicated manufacturing jobs increased 17,000 in February.

The ISM non-manufacturing employment index decreased in February to 55.2%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll increased 210,000 in February.

Combined, the ISM surveys suggest employment gains slightly above the consensus expectations.

• Initial weekly unemployment claims averaged 226,000 in February, up from 220,000 in January. For the BLS reference week (includes the 12th of the month), initial claims were at 217,000, up from 212,000 during the reference week the previous month.

The increase during the reference week suggests a weaker employment report in February than in January.

• The final February University of Michigan consumer sentiment index increased to 93.8 from the January reading of 91.2. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Government Shutdown: The unemployment rate should decline in February (government employees on furlough were counted as unemployed in the household survey, but as having a job in the establishment survey).

• Weather could negatively impact the February report.

• Conclusion: In general these reports suggest a solid employment report. There might be some negative impact from weather - and some February hiring might have happened in January (included in the strong report) - so my guess is job growth will be below consensus, but that the unemployment rate will decline to 3.8% or 3.9%.

Fed's Flow of Funds: Household Net Worth decreased in Q4

by Calculated Risk on 3/07/2019 01:11:00 PM

The Federal Reserve released the Q4 2018 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth decreased in Q4 2018 to $104.3 trillion, from $106.9 trillion in Q3 2018:

The net worth of households and nonprofits fell to $104.3 trillion during the fourth quarter of 2018. The value of directly and indirectly held corporate equities decreased $4.6 trillion and the value of real estate increased $0.3 trillion.The Fed estimated that the value of household real estate increased to $25.9 trillion in Q4. The value of household real estate is now above the bubble peak in early 2006 - but not adjusted for inflation, and this also includes new construction.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is higher than the peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q4 2018, household percent equity (of household real estate) was at 60.0% - up from Q3, and the highest since 2002. This was because of an increase in house prices in Q4 (the Fed uses CoreLogic).

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 60.0% equity - and about 2.2 million homeowners still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $56 billion in Q4.

Mortgage debt has declined by $0.36 trillion from the peak, and, as a percent of GDP is at 49.5%, down from a peak of 73.5% of GDP during the housing bubble.

The value of real estate, as a percent of GDP, was unchanged in Q4, and is above the average of the last 30 years (excluding bubble). However, mortgage debt as a percent of GDP, continues to decline.

Black Knight Mortgage Monitor for January

by Calculated Risk on 3/07/2019 09:52:00 AM

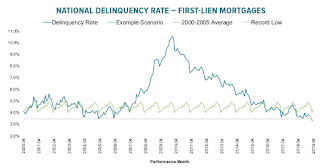

Black Knight released their Mortgage Monitor report for January today. According to Black Knight, 3.75% of mortgages were delinquent in January, down from 4.31% in January 2018. Black Knight also reported that 0.51% of mortgages were in the foreclosure process, down from 0.66% a year ago.

This gives a total of 4.26% delinquent or in foreclosure.

Press Release: Black Knight: Affordability Outlook Improves as Interest Rates Fall; Annual Home Price Growth Continues to Slow, Prices See Fourth Consecutive Monthly Decline

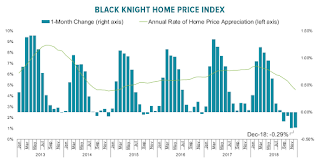

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage performance, housing and public records datasets. This month’s report leveraged the latest data from the Black Knight Home Price Index (HPI) to look into the continued slowdown in annual home price appreciation (HPA) and its impact on home affordability. Ben Graboske, president of Black Knight’s Data & Analytics division, explained that while home prices are still up year-over-year in all 50 states and the nation’s 100 largest markets, slowing is noticeable nationwide and – combined with recent interest rate reductions – is helping to improve the overall affordability outlook.

“At the end of December, home prices at the national level had fallen 0.3 percent from November for their fourth consecutive monthly decline,” said Graboske. “As a result, the average home has lost more than $2,400 in value since the summer of 2018. And while home prices are still up on an annual basis, the slowdown continues nationwide and, importantly, is not being driven by seasonal effects. December marked the 10th straight month of slowing annual home price appreciation, falling from a high of 6.8 percent annual growth in February to 4.6 percent at the end of the year. With more than 50 percent of areas reporting, early numbers for January suggest we’re likely to see more of the same. That said, it’s important to keep in mind that annual growth is still outpacing the 25-year average of 3.9 percent – although the gap is closing quickly. Also, it’s yet to be seen what impact the recent pullback in interest rates may have on the national home price growth rate.

“There is good news in these numbers for prospective homebuyers, though. Combined with the average 30-year fixed rate declining by more than half a point over the last three months, housing is now the most affordable it’s been since early in the 2018 home buying season. It currently requires 22.2 percent of median income to purchase the average home with a 20 percent down payment on a 30-year fixed-rate loan. That’s down from a post-recession high of 23.4 percent just a few months ago, and well below the long-term average of 25 percent seen in the late 1990s through the early 2000s, before the housing bubble. The recent decline in rates has translated into a more than 6 percent increase in a homebuyer’s purchase power – while keeping monthly payments the same – or a decrease of $62 a month in principal and interest on the average home bought with 20 percent down. While this is all welcome news for consumers heading into the spring home buying season, it remains to be seen whether recent rate declines and easing affordability will be enough to halt the deceleration in home price growth.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows the National delinquency rate over time.

