by Calculated Risk on 1/18/2019 02:48:00 PM

Friday, January 18, 2019

Q4 GDP Forecasts: Mid-to-High 2s

From Merrill Lynch:

4Q GDP tracking remains at 2.8%. We forecast 1Q GDP growth of 2.2%, but downside risks are emerging due to the government shutdown. [Jan 18 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 2.6% for 2018:Q4 and 2.2% for 2019:Q1. [Jan 18 estimate]And from the Altanta Fed: GDPNow

The current GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 is 2.8 percent on January 16, unchanged from January 10. [Jan 16 estimate]CR Note: These estimates suggest GDP in the mid-to-high 2s for Q4.

Consumer Sentiment Declined in January, Lowest since 2006

by Calculated Risk on 1/18/2019 02:38:00 PM

From the University of Michigan: Preliminary Results for January 2019

Consumer sentiment declined in early January to its lowest level since Trump was elected. The decline was primarily focused on prospects for the domestic economy, with the year-ahead outlook for the national economy judged the worst since mid 2014. The loss was due to a host of issues including the partial government shutdown, the impact of tariffs, instabilities in financial markets, the global slowdown, and the lack of clarity about monetary policies.CR Note: Sentiment is a coincident indicator.

emphasis added

BLS: Unemployment Rates Higher in 4 states in December; Lower in 3 States

by Calculated Risk on 1/18/2019 11:49:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were higher in December in 4 states, lower in 3 states, and stable in 43 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Fourteen states had jobless rate decreases from a year earlier and 36 states and the District had little or no change.

...

Iowa had the lowest unemployment rate in December, 2.4 percent. Alaska had the highest jobless rate, 6.3 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 1976.

At the worst of the great recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently only one state, Alaska, has an unemployment rate at or above 6% (dark blue). Only two states and the D.C. have unemployment rates above 5%; Alaska, West Virginia.

A total of seven states are at the series low.

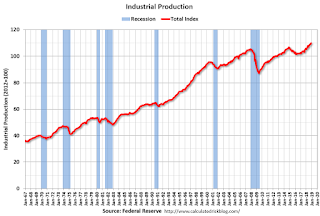

Industrial Production Increased 0.3% in December

by Calculated Risk on 1/18/2019 09:25:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production increased 0.3 percent in December after rising 0.4 percent in November. For the fourth quarter as a whole, total industrial production moved up at an annual rate of 3.8 percent. In December, manufacturing output increased 1.1 percent, its largest gain since February 2018. The output of mines rose 1.5 percent, but the index for utilities fell 6.3 percent, as warmer-than-usual temperatures lowered the demand for heating. At 109.9 percent of its 2012 average, total industrial production was 4.0 percent higher in December than it was a year earlier. Capacity utilization for the industrial sector rose 0.1 percentage point in December to 78.7 percent, a rate that is 1.1 percentage points below its long-run (1972–2017) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.0 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.7% is 1.1% below the average from 1972 to 2017 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in December to 109.9. This is 26% above the recession low, and 4% above the pre-recession peak.

The increase in industrial production was above the consensus forecast. Capacity utilization was also above consensus.

Thursday, January 17, 2019

Friday: Industrial Production

by Calculated Risk on 1/17/2019 07:47:00 PM

Friday:

• At 9:15 AM ET, The Fed will release Industrial Production and Capacity Utilization for December. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to be unchanged at 78.5%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for January). The consensus is for a reading of 97.0.

• At 10:00 AM, State Employment and Unemployment (Monthly) for December 2018

California Existing Homes in December: Sales Down 12% YoY, Inventory Up 31%

by Calculated Risk on 1/17/2019 03:08:00 PM

The CAR reported: California home sales close year on downward trend as home prices post mild gains, C.A.R. reports

California home sales declined for the eighth straight month in December, and a stagnating market for much of the year pushed sales lower in 2018 for the first time in four years, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.Here is some inventory data from the NAR and CAR (ht Tom Lawler).

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 372,260 units in December, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2018 if sales maintained the December pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

December’s sales figure was down 2.4 percent from the revised 381,400 level in November and down 11.6 percent from home sales in December 2017 of 420,960. December marked the fifth month in a row that sales were below 400,000 and the lowest level of sales sold since January 2015.

