by Calculated Risk on 2/27/2019 09:03:00 PM

Wednesday, February 27, 2019

Thursday: Q4 GDP, Unemployment Claims and More

Finally - Q4 GDP!

Thursday:

• At 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, up from 216 thousand the previous week.

• Also at 8:30 AM: Gross Domestic Product, 4th quarter 2018 (Initial estimate). The consensus is that real GDP increased 2.4% annualized in Q4, down from 3.4% in Q3.

• At 9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for a reading of 55.8, down from 56.7 in January.

• At 10:00 AM: the Q4 2018 Housing Vacancies and Homeownership from the Census Bureau.

• At 11:00 AM: the Kansas City Fed manufacturing survey for February. This is the last of regional manufacturing surveys for February.

Chemical Activity Barometer "Flat" in February

by Calculated Risk on 2/27/2019 06:45:00 PM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Is Flat In February

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), posted a 0.0 percent change in February on a three-month moving average (3MMA) basis. On a year-over-year (Y/Y) basis, the barometer is up 0.2 percent (3MMA).

...

“The Chemical Activity Barometer reading was essentially flat in February following three months of decline,” said Kevin Swift, chief economist at ACC. “The cumulative drop was 1.0 percent – still well below the 3.0 percent threshold for a recession signal. The latest CAB signals gains in U.S. commercial and industrial activity through mid-2019, but at a slower rate of growth as compared with a year earlier.”

The government shutdown resulted in delays in publishing many data series that ACC uses to compare the CAB. Such delays can make it more difficult to gauge current economic conditions.

…

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

The year-over-year increase in the CAB has softened recently, suggesting further gains in industrial production into 2019, but at a slower pace.

Zillow Case-Shiller Forecast: Smaller YoY House Price Gains in January

by Calculated Risk on 2/27/2019 12:30:00 PM

The Case-Shiller house price indexes for December were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Aaron Terrazas at Zillow: December Case-Shiller Results and January Forecast: Slowing home price gains

For years, the housing market has been anything but “normal” or “balanced.” But as the start of the busy home shopping season looms, someone squinting at the market might be able to find signs of both normalcy and balance as the market continues to cool off after a years-long sizzle.The Zillow forecast is for the year-over-year change for the Case-Shiller National index to decline to 4.4% in January compared to 4.7% in December.

Annual home price growth, while still rapid in a handful of the most in-demand and/or affordable markets, has fallen to a pace not far off historic norms and feels largely sustainable for now at a national level of 4.7 percent year-over-year in December. That pace is down from 5.1 percent in November, according to the Case-Shiller home price index.

The Zillow forecast is for the 20-City index to decline to 3.5% YoY in January, and for the 10-City index to decline to 3.2% YoY.

The Zillow forecast is for the 20-City index to decline to 3.5% YoY in January, and for the 10-City index to decline to 3.2% YoY.

NAR: Pending Home Sales Index Increased 4.6% in January

by Calculated Risk on 2/27/2019 10:02:00 AM

From the NAR: Pending Home Sales Jump 4.6 Percent in January

Pending home sales rebounded strongly in January, according to the National Association of Realtors®. All four major regions saw growth last month, including the largest surge in the South.This was well above expectations of a 3% decrease for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in February and March.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, increased 4.6 percent to 103.2 in January, up from 98.7 in December. Year-over-year contract signings, however, declined 2.3 percent, making this the thirteenth straight month of annual decreases.

...

The PHSI in the Northeast rose 1.6 percent to 94.0 in January, and is now 7.6 percent above a year ago. In the Midwest, the index rose 2.8 percent to 100.2 in January, 0.3 percent lower than January 2018.

Pending home sales in the South jumped 8.9 percent to an index of 119.8 in January, which is 3.1 percent lower than this time last year. The index in the West increased 0.3 percent in January to 87.3 and fell 10.1 percent below a year ago.

emphasis added

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 2/27/2019 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications increased 5.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 22, 2019. This week’s results include an adjustment for the Washington's Birthday (Presidents’ Day) holiday.

... The Refinance Index increased 5 percent from the previous week. The seasonally adjusted Purchase Index increased 6 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 3 percent higher than the same week one year ago.

...

“Mortgage rates were little changed last week, but as we anticipated, homebuyers are responding favorably to this more stable rate environment,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “Purchase applications for both conventional and government loans rose last week, with the government gain led by a 14 percent increase in applications for VA purchase loans.”

Added Fratantoni, “Refinance application volume increased as well, with the index reaching its highest level in a month. Borrowers with larger loans tend to be more responsive for a given drop in rates, and competition for these loans is fierce. Therefore, it was not surprising to see the average rate for a 30-year fixed jumbo loan drop to its lowest level since January 2018.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 4.65 percent from 4.66 percent, with points remaining unchanged at 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Rates would have to fall further for a significant increase in refinance activity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 3% year-over-year.

Tuesday, February 26, 2019

Wednesday: Pending Home Sales, Fed Chair Powell

by Calculated Risk on 2/26/2019 08:08:00 PM

Wednesday:

• At 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Pending Home Sales Index for January. The consensus is for a 3.0% decrease in the index.

• Also at 10:00 AM, Testimony by Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

Real House Prices and Price-to-Rent Ratio in December

by Calculated Risk on 2/26/2019 04:41:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 4.7% year-over-year in December

It has been over eleven years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 11.9% above the previous bubble peak. However, in real terms, the National index (SA) is still about 8.2% below the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 14.8% below the bubble peak.

The year-over-year increase in prices has slowed to 4.7% nationally, and will probably slow more as inventory picks up.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $286,000 today adjusted for inflation (43%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA)and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to January 2005 levels, and the Composite 20 index is back to June 2004.

In real terms, house prices are at 2004/2005 levels.

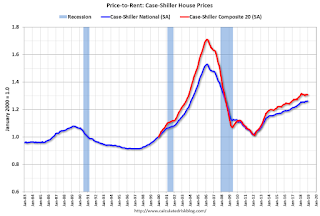

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to March 2004 levels, and the Composite 20 index is back to November 2003 levels.

In real terms, prices are back to late 2004 levels, and the price-to-rent ratio is back to late 2003, early 2004.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 2/26/2019 02:33:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through December 2018). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Comments on December Housing Starts

by Calculated Risk on 2/26/2019 11:32:00 AM

Earlier: Housing Starts Decreased to 1.078 Million Annual Rate in December

Total housing starts in December were well below expectations, and starts for October and November were revised down.

The housing starts report released this morning showed starts were down 11.2% in December compared to November (November starts were revised down), and starts were down 10.9% year-over-year compared to December 2017.

Single family starts were down 10.5% year-over-year. This was the weakest month for single family starts since August 2016.

This first graph shows the month to month comparison for total starts between 2017 (blue) and 2018 (red).

Starts were down 10.9% in December compared to December 2017.

Even with the year end weakness, total starts were up 3.6% in 2018 compared to 2017. The weakness at the end of 2018 has been blamed on higher mortgage rates (that have since come down to around 4.5%), the stock market volatility (since stabilized), trade and immigration policies (impacting foreign buyers), and the partial government shutdown (started in December, but mostly in January).

My sense is starts will pick up in Q1 compared to Q4 2018.

Single family starts were up 2.8% in 2018 compared to 2017.

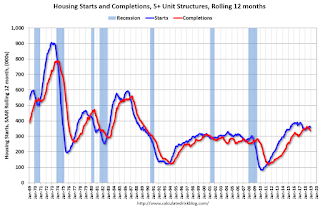

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - but turned down, and has moved sideways recently. Completions (red line) had lagged behind - however completions and starts are at about the same level now (more deliveries).

As I've been noting for a few years, the significant growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR) - however multi-family has picked up a little recently.

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect some further increases in single family starts and completions.

Fed Chair Powell: Semiannual Monetary Policy Report to the Congress

by Calculated Risk on 2/26/2019 10:02:00 AM

From Fed Chair Jerome Powell: Semiannual Monetary Policy Report to the Congress. Excerpts:

While we view current economic conditions as healthy and the economic outlook as favorable, over the past few months we have seen some crosscurrents and conflicting signals. Financial markets became more volatile toward year-end, and financial conditions are now less supportive of growth than they were earlier last year. Growth has slowed in some major foreign economies, particularly China and Europe. And uncertainty is elevated around several unresolved government policy issues, including Brexit and ongoing trade negotiations. We will carefully monitor these issues as they evolve.And on the balance sheet:

emphasis added

In light of the substantial progress we have made in reducing reserves, and after extensive deliberations, the Committee decided at our January meeting to continue over the longer run to implement policy with our current operating procedure. That is, we will continue to use our administered rates to control the policy rate, with an ample supply of reserves so that active management of reserves is not required. Having made this decision, the Committee can now evaluate the appropriate timing and approach for the end of balance sheet runoff. I would note that we are prepared to adjust any of the details for completing balance sheet normalization in light of economic and financial developments. In the longer run, the size of the balance sheet will be determined by the demand for Federal Reserve liabilities such as currency and bank reserves.