From Black Knight:

• At 3.75%, the national delinquency rate now stands nearly a full percentage point below the pre-recession January average of 4.74%The second graph shows the month-over-month and YoY change in the Black Knight House Price Index:

• February and March tend to be two of the strongest performing months, with delinquencies falling by more than 12% over those two months in an average year

...

• If we saw the average seasonal decline this year, the national delinquency rate would fall to 3.3% in March, nearly 20BPS below the previous record low of 3.48% recorded in March of 2005

• A more pessimistic scenario – which may be wise, as March 2019 ends on a Sunday – has delinquencies closer to 3.5% in March (slightly above the record low), but falling to record lows in April

• The average home declined in value by 0.3% (-$850) in December, marking the fourth consecutive monthly decline in home pricesThere is much more in the mortgage monitor.

• December marked the 10th straight month of slowing annual home price appreciation (HPA), falling from a high of 6.8% annual growth in February to 4.6% at the end of the year

• With more than 50% of areas reporting, early numbers for January suggest we’re likely to see more of the same

…

• Also, it’s yet to be seen what impact the recent pullback in interest rates may have on the national home price growth rate as late December/early January declines haven’t had time to manifest themselves in terms of closed home sales

CoreLogic: Homeowners with Negative Equity Increased by 35,000 in Q4 2018

by Calculated Risk on 3/07/2019 08:44:00 AM

From CoreLogic:

CoreLogic Reports Homeowners with Negative Equity Increased by 35,000 in the Fourth Quarter of 2018

CoreLogic … today released the Home Equity Report for the fourth quarter of 2018. The report shows that U.S. homeowners with mortgages (which account for roughly 63 percent of all properties) have seen their equity increase by 8.1 percent year over year, representing a gain of nearly $678.4 billion since the fourth quarter of 2017.

Additionally, the average homeowner gained $9,700 in home equity between the fourth quarter of 2017 and the fourth quarter of 2018. While home equity grew in almost every state in the nation, western states experienced the most significant annual increases. Nevada homeowners gained an average of approximately $29,400 in home equity, while Hawaii homeowners gained an average of approximately $26,900 and Idaho homeowners gained an average of $24,700. California homeowners experienced the fourth-highest growth with an average increase of approximately $19,600 in home equity.

From the third quarter of 2018 to the fourth quarter of 2018, the total number of mortgaged homes in negative equity increased 1.6 percent to 2.2 million homes or 4.2 percent of all mortgaged properties. This was the first quarterly increase since the fourth quarter of 2015. Despite that quarter-over-quarter increase, on a year-over-year basis, the number of mortgaged properties in negative equity fell 14 percent, or by 351,000, from 2.6 million homes – or 4.9 percent of all mortgaged properties – in the fourth quarter of 2018.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoreLogic shows Home Equity by LTV distribution comparison between Q3 2018 and Q4 2018.

On a year-over-year basis, the number of homeowners with negative equity has declined by 351,000 (from 2.6 million to 2.2 million).

Weekly Initial Unemployment Claims decreased to 223,000

by Calculated Risk on 3/07/2019 08:32:00 AM

The DOL reported:

In the week ending March 2, the advance figure for seasonally adjusted initial claims was 223,000, a decrease of 3,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 225,000 to 226,000. The 4-week moving average was 226,250, a decrease of 3,000 from the previous week's revised average. The previous week's average was revised up by 250 from 229,000 to 229,250.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 226,250.

This was close to the consensus forecast.

Wednesday, March 06, 2019

Thursday: Unemployment Claims, Q4 Flow of Funds

by Calculated Risk on 3/06/2019 06:53:00 PM

Thursday:

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, unchanged from 225 thousand the previous week.

• At 12:00 PM, Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

• At 3:00 PM, Consumer Credit from the Federal Reserve.

Fed's Beige Book: Economic Growth "Slight to moderate", Labor Market "Tight"

by Calculated Risk on 3/06/2019 02:27:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Kansas City based on information collected on or before February 25, 2019."

Economic activity continued to expand in late January and February, with ten Districts reporting slight-to-moderate growth, and Philadelphia and St. Louis reporting flat economic conditions. About half of the Districts noted that the government shutdown had led to slower economic activity in some sectors including retail, auto sales, tourism, real estate, restaurants, manufacturing, and staffing services. Consumer spending activity was mixed across the country, with contacts from several Districts attributing lower retail and auto sales to harsh winter weather and to higher costs of credit. Manufacturing activity strengthened on balance, but numerous manufacturing contacts conveyed concerns about weakening global demand, higher costs due to tariffs, and ongoing trade policy uncertainty. Activity in the nonfinancial services sector increased at a modest-to-moderate pace in most Districts, driven in part by growth in the professional, scientific, and technical services sub-sector. Residential construction activity was steady or slightly higher across most of the U.S., but residential home sales were generally lower. Several real estate contacts noted that inventories had risen slightly but remained historically low, while home prices continued to appreciate but at a slightly slower pace. Agricultural conditions remained weak, and energy activity was mixed across Districts.

...

Employment increased in most Districts, with modest-to-moderate gains in a majority of Districts and steady to slightly higher employment in the rest. Labor markets remained tight for all skill levels, including notable worker shortages for positions relating to information technology, manufacturing, trucking, restaurants, and construction. Contacts reported labor shortages were restricting employment growth in some areas.

emphasis added