“The housing market continued to shift in December and drift downward as sales have fallen double digits for the past three out of four months,” said C.A.R. President Jared Martin. “This trend is expected to continue, as buyers remain cautious about the murky housing market outlook due primarily to the volatility in the financial markets and uncertainty in the economic and political arenas.

“Additionally, housing markets in and around the wildfire areas have been exhibiting unusual patterns that could remain unsettled for the next few months. The impact, however, is confined mostly within the region and should not have a noticeable effect in the housing market at the state level.”

...

Statewide active listings rose for the ninth consecutive month after nearly three straight years of declines, increasing 30.6 percent from the previous year. All major regions recorded an increase in active listings, with the Bay Area posting the highest increase at 65 percent, followed by Southern California (34 percent), Central Valley (24 percent) and the Central Coast (12 percent).

The Unsold Inventory Index, which is a ratio of inventory over sales, increased year-to-year from 2.5 months in December 2017 to 3.5 months in December 2018. The index measures the number of months it would take to sell the supply of homes on the market at the current sales rate.

emphasis added

| YOY % Change, Existing SF Homes for Sale | ||

|---|---|---|

| NAR (National) | CAR (California) | |

| Sep-17 | -8.4% | -11.2% |

| Oct-17 | -10.4% | -11.5% |

| Nov-17 | -9.7% | -11.5% |

| Dec-17 | -11.5% | -12.0% |

| Jan-18 | -9.5% | -6.6% |

| Feb-18 | -8.6% | -1.3% |

| Mar-18 | -7.2% | -1.0% |

| Apr-18 | -6.3% | 1.9% |

| May-18 | -5.1 | 8.3% |

| Jun-18 | -0.5% | 8.1% |

| Jul-18 | 0.0% | 11.9% |

| Aug-18 | 2.1% | 17.2% |

| Sep-18 | 1.1% | 20.4% |

| Oct-18 | 2.8% | 28% |

| Nov-18 | 4.2% | 31% |

| Dec-18 | 5.5%1 | 30.6% |

| 1Estimate from Tom Lawler | ||

Economic Comic Relief

by Calculated Risk on 1/17/2019 11:39:00 AM

This is from the Humor Session of the 2019 American Economic Association annual meeting.

Philly Fed Mfg "Continued to Grow" in January

by Calculated Risk on 1/17/2019 09:30:00 AM

From the Philly Fed: January 2019 Manufacturing Business Outlook Survey

Manufacturing activity in the region continued to grow, according to results from the January Manufacturing Business Outlook Survey. The survey’s broad indicators remained positive, although their movements were mixed again this month: The general activity and new orders indicators increased from their readings last month, while the indicators for shipments and employment decreased. The firms reported growth in the underlying demand for their products and are generally optimistic about future growth and employment.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The index for current manufacturing activity in the region increased from a revised reading of 9.1 in December to 17.0 this month. Over 30 percent of the manufacturers reported increases in overall activity, while 13 percent reported decreases. The new orders index increased 8 points to 21.3, its highest reading in six months. … The firms continued to report overall higher employment, but the current employment index fell nearly 10 points to 9.6, its lowest reading in 16 months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through January), and five Fed surveys are averaged (blue, through December) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through December (right axis).

This suggests the ISM manufacturing index will show expansion again in January, at about the same level as in December.

Weekly Initial Unemployment Claims decreased to 213,000

by Calculated Risk on 1/17/2019 08:33:00 AM

The DOL reported:

In the week ending January 12, the advance figure for seasonally adjusted initial claims was 213,000, a decrease of 3,000 from the previous week's unrevised level of 216,000. The 4-week moving average was 220,750, a decrease of 1,000 from the previous week's unrevised average of 221,750.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 220,750.

This was lower than the consensus forecast.

Wednesday, January 16, 2019

Thursday: Housing Starts (Postponed), Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 1/16/2019 08:54:00 PM

Thursday:

• At 8:30 AM, POSTPONED Housing Starts for December. The consensus is for 1.256 million SAAR, unchanged from 1.256 million SAAR.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 216 thousand the previous week.

• At 8:30 AM, the Philly Fed manufacturing survey for January. The consensus is for a reading of 10.0, up from 9.